Buy and Sell Volume Heatmap with Real-Time Price Strategy

Author: ChaoZhang, Date: 2024-05-24 17:16:58Tags: EMAVWAPSMA

Overview

This strategy combines a volume heatmap and real-time price to generate buy and sell signals by analyzing the distribution of price and volume over a certain period. The strategy first calculates several price levels based on the current price and a set price range percentage. It then counts the buy and sell volumes at each price level over a past period and calculates the cumulative buy and sell volumes. The color of the labels is determined based on the cumulative buy and sell volumes. Additionally, the strategy plots the real-time price curve. Moreover, the strategy incorporates indicators such as EMA and VWAP to generate buy and sell signals based on their relationship with price and volume. A buy signal is generated when the buy conditions are met, and no previous signal has occurred. A sell signal is generated when the sell conditions are met, or there are two consecutive red candles, and no previous signal has occurred.

Strategy Principle

- Calculate several price levels based on the current price and a set price range percentage.

- Count the buy and sell volumes at each price level over a past period and calculate the cumulative buy and sell volumes.

- Determine the color of the labels based on the cumulative buy and sell volumes and display the labels or plot shapes.

- Plot the real-time price curve.

- Calculate indicators such as EMA and VWAP.

- Determine whether the buy conditions are met based on the relationship between price and indicators like EMA and VWAP, as well as volume conditions. If met and no previous signal has occurred, generate a buy signal.

- Determine whether the sell conditions are met based on the relationship between price and indicators like EMA, as well as volume conditions. If met and no previous signal has occurred, generate a sell signal. If there are two consecutive red candles and no previous signal has occurred, also generate a sell signal.

- Record the current buy and sell condition states and update the signal occurrence status.

Advantage Analysis

- The combination of volume heatmap and real-time price provides an intuitive display of the price and volume distribution, serving as a reference for trading decisions.

- The incorporation of indicators such as EMA and VWAP enriches the strategy’s condition judgment and improves its reliability.

- The strategy considers multiple factors, including price, indicators, and volume, making the buy and sell signals more comprehensive and robust.

- The strategy sets limitations on signal generation to avoid generating repeated signals continuously, reducing misleading signals.

Risk Analysis

- The strategy’s performance may be affected by parameter settings such as the price range percentage and lookback period, requiring adjustments and optimizations based on specific situations.

- Indicators like EMA and VWAP have inherent lagging and limitations, which may become ineffective in certain market environments.

- The strategy is mainly suitable for trending markets and may generate more false signals in choppy markets.

- The risk control measures of the strategy are relatively simple, lacking risk management tools such as stop-loss and position sizing.

Optimization Direction

- Introduce more technical indicators and market sentiment indicators, such as RSI, MACD, Bollinger Bands, etc., to enrich the strategy’s judgment basis.

- Optimize the conditions for generating buy and sell signals to improve signal accuracy and reliability. Consider incorporating multi-timeframe analysis to confirm trend directions.

- Incorporate risk control measures such as stop-loss and position sizing, setting reasonable stop-loss levels and position sizes to control the risk exposure of individual trades.

- Perform parameter optimization and backtesting on the strategy to find the optimal parameter combinations and market applicability.

- Consider combining this strategy with other strategies to leverage the strengths of different strategies and improve overall stability and profitability.

Summary

This strategy generates buy and sell signals by combining a volume heatmap, real-time price, and multiple technical indicators, providing a certain reference value. The strategy’s advantage lies in its ability to intuitively display the price and volume distribution and comprehensively consider multiple factors to generate signals. However, the strategy also has some limitations and risks, such as the impact of parameter settings, the lagging nature of indicators, and the reliance on trending markets. Therefore, in practical applications, further optimization and improvement of the strategy are needed, such as introducing more indicators, optimizing signal conditions, enhancing risk control, etc., to improve the strategy’s robustness and profitability.

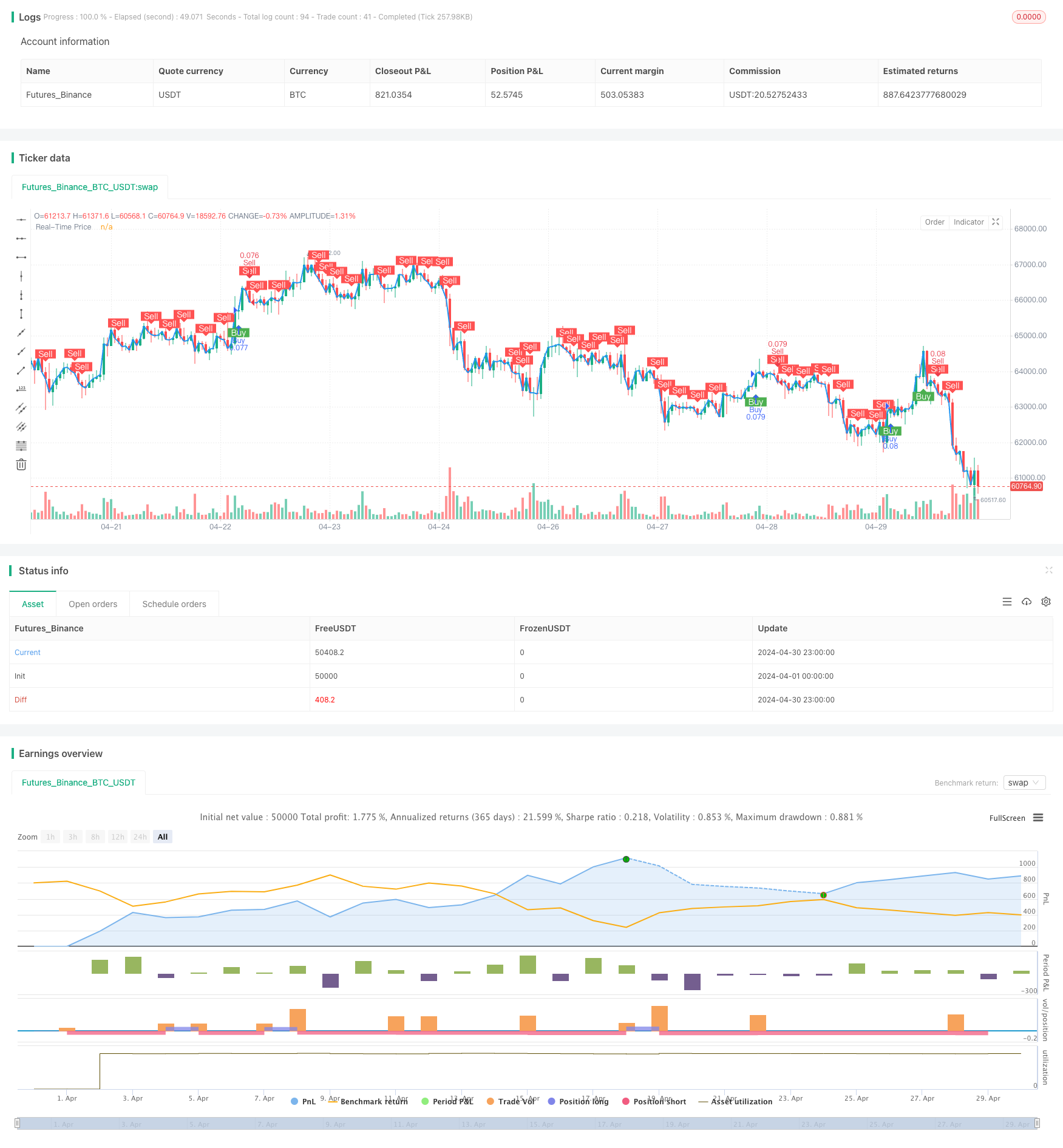

/*backtest

start: 2024-04-01 00:00:00

end: 2024-04-30 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Buy and Sell Volume Heatmap with Real-Time Price Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Settings for Volume Heatmap

lookbackPeriod = input.int(100, title="Lookback Period")

baseGreenColor = input.color(color.green, title="Buy Volume Color")

baseRedColor = input.color(color.red, title="Sell Volume Color")

priceLevels = input.int(10, title="Number of Price Levels")

priceRangePct = input.float(0.01, title="Price Range Percentage")

labelSize = input.string("small", title="Label Size", options=["tiny", "small", "normal", "large"])

showLabels = input.bool(true, title="Show Volume Labels")

// Initialize arrays to store price levels, buy volumes, and sell volumes

var float[] priceLevelsArr = array.new_float(priceLevels)

var float[] buyVolumes = array.new_float(priceLevels)

var float[] sellVolumes = array.new_float(priceLevels)

// Calculate price levels around the current price

for i = 0 to priceLevels - 1

priceLevel = close * (1 + (i - priceLevels / 2) * priceRangePct) // Adjust multiplier for desired spacing

array.set(priceLevelsArr, i, priceLevel)

// Calculate buy and sell volumes for each price level

for i = 0 to priceLevels - 1

level = array.get(priceLevelsArr, i)

buyVol = 0.0

sellVol = 0.0

for j = 1 to lookbackPeriod

if close[j] > open[j]

if close[j] >= level and low[j] <= level

buyVol := buyVol + volume[j]

else

if close[j] <= level and high[j] >= level

sellVol := sellVol + volume[j]

array.set(buyVolumes, i, buyVol)

array.set(sellVolumes, i, sellVol)

// Determine the maximum volumes for normalization

maxBuyVolume = array.max(buyVolumes)

maxSellVolume = array.max(sellVolumes)

// Initialize cumulative buy and sell volumes for the current bar

cumulativeBuyVol = 0.0

cumulativeSellVol = 0.0

// Calculate colors based on the volumes and accumulate volumes for the current bar

for i = 0 to priceLevels - 1

buyVol = array.get(buyVolumes, i)

sellVol = array.get(sellVolumes, i)

cumulativeBuyVol := cumulativeBuyVol + buyVol

cumulativeSellVol := cumulativeSellVol + sellVol

// Determine the label color based on which volume is higher

labelColor = cumulativeBuyVol > cumulativeSellVol ? baseGreenColor : baseRedColor

// Initialize variables for plotshape

var float shapePosition = na

var color shapeColor = na

if cumulativeBuyVol > 0 or cumulativeSellVol > 0

if showLabels

labelText = "Buy: " + str.tostring(cumulativeBuyVol) + "\nSell: " + str.tostring(cumulativeSellVol)

label.new(x=bar_index, y=high + (high - low) * 0.02, text=labelText, color=color.new(labelColor, 0), textcolor=color.white, style=label.style_label_down, size=labelSize)

else

shapePosition := high + (high - low) * 0.02

shapeColor := labelColor

// Plot the shape outside the local scope

plotshape(series=showLabels ? na : shapePosition, location=location.absolute, style=shape.circle, size=size.tiny, color=shapeColor)

// Plot the real-time price on the chart

plot(close, title="Real-Time Price", color=color.blue, linewidth=2, style=plot.style_line)

// Mpullback Indicator Settings

a = ta.ema(close, 9)

b = ta.ema(close, 20)

e = ta.vwap(close)

volume_ma = ta.sma(volume, 20)

// Calculate conditions for buy and sell signals

buy_condition = close > a and close > e and volume > volume_ma and close > open and low > a and low > e // Ensure close, low are higher than open, EMA, and VWAP

sell_condition = close < a and close < b and close < e and volume > volume_ma

// Store the previous buy and sell conditions

var bool prev_buy_condition = na

var bool prev_sell_condition = na

// Track if a buy or sell signal has occurred

var bool signal_occurred = false

// Generate buy and sell signals based on conditions

buy_signal = buy_condition and not prev_buy_condition and not signal_occurred

sell_signal = sell_condition and not prev_sell_condition and not signal_occurred

// Determine bearish condition (close lower than the bottom 30% of the candle's range)

bearish = close < low + (high - low) * 0.3

// Add sell signal when there are two consecutive red candles and no signal has occurred

two_consecutive_red_candles = close[1] < open[1] and close < open

sell_signal := sell_signal or (two_consecutive_red_candles and not signal_occurred)

// Remember the current conditions for the next bar

prev_buy_condition := buy_condition

prev_sell_condition := sell_condition

// Update signal occurred status

signal_occurred := buy_signal or sell_signal

// Plot buy and sell signals

plotshape(buy_signal, title="Buy", style=shape.labelup, location=location.belowbar, color=color.green, text="Buy", textcolor=color.white)

plotshape(sell_signal, title="Sell", style=shape.labeldown, location=location.abovebar, color=color.red, text="Sell", textcolor=color.white)

// Strategy entry and exit

if buy_signal

strategy.entry("Buy", strategy.long)

if sell_signal

strategy.entry("Sell", strategy.short)

- Multi-Period Moving Average Trend Following with VWAP Cross Strategy

- Technical Trading Strategy for BTC 15-minute Chart

- High-Frequency Dynamic Multi-Indicator Moving Average Crossover Strategy

- Enhanced EMA/WMA Crossover Strategy with Comprehensive Exit Conditions

- Multi-Indicator Trend Following Options Trading EMA Cross Strategy

- Multi-Filter Trend Breakthrough Smart Moving Average Trading Strategy

- Multi-EMA Cross with Volume-Price Momentum Trading Strategy

- Trading ABC

- Super Moving Average and Upperband Crossover Strategy

- EMA Crossover Momentum Scalping Strategy

- QQE and RSI-based Long-Short Signal Strategy

- Zero Lag MACD Dual Crossover Trading Strategy - High-Frequency Trading Based on Short-Term Trend Capture

- Trend Following Average True Range Trailing Stop Strategy

- SMC & EMA Strategy with P&L Projections

- Nadaraya-Watson Envelope Multi-Confirmation Dynamic Stop-Loss Strategy

- Dynamic Take Profit Bollinger Bands Strategy

- CCI + MA Crossover Pullback Buy Strategy

- Short-term Short Selling Strategy for High-liquidity Currency Pairs

- MOST Indicator Dual Position Adaptive Strategy

- Bollinger Bands RSI Trading Strategy

- Dual Moving Average Regression Trading Strategy

- Multi-Indicator Quantitative Trading Strategy - Super Indicator 7-in-1 Strategy

- SMK ULTRA TREND Dual Moving Average Crossover Strategy

- Quintuple Strong Moving Average Strategy

- EMA-SMA Crossover Bull Market Support Band Strategy

- Multi-Timeframe Trend Following Strategy with 200 EMA Filter - Long Only

- SMC Market High-Low Breakout Strategy

- Dynamic Trend Momentum Trading Strategy

- EMA Crossover with Short-term Signals Strategy

- Ichimoku Cloud and ATR Strategy