动态趋势动量交易策略

Author: ChaoZhang, Date: 2024-05-23 17:57:22Tags: EMAMACDVWAPRSI

概述

该策略结合了EMA、MACD、VWAP和RSI等多个指标,旨在捕捉高概率的交易机会。策略使用EMA来判断趋势方向,MACD来判断动量,VWAP来判断成交量,RSI来判断超买超卖情况。策略根据这些指标的组合来产生买入和卖出信号,同时使用移动止损来保护利润。

策略原理

- 使用EMA来判断趋势方向,当价格在EMA上方时认为是上升趋势,在EMA下方时认为是下降趋势。

- 使用MACD来判断动量,当MACD快线上穿慢线时认为动量转强,快线下穿慢线时认为动量转弱。

- 使用VWAP来判断成交量,当价格在VWAP上方时认为买盘强于卖盘,在VWAP下方时认为卖盘强于买盘。

- 使用RSI来判断超买超卖情况,当RSI高于70时认为超买,低于30时认为超卖。

- 当价格在EMA上方,MACD快线上穿慢线,价格在VWAP上方,RSI低于超买水平时,产生买入信号。

- 当价格在EMA下方,MACD快线下穿慢线,价格在VWAP下方,RSI高于超卖水平时,产生卖出信号。

- 根据账户资金和风险比例来计算头寸大小。

- 使用移动止损来保护利润,止损价格随着价格变动而变动。

策略优势

- 多指标组合使用,可以更全面地判断市场状态,提高交易信号的准确性。

- 使用移动止损,可以在趋势延续时保护利润,减少回撤。

- 根据账户资金和风险比例来计算头寸大小,可以控制每笔交易的风险。

- 参数可以根据用户偏好进行调整,提高策略的灵活性。

策略风险

- 在震荡市场中,频繁的交易信号可能导致过度交易和手续费损失。

- 在趋势反转时,移动止损可能无法及时止损,导致较大的回撤。

- 参数的选择需要根据不同市场和品种进行优化,不恰当的参数可能导致策略表现不佳。

策略优化方向

- 可以考虑加入更多的过滤条件,如交易量、波动率等,以进一步提高信号的准确性。

- 可以考虑使用更加动态的止损方式,如ATR止损等,以更好地应对不同的市场状况。

- 可以考虑对参数进行优化,如使用遗传算法等方法,寻找最优参数组合。

- 可以考虑加入仓位管理和资金管理策略,以更好地控制风险和提高收益。

总结

该策略通过结合多个指标来判断市场状态,产生交易信号,同时使用移动止损来保护利润。策略参数可以根据用户偏好进行调整,提高策略的灵活性。但是,策略在震荡市场中可能表现不佳,在趋势反转时可能面临较大回撤,因此需要根据不同市场和品种进行优化和改进。未来可以考虑加入更多的过滤条件、动态止损方式、参数优化和仓位管理等方面的优化,以提高策略的稳定性和盈利能力。

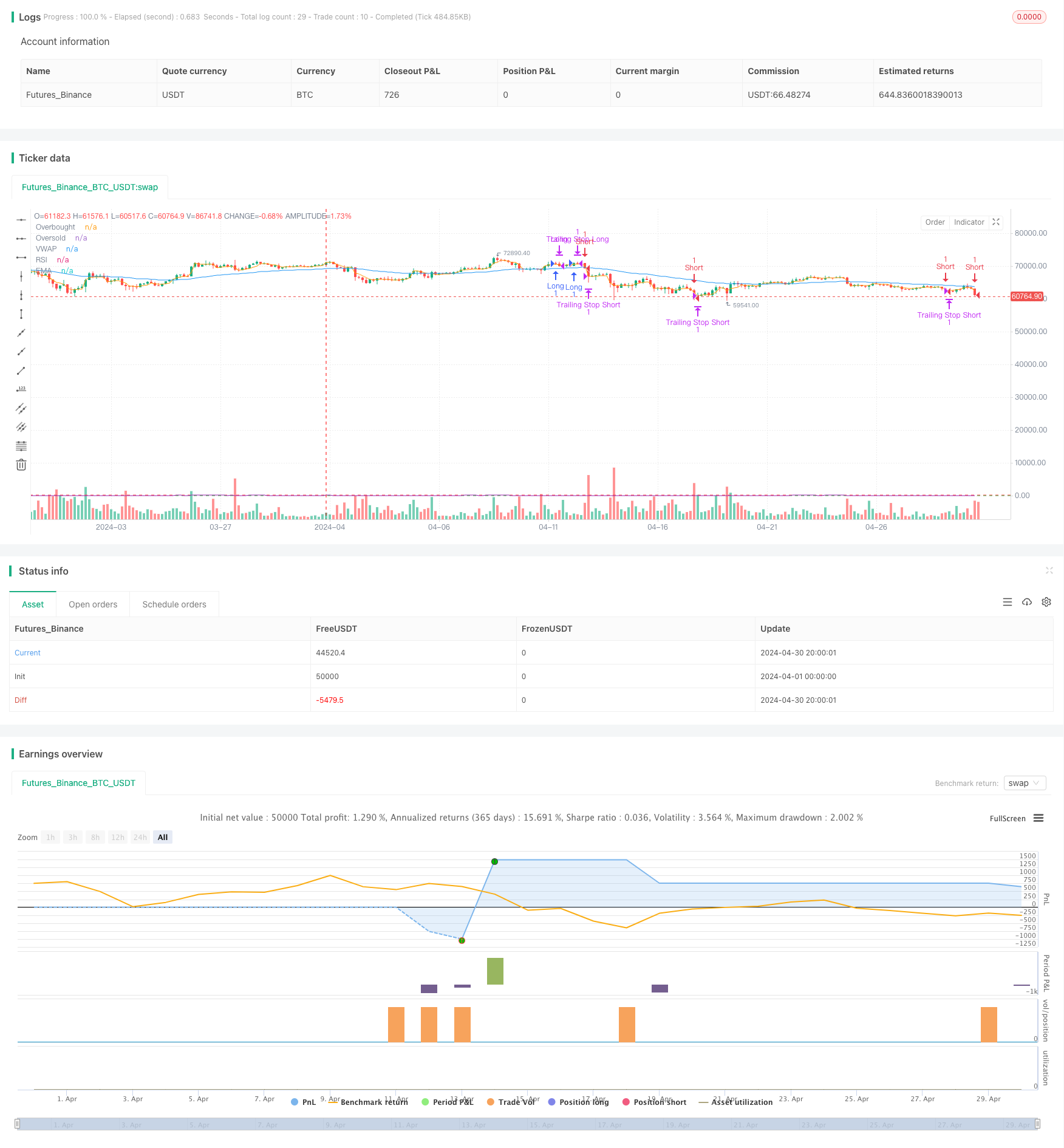

/*backtest

start: 2024-04-01 00:00:00

end: 2024-04-30 23:59:59

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Intraday Strategy", overlay=true)

// Input parameters

emaLength = input.int(50, title="EMA Length")

macdShort = input.int(12, title="MACD Short Period")

macdLong = input.int(26, title="MACD Long Period")

macdSignal = input.int(9, title="MACD Signal Period")

rsiLength = input.int(14, title="RSI Length")

rsiOverbought = input.int(70, title="RSI Overbought Level")

rsiOversold = input.int(30, title="RSI Oversold Level")

risk = input.float(1, title="Risk Percentage", minval=0.1, step=0.1)

trailOffset = input.float(0.5, title="Trailing Stop Offset", minval=0.1, step=0.1)

// Calculating indicators

ema = ta.ema(close, emaLength)

[macdLine, signalLine, _] = ta.macd(close, macdShort, macdLong, macdSignal)

rsi = ta.rsi(close, rsiLength)

vwap = ta.vwap(close)

// Entry conditions

longCondition = ta.crossover(macdLine, signalLine) and close > ema and rsi < rsiOverbought and close > vwap

shortCondition = ta.crossunder(macdLine, signalLine) and close < ema and rsi > rsiOversold and close < vwap

// Exit conditions

longExitCondition = ta.crossunder(macdLine, signalLine) or close < ema

shortExitCondition = ta.crossover(macdLine, signalLine) or close > ema

// Position sizing based on risk percentage

capital = strategy.equity

positionSize = (capital * (risk / 100)) / close

// Executing trades

if (longCondition)

strategy.entry("Long", strategy.long, qty=1)

if (shortCondition)

strategy.entry("Short", strategy.short, qty=1)

if (longExitCondition)

strategy.close("Long")

if (shortExitCondition)

strategy.close("Short")

// Trailing stop loss

if (strategy.position_size > 0)

strategy.exit("Trailing Stop Long", from_entry="Long", trail_price=close, trail_offset=trailOffset)

if (strategy.position_size < 0)

strategy.exit("Trailing Stop Short", from_entry="Short", trail_price=close, trail_offset=trailOffset)

// Plotting indicators

plot(ema, title="EMA", color=color.blue)

hline(rsiOverbought, "Overbought", color=color.red)

hline(rsiOversold, "Oversold", color=color.green)

plot(rsi, title="RSI", color=color.purple)

plot(vwap, title="VWAP", color=color.orange)

相关内容

- 多指标趋势跟踪期权交易EMA交叉策略

- 多指标组合的高频交易策略:指数均线与动量指标相结合的短线交易系统

- EMA交叉与RSI过滤的双重趋势策略

- 趋势波段交易EMA-MACD复合策略

- EMA RSI MACD动态止盈止损交易策略

- 基于多重技术指标的趋势跟踪与动量策略

- EMA、MACD、RSI三重指标动量策略

- 多级平衡量化交易策略

- EMA动态止损交易策略

- 复合技术指标多维度趋势跟踪量化策略

更多内容

- MOST指标双仓位自适应策略

- 布林带RSI交易策略

- 基于成交量热图与实时价格的买卖策略

- 双均线回归交易策略

- 多指标量化交易策略 - 7合1超级指标策略

- SMK ULTRA TREND 双均线交叉策略

- 五重强势移动平均策略

- 均线交叉牛市支撑带策略

- 多时间框架与200EMA过滤器的趋势跟踪策略 - 仅做多

- SMC市场高低点突破策略

- EMA均线交叉与短期信号策略

- 一目云和ATR策略

- BONK多因子交易策略

- 双均线交叉策略

- HalfTrend多空趋势追踪止损限价买入策略

- Alligator 长期趋势跟踪交易策略

- 基于脉冲MACD和双均线交叉的多时间尺度趋势追踪策略

- EMA5与EMA13交叉策略

- EMA SAR 中长期趋势跟踪策略

- 逆向波动率突破策略