Dynamic Adaptive Momentum Breakout Strategy

Author: ChaoZhang, Date: 2024-07-29 14:36:32Tags: ATREMAMOM

Overview

The Dynamic Adaptive Momentum Breakout Strategy is an advanced quantitative trading approach that utilizes an adaptive momentum indicator and candlestick pattern recognition. This strategy dynamically adjusts its momentum period to adapt to market volatility and combines multiple filtering conditions to identify high-probability trend breakout opportunities. The core of the strategy lies in capturing changes in market momentum while using engulfing patterns as entry signals to enhance trading accuracy and profitability.

Strategy Principles

-

Dynamic Period Adjustment:

- The strategy employs an adaptive momentum indicator, dynamically adjusting the calculation period based on market volatility.

- During high volatility periods, the period shortens to respond quickly to market changes; during low volatility, it extends to avoid overtrading.

- The period range is set between 10 and 40, with volatility state determined by the ATR indicator.

-

Momentum Calculation and Smoothing:

- Momentum is calculated using the dynamic period.

- Optional EMA smoothing of momentum, defaulting to a 7-period EMA.

-

Trend Direction Determination:

- Trend direction is determined by calculating the momentum slope (difference between current and previous values).

- Positive slope indicates an uptrend, negative slope a downtrend.

-

Engulfing Pattern Recognition:

- Custom functions identify bullish and bearish engulfing patterns.

- Considers the relationship between current and previous candle’s open and close prices.

- Incorporates minimum body size filtering to enhance pattern reliability.

-

Trade Signal Generation:

- Long signal: Bullish engulfing pattern + positive momentum slope.

- Short signal: Bearish engulfing pattern + negative momentum slope.

-

Trade Management:

- Entry on the opening of the candle following signal confirmation.

- Automatic exit after a fixed holding period (default 3 candles).

Strategy Advantages

-

Strong Adaptability:

- Dynamically adjusts momentum period to suit different market environments.

- Responds quickly in high volatility and avoids overtrading in low volatility.

-

Multiple Confirmation Mechanisms:

- Combines technical indicators (momentum) and price patterns (engulfing), increasing signal reliability.

- Uses slope and body size filtering to reduce false signals.

-

Precise Entry Timing:

- Utilizes engulfing patterns to capture potential trend reversal points.

- Combines with momentum slope to ensure entry into emerging trends.

-

Proper Risk Management:

- Fixed holding period avoids excessive holding leading to drawdowns.

- Body size filtering reduces misjudgments caused by small fluctuations.

-

Flexible and Customizable:

- Multiple adjustable parameters for optimization across different markets and timeframes.

- Optional EMA smoothing balances sensitivity and stability.

Strategy Risks

-

False Breakout Risk:

- May generate frequent false breakout signals in ranging markets.

- Mitigation: Incorporate additional trend confirmation indicators, such as moving average crossovers.

-

Lag Issues:

- EMA smoothing may cause signal lag, missing optimal entry points.

- Mitigation: Adjust EMA period or consider more sensitive smoothing methods.

-

Fixed Exit Mechanism Limitations:

- Fixed period exits may prematurely end profitable trends or prolong losses.

- Mitigation: Introduce dynamic profit-taking and stop-loss, such as trailing stops or volatility-based exits.

-

Over-reliance on Single Timeframe:

- Strategy may ignore overall trends in larger timeframes.

- Mitigation: Incorporate multi-timeframe analysis to ensure trade direction aligns with larger trends.

-

Parameter Sensitivity:

- Many adjustable parameters may lead to overfitting historical data.

- Mitigation: Use walk-forward optimization and out-of-sample testing to validate parameter stability.

Strategy Optimization Directions

-

Multi-Timeframe Integration:

- Introduce larger timeframe trend judgments, trading only in the direction of the main trend.

- Reason: Improve overall trade success rate, avoid trading against major trends.

-

Dynamic Profit-Taking and Stop-Loss:

- Implement dynamic stops based on ATR or momentum changes.

- Use trailing stops to maximize trend profits.

- Reason: Adapt to market volatility, protect profits, reduce drawdowns.

-

Volume Profile Analysis:

- Integrate volume profile to identify key support and resistance levels.

- Reason: Increase precision of entry positions, avoid trading at ineffective breakout points.

-

Machine Learning Optimization:

- Use machine learning algorithms to dynamically adjust parameters.

- Reason: Achieve continuous strategy adaptation, improve long-term stability.

-

Sentiment Indicator Integration:

- Incorporate market sentiment indicators like VIX or option implied volatility.

- Reason: Adjust strategy behavior during extreme sentiment, avoid overtrading.

-

Correlation Analysis:

- Consider correlated asset movements.

- Reason: Enhance signal reliability, identify stronger market trends.

Conclusion

The Dynamic Adaptive Momentum Breakout Strategy is an advanced trading system combining technical analysis and quantitative methods. By dynamically adjusting momentum periods, identifying engulfing patterns, and incorporating multiple filtering conditions, this strategy can adaptively capture high-probability trend breakout opportunities across various market environments. While inherent risks exist, such as false breakouts and parameter sensitivity, the proposed optimization directions, including multi-timeframe analysis, dynamic risk management, and machine learning applications, offer potential for further enhancing the strategy’s stability and profitability. Overall, this is a well-thought-out, logically rigorous quantitative strategy that provides traders with a powerful tool to capitalize on market momentum and trend changes.

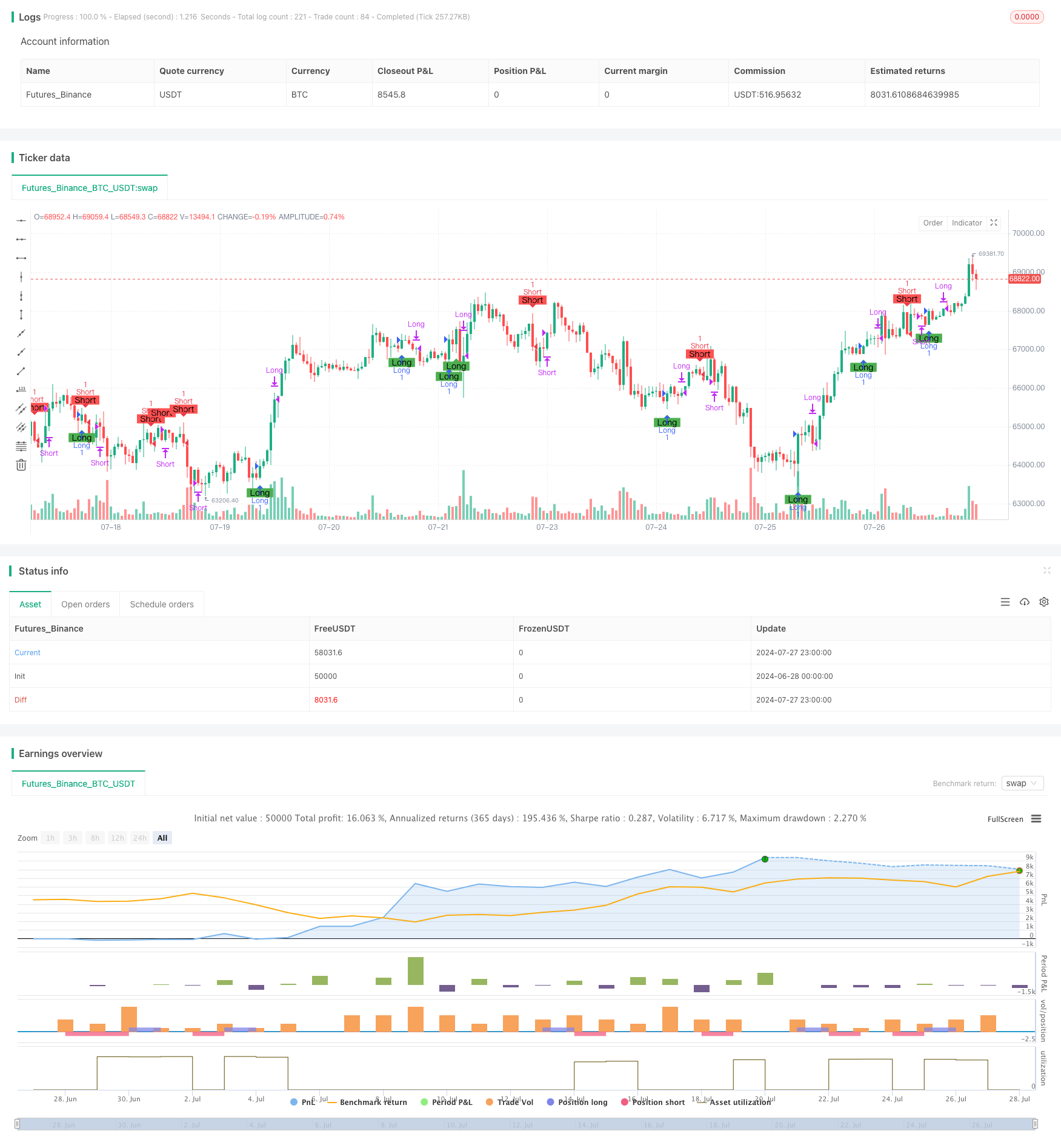

/*backtest

start: 2024-06-28 00:00:00

end: 2024-07-28 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ironperol

//@version=5

strategy("Adaptive Momentum Strategy", overlay=true, margin_long=100, margin_short=100)

// Input parameters for customization

src = input.source(close, title="Source")

min_length = input.int(10, minval=1, title="Minimum Length")

max_length = input.int(40, minval=1, title="Maximum Length")

ema_smoothing = input.bool(true, title="EMA Smoothing")

ema_length = input.int(7, title="EMA Length")

percent = input.float(2, title="Percent of Change", minval=0, maxval=100) / 100.0

// Separate body size filters for current and previous candles

min_body_size_current = input.float(0.5, title="Minimum Body Size for Current Candle (as a fraction of previous body size)", minval=0)

min_body_size_previous = input.float(0.5, title="Minimum Body Size for Previous Candle (as a fraction of average body size of last 5 candles)", minval=0)

close_bars = input.int(3, title="Number of Bars to Hold Position", minval=1) // User-defined input for holding period

//######################## Calculations ##########################

// Initialize dynamic length variable

startingLen = (min_length + max_length) / 2.0

var float dynamicLen = na

if na(dynamicLen)

dynamicLen := startingLen

high_Volatility = ta.atr(7) > ta.atr(14)

if high_Volatility

dynamicLen := math.max(min_length, dynamicLen * (1 - percent))

else

dynamicLen := math.min(max_length, dynamicLen * (1 + percent))

momentum = ta.mom(src, int(dynamicLen))

value = ema_smoothing ? ta.ema(momentum, ema_length) : momentum

// Calculate slope as the difference between current and previous value

slope = value - value[1]

// Calculate body sizes

currentBodySize = math.abs(close - open)

previousBodySize = math.abs(close[1] - open[1])

// Calculate average body size of the last 5 candles

avgBodySizeLast5 = math.avg(math.abs(close[1] - open[1]), math.abs(close[2] - open[2]), math.abs(close[3] - open[3]), math.abs(close[4] - open[4]), math.abs(close[5] - open[5]))

//######################## Long Signal Condition ##########################

// Function to determine if the candle is a bullish engulfing

isBullishEngulfing() =>

currentOpen = open

currentClose = close

previousOpen = open[1]

previousClose = close[1]

isBullish = currentClose >= currentOpen

wasBearish = previousClose <= previousOpen

engulfing = currentOpen <= previousClose and currentClose >= previousOpen

bodySizeCheckCurrent = currentBodySize >= min_body_size_current * previousBodySize

bodySizeCheckPrevious = previousBodySize >= min_body_size_previous * avgBodySizeLast5

isBullish and wasBearish and engulfing and bodySizeCheckCurrent and bodySizeCheckPrevious

// Long signal condition

longCondition = isBullishEngulfing() and slope > 0

// Plotting long signals on chart

plotshape(series=longCondition, location=location.belowbar, color=color.green, style=shape.labelup, text="Long", title="Long Condition")

// Alerts for long condition

if (longCondition)

alert("Long condition met", alert.freq_once_per_bar_close)

//######################## Short Signal Condition ##########################

// Function to determine if the candle is a bearish engulfing

isBearishEngulfing() =>

currentOpen = open

currentClose = close

previousOpen = open[1]

previousClose = close[1]

isBearish = currentClose <= currentOpen

wasBullish = previousClose >= previousOpen

engulfing = currentOpen >= previousClose and currentClose <= previousOpen

bodySizeCheckCurrent = currentBodySize >= min_body_size_current * previousBodySize

bodySizeCheckPrevious = previousBodySize >= min_body_size_previous * avgBodySizeLast5

isBearish and wasBullish and engulfing and bodySizeCheckCurrent and bodySizeCheckPrevious

// Short signal condition

shortCondition = isBearishEngulfing() and slope < 0

// Plotting short signals on chart

plotshape(series=shortCondition, location=location.abovebar, color=color.red, style=shape.labeldown, text="Short", title="Short Condition")

// Alerts for short condition

if (shortCondition)

alert("Short condition met", alert.freq_once_per_bar_close)

//######################## Trading Logic ##########################

// Track the bar number when the position was opened

var int longEntryBar = na

var int shortEntryBar = na

// Enter long trade on the next candle after a long signal

if (longCondition and na(longEntryBar))

strategy.entry("Long", strategy.long)

longEntryBar := bar_index + 1

// Enter short trade on the next candle after a short signal

if (shortCondition and na(shortEntryBar))

strategy.entry("Short", strategy.short)

shortEntryBar := bar_index + 1

// Close long trades `close_bars` candles after entry

if (not na(longEntryBar) and bar_index - longEntryBar >= close_bars)

strategy.close("Long")

longEntryBar := na

// Close short trades `close_bars` candles after entry

if (not na(shortEntryBar) and bar_index - shortEntryBar >= close_bars)

strategy.close("Short")

shortEntryBar := na

- Enhanced Multi-Indicator Momentum Trading Strategy

- K Consecutive Candles Bull Bear Strategy

- Keltner Channels EMA ATR Strategy

- Multi-Exponential Moving Average Crossover Strategy with Volume-Based ATR Dynamic Stop-Loss Optimization

- Multi-Timeframe Trend Following Strategy with ATR-Based Take Profit and Stop Loss

- ATR and EMA-based Dynamic Take Profit and Stop Loss Adaptive Strategy

- Volatility and Linear Regression-based Long-Short Market Regime Optimization Strategy

- EMA Dynamic Trend Following Trading Strategy

- Triple EMA Crossover Strategy

- Multi-Indicator Trend Following Strategy with Dynamic Channel and Moving Average Trading System

- Weighted Moving Average and Relative Strength Index Crossover Strategy with Risk Management Optimization System

- Double-Smoothed Heiken Ashi Trend Following Strategy

- RSI Reversal Cross Momentum Profit Target Quantitative Trading Strategy

- Multi-Indicator Adaptive Trend Following Strategy

- Multi-Indicator Comprehensive Trading Strategy: Perfect Combination of Momentum, Overbought/Oversold, and Volatility

- High-Precision RSI and Bollinger Bands Breakout Strategy with Optimized Risk-Reward Ratio

- Advanced EMA Crossover Strategy: Adaptive Trading System with Dynamic Stop-Loss and Take-Profit Targets

- EMA Crossover with Dual Take Profit and Stop Loss Strategy

- Multi-Timeframe Hull Moving Average Crossover Strategy

- Dynamic Trailing Stop Dual Target Moving Average Crossover Strategy

- Adaptive Moving Average Crossover with Trailing Stop-Loss Strategy

- EMA Trend-Following Automated Trading Strategy

- Darvas Box Breakout and Risk Management Strategy

- Multi-Timeframe Exponential Moving Average Crossover Strategy with Risk-Reward Optimization

- SMA Crossover Long-Short Strategy with Peak Drawdown Control and Auto-Termination

- High-Frequency Flip Percentage Tracking Momentum Strategy

- SMI and Pivot Point Momentum Crossover Strategy

- Support and Resistance Strategy with Dynamic Risk Management System

- RSI-Bollinger Bands Integration Strategy: A Dynamic Self-Adaptive Multi-Indicator Trading System

- Multi-Timeframe Trend Following and Order Block Quantitative Trading Strategy