Dual Indicator Cross-Confirmation Momentum Volume Quantitative Trading Strategy

Author: ChaoZhang, Date: 2024-07-30 12:26:16Tags: OBVATR

Overview

This strategy is a quantitative trading system based on the price-volume relationship, primarily utilizing the Volume Oscillator (VO) and On-Balance Volume (OBV) indicators to analyze market momentum and trends. The strategy identifies potential buy and sell opportunities by observing the crossovers of these two indicators and their positions relative to their moving averages. Additionally, the strategy incorporates the Average True Range (ATR) as a volatility filter to enhance signal reliability.

Strategy Principles

Volume Oscillator (VO):

- Calculation: VO = EMA(Volume, 20) - SMA(Volume, 20)

- Function: Reflects volume trend changes by comparing the exponential and simple moving averages of volume.

On-Balance Volume (OBV):

- Calculation: Adds volume on up days and subtracts volume on down days.

- Function: Reflects the relationship between price changes and volume, used to judge the strength of market trends.

Average True Range (ATR):

- Calculation: Uses a 14-period ATR

- Function: Measures market volatility, used to filter out false signals in low volatility environments.

Buy Signal:

- VO crosses above the user-defined volume threshold

- OBV is above its 20-period simple moving average

Sell Signal:

- VO crosses below the negative user-defined volume threshold

- OBV is below its 20-period simple moving average

Strategy Advantages

Multi-dimensional Analysis: Combines market information from volume, price, and volatility dimensions, improving signal accuracy.

Trend Confirmation: Effectively filters out potential false breakouts by comparing OBV with its moving average.

Flexibility: Allows users to customize VO and OBV periods, as well as volume thresholds, adapting to different market environments.

Visual Effect: Uses color markers and arrows to clearly display buy and sell signals, facilitating quick identification of trading opportunities.

Risk Management: Incorporates the ATR indicator, allowing position size adjustment based on market volatility, beneficial for risk control.

Automated Execution: The strategy can automatically execute trading orders, reducing human emotional interference.

Strategy Risks

Lag: Moving averages and oscillators have inherent lag, potentially missing the best entry points at the beginning of trends.

False Signals: In choppy markets, frequent false breakout signals may occur, increasing trading costs.

Trend Dependency: The strategy performs well in strong trend markets but may be less effective during consolidation periods.

Overtrading: Improper parameter settings may lead to excessive trading, increasing commission expenses.

Single Market Limitation: The strategy may only be suitable for specific market environments, lacking universality.

Strategy Optimization Directions

Dynamic Parameter Adjustment:

- Automatically adjust VO and OBV periods based on market volatility to adapt to different market states.

- Implementation: Use ATR or other volatility indicators to dynamically adjust parameters.

Multi-timeframe Analysis:

- Incorporate longer-term timeframes to confirm major trends, improving trade win rates.

- Implementation: Add VO and OBV analysis for multiple time periods.

Introduce Price Action Analysis:

- Combine candlestick patterns or support/resistance analysis to improve entry point precision.

- Implementation: Add logic to identify specific price patterns.

Optimize Position Management:

- Dynamically adjust position sizes based on signal strength and market volatility.

- Implementation: Use ATR or signal strength to calculate position percentage for each trade.

Add Market Sentiment Indicators:

- Introduce VIX or other sentiment indicators to filter signals in extreme market environments.

- Implementation: Add monitoring and signal filtering logic for market sentiment indicators.

Conclusion

The Dual Indicator Cross-Confirmation Momentum Volume Quantitative Trading Strategy is a quantitative trading system that combines the Volume Oscillator (VO) and On-Balance Volume (OBV). By analyzing the changes and relative positions of these two indicators, the strategy can capture market momentum changes and potential trend reversals. The introduction of the Average True Range (ATR) as a volatility filter further enhances signal reliability.

The main advantages of this strategy lie in its multi-dimensional analysis method and flexible parameter settings, allowing it to adapt to different market environments. However, the strategy also has some inherent risks, such as signal lag and potential overtrading. To optimize strategy performance, consideration can be given to introducing dynamic parameter adjustments, multi-timeframe analysis, and more sophisticated position management methods.

Overall, this is a quantitative strategy based on solid price-volume analysis theory, with a good theoretical foundation and practical application potential. Through continuous optimization and backtesting, this strategy has the potential to achieve stable returns in actual trading. However, investors should still carefully consider market risks when using this strategy and combine it with appropriate fund management based on their own risk tolerance and investment objectives.

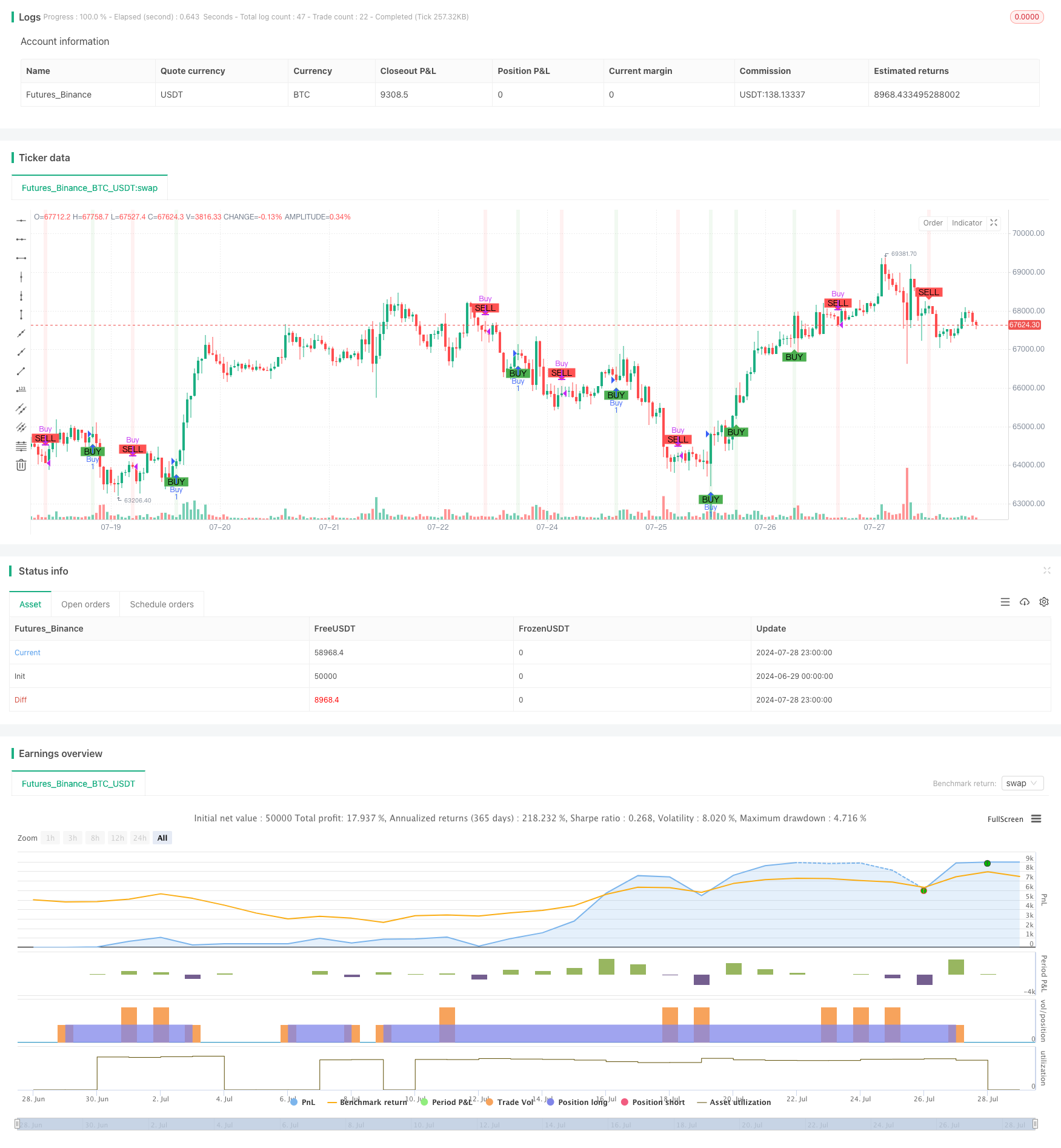

/*backtest

start: 2024-06-29 00:00:00

end: 2024-07-29 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Volume-Based Analysis", overlay=true)

// Inputs

voLength = input.int(20, title="Volume Oscillator Length")

obvLength = input.int(20, title="OBV Length")

volumeThreshold = input.float(1.0, title="Volume Threshold")

atrLength = input.int(14, title="ATR Length")

// Volume Oscillator

vo = ta.ema(volume, voLength) - ta.sma(volume, voLength)

// On-Balance Volume (OBV)

obv = ta.cum(close > close[1] ? volume : close < close[1] ? -volume : 0)

// Average True Range (ATR)

atr = ta.atr(atrLength)

// Signals

buySignal = ta.crossover(vo, volumeThreshold) and obv > ta.sma(obv, obvLength)

sellSignal = ta.crossunder(vo, -volumeThreshold) and obv < ta.sma(obv, obvLength)

// Plots

plotshape(series=buySignal, location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=sellSignal, location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

bgcolor(buySignal ? color.new(color.green, 90) : na)

bgcolor(sellSignal ? color.new(color.red, 90) : na)

// Strategy execution

if (buySignal)

strategy.entry("Buy", strategy.long)

if (sellSignal)

strategy.close("Buy")

- Multi-Indicator Trend Following and Volatility Breakout Strategy

- Multi-Strategy Adaptive Trend Following and Breakout Trading System

- Volume MA-based Adaptive Pyramiding Dynamic Stop Loss and Take Profit Trading Strategy

- Multi-Indicator Filtered Trading Strategy with Bollinger Bands and Woodies CCI

- Multi-Level Multi-Period EMA Crossover Dynamic Take-Profit Optimization Strategy

- Volatility Range Trading Strategy Based on Stochastic Oscillator

- HalfTrend Bullish and Bearish Trend Following Stop-Limit Buy Strategy

- Dynamic Timing and Position Management Strategy Based on Volatility

- Fibonacci Progression With Breaks

- Chandelier Exit

- Advanced Fibonacci Retracement and Volume-Weighted Price Action Trading Strategy

- Adaptive Standard Deviation Breakout Trading Strategy: Multi-Period Optimization System Based on Dynamic Volatility

- Dynamic Position Dual Moving Average Crossover Strategy

- Dynamic Signal Line Trend Following Strategy Combining ATR and Volume

- Multi-Indicator Dynamic Volatility Alert Trading System

- Dynamic Trend-Following Trading Strategy Based on Gann Angles

- VWAP-ATR Trend Following and Price Reversal Strategy

- Bollinger Bands RSI Neutral Market Quantitative Trading Strategy

- Multi-Level Oversold Oscillator Buy Strategy

- Adaptive Trend Following Strategy Combining AlphaTrend and KAMA with Risk Management

- Dynamic Trend Following Strategy - Multi-Indicator Integrated Momentum Analysis System

- Multi-EMA and Supertrend Crossover Strategy

- Dynamic Mean Reversion and Momentum Strategy

- Dual EMA Dynamic Trend Capture Trading System

- Multi-Confirmation Reversal Buy Strategy

- Enhanced Dual EMA Pullback Breakout Trading Strategy

- Multi-Timeframe Exponential Moving Average Crossover Strategy

- Multi-Period Dynamic Channel Crossover Strategy

- Comprehensive Price Gap Short-Term Trend Capture Strategy

- Multi-Stochastic Oscillation and Momentum Analysis System