概述

多重随机震荡策略与动量分析系统是一种基于多重随机指标和动量分析的量化交易策略。该策略利用8条不同参数设置的随机震荡指标线,通过分析这些指标线之间的相对位置和走势,来判断市场的趋势和动量。策略的核心思想是,当所有指标线按照特定顺序排列时,表明市场具有强烈的上涨或下跌趋势,此时进行相应的多头或空头交易。

策略原理

该策略的核心原理是使用多重随机震荡指标来分析市场动量和趋势。具体实现如下:

- 计算8条随机震荡指标线(k1到k8),每条线使用不同的参数设置。

- 所有指标线都基于HLC3(最高价、最低价和收盘价的平均值)计算。

- 每条指标线都经过SMA(简单移动平均线)和EMA(指数移动平均线)的双重平滑处理。

- 策略通过比较相邻指标线的位置关系来判断市场趋势:

- 当k1 >= k2 >= k3 >= k4 >= k5 >= k6 >= k7 >= k8 >= k8[1]时,触发多头信号。

- 当k1 < k2 < k3 < k4 < k5 < k6 < k7 < k8 < k8[1]时,触发空头信号。

- 策略还设置了超买(80)和超卖(20)水平线,以及中间水平线(50),用于辅助判断市场状态。

策略优势

多重指标融合:通过使用8条不同参数的随机震荡指标,策略能够全面捕捉市场的多个时间框架的动态变化,减少单一指标可能带来的假信号。

动量捕捉:策略设计能有效捕捉市场的强劲趋势,特别是在趋势初期阶段,有助于及早进场。

视觉化决策支持:策略将不同指标线用不同颜色显示,直观反映市场状态,有助于交易者快速判断市场走势。

灵活性:策略参数可调整,使用者可以根据不同市场环境和交易品种进行优化。

风险管理:通过设置超买超卖水平线,策略提供了额外的风险控制手段。

策略风险

过度交易风险:在震荡市场中,策略可能产生频繁的交易信号,导致过度交易和增加交易成本。

滞后性:由于使用了多重移动平均线,策略在快速反转行情中可能反应较慢。

假突破风险:在横盘整理阶段,策略可能误判小幅波动为趋势开始,造成错误交易。

参数敏感性:策略效果高度依赖于参数设置,不同市场环境可能需要频繁调整参数。

缺乏止损机制:代码中未明确设置止损条件,可能导致在错误判断时承受较大亏损。

策略优化方向

引入自适应参数:可以考虑使用自适应算法动态调整随机震荡指标的参数,以适应不同市场环境。

增加过滤条件:结合其他技术指标(如ATR、RSI等)作为辅助过滤条件,减少假信号。

完善风险管理:加入止损和止盈机制,如基于ATR的动态止损,保护已获利润和限制潜在亏损。

优化入场时机:可以考虑在指标线交叉时入场,而不是等待所有指标线完全排列,以提高入场的及时性。

引入成交量分析:结合成交量指标,验证趋势的有效性,提高交易信号的可靠性。

增加时间过滤:添加交易时间窗口限制,避开波动较大或流动性不足的时段。

实现部分仓位管理:根据信号强度调整仓位大小,在更强烈的信号出现时增加仓位。

总结

多重随机震荡策略与动量分析系统是一种创新性的量化交易方法,通过融合多重随机震荡指标,有效捕捉市场动量和趋势。该策略在趋势明确的市场中表现出色,能够及早发现并跟随大趋势。然而,策略也存在一些潜在风险,如过度交易和参数敏感性等。通过引入自适应参数、增加过滤条件、完善风险管理等优化措施,可以进一步提升策略的稳定性和盈利能力。对于追求趋势跟踪和动量交易的投资者来说,这是一个值得深入研究和实践的策略框架。

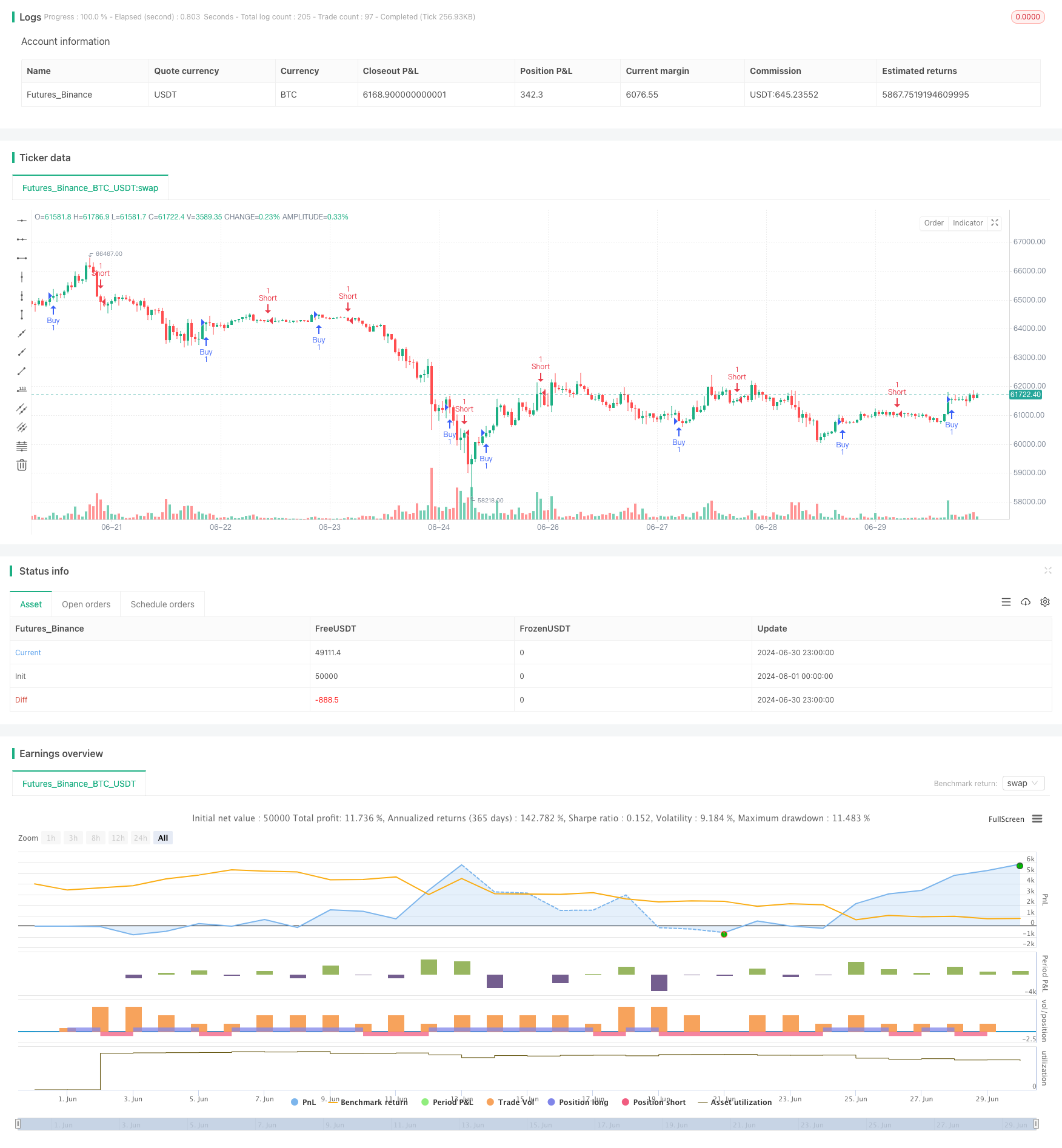

/*backtest

start: 2024-06-01 00:00:00

end: 2024-06-30 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Stochaholic Strategy", shorttitle="Stochaholic Strat", overlay=true)

// Indicator parameters

length = input.int(14, "Length")

// Source

src = hlc3

// Calculations for the Stochaholic indicator

k1 = ta.ema(ta.sma(ta.stoch(src, high, low, length), 3), 3)

k2 = ta.ema(ta.sma(ta.stoch(src, high, low, length), 4), 3)

k3 = ta.ema(ta.sma(ta.stoch(src, high, low, length), 5), 3)

k4 = ta.ema(ta.sma(ta.stoch(src, high, low, length), 6), 3)

k5 = ta.ema(ta.sma(ta.stoch(src, high, low, length), 7), 3)

k6 = ta.ema(ta.sma(ta.stoch(src, high, low, length), 8), 3)

k7 = ta.ema(ta.sma(ta.stoch(src, high, low, length), 9), 3)

k8 = ta.ema(ta.sma(ta.stoch(src, high, low, length), 10), 3)

// Plotting the Stochaholic lines

// plot(k1, linewidth=2, color=k1 >= k2 ? color.lime : color.red)

// plot(k2, linewidth=2, color=k2 >= k3 ? color.lime : color.red)

// plot(k3, linewidth=2, color=k3 >= k4 ? color.lime : color.red)

// plot(k4, linewidth=2, color=k4 >= k5 ? color.lime : color.red)

// plot(k5, linewidth=2, color=k5 >= k6 ? color.lime : color.red)

// plot(k6, linewidth=2, color=k6 >= k7 ? color.lime : color.red)

// plot(k7, linewidth=2, color=k7 >= k8 ? color.lime : color.red)

// plot(k8, linewidth=2, color=k8 >= k8[1] ? color.lime : color.red)

// Overbought and Oversold Levels

// hline(80, color=color.red, title="OB Level")

// hline(50, linewidth=1, title="Mid Level")

// hline(20, color=color.green, title="OS Level")

// Strategy logic

longCondition = (k1 >= k2 and k2 >= k3 and k3 >= k4 and k4 >= k5 and k5 >= k6 and k6 >= k7 and k7 >= k8 and k8 >= k8[1])

shortCondition = (k1 < k2 and k2 < k3 and k3 < k4 and k4 < k5 and k5 < k6 and k6 < k7 and k7 < k8 and k8 < k8[1])

if (longCondition)

strategy.entry("Buy", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)