Moving Average Crossover and Candlestick Pattern Smart Timing Strategy

Author: ChaoZhang, Date: 2024-11-28 17:18:29Tags: SMAMACANDLEWICKRSIATR

Overview

This strategy is an intelligent trading system that combines classical technical analysis tools including moving average crossovers and candlestick pattern recognition. The strategy identifies potential market turning points by analyzing the relationship between candlestick shadows and bodies, while incorporating dual moving average crossover signals. The system not only focuses on price trends but also calculates average ranges to dynamically adjust trading parameters for improved adaptability.

Strategy Principles

The core logic consists of two main components:

-

The candlestick pattern recognition module identifies potential reversal signals by calculating the ratio between shadows and bodies. The system includes adjustable parameters for shadow multiplier (wickMultiplier) and body percentage (bodyPercentage) to optimize signal quality. When a candlestick displays qualifying long upper or lower shadows, the system generates corresponding long or short signals.

-

The dual moving average crossover system utilizes 14-period and 28-period Simple Moving Averages (SMA) as trend indicators. Long signals are generated when the short-term MA crosses above the long-term MA, while short signals occur when the short-term MA crosses below the long-term MA.

Strategy Advantages

- Strict Signal Filtering: Effectively filters out low-quality signals through shadow multiplier and body percentage thresholds

- Strong Parameter Adaptability: Provides flexible parameter adjustment interfaces for optimizing strategy performance across different market conditions

- Combines Trend Following and Reversal Signals: Captures both trending markets and important reversal opportunities

- Comprehensive Risk Control: Utilizes 50-period average range calculations to dynamically adjust trading parameters for enhanced stability

Strategy Risks

- Parameter Sensitivity: Different parameter settings may lead to significant performance variations, requiring thorough optimization

- Market Environment Dependency: May generate excessive false signals in ranging markets, increasing trading costs

- Slippage Impact: Potential for significant slippage in markets with poor liquidity

- Signal Delay: Moving average systems have inherent lag, possibly missing optimal entry points

Strategy Optimization Directions

- Incorporate Volume Indicators: Analyze volume changes to confirm reversal signal validity

- Enhance Dynamic Parameter Adjustment: Automatically adjust shadow multiplier and body percentage parameters based on market volatility

- Add Trend Strength Filtering: Integrate RSI or ADX indicators to filter signals in weak market conditions

- Improve Stop-Loss Mechanism: Design dynamic stop-loss positions based on ATR indicator for more precise risk control

Summary

This strategy constructs a relatively complete trading decision framework by combining candlestick pattern recognition with moving average crossover systems. Its strengths lie in strict signal filtering mechanisms and flexible parameter adjustment capabilities, while attention must be paid to parameter optimization and market environment adaptability. Through continuous optimization and refinement, the strategy shows potential for maintaining stable performance across various market conditions.

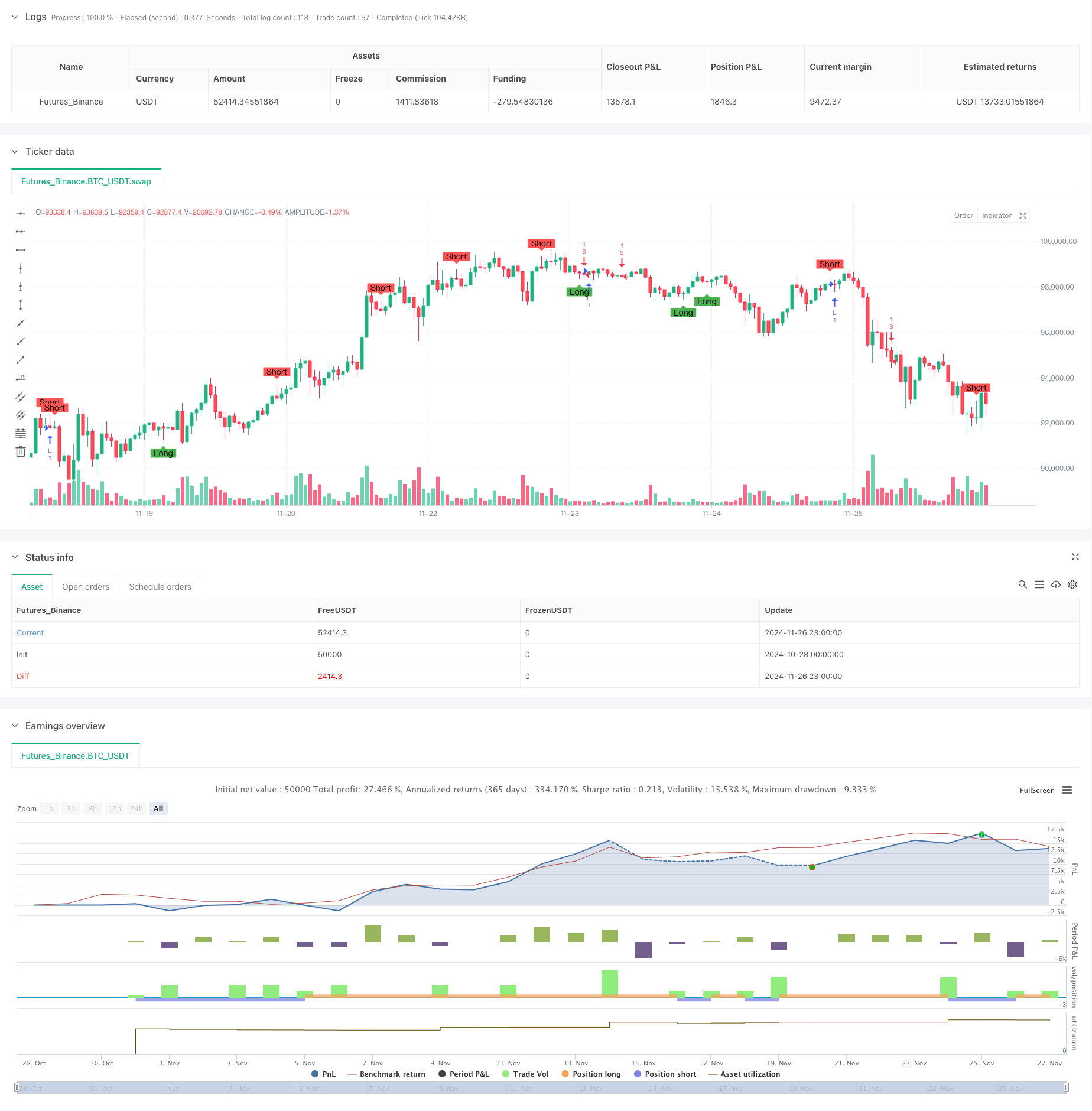

/*backtest

start: 2024-10-28 00:00:00

end: 2024-11-27 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5 indicator("Wick Reversal Setup", overlay=true)

// Input parameters

wickMultiplier = input.float(3.5, title="Wick Multiplier", minval=0.5, maxval=20)

bodyPercentage = input.float(0.25, title="Body Percentage", minval=0.1, maxval=1.0)

// Calculate the average range over 50 periods

avgRange = ta.sma(high - low, 50)

// Define the lengths of wicks and bodies

bodyLength = math.abs(close - open)

upperWickLength = high - math.max(close, open)

lowerWickLength = math.min(close, open) - low

totalRange = high - low

// Long signal conditions

longSignal = (close > open and upperWickLength >= bodyLength * wickMultiplier and upperWickLength <= totalRange * bodyPercentage) or

(close < open and lowerWickLength >= bodyLength * wickMultiplier and upperWickLength <= totalRange * bodyPercentage) or

(close == open and close != high and upperWickLength >= bodyLength * wickMultiplier and upperWickLength <= totalRange * bodyPercentage) or

(open == high and close == high and totalRange >= avgRange)

// Short signal conditions

shortSignal = (close < open and (high - open) >= bodyLength * wickMultiplier and lowerWickLength <= totalRange * bodyPercentage) or

(close > open and (high - close) >= bodyLength * wickMultiplier and lowerWickLength <= totalRange * bodyPercentage) or

(close == open and close != low and lowerWickLength >= bodyLength * wickMultiplier and lowerWickLength <= totalRange * bodyPercentage) or

(open == low and close == low and totalRange >= avgRange)

// Plot signals

plotshape(series=longSignal, location=location.belowbar, color=color.green, style=shape.labelup, text="Long")

plotshape(series=shortSignal, location=location.abovebar, color=color.red, style=shape.labeldown, text="Short")

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Sahaj_Beriwal

//@version=5

strategy("My strategy", overlay=true, margin_long=100, margin_short=100)

longCondition = ta.crossover(ta.sma(close, 14), ta.sma(close, 28))

if (longCondition)

strategy.entry("L", strategy.long)

shortCondition = ta.crossunder(ta.sma(close, 14), ta.sma(close, 28))

if (shortCondition)

strategy.entry("S", strategy.short)

- Intelligent Time-Based Long-Short Rotation Balanced Trading Strategy

- No Upper Wick Bullish Candle Breakout Strategy

- Elliott Wave Theory 4-9 Impulse Wave Automatic Detection Trading Strategy

- MA, SMA, MA Slope, Trailing Stop Loss, Re-Entry

- Multi-Moving Average Momentum Trend Following Strategy

- Multi-Level Dynamic Trend Following System

- Multi-Period Moving Average and RSI Momentum Cross Trend Following Strategy

- RSI-ATR Momentum Volatility Combined Trading Strategy

- Multi-Period Moving Average and RSI Momentum Cross Strategy

- Dual Moving Average RSI Trend Momentum Strategy

- Adaptive FVG Detection and MA Trend Trading Strategy with Dynamic Resistance

- Multi-Frequency Momentum Reversal Quantitative Strategy System

- Automated Quantitative Trading System with Dual EMA Crossover and Risk Management

- Dynamic Dual-SMA Trend Following Strategy with Smart Risk Management

- KNN-Based Adaptive Parametric Trend Following Strategy

- Multi-Period Trend Following Trading System Based on EMA Volatility Bands

- Random bidding generator for the retesting system

- Multi-Timeframe EMA Cross High-Win Rate Trend Following Strategy (Advanced)

- Adaptive Range Volatility Trend Following Trading Strategy

- Dual Moving Average Trend Following Trading System with Risk-Reward Ratio Optimization Strategy

- Dynamic Dual Moving Average Crossover Quantitative Trading Strategy

- Bollinger Bands and RSI Combined Trading Strategy

- Multi-EMA Trend Following Strategy with Dynamic ATR Targets

- Elder's Force Index Quantitative Trading Strategy Based on Standard Deviation and Moving Averages

- ATR Fusion Trend Optimization Model Strategy

- Enhanced Multi-Indicator Trend Reversal Intelligence Strategy

- RSI Trend Momentum Trading Strategy with Dual MA and Volume Confirmation

- Triple EMA Crossover Trading Strategy with Dynamic Stop-Loss and Take-Profit

- Dual Momentum Squeeze Trading System (SMI+UBS Indicator Combination Strategy)

- RSI-MACD Multi-Signal Trading System with Dynamic Stop Management