Estrategia de seguimiento de la fuga

El autor:¿ Qué pasa?, Fecha: 2023-10-17 16:36:49Las etiquetas:

Resumen general

Esta estrategia utiliza principalmente el indicador

Estrategia lógica

-

Parámetros de ajuste para el indicador

Canal de Donchian , período predeterminado es 20; -

Establecer la media móvil de la EMA, el período de impago es 200;

-

Se establece una relación riesgo/recompensación, por defecto es 1.5;

-

Establecer los parámetros de retroceso después de la ruptura para largo y corto;

-

Registrar si el rompimiento anterior fue un punto alto o bajo;

-

Signales largos: si la ruptura anterior fue baja, el precio se rompe por encima de la banda superior de Donchian y por encima de la línea EMA;

-

Si la ruptura anterior fue alta, el precio se rompe por debajo de la banda inferior de Donchian y por debajo de la línea EMA.

-

Después de una entrada larga, establece el stop loss en la banda inferior de Donchian menos 5 puntos, toma ganancias en la relación riesgo/recompensa veces la distancia stop loss;

-

Después de una entrada corta, establece el stop loss en la banda superior de Donchian más 5 puntos, toma ganancias en la relación riesgo/recompensa veces la distancia stop loss.

De esta manera, la estrategia combina el seguimiento de tendencias y el comercio de ruptura, para operar junto con la tendencia principal.

Análisis de ventajas

-

Sigue la tendencia principal, evita el comercio contra la tendencia.

-

El canal de Donchian como indicador a largo plazo, combinado con el filtro EMA, puede identificar eficazmente la tendencia.

-

Detener pérdidas y obtener ganancias controla el riesgo por operación, limita las pérdidas potenciales.

-

La optimización de la relación riesgo / recompensa puede aumentar el factor de ganancia, buscando rendimientos excedentes.

-

Los parámetros de backtest flexibles, pueden optimizar los parámetros para diferentes mercados.

Análisis de riesgos

-

El canal de Donchian y la EMA pueden dar señales equivocadas a veces.

-

El comercio de ruptura puede ser fácilmente atrapado, necesita identificar claramente el fondo de la tendencia.

-

El stop loss fijo y el take profit no pueden ajustarse en función de la volatilidad del mercado.

-

Espacio de optimización limitado para parámetros, rendimiento en vivo no garantizado.

-

Los sistemas de negociación vulnerables a los eventos del cisne negro, pueden conducir a pérdidas severas.

Direcciones de optimización

-

Considera añadir más filtros como osciladores para mejorar la calidad de la señal.

-

Establecer un stop loss adaptativo y obtener ganancias en función de la volatilidad del mercado y del ATR.

-

Utilice el aprendizaje automático para probar y optimizar los parámetros para adaptarse a los mercados reales.

-

Optimizar la lógica de entrada con volumen o volatilidad como condición para evitar trampas.

-

Combinar con sistemas de seguimiento de tendencias o aprendizaje automático para crear modelos híbridos de robustez.

Conclusión

Esta estrategia es una estrategia de seguimiento de la ruptura, con la lógica de la negociación a lo largo de la tendencia principal identificada, y tomar la ruptura como señal de entrada, mientras que la configuración de stop loss y tomar ganancias para controlar el riesgo por comercio. La estrategia tiene algunas ventajas, pero también espacio para mejoras. En general, con el ajuste adecuado de parámetros, el tiempo de entrada, y mejoras con otras técnicas, puede convertirse en una estrategia práctica de seguimiento de la tendencia. Pero los inversores siempre deben tener en cuenta que ningún sistema de negociación puede eliminar el riesgo del mercado por completo, y la gestión del riesgo es esencial.

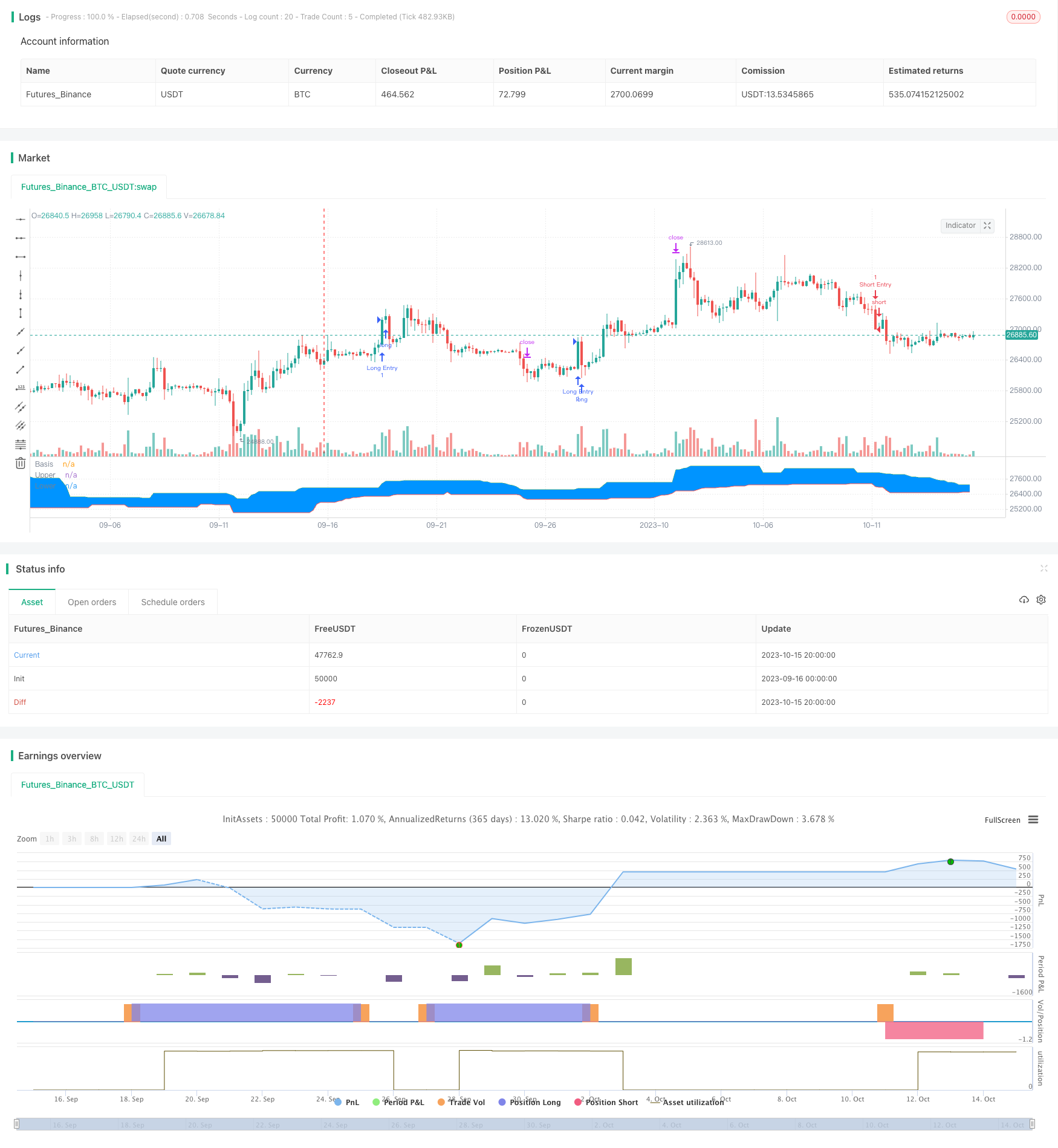

/*backtest

start: 2023-09-16 00:00:00

end: 2023-10-16 00:00:00

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

// Welcome to my second script on Tradingview with Pinescript

// First of, I'm sorry for the amount of comments on this script, this script was a challenge for me, fun one for sure, but I wanted to thoroughly go through every step before making the script public

// Glad I did so because I fixed some weird things and I ended up forgetting to add the EMA into the equation so our entry signals were a mess

// This one was a lot tougher to complete compared to my MACD crossover trend strategy but I learned a ton from it, which is always good and fun

// Also I'll explain the strategy and how I got there through some creative coding(I'm saying creative because I had to figure this stuff out by myself as I couldn't find any reference codes)

// First things first. This is a Donchian Channel Breakout strategy which follows the following rules

// If the price hits the upperband of the Donchian Channel + price is above EMA and the price previously hit the lowerband of the Donchian Channel it's a buy signal

// If the price hits the lowerband of the Donchian Channel + price is below EMA and the price prevbiously hit the upper band of the Donchian Channel it's a sell signal

// Stop losses are set at the lower or upper band with a 0.5% deviation because we are acting as if those two bands are the resistance in this case

// Last but not least(yes, this gave BY FAR the most trouble to code), the profit target is set with a 1.5 risk to reward ratio

// If you have any suggestions to make my code more efficient, I'll be happy to hear so from you

// So without further ado, let's walk through the code

// The first line is basically standard because it makes backtesting so much more easy, commission value is based on Binance futures fees when you're using BNB to pay those fees in the futures market

// strategy(title="Donchian Channels", shorttitle="DC", overlay=true, default_qty_type = strategy.cash, default_qty_value = 150, initial_capital = 1000, currency = currency.USD, commission_type = "percent", commission_value = 0.036)

// The built-in Donchian Channels + an added EMA input which I grouped with the historical bars from the Donchian Channels

length = input(20, minval=1, group = "Indicators")

lower = lowest(length)

upper = highest(length)

basis = avg(upper, lower)

emaInput = input(title = "EMA Input", type = input.integer, defval = 200, minval = 10, maxval = 400, step = 1, group = "Indicators")

// I've made three new inputs, for risk/reward ratio and for the standard pullback deviation. My advise is to not use the pullback inputs as I'm not 100% sure if they work as intended or not

riskreward = input(title = "Risk/Reward Ratio", type = input.float, defval = 1.50, minval = 0.01, maxval = 100, step = 0.01, group = "Risk/Reward")

pullbackLong = input(title = "Distance from Long pullback %", type = input.float, defval = 0.995, minval = 0.001, maxval = 2, step = 0.001, group = "Risk/Reward")

pullbackShort = input(title = "Distance from Short pullback %", type = input.float, defval = 1.005, minval = 0.001, maxval = 2, step = 0.001, group = "Risk/Reward")

// Input backtest range, you can adjust these in the input options, just standard stuff

fromMonth = input(defval = 1, title = "From Month", type = input.integer, minval = 1, maxval = 12, group = "Backtest Date Range")

fromDay = input(defval = 1, title = "From Day", type = input.integer, minval = 1, maxval = 31, group = "Backtest Date Range")

fromYear = input(defval = 2000, title = "From Year", type = input.integer, minval = 1970, group = "Backtest Date Range")

thruMonth = input(defval = 1, title = "Thru Month", type = input.integer, minval = 1, maxval = 12, group = "Backtest Date Range")

thruDay = input(defval = 1, title = "Thru Day", type = input.integer, minval = 1, maxval = 31, group = "Backtest Date Range")

thruYear = input(defval = 2099, title = "Thru Year", type = input.integer, minval = 1970, group = "Backtest Date Range")

// Date variable also standard stuff

inDataRange = (time >= timestamp(syminfo.timezone, fromYear, fromMonth, fromDay, 0, 0)) and (time < timestamp(syminfo.timezone, thruYear, thruMonth, thruDay, 0, 0))

// I had to makes these variables because the system has to remember whether the previous 'breakout' was a high or a low

// Also, because I based my stoploss on the upper/lower band of the indicator I had to find a way to change this value just once without losing the value, that was added, on the next bar

var previousishigh = false

var previousislow = false

var longprofit = 0.0

var shortprofit = 0.0

var stoplossLong = 0.0

var stoplossShort = 0.0

// These are used as our entry variables

emaCheck = ema(close, emaInput)

longcond = high >= upper and close > emaCheck

shortcond = low <= lower and close < emaCheck

// With these two if statements I'm changing the boolean variable above to true, we need this to decide out entry position

if high >= upper

previousishigh := true

if low <= lower

previousislow := true

// Made a last minute change on this part. To clean up our entry signals we don't want our breakouts, while IN a position, to change. This way we do not instantly open a new position, almost always in the opposite direction, upon exiting one

if strategy.position_size > 0 or strategy.position_size < 0

previousishigh := false

previousislow := false

// Strategy inputs

// Long - previous 'breakout' has to be a low, the current price has to be a new high and above the EMA, we're not allowed to be in a position and ofcourse it has to be within our given data for backtesting purposes

if previousislow == true and longcond and strategy.position_size == 0 and inDataRange

strategy.entry("Long Entry", strategy.long, comment = "Entry Long")

stoplossLong := lower * pullbackLong

longprofit := ((((1 - stoplossLong / close) * riskreward) + 1) * close)

strategy.exit("Long Exit", "Long Entry", limit = longprofit, stop = stoplossLong, comment = "Long Exit")

// Short - Previous 'breakout' has to be a high, current price has to be a new low and lowe than the 200EMA, we're not allowed to trade when we're in a position and it has to be within our given data for backtesting purposes

if previousishigh == true and shortcond and strategy.position_size == 0 and inDataRange

strategy.entry("Short Entry", strategy.short, comment = "Entry Short")

stoplossShort := upper * pullbackShort

shortprofit := (close - ((((1 - close / stoplossShort) * riskreward) * close)))

strategy.exit("Short Exit", "Short Entry", limit = shortprofit, stop = stoplossShort, comment = "Short Exit")

// This plots the Donchian Channels on the chart which is just using the built-in Donchian Channels

plot(basis, "Basis", color=color.blue)

u = plot(upper, "Upper", color=color.green)

l = plot(lower, "Lower", color=color.red)

fill(u, l, color=#0094FF, transp=95, title="Background")

// These plots are to show if the variables are working as intended, it's a mess I know but I didn't have any better ideas, they work well enough for me

// plot(previousislow ? close * 0.95 : na, color=color.red, linewidth=2, style=plot.style_linebr)

// plot(previousishigh ? close * 1.05 : na, color=color.green, style=plot.style_linebr)

// plot(longprofit, color=color.purple)

// plot(shortprofit, color=color.silver)

// plot(stoplossLong)

// plot(stoplossShort)

// plot(strategy.position_size)

- Estrategia del sistema de bandas de Bollinger de doble media móvil

- Estrategia de pruebas de retroceso de la arquitectura

- Estrategia de escape basada en el comercio de tortugas

- La tendencia de la DEMA a seguir la estrategia

- Algorithm RSI Estrategia de ruptura de rango

- RSI: estrategia de tendencias de criptomonedas en ascenso

- Tendencia cruzada de la pendiente de la EMA siguiendo la estrategia

- Estrategia de negociación del RSI intradiario TAM

- Estrategia de cruce de la media móvil exponencial

- Estrategia de cruce de la media móvil

- Modelo de seguimiento de las dos medias móviles

- Estrategia de reversión media basada en el ATR

- Tendencia del volumen relativo tras la estrategia de negociación

- Estrategia de balanceo de tendencia del MACD

- EMA y estrategia de negociación de Heikin Ashi

- Tendencia de seguir una estrategia de largo plazo

- Estrategia de combinación de patrones de velas de varios modelos

- Análisis de la estrategia de negociación de la reversión del canal

- Estrategia de negociación de reversión leve con doble indicador

- Estrategia del surfista