Estrategia de tendencia dinámica a la absorción

El autor:¿ Qué pasa?, Fecha: 2024-02-29 11:24:18Las etiquetas:

Resumen general

La estrategia de tendencia de engulfing dinámico es una estrategia comercial que toma posiciones largas o cortas basadas en patrones de engulfing en la dirección de la tendencia. Esta estrategia utiliza el rango verdadero promedio (ATR) para medir la volatilidad del mercado, el indicador de super tendencia para determinar la dirección de la tendencia del mercado, y entra en operaciones cuando los patrones de engulfing se alinean con la dirección de la tendencia.

Estrategia lógica

- Calcular el ATR para medir la volatilidad del mercado.

- Calcular el indicador Supertrend para identificar la tendencia del mercado.

- Definir las condiciones para la tendencia al alza y la tendencia a la baja.

- Identificar el engulfamiento alcista (en tendencia alcista) y el engulfamiento bajista (en tendencia bajista).

- Se calcularán los niveles de Stop Loss (SL) y Take Profit (TP) basados en los patrones de engulfing.

- Entrar en operaciones cuando los patrones de engulfamiento coinciden con la dirección de la tendencia.

- Las operaciones de salida cuando el precio alcanza los niveles SL o TP.

- Trace los patrones de engullida en la tabla.

Análisis de ventajas

Las ventajas de esta estrategia incluyen:

- Mejora de la calidad de la señal mediante la combinación de patrones de absorción con tendencia.

- Capacidad para identificar inversiones de tendencia para entradas precisas.

- Despeje señales largas/cortas para un mejor tiempo.

- La estrategia de detención de engulfing sigue la tendencia mientras gestiona los riesgos.

- Marco de código modular para la optimización fácil.

Análisis de riesgos

También hay algunos riesgos a tener en cuenta:

- Los patrones de ingestión pueden resultar ser falsos brotes.

- Es difícil determinar los parámetros óptimos como el tamaño del patrón, la duración, etc.

- La determinación de tendencias imperfecta puede llevar a señales falsas.

- Los niveles de stop loss y take profit dependen de discreciones y pueden ser subjetivos.

- El rendimiento depende del ajuste de parámetros basado en datos históricos.

Los riesgos pueden mitigarse mediante:

- Añadiendo filtros para eliminar señales falsas de fuga.

- Utilizando ATR adaptativo para cálculos de parámetros robustos.

- Mejorar la determinación de tendencias mediante el aprendizaje automático.

- Encontrar parámetros óptimos mediante algoritmos genéticos.

- Pruebas de retroceso durante períodos más largos para garantizar la robustez.

Direcciones de optimización

Hay margen para una mayor optimización:

- El aprendizaje automático puede mejorar la determinación de tendencias.

- Los nuevos métodos de reconocimiento de patrones pueden identificar mejor los patrones de absorción.

- Las últimas estrategias de stop loss / take profit pueden optimizar dinámicamente los niveles.

- Los datos de alta frecuencia pueden desarrollar un sistema a corto plazo.

- Ajuste de parámetros para diferentes instrumentos.

Conclusión

En resumen, la estrategia de tendencia de engulfing dinámico combina las señales de patrón de engulfing de alta calidad con la determinación de tendencia precisa para generar un sistema de negociación con entradas precisas y pérdidas de parada razonables y toma de ganancias.

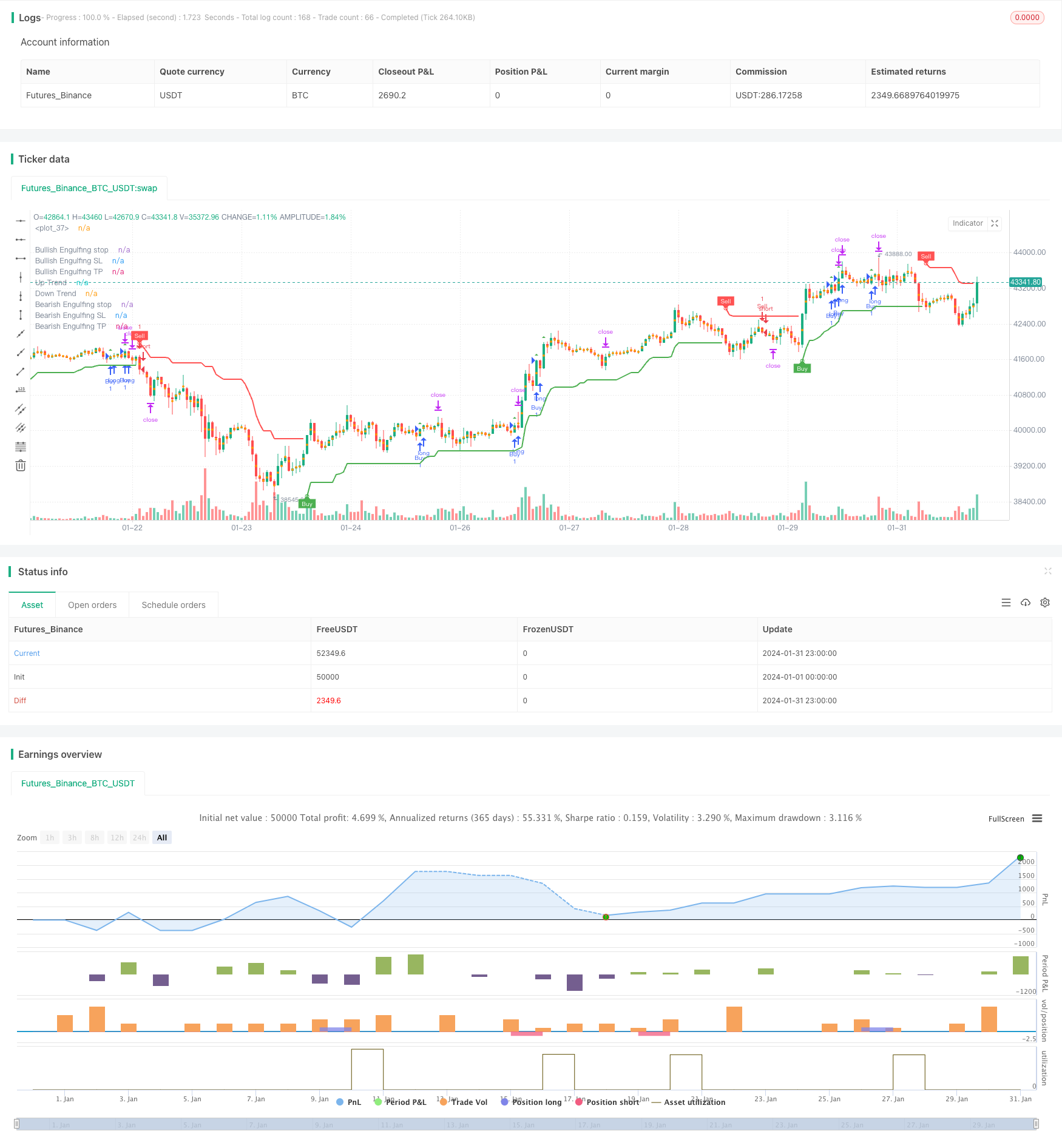

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Malikdrajat

//@version=4

strategy("Engulfing with Trend", overlay=true)

Periods = input(title="ATR Period", type=input.integer, defval=10)

src = input(hl2, title="Source")

Multiplier = input(title="ATR Multiplier", type=input.float, step=0.1, defval=3.0)

changeATR= input(title="Change ATR Calculation Method ?", type=input.bool, defval=true)

showsignals = input(title="Show Buy/Sell Signals ?", type=input.bool, defval=true)

highlighting = input(title="Highlighter On/Off ?", type=input.bool, defval=true)

atr2 = sma(tr, Periods)

atr= changeATR ? atr(Periods) : atr2

up=src-(Multiplier*atr)

up1 = nz(up[1],up)

up := close[1] > up1 ? max(up,up1) : up

dn=src+(Multiplier*atr)

dn1 = nz(dn[1], dn)

dn := close[1] < dn1 ? min(dn, dn1) : dn

trend = 1

trend := nz(trend[1], trend)

trend := trend == -1 and close > dn1 ? 1 : trend == 1 and close < up1 ? -1 : trend

upPlot = plot(trend == 1 ? up : na, title="Up Trend", style=plot.style_linebr, linewidth=2, color=color.green)

buySignal = trend == 1 and trend[1] == -1

plotshape(buySignal ? up : na, title="UpTrend Begins", location=location.absolute, style=shape.circle, size=size.tiny, color=color.green, transp=0)

plotshape(buySignal and showsignals ? up : na, title="Buy", text="Buy", location=location.absolute, style=shape.labelup, size=size.tiny, color=color.green, textcolor=color.white, transp=0)

dnPlot = plot(trend == 1 ? na : dn, title="Down Trend", style=plot.style_linebr, linewidth=2, color=color.red)

sellSignal = trend == -1 and trend[1] == 1

plotshape(sellSignal ? dn : na, title="DownTrend Begins", location=location.absolute, style=shape.circle, size=size.tiny, color=color.red, transp=0)

plotshape(sellSignal and showsignals ? dn : na, title="Sell", text="Sell", location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.red, textcolor=color.white, transp=0)

mPlot = plot(ohlc4, title="", style=plot.style_circles, linewidth=0)

longFillColor = highlighting ? (trend == 1 ? color.green : color.white) : color.white

shortFillColor = highlighting ? (trend == -1 ? color.red : color.white) : color.white

fill(mPlot, upPlot, title="UpTrend Highligter", color=longFillColor)

fill(mPlot, dnPlot, title="DownTrend Highligter", color=shortFillColor)

alertcondition(buySignal, title="SuperTrend Buy", message="SuperTrend Buy!")

alertcondition(sellSignal, title="SuperTrend Sell", message="SuperTrend Sell!")

changeCond = trend != trend[1]

alertcondition(changeCond, title="SuperTrend Direction Change", message="SuperTrend has changed direction!")

// Define Downtrend and Uptrend conditions

downtrend = trend == -1

uptrend = trend == 1

// Engulfing

boringThreshold = input(25, title="Boring Candle Threshold (%)", minval=1, maxval=100, step=1)

engulfingThreshold = input(50, title="Engulfing Candle Threshold (%)", minval=1, maxval=100, step=1)

stopLevel = input(200, title="Stop Level (Pips)", minval=1)

// Boring Candle (Inside Bar) and Engulfing Candlestick Conditions

isBoringCandle = abs(open[1] - close[1]) * 100 / abs(high[1] - low[1]) <= boringThreshold

isEngulfingCandle = abs(open - close) * 100 / abs(high - low) <= engulfingThreshold

// Bullish and Bearish Engulfing Conditions

bullEngulfing = uptrend and close[1] < open[1] and close > open[1] and not isBoringCandle and not isEngulfingCandle

bearEngulfing = downtrend and close[1] > open[1] and close < open[1] and not isBoringCandle and not isEngulfingCandle

// Stop Loss, Take Profit, and Entry Price Calculation

bullStop = close + (stopLevel * syminfo.mintick)

bearStop = close - (stopLevel * syminfo.mintick)

bullSL = low

bearSL = high

bullTP = bullStop + (bullStop - low)

bearTP = bearStop - (high - bearStop)

// Entry Conditions

enterLong = bullEngulfing and uptrend

enterShort = bearEngulfing and downtrend

// Exit Conditions

exitLong = crossover(close, bullTP) or crossover(close, bullSL)

exitShort = crossover(close, bearTP) or crossover(close, bearSL)

// Check if exit conditions are met by the next candle

exitLongNextCandle = exitLong and (crossover(close[1], bullTP[1]) or crossover(close[1], bullSL[1]))

exitShortNextCandle = exitShort and (crossover(close[1], bearTP[1]) or crossover(close[1], bearSL[1]))

// Strategy Execution

strategy.entry("Buy", strategy.long, when=enterLong )

strategy.entry("Sell", strategy.short, when=enterShort )

// Exit Conditions for Long (Buy) Positions

if (bullEngulfing and not na(bullTP) and not na(bullSL))

strategy.exit("Exit Long", from_entry="Buy", stop=bullSL, limit=bullTP)

// Exit Conditions for Short (Sell) Positions

if (bearEngulfing and not na(bearTP) and not na(bearSL))

strategy.exit("Exit Short", from_entry="Sell", stop=bearSL, limit=bearTP)

// Plot Shapes and Labels

plotshape(bullEngulfing, style=shape.triangleup, location=location.abovebar, color=color.green)

plotshape(bearEngulfing, style=shape.triangledown, location=location.abovebar, color=color.red)

// Determine OP, SL, and TP

plot(bullEngulfing ? bullStop : na, title="Bullish Engulfing stop", color=color.red, linewidth=3, style=plot.style_linebr)

plot(bearEngulfing ? bearStop : na, title="Bearish Engulfing stop", color=color.red, linewidth=3, style=plot.style_linebr)

plot(bullEngulfing ? bullSL : na, title="Bullish Engulfing SL", color=color.red, linewidth=3, style=plot.style_linebr)

plot(bearEngulfing ? bearSL : na, title="Bearish Engulfing SL", color=color.red, linewidth=3, style=plot.style_linebr)

plot(bullEngulfing ? bullTP : na, title="Bullish Engulfing TP", color=color.green, linewidth=3, style=plot.style_linebr)

plot(bearEngulfing ? bearTP : na, title="Bearish Engulfing TP", color=color.green, linewidth=3, style=plot.style_linebr)

- Estrategia de cruce de impulso con stop loss de seguimiento dinámico

- EMA y RSI Estrategia de negociación cuantitativa

- Estrategia de tendencia de impulso basada en las bandas MACD y Bollinger

- Estrategia estocástica de varios plazos

- Estrategia de cruce de promedio móvil con patrones de candlestick intradiarios

- Estrategia de scalping de Bitcoin basada en patrones de cruce de promedios móviles y candlesticks

- Combinación de la estrategia de largo plazo entre el impulso y la media móvil

- Indice de movimiento direccional promedio de impulso promedio de movimiento estrategia cruzada

- Estrategia de seguimiento de tendencias de doble EMA cruzada

- Estrategia de negociación combinada de media móvil doble y MACD

- Estrategia de negociación de retroceso de promedio móvil de varios plazos

- Estrategia de seguimiento de la volatilidad de la media móvil doble

- Estrategia de negociación a corto plazo basada en bandas de Bollinger

- Estrategia de tendencia basada en MOST y KAMA

- Tendencia de doble marco de tiempo siguiendo la estrategia

- Estrategia de negociación de Bitlinc MARSI

- Estrategia de seguimiento de bandas de Bollinger

- Estrategia de ruptura de SuperTrend

- El análisis de la doble estrategia de la EMA

- La estrategia de negociación de devoluciones de llamadas de avance