Tendance à la double inversion de la bande oscillante suivant la stratégie

Auteur:ChaoZhang est là., Date: 2024-01-25 16:01:04 Je vous en prie.Les étiquettes:

Résumé

Principe de stratégie

123 Système d'inversion

Indicateur des bandes de chaos fractales

Acheter lorsque le prix franchit le niveau supérieur vers le haut; vendre lorsque le prix franchit le niveau inférieur vers le bas.

Les avantages de la stratégie

- Combiner l'inversion et la tendance pour saisir les opportunités de manière globale

- Réduire les faux signaux et améliorer le taux de réussite

Comparée à un seul indicateur, cette stratégie peut réduire considérablement les faux signaux et améliorer le taux de gain et le taux de profit des transactions réelles grâce au filtrage des combinaisons de deux indicateurs.

Risques et optimisation

- Incapable de s'adapter aux grandes tendances

- Requiert un soutien en capital de marge

La stratégie de suivi de tendance à bande oscillante à double inversion appartient à des types de négociation fréquents, nécessitant un capital de marge suffisant pour soutenir les exigences de marge pour l'ouverture de positions.

- Peut combiner plusieurs indicateurs pour le filtrage

Conclusion

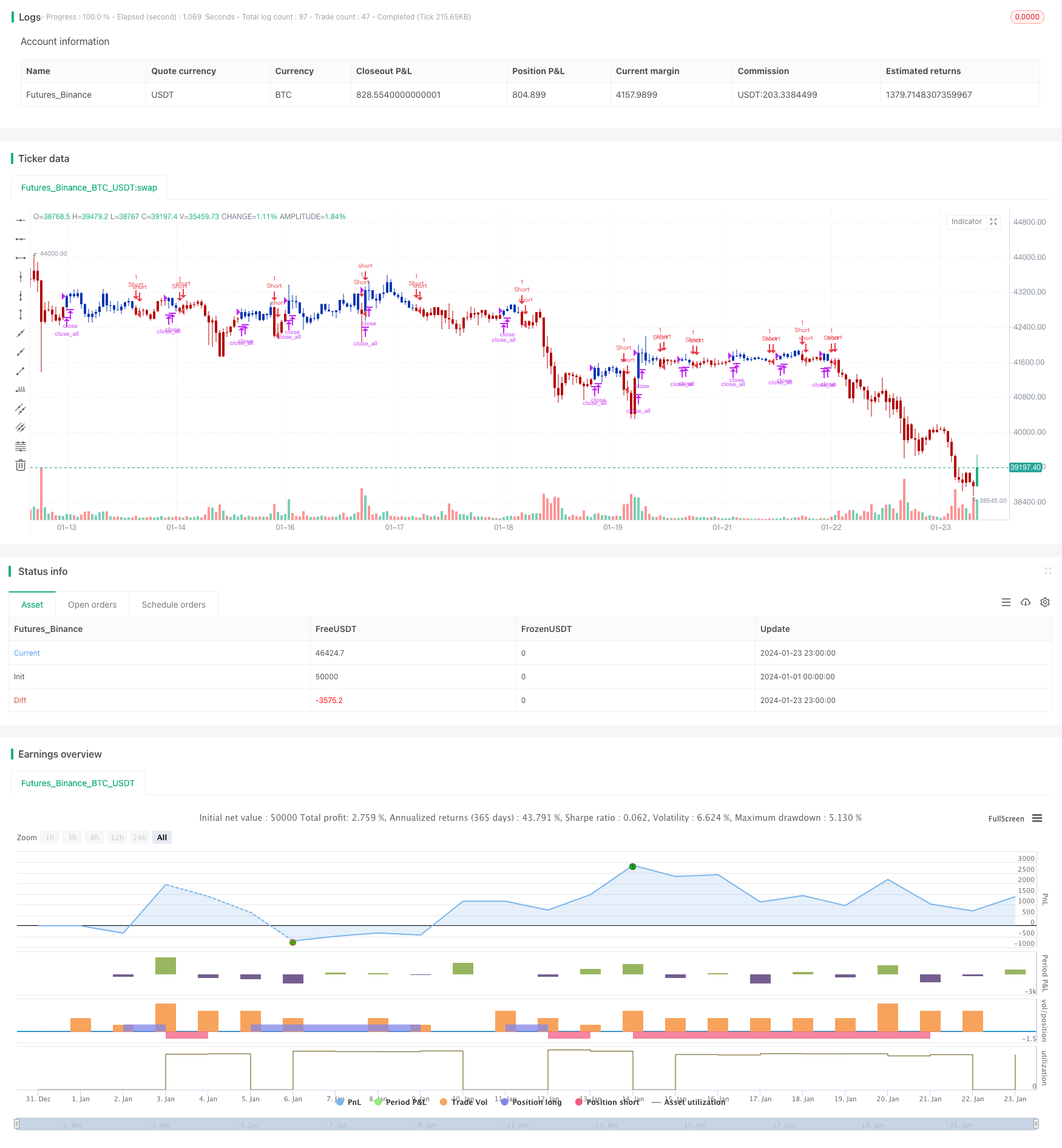

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-24 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 21/09/2020

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// Stock market moves in a highly chaotic way, but at a larger scale, the movements

// follow a certain pattern that can be applied to shorter or longer periods of time

// and we can use Fractal Chaos Bands Indicator to identify those patterns. Basically,

// the Fractal Chaos Bands Indicator helps us to identify whether the stock market is

// trending or not. When a market is trending, the bands will have a slope and if market

// is not trending the bands will flatten out. As the slope of the bands decreases, it

// signifies that the market is choppy, insecure and variable. As the graph becomes more

// and more abrupt, be it going up or down, the significance is that the market becomes

// trendy, or stable. Fractal Chaos Bands Indicator is used similarly to other bands-indicator

// (Bollinger bands for instance), offering trading opportunities when price moves above or

// under the fractal lines.

//

// The FCB indicator looks back in time depending on the number of time periods trader selected

// to plot the indicator. The upper fractal line is made by plotting stock price highs and the

// lower fractal line is made by plotting stock price lows. Essentially, the Fractal Chaos Bands

// show an overall panorama of the price movement, as they filter out the insignificant fluctuations

// of the stock price.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

fractalUp(pattern) =>

p = high[pattern+1]

okl = 1

okr = 1

res = 0.0

for i = pattern to 1

okl := iff(high[i] < high[i+1] and okl == 1 , 1, 0)

for i = pattern+2 to pattern*2+1

okr := iff(high[i] < high[i-1] and okr == 1, 1, 0)

res := iff(okl == 1 and okr == 1, p, res[1])

res

fractalDn(pattern) =>

p = low[pattern+1]

okl = 1

okr = 1

res =0.0

for i = pattern to 1

okl := iff(low[i] > low[i+1] and okl == 1 , 1, 0)

for i = pattern+2 to pattern*2+1

okr := iff(low[i] > low[i-1] and okr == 1, 1, 0)

res := iff(okl == 1 and okr == 1, p, res[1])

res

FCB(Pattern) =>

pos = 0.0

xUpper = fractalUp(Pattern)

xLower = fractalDn(Pattern)

pos := iff(close > xUpper, 1,

iff(close < xLower, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Fractal Chaos Bands", shorttitle="Combo", overlay = true)

Length = input(15, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

Pattern = input(1, minval=1)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posFCB = FCB(Pattern)

pos = iff(posReversal123 == 1 and posFCB == 1 , 1,

iff(posReversal123 == -1 and posFCB == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )

Plus de

- Stratégie à court terme de régression linéaire et de moyenne mobile double

- Stratégie de dynamique stochastique à triple chevauchement

- Stratégie de tendance à la dynamique

- Stratégie quantitative de la moyenne mobile de l'élan

- Stratégie combinée de double inversion de la moyenne mobile et de l'arrêt de traînée ATR

- Stratégie de négociation des contrats à terme à effet de levier Martingale

- Stratégie de reprise de l' élan

- Prédiction à deux bougies stratégie de clôture

- Stratégie de négociation de suivi des supertendances stochastiques avec arrêt des pertes

- Suivre la tendance en suivant une stratégie basée sur l'IMD et l'ISR

- Stratégie quantitative d'oscillation de soutien et de résistance

- Stratégie de suivi des tendances avec 3 EMA, DMI et MACD

- Stratégie révolutionnaire à double indicateur

- Stratégie du système de négociation Pete Wave

- Stratégie quantitative basée sur la pondération exponentielle de la moyenne mobile et du volume

- Stratégie d' Origix Ashi basée sur une moyenne mobile lisse

- Stratégie du scanner de tendance macro de BlackBit Trader XO

- Tendance de l'ADX du pétrole brut à la suite de la stratégie

- Stratégie de négociation par MT-coordination