Stratégie de négociation MACD sur plusieurs délais

Auteur:ChaoZhang est là., Date: 2024-01-30 17:44:36 Le projet de loi est en cours d'adoption.Les étiquettes:

Résumé

Cette stratégie est basée sur l'indicateur MACD classique, combiné avec des indicateurs de jugement de tendance, des méthodes de stop loss et des méthodes de prise de profit pour former une stratégie de trading de suivi de tendance relativement complète.

Logique de négociation

-

Indicateur MACD

- La différence entre l'EMA de période FASTLENGTH et l'EMA de période SLOWLENGTH forme l'histogramme MACD

- L'EMA de la période MACDLENGTH aplatit l'histogramme MACD pour former la ligne MACD

- Histogramme MACD croisant l'axe 0 forme des signaux de négociation

-

Filtre de tendance

- ADX: Indice directionnel moyen, pour juger de l'existence d'une tendance

- MA: Moyenne mobile, le prix au-dessus et au-dessous de MA forme une tendance

- SAR: SAR parabolique, le SAR se déplaçant au-dessus et au-dessous du prix indique une tendance

-

Arrêtez la perte

- L'exposition au risque est calculée sur la base de l'exposition au risque.

- SAR Stop Loss: Utiliser SAR comme stop loss de suivi

-

Faites du profit

- ATR Distance fixe de prise de profit: Distance fixe de prise de profit établie sur la base de l'ATR

- Pourcentage de prise de profit: distance de prise de profit en pourcentage

-

Sortie chronométrée

- Peut définir la sortie après un nombre spécifié de barres

Analyse des avantages

-

Arrêt auxiliaire multiples

- Le jugement de la tendance, du support et de la résistance évite les faux signaux

- L'arrêt des pertes ATR/SAR permet de mieux contrôler le risque

-

Configuration souple

- Choisissez si vous voulez utiliser le filtre de tendance

- Sélectionnez ATR ou SAR stop loss

- Choisissez ATR ou prise de profit standard

- Les paramètres sont configurables

-

Analyse des divergences fournie

- Affiche les écarts historiques réguliers/cachés

- Fournir des notifications par texte

-

Facile à optimiser

- Beaucoup de paramètres configurables intégrés

- Facile à tester différentes combinaisons de paramètres

Analyse des risques

-

Des paramètres incorrects peuvent accroître les pertes

- Les paramètres incorrects de l'ATR et du SAR peuvent entraîner un arrêt prématuré des pertes

- Un taux de prise de profit excessif peut entraîner une prise de profit prématurée

-

Risque de défaillance de la tendance

- Des paramètres d'indicateur de tendance incorrects peuvent entraîner une erreur de jugement

- Les événements du cygne noir peuvent entraîner une défaillance de la tendance

-

Risques de sortie chronométrés

- Résultats de l'évaluation des risques

Directions d'optimisation

- Ajustez les paramètres ATR et SAR pour des arrêts plus fluides

- Testez différentes périodes de MA afin d'optimiser le jugement des tendances

- Test ajusté des ratios de prise de profit pour augmenter le taux de profit

- Incorporer des indicateurs de volatilité pour optimiser les configurations

Conclusion

Cette stratégie prend en compte de manière exhaustive l'identification de la tendance, du stop loss, du profit, du pullback pour former une stratégie de trading de crypto-monnaie relativement complète. Elle combine les avantages des indicateurs MACD, ajoute le filtrage de tendance pour éviter de fausses transactions; ajoute l'ATR/SAR stop loss pour un meilleur contrôle des risques; l'identification du pullback fournit une référence supplémentaire. Les multiples paramètres configurables peuvent être facilement testés et optimisés.

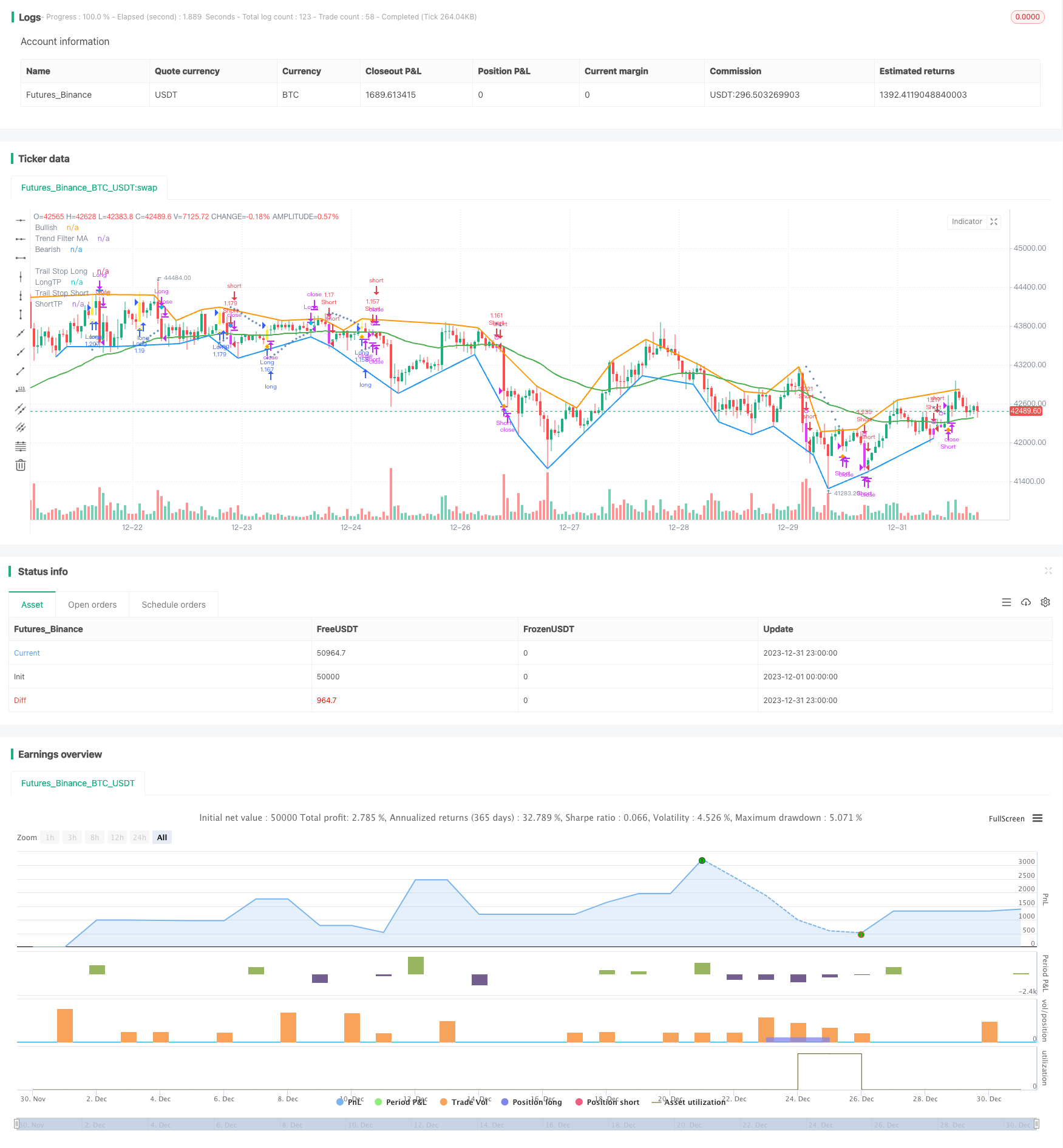

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © systemalphatrader

//@version=4

strategy(title="MACD+ Strategy [SystemAlpha]", shorttitle="MACD+ Strategy [SA]", overlay=true, initial_capital=10000, currency='USD',

default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type=strategy.commission.percent, commission_value=0.04)

// == MAIN INPUT ==

// TREND FILTER

// Make input option to configure trend filter

trendFilter = input(title="Trend Filter", defval='MA', options=['ADX', 'MA', 'SAR', 'All', 'None'])

// Translate input into trend filters

useADXFilter = (trendFilter == 'ADX') or (trendFilter == 'All')

useSARFilter = (trendFilter == 'SAR') or (trendFilter == 'All')

useMAFilter = (trendFilter == 'MA') or (trendFilter == 'All')

// TRAIL STOP

// Make input option to configure trail stop

trailStop = input(title="Trailing Stop Loss", defval='SAR', options=['ATR', 'SAR', 'None'])

// Translate input

useATRStop = (trailStop == 'ATR')

useSARStop = (trailStop == 'SAR')

// TAKE PROFIT TARGET

// Make input option to configure trail stop

TPtarget = input(title="Take Profit Type", defval='ATR', options=['ATR', 'Percent', 'None'])

// Translate input

useATRTP = (TPtarget == 'ATR')

usePercentTP = (TPtarget == 'Percent')

// ALERTS and BAR COLOR

// Make input option to configure alerts

alerts = input(title="Select Alerts to Display", defval='None', options=['Buy/Sell', 'Exit', 'Both', 'None'])

// Translate input

showsignals = (alerts == 'Buy/Sell') or (alerts == 'Both')

showexitsignals = (alerts == 'Exit') or (alerts == 'Both')

showBarColor = input(true, title="Show Bar Color")

// == /MAIN INPUT ==

/////////////////////////////////////

//*STRATEGY LOGIC *//

/////////////////////////////////////

// == MACD ==

fastLength = input(12, title="Fast Length")

slowlength = input(26, title="Slow Length")

MACDLength = input(9, title="MACD Length")

MACD = ema(close, fastLength) - ema(close, slowlength)

aMACD = ema(MACD, MACDLength)

delta = MACD - aMACD

// Calc breakouts

break_up = crossover(delta, 0)

break_down = crossunder(delta,0)

// == /MACD ==

// == DIVERGENCE ==

method = input(title="Divergence Method", defval='Hist', options=['Hist', 'MACD'])

divtype = input(title="Divergence Type", defval='None', options=['Regular', 'Hidden', 'Both', 'None'])

uReg = divtype == 'Regular' or divtype == 'Both'

uHid = divtype == 'Hidden' or divtype == 'Both'

showlabel = input(true, title="Show Divergence Label")

v_show_last = input(500, "Plotting Lookback Bars Length")

high_src = high

low_src = low

// || Functions:

f_top_fractal(_src) =>

_src[4] < _src[2] and _src[3] < _src[2] and _src[2] > _src[1] and

_src[2] > _src[0]

f_bot_fractal(_src) =>

_src[4] > _src[2] and _src[3] > _src[2] and _src[2] < _src[1] and

_src[2] < _src[0]

f_fractalize(_src) =>

f_bot_fractal__1 = f_bot_fractal(_src)

f_top_fractal(_src) ? 1 : f_bot_fractal__1 ? -1 : 0

// === End of Functions

// || Method selection

oscilator_high = float(na)

oscilator_low = float(na)

if method == 'MACD'

oscilator_high := MACD

oscilator_low := MACD

if method == 'Hist'

oscilator_high := delta

oscilator_low := delta

//

fractal_top = f_fractalize(oscilator_high) > 0 ? oscilator_high[2] : na

fractal_bot = f_fractalize(oscilator_low) < 0 ? oscilator_low[2] : na

high_prev = valuewhen(fractal_top, oscilator_high[2], 0)[2]

high_price = valuewhen(fractal_top, high[2], 0)[2]

low_prev = valuewhen(fractal_bot, oscilator_low[2], 0)[2]

low_price = valuewhen(fractal_bot, low[2], 0)[2]

regular_bearish_div = fractal_top and high[2] > high_price and oscilator_high[2] < high_prev

hidden_bearish_div = fractal_top and high[2] < high_price and oscilator_high[2] > high_prev

regular_bullish_div = fractal_bot and low[2] < low_price and oscilator_low[2] > low_prev

hidden_bullish_div = fractal_bot and low[2] > low_price and oscilator_low[2] < low_prev

// Plotting

plot(title='Bullish', series=fractal_top ? high[2] : na, color = regular_bearish_div and uReg or hidden_bearish_div and uHid ? color.red : na, linewidth = 2, transp=50, offset=-2, show_last = v_show_last)

plot(title='Bearish', series=fractal_bot ? low[2] : na, color = regular_bullish_div and uReg or hidden_bullish_div and uHid ? color.green : na, linewidth = 2, transp=50, offset=-2, show_last = v_show_last)

plotshape(title='Regular Bearish', series=not showlabel or not uReg ? na : regular_bearish_div ? high[2] : na, text='R', style=shape.labeldown, location=location.absolute, color=color.red, textcolor=color.white, transp=50, offset=-2, show_last = v_show_last)

plotshape(title='Hidden Bearish', series=not showlabel or not uHid ? na : hidden_bearish_div ? high[2] : na, text='H', style=shape.labeldown, location=location.absolute, color=color.red, textcolor=color.white, transp=80, offset=-2, show_last = v_show_last)

plotshape(title='Regular Bullish', series=not showlabel or not uReg ? na : regular_bullish_div ? low[2] : na, text='R', style=shape.labelup, location=location.absolute, color=color.green, textcolor=color.white, transp=50, offset=-2, show_last = v_show_last)

plotshape(title='Hidden Bullish', series=not showlabel or not uHid ? na : hidden_bullish_div ? low[2] : na, text='H', style=shape.labelup, location=location.absolute, color=color.green, textcolor=color.white, transp=80, offset=-2, show_last = v_show_last)

// == /DIVERGENCE ==

// == ENTRY ==

// == ADX FILTERING ==

// Look at ADX when it is above a user-defined key level (23 default) and this is to identify when it is trending.

// It then looks at the DMI levels. If D+ is above D- and the ADX is sloping upwards and above the key level, it triggers a buy condition. Opposite for short.

adxlen = 13 //input(13, title="TF ADX Smoothing")

dilen = 13 //input(13, title="TF DI Period")

keyLevel = 23 //input(23, title="TF Keylevel for ADX")

// == USE BUILT-IN DMI FUNCTION TO DETERMINE ADX AND BULL/BEAR STRENGTH

[diplus, diminus, adx] = dmi(dilen, adxlen)

//Buy and Sell Filter

ADXBuyCheck = useADXFilter? diplus > diminus : true

ADXSellCheck = useADXFilter? diplus < diminus : true

// == /ADX FILTERING ==

// == MOVING AVERAGE FILTERING ==

// MA FILTER: Use a user-defined moving average to filter long/short if desried.

maType = input(defval="EMA", options=["EMA", "SMA"], title = "TF MA Type")

maLength = input(defval = 50, title = "TF MA Period", minval = 1)

// Declare function to be able to swap out EMA/SMA

ma(maType, src, length) =>

maType == "EMA" ? ema(src, length) : sma(src, length)

maFilter = ma(maType, close, maLength)

// Check to see if the useMaFilter check box is checked, this then inputs this conditional "maFilterCheck" variable into the strategy entry

maFilterCheck = if useMAFilter == true

maFilter

else

close

// == /MOVING AVERAGE FILTERING ==

// == PARABOLIC SAR AS AN ENTRY and EXIT OPTION ==

// SAR FILTER: The Parabolic SAR (Stop and Reverse) is a time and price technical analysis tool primarily used to identify points of potential stops and reverses.

// Go long when is located below price (BULLISH) and go short when is located above price (BEARISH).

sarStart = 0.04 //input(0.04, "SAR Start")

sarIncrement = 0.02 //input(0.02, "SAR Increment")

sarMaximum = 0.5 //input(0.5, "SAR Max Value")

htclose = close

sarOut = useSARFilter or useSARStop ? sar(sarStart, sarIncrement, sarMaximum) : na

Trend = sarOut < htclose ? 1 : -1

//Buy and Sell Filter

sarBuyCheck = useSARFilter? Trend == 1: true

sarSellCheck = useSARFilter? Trend == -1: true

// Trigger stop based on High/Low

trigResistance = high

trigSupport = low

// Determine if price is above resistance or below support

sarResistanceHit = close >= sarOut and useSARStop == true

sarSupportHit = close <= sarOut and useSARStop == true

// == /PARABOLIC SAR AS AN ENTRY and EXIT OPTION ==

// == EXITS ==

// == ATR TRAILING STOPS ==

// The ATR % stop method can be used by any type of trader because the width of the stop is determined by the percentage of average true range (ATR).

// ATR is a measure of volatility over a specified period of time.

// Exit with ATR support/resistance is hit.

atrLookback = 14 //input(defval=14,title="ATR Lookback Period",type=input.integer)

multiplier = input(defval=2,title="ATR Trailing Stop Multiplier",type=input.float, step=0.1, minval=0.5, maxval=5)

// Calculate the trailing ATR

atrValue = atr(atrLookback)

atrMultiplied = atrValue * multiplier

// Plot the price plus or minus the ATR

atrLow = low - atrMultiplied

atrHigh = high + atrMultiplied

// Calculate both the low and high trailing ATRs every time. The low one never goes down, and the high one never goes up

// Set them to something to start with

trailAtrLow = atrLow

trailAtrHigh = atrHigh

// If the ATR Low has gone up AND it has gone above the trail, the low trailing ATR should also go up. If the ATR Low has gone up or down, but not below the trail, the ATR trail stays where it is

trailAtrLow := na(trailAtrLow[1]) ? trailAtrLow : atrLow >= trailAtrLow[1] ? atrLow : trailAtrLow[1]

// Same for the High

trailAtrHigh := na(trailAtrHigh[1]) ? trailAtrHigh : atrHigh <= trailAtrHigh[1] ? atrHigh : trailAtrHigh[1]

// Determine if price is above resistance or below support

atrResistanceHit = trigResistance >= trailAtrHigh and useATRStop == true

atrSupportHit = trigSupport <= trailAtrLow and useATRStop == true

// If price is above resistance or below support, reset the trailing ATR

trailAtrLow := atrSupportHit ? atrLow : trailAtrLow

trailAtrHigh := atrResistanceHit ? atrHigh : trailAtrHigh

// == /ATR TRAILING STOPS ==

// == INITIAL TP==

// ATR

tpmultiplier = input(defval=3,title="ATR Take Profit Multiplier",type=input.float, step=0.1, minval=0.5, maxval=5)

ema = ema(close, atrLookback)

atr = rma(tr(true), atrLookback)

longATRTP = ema + (atr * tpmultiplier)

shortATRTP = ema - (atr * tpmultiplier)

// Determine if price is above resistance or below support

longATRTPHit = high >= longATRTP and useATRTP == true

shortATRTPHit = low <= shortATRTP and useATRTP == true

// STANDARD TAKE PROFIT %

// User Options to Change Inputs (%)

takePer = input(10, title='Take Profit %', type=input.float, step=0.1, minval=0.5, maxval=100) / 100

//fixed TP prices

longPercentTP = ema * (1 + takePer)

shortPercentTP = ema * (1 - takePer)

// Determine if price is above resistance or below support

longPercentTPHit = high >= longPercentTP and usePercentTP == true

shortPercentTPHit = low <= shortPercentTP and usePercentTP == true

// Set Stop and TP Values

buyStop = trailStop == 'ATR'? trailAtrLow : trailStop == 'SAR'? sarOut : na

sellStop = trailStop == 'ATR'? trailAtrHigh : trailStop == 'SAR'? sarOut : na

longTP = TPtarget == 'ATR'? longATRTP : TPtarget == 'Percent'? longPercentTP : na

shortTP = TPtarget == 'ATR'? shortATRTP : TPtarget == 'Percent'? shortPercentTP : na

// == /EXITS ==

// == PLOTTING ==

buySignal = break_up and ADXBuyCheck and close >= maFilterCheck and sarBuyCheck

shortSignal = break_down and ADXSellCheck and close <= maFilterCheck and sarSellCheck

sellSignal = atrSupportHit or sarSupportHit or longPercentTPHit or longATRTPHit

coverSignal = atrResistanceHit or sarResistanceHit or shortPercentTPHit or shortATRTPHit

//Set BarSince counter

barsSinceLong = 0

barsSinceShort = 0

barsSinceLong := nz(barsSinceLong[1])

barsSinceShort := nz(barsSinceShort[1])

//Plot Sell and Cover Signal

plotshape(not showexitsignals and sellSignal and barsSinceLong == 1? sellSignal : na, title="Sell Long", location=location.abovebar, style=shape.diamond, size=size.auto, color=color.aqua, transp=0, show_last = v_show_last, editable = false)

plotshape(not showexitsignals and coverSignal and barsSinceShort == 1 ? coverSignal : na, title="Cover Short", location=location.belowbar, style=shape.diamond, size=size.auto, color=color.orange, transp=0, show_last = v_show_last, editable = false)

plotshape(showexitsignals and sellSignal and barsSinceLong == 1? sellSignal : na, title="Close Long Text", location=location.abovebar, style=shape.diamond, size=size.auto, color=color.aqua, transp=0, show_last = v_show_last, textcolor=color.aqua, text = "Close\nLong", editable = false)

plotshape(showexitsignals and coverSignal and barsSinceShort == 1 ? coverSignal : na, title="Cover Short Text", location=location.belowbar, style=shape.diamond, size=size.auto, color=color.orange, transp=0, show_last = v_show_last, textcolor=color.orange, text = "Cover\nShort", editable = false)

// Reset BarSince counter

if buySignal

barsSinceLong := 1

barsSinceShort := 0

if shortSignal

barsSinceShort := 1

barsSinceLong := 0

if sellSignal

barsSinceLong := 0

if coverSignal

barsSinceShort := 0

// Show bar color

barcolor(showBarColor? (buySignal or shortSignal ? (shortSignal ? color.fuchsia : color.yellow) : na) : na)

// Plot Buy Alerts

plotshape(buySignal ? buySignal : na, title="Breakout Up", location=location.belowbar, style=shape.circle, size=size.auto, color=color.yellow, transp=0, editable = false)

plotshape(showsignals and buySignal, title= "Long", color=color.green, style=shape.labelup, location=location.belowbar, size=size.auto, show_last = v_show_last, text = "BUY", textcolor=color.white, editable = false)

// Plot Sell Alerts

plotshape(shortSignal ? shortSignal : na, title="Breakout Down", location=location.abovebar, style=shape.circle, size=size.auto, color=color.fuchsia, transp=0, editable = false)

plotshape(showsignals and shortSignal, title= "Short", color=color.red, style=shape.labeldown, location=location.abovebar, size=size.auto, show_last = v_show_last, text = "SELL", textcolor=color.white, editable = false)

// Plot MA Trend Filter

plot(useMAFilter? maFilter : na, title = "Trend Filter MA", color = color.green, linewidth = 2, style = plot.style_line, transp = 20, editable = true)

// Plot Initial Stop

plot(trailStop != 'None' and barsSinceLong >= 1? buyStop : na, color=#3A6CA8, title="Trail Stop Long", style = plot.style_cross, linewidth = 1, transp = 20, editable = true)

plot(trailStop != 'None' and barsSinceShort >= 1? sellStop : na, color=#3A6CA8, title="Trail Stop Short", style = plot.style_cross, linewidth = 1, transp = 20, editable = true)

// Plot Initial Target Profit

plot(TPtarget != 'None' and buySignal? longTP : na, color=color.green, title="LongTP", style = plot.style_linebr, linewidth = 1, editable = false)

plot(TPtarget != 'None' and shortSignal? shortTP : na, color=color.green, title="ShortTP", style = plot.style_linebr, linewidth = 1, editable = false)

// == /PLOTTING ==

// == ALERTS ==

// Buy and Sell Signal

alertcondition(buySignal, title='MACD Long', message='MACD {{exchange}}:{{ticker}} TF: {{interval}}. LONG (TRADE). ENTRY: {{close}}, Target Profit: {{plot("LongTP")}}, STOP LOSS: {{plot("Trail Stop Long")}}')

alertcondition(shortSignal, title='MACD Short', message='MACD {{exchange}}:{{ticker}} TF: {{interval}}. SHORT (TRADE). ENTRY: {{close}}, Target Profit: {{plot("ShortTP")}}, STOP LOSS: {{plot("Trail Stop Short")}}')

alertcondition(sellSignal, title='MACD Close Long', message='MACD {{exchange}}:{{ticker}} Close Long, Price = {{close}}')

alertcondition(coverSignal, title='MACD Cover Short', message='MACD {{exchange}}:{{ticker}} Cover Short, Price = {{close}}')

alertcondition(sellSignal or coverSignal, title="MACD Close Orders", message="{{ticker}} Close Orders")

// Initial SL and TP Hit

stophit = low <= buyStop or high >= sellStop

tphit = low <= shortTP or high >= longTP

alertcondition(stophit, title='MACD SL Hit', message='MACD {{exchange}}:{{ticker}} Stop Loss Hit, Price = {{close}}')

alertcondition(tphit, title='MACD TP Hit', message='MACD {{exchange}}:{{ticker}} Target Profit Hit, Price = {{close}}')

//Divergence Alerts

alertcondition(regular_bullish_div, title='MACD Bullish Divergence', message='MACD Regular Bullish Divergence')

alertcondition(regular_bearish_div, title='MACD Bearish Divergence', message='MACD Regular Bearish Divergence')

alertcondition(hidden_bullish_div, title='MACD Hidden Bullish Divergence', message='MACD Hidden Bullish Divergence')

alertcondition(hidden_bearish_div, title='MACD Hidden Bearish Divergence', message='MACD Hidden Bearish Divergence')

// == /ALERTS ==

//////////////////////////

//* STRATEGY COMPONENT *//

//////////////////////////

// === BACKTEST RANGE ===

From_Year = input(defval = 2017, title = "BACKTEST: From Year")

From_Month = input(defval = 1, title = "BACKTEST: From Month", minval = 1, maxval = 12)

From_Day = input(defval = 1, title = "BACKTEST: From Day", minval = 1, maxval = 31)

To_Year = input(defval = 9999, title = "BACKTEST: To Year")

To_Month = input(defval = 1, title = "BACKTEST: To Month", minval = 1, maxval = 12)

To_Day = input(defval = 1, title = "BACKTEST: To Day", minval = 1, maxval = 31)

Start = timestamp(From_Year, From_Month, From_Day, 00, 00) // backtest start window

Finish = timestamp(To_Year, To_Month, To_Day, 23, 59) // backtest finish window

testPeriod() => true

// === /BACKTEST RANGE ===

// === STRATEGY ===

// Make input option to configure trade direction

tradeDirection = input(title="Trade Direction", defval="Both", options=["Long", "Short", "Both"])

// Translate input into trading conditions

longOK = (tradeDirection == "Long") or (tradeDirection == "Both")

shortOK = (tradeDirection == "Short") or (tradeDirection == "Both")

// == STRATEGY ENTRIES/EXITS ==

timedExit = input(title = "Use Timed Exit", type = input.bool, defval = true)

exitmethod = input(title="Timed Exit Method", defval='3', options=['1', '2', '3'])

bse = input(10, "Bar Since Entry") // Bars to exit after entry

barsSinceEntry = 0

barsSinceEntry := nz(barsSinceEntry[1]) + 1

longCondition = longOK and buySignal and testPeriod()

shortcondition = shortOK and shortSignal and testPeriod()

if strategy.position_size == 0

barsSinceEntry := 0

// === STRATEGY - LONG POSITION EXECUTION ===

if longCondition

strategy.entry("Long", strategy.long)

barsSinceEntry := 0

// === STRATEGY - SHORT POSITION EXECUTION ===

if shortcondition

strategy.entry("Short", strategy.short)

barsSinceEntry := 0

// == STRATEGY EXITS ==

if sellSignal

strategy.close("Long")

barsSinceEntry := 0

if coverSignal

strategy.close("Short")

barsSinceEntry := 0

// Enable Timed Exit

// Exit after specified number of bars.

if timedExit and exitmethod == '1' and barsSinceEntry > bse

strategy.close_all()

barsSinceEntry := 0

// Exit after specified number of bars, ONLY if position is currently profitable.

if timedExit and exitmethod == '2' and strategy.openprofit > 0 and barsSinceEntry > bse

strategy.close_all()

barsSinceEntry := 0

// Exit after specified number of bars, ONLY if position is currently losing.

if timedExit and exitmethod == '3' and strategy.openprofit < 0 and barsSinceEntry > bse

strategy.close_all()

barsSinceEntry := 0

// === /STRATEGY ===

//EOF

- Stratégie de croisement des moyennes mobiles doubles

- Stratégie de suivi dynamique des tendances à double mécanisme

- Stratégie de trading Bitcoin basée sur le Cloud Ichimoku

- Système de suivi du marché haussier

- Stratégie de négociation intraday pour les actions basée sur le retracement du point bas de Renko

- Stratégie de négociation de tendance basée sur le canal de prix des moyennes mobiles doubles

- Stratégie de rupture à double MA

- Stratégie de négociation quantitative professionnelle SMART

- Stratégie de chaîne de volatilité à double rupture

- Tendance à la suite d'une stratégie basée sur plusieurs indicateurs

- Stratégie de rendement mensuel avec référence

- Stratégie de rupture de l' élan

- Stratégie de double percée

- Stratégie de négociation algorithmique de la rupture et de l' engorgement de l' élan

- Stratégie de confluence de deux moyennes mobiles

- Une stratégie de négociation de renversement de l'indice de risque

- Stratégie de négociation ADX bidirectionnelle

- Vix fixe la stratégie de pêche au fond par régression linéaire

- Trois moyennes mobiles exponentielles et stratégie de négociation de l'indice de force relative stochastique

- Stratégie double de 7 jours.