Stratégie dynamique de tendance à l'engorgement

Auteur:ChaoZhang est là., Date: le 29 février 2024 11:24:18Les étiquettes:

Résumé

La stratégie Dynamic Engulfing Trend est une stratégie de trading qui prend des positions longues ou courtes basées sur des modèles d'engulfement dans la direction de la tendance. Cette stratégie utilise la moyenne True Range (ATR) pour mesurer la volatilité du marché, l'indicateur Supertrend pour déterminer la direction de la tendance du marché et entre dans les transactions lorsque les modèles d'engulfement s'alignent sur la direction de la tendance.

La logique de la stratégie

- Calculer l'ATR pour mesurer la volatilité du marché.

- Calculer l'indicateur Supertrend pour identifier la tendance du marché.

- Définir les conditions de tendance haussière et de tendance baissière.

- Identifier l' engorgement haussier (en tendance haussière) et l' engorgement baissier (en tendance baissière).

- Les niveaux d'arrêt des pertes (SL) et de prise de profit (TP) sont calculés sur la base des modèles d'engorgement.

- Entrez dans les transactions lorsque les tendances correspondent à la tendance.

- Exit trades lorsque le prix atteint les niveaux SL ou TP.

- Tracez les schémas d'engloutissement sur le graphique.

Analyse des avantages

Les avantages de cette stratégie sont les suivants:

- Amélioration de la qualité du signal en combinant les schémas d'engorgement avec la tendance.

- Capacité d'identifier des renversements de tendance pour des entrées précises.

- Éliminez les signaux longs/courts pour un meilleur timing.

- La stratégie d'arrêt d'engorgement suit la tendance tout en gérant les risques.

- Cadre de code modulaire pour des optimisations faciles.

Analyse des risques

Il y a aussi quelques risques à prendre en considération:

- Les schémas d'engorgement peuvent s'avérer être de fausses fuites.

- Difficile de déterminer les paramètres optimaux tels que la taille du motif, la durée, etc.

- Une détermination de tendance imparfaite peut conduire à de faux signaux.

- Les niveaux de stop-loss et de profit dépendent de la discrétion et peuvent être subjectifs.

- Les performances dépendent du réglage des paramètres basé sur les données historiques.

Les risques peuvent être atténués par:

- J'ajoute des filtres pour éliminer les faux signaux.

- Utilisation de l'ATR adaptatif pour des calculs de paramètres fiables.

- Amélioration de la détermination des tendances par l'apprentissage automatique.

- Trouver les paramètres optimaux par des algorithmes génétiques.

- Tests de retour sur des durées plus longues pour assurer la robustesse.

Directions d'optimisation

Il existe des possibilités d'optimisation supplémentaires:

- L'apprentissage automatique peut améliorer la détermination des tendances.

- De nouvelles méthodes de reconnaissance des modèles permettent de mieux identifier les modèles d'engloutissement.

- Les dernières stratégies stop loss/take profit peuvent optimiser dynamiquement les niveaux.

- Les données à haute fréquence peuvent développer un système à court terme.

- Paramètre de réglage pour différents instruments.

Conclusion

En résumé, la stratégie Dynamic Engulfing Trend combine les signaux de modèle d'engulissement de haute qualité avec une détermination précise de la tendance pour générer un système de trading avec des entrées précises et des pertes de stop raisonnables et une prise de profit.

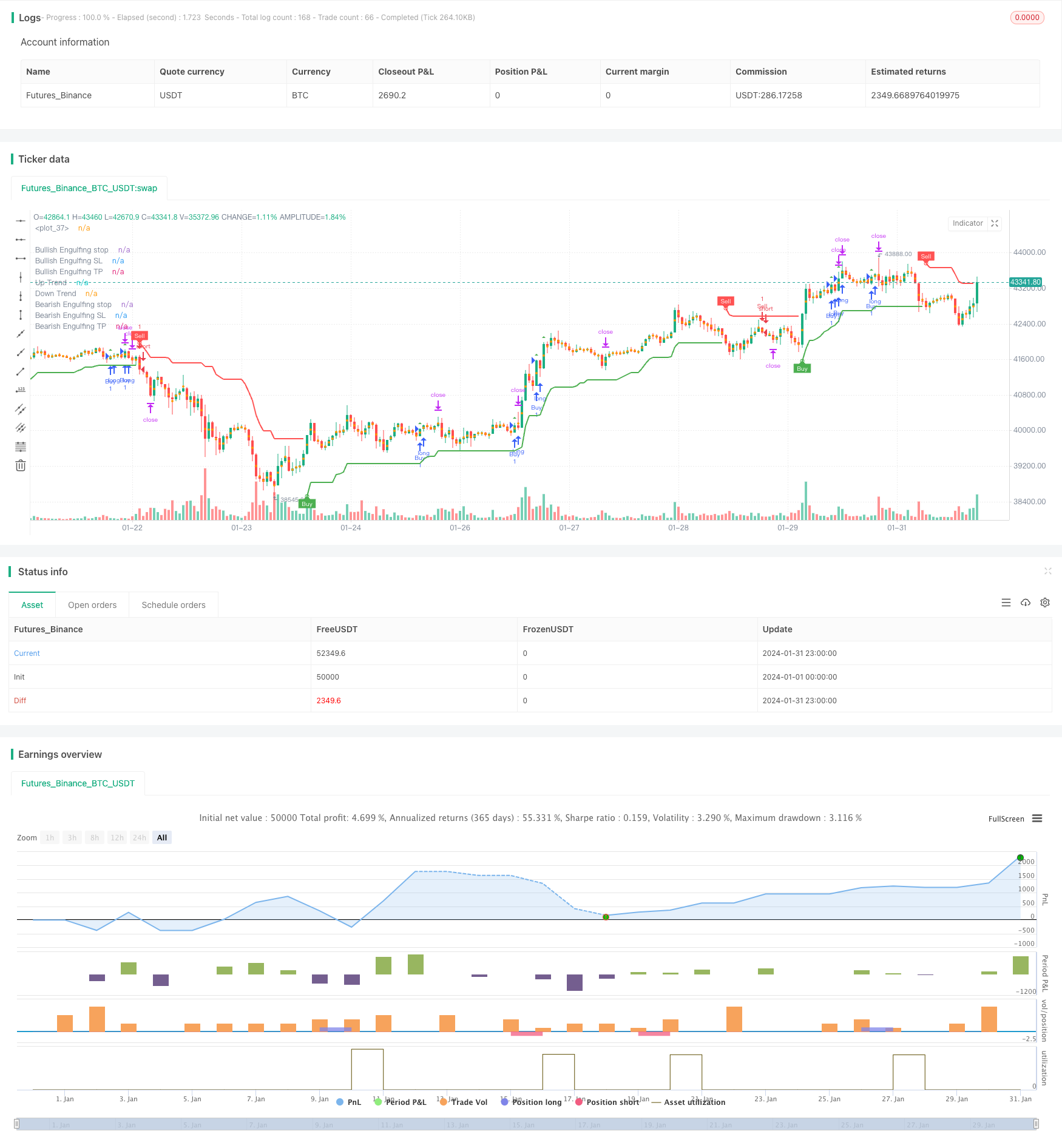

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Malikdrajat

//@version=4

strategy("Engulfing with Trend", overlay=true)

Periods = input(title="ATR Period", type=input.integer, defval=10)

src = input(hl2, title="Source")

Multiplier = input(title="ATR Multiplier", type=input.float, step=0.1, defval=3.0)

changeATR= input(title="Change ATR Calculation Method ?", type=input.bool, defval=true)

showsignals = input(title="Show Buy/Sell Signals ?", type=input.bool, defval=true)

highlighting = input(title="Highlighter On/Off ?", type=input.bool, defval=true)

atr2 = sma(tr, Periods)

atr= changeATR ? atr(Periods) : atr2

up=src-(Multiplier*atr)

up1 = nz(up[1],up)

up := close[1] > up1 ? max(up,up1) : up

dn=src+(Multiplier*atr)

dn1 = nz(dn[1], dn)

dn := close[1] < dn1 ? min(dn, dn1) : dn

trend = 1

trend := nz(trend[1], trend)

trend := trend == -1 and close > dn1 ? 1 : trend == 1 and close < up1 ? -1 : trend

upPlot = plot(trend == 1 ? up : na, title="Up Trend", style=plot.style_linebr, linewidth=2, color=color.green)

buySignal = trend == 1 and trend[1] == -1

plotshape(buySignal ? up : na, title="UpTrend Begins", location=location.absolute, style=shape.circle, size=size.tiny, color=color.green, transp=0)

plotshape(buySignal and showsignals ? up : na, title="Buy", text="Buy", location=location.absolute, style=shape.labelup, size=size.tiny, color=color.green, textcolor=color.white, transp=0)

dnPlot = plot(trend == 1 ? na : dn, title="Down Trend", style=plot.style_linebr, linewidth=2, color=color.red)

sellSignal = trend == -1 and trend[1] == 1

plotshape(sellSignal ? dn : na, title="DownTrend Begins", location=location.absolute, style=shape.circle, size=size.tiny, color=color.red, transp=0)

plotshape(sellSignal and showsignals ? dn : na, title="Sell", text="Sell", location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.red, textcolor=color.white, transp=0)

mPlot = plot(ohlc4, title="", style=plot.style_circles, linewidth=0)

longFillColor = highlighting ? (trend == 1 ? color.green : color.white) : color.white

shortFillColor = highlighting ? (trend == -1 ? color.red : color.white) : color.white

fill(mPlot, upPlot, title="UpTrend Highligter", color=longFillColor)

fill(mPlot, dnPlot, title="DownTrend Highligter", color=shortFillColor)

alertcondition(buySignal, title="SuperTrend Buy", message="SuperTrend Buy!")

alertcondition(sellSignal, title="SuperTrend Sell", message="SuperTrend Sell!")

changeCond = trend != trend[1]

alertcondition(changeCond, title="SuperTrend Direction Change", message="SuperTrend has changed direction!")

// Define Downtrend and Uptrend conditions

downtrend = trend == -1

uptrend = trend == 1

// Engulfing

boringThreshold = input(25, title="Boring Candle Threshold (%)", minval=1, maxval=100, step=1)

engulfingThreshold = input(50, title="Engulfing Candle Threshold (%)", minval=1, maxval=100, step=1)

stopLevel = input(200, title="Stop Level (Pips)", minval=1)

// Boring Candle (Inside Bar) and Engulfing Candlestick Conditions

isBoringCandle = abs(open[1] - close[1]) * 100 / abs(high[1] - low[1]) <= boringThreshold

isEngulfingCandle = abs(open - close) * 100 / abs(high - low) <= engulfingThreshold

// Bullish and Bearish Engulfing Conditions

bullEngulfing = uptrend and close[1] < open[1] and close > open[1] and not isBoringCandle and not isEngulfingCandle

bearEngulfing = downtrend and close[1] > open[1] and close < open[1] and not isBoringCandle and not isEngulfingCandle

// Stop Loss, Take Profit, and Entry Price Calculation

bullStop = close + (stopLevel * syminfo.mintick)

bearStop = close - (stopLevel * syminfo.mintick)

bullSL = low

bearSL = high

bullTP = bullStop + (bullStop - low)

bearTP = bearStop - (high - bearStop)

// Entry Conditions

enterLong = bullEngulfing and uptrend

enterShort = bearEngulfing and downtrend

// Exit Conditions

exitLong = crossover(close, bullTP) or crossover(close, bullSL)

exitShort = crossover(close, bearTP) or crossover(close, bearSL)

// Check if exit conditions are met by the next candle

exitLongNextCandle = exitLong and (crossover(close[1], bullTP[1]) or crossover(close[1], bullSL[1]))

exitShortNextCandle = exitShort and (crossover(close[1], bearTP[1]) or crossover(close[1], bearSL[1]))

// Strategy Execution

strategy.entry("Buy", strategy.long, when=enterLong )

strategy.entry("Sell", strategy.short, when=enterShort )

// Exit Conditions for Long (Buy) Positions

if (bullEngulfing and not na(bullTP) and not na(bullSL))

strategy.exit("Exit Long", from_entry="Buy", stop=bullSL, limit=bullTP)

// Exit Conditions for Short (Sell) Positions

if (bearEngulfing and not na(bearTP) and not na(bearSL))

strategy.exit("Exit Short", from_entry="Sell", stop=bearSL, limit=bearTP)

// Plot Shapes and Labels

plotshape(bullEngulfing, style=shape.triangleup, location=location.abovebar, color=color.green)

plotshape(bearEngulfing, style=shape.triangledown, location=location.abovebar, color=color.red)

// Determine OP, SL, and TP

plot(bullEngulfing ? bullStop : na, title="Bullish Engulfing stop", color=color.red, linewidth=3, style=plot.style_linebr)

plot(bearEngulfing ? bearStop : na, title="Bearish Engulfing stop", color=color.red, linewidth=3, style=plot.style_linebr)

plot(bullEngulfing ? bullSL : na, title="Bullish Engulfing SL", color=color.red, linewidth=3, style=plot.style_linebr)

plot(bearEngulfing ? bearSL : na, title="Bearish Engulfing SL", color=color.red, linewidth=3, style=plot.style_linebr)

plot(bullEngulfing ? bullTP : na, title="Bullish Engulfing TP", color=color.green, linewidth=3, style=plot.style_linebr)

plot(bearEngulfing ? bearTP : na, title="Bearish Engulfing TP", color=color.green, linewidth=3, style=plot.style_linebr)

- Stratégie de croisement dynamique avec stop loss dynamique

- Stratégie de négociation quantitative de l'EMA et du RSI

- Stratégie de tendance à la dynamique basée sur les bandes MACD et Bollinger

- Stratégie stochastique sur plusieurs délais

- Stratégie de croisement de moyenne mobile avec des modèles de chandeliers intraday

- Stratégie de scalping Bitcoin basée sur des modèles de croisement de moyenne mobile et de chandeliers

- Stratégie à long terme combinant dynamique et moyenne mobile

- Indice de mouvement directionnel moyen de l'élan Motionnel moyen Stratégie de croisement

- Stratégie de suivi des tendances croisées à la double EMA

- Stratégie de négociation combinée de moyenne mobile double et MACD

- Stratégie de négociation de remise en arrière des moyennes mobiles sur plusieurs délais

- Stratégie de suivi de la volatilité des moyennes mobiles doubles

- Stratégie de négociation à court terme basée sur des bandes de Bollinger

- Stratégie de conduite de tendance basée sur MOST et KAMA

- Tendance à deux délais suivant la stratégie

- Stratégie de négociation de Bitlinc MARSI

- Stratégie de suivi des bandes de Bollinger

- Stratégie de rupture de SuperTrend

- L'analyse de la double stratégie de l'EMA

- La stratégie de négociation de rappel de rupture