La tendance ATR de la bande de Bollinger suivant la stratégie

Auteur:ChaoZhang est là., Date: 2024-05-15 à 10h50Les étiquettes:BBSMAATR

Résumé

Cette stratégie est basée sur les bandes de Bollinger et l'indicateur ATR. Elle capture les fluctuations de prix à l'aide des bandes de Bollinger, utilise les écarts de prix au-dessus ou en dessous des bandes comme signaux d'entrée et utilise ATR comme stop loss.

Principes de stratégie

- Calculer les bandes de Bollinger: utiliser le prix de clôture pour calculer la moyenne mobile simple (SMA) comme bande intermédiaire, et calculer les bandes supérieure et inférieure en fonction de la volatilité (déviation type).

- Calculer l'ATR: utiliser la moyenne mobile de la plage réelle (TR) pour calculer l'ATR comme base du stop loss de suivi.

- Générer des signaux de négociation: lorsque le prix dépasse la bande de Bollinger inférieure, générer un signal long; lorsqu'il dépasse la bande de Bollinger supérieure, générer un signal court. Lorsque le prix dépasse l'arrêt de suivi ATR, générer un signal long; lorsqu'il dépasse l'arrêt de suivi ATR, générer un signal court.

- Fermer les positions: pour les positions longues, si le prix dépasse la moyenne mobile simple, fermer la position longue; pour les positions courtes, si le prix dépasse la moyenne mobile simple, fermer la position courte.

Les avantages de la stratégie

- Suivi des tendances: Capture les tendances des marchés en utilisant des bandes de Bollinger et un arrêt de suivi ATR, en s'adaptant à différents environnements de marché.

- L'opération de mise en place d'un stop loss rapide: utilise l'ATR comme stop loss de suivi, ajustant dynamiquement la position de stop loss en fonction de la volatilité du marché afin de contrôler le risque.

- Simple et facile à utiliser: la logique de la stratégie est claire, avec peu de paramètres, ce qui la rend facile à comprendre et à appliquer.

Risques stratégiques

- Sensibilité des paramètres: le rendement de la stratégie est affecté par le choix des paramètres des bandes de Bollinger et de l'ATR, ce qui nécessite une optimisation pour différents marchés et instruments.

- Marchés instables: dans des conditions de marché instables, des signaux de négociation fréquents peuvent entraîner une fréquence et des coûts de négociation excessifs.

- Inversion de tendance: lorsqu'une tendance s'inverse, la stratégie peut connaître des retombées importantes.

Directions d'optimisation de la stratégie

- Optimisation des paramètres: optimiser les paramètres des bandes de Bollinger et de l'ATR pour trouver la meilleure combinaison pour différents marchés et instruments.

- Filtres: ajouter d'autres indicateurs techniques ou des modèles de comportement des prix comme filtres pour réduire les erreurs de jugement et améliorer la qualité du signal.

- Gestion des positions: ajustement dynamique des positions en fonction de la volatilité du marché ou du risque de compte afin d'améliorer l'efficacité de l'utilisation du capital et les rendements ajustés au risque.

Résumé

La stratégie de suivi de tendance ATR de la bande de Bollinger capture les marchés en tendance à l'aide des bandes de Bollinger et de l'indicateur ATR. Elle présente les avantages de suivre la tendance, d'arrêter la perte en temps opportun et de la simplicité.

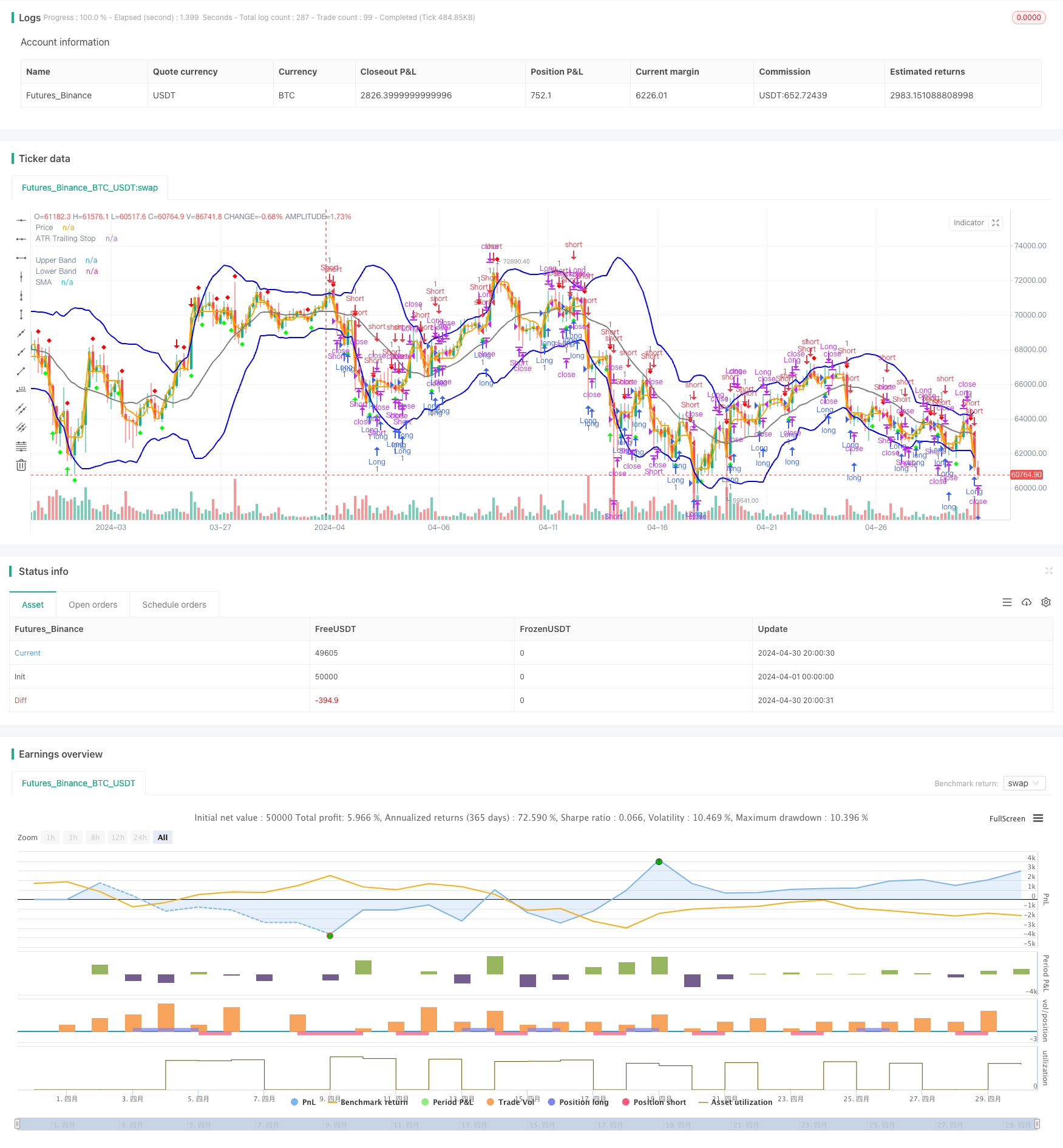

/*backtest

start: 2024-04-01 00:00:00

end: 2024-04-30 23:59:59

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Bollinger Bands and ATR Strategy", overlay=true)

// Veri Çekme

symbol = "AAPL"

timeframe = "D"

src = close

// Bollinger Bantları Hesaplama

len = 20

mult = 2

sum1 = 0.0, sum2 = 0.0

for i = 0 to len - 1

sum1 += src[i]

basis = sum1 / len

for i = 0 to len - 1

diff = src[i] - basis

sum2 += diff * diff

dev = math.sqrt(sum2 / len)

upper_band = basis + dev * mult

lower_band = basis - dev * mult

// ATR Hesaplama

atr_period = input(10, title="ATR Period")

atr_value = 0.0

for i = 0 to atr_period - 1

atr_value += math.abs(src[i] - src[i + 1])

atr_value /= atr_period

loss = input(1, title="Key Value (Sensitivity)")

atr_trailing_stop = src[1]

if src > atr_trailing_stop[1]

atr_trailing_stop := math.max(atr_trailing_stop[1], src - loss * atr_value)

else if src < atr_trailing_stop[1]

atr_trailing_stop := math.min(atr_trailing_stop[1], src + loss * atr_value)

else

atr_trailing_stop := src - loss * atr_value

// Sinyal Üretme

long_condition = src < lower_band and src[1] >= lower_band[1]

short_condition = src > upper_band and src[1] <= upper_band[1]

close_long = src > basis

close_short = src < basis

buy_signal = src > atr_trailing_stop[1] and src[1] <= atr_trailing_stop[1]

sell_signal = src < atr_trailing_stop[1] and src[1] >= atr_trailing_stop[1]

if (long_condition)

strategy.entry("Long", strategy.long, comment="Long Signal")

if (short_condition)

strategy.entry("Short", strategy.short, comment="Short Signal")

if (close_long)

strategy.close("Long", comment="Close Long")

if (close_short)

strategy.close("Short", comment="Close Short")

if (buy_signal)

strategy.entry("Long", strategy.long, comment="Buy Signal")

if (sell_signal)

strategy.entry("Short", strategy.short, comment="Sell Signal")

// Çizim

plot(upper_band, color=#0000FF, linewidth=2, title="Upper Band")

plot(lower_band, color=#0000FF, linewidth=2, title="Lower Band")

plot(basis, color=#808080, linewidth=2, title="SMA")

plot(atr_trailing_stop, color=#FFA500, linewidth=2, title="ATR Trailing Stop")

plot(src, color=#FFA500, linewidth=2, title="Price")

// Sinyal İşaretleri

plotshape(long_condition, style=shape.arrowup, color=#00FF00, location=location.belowbar, size=size.small, title="Long Signal")

plotshape(short_condition, style=shape.arrowdown, color=#FF0000, location=location.abovebar, size=size.small, title="Short Signal")

plotshape(buy_signal, style=shape.diamond, color=#00FF00, location=location.belowbar, size=size.small, title="Buy Signal")

plotshape(sell_signal, style=shape.diamond, color=#FF0000, location=location.abovebar, size=size.small, title="Sell Signal")

Relationnée

- Stratégie de négociation quantitative d' inversion de tendance des bandes de Bollinger à plusieurs périodes

- Stratégie de rupture RSI et Bollinger Bands de haute précision avec ratio risque-rendement optimisé

- Stratégie d'optimisation de l'élan des bandes de Bollinger

- Stratégie de négociation équilibrée basée sur le temps et sur la rotation à court terme

- La stratégie de rupture de la dynamique des bandes de Bollinger à double écart type

- Stratégie quantitative améliorée de réversion de la moyenne de Bollinger

- Triple Supertrend et Bandes de Bollinger Tendance multi-indicateur suivant la stratégie

- Stratégie de négociation dynamique adaptative multi-indicateur technique (MTDAT)

- Stratégie de négociation dynamique de volatilité basée sur des bandes de Bollinger et des modèles de chandeliers

- La tendance à un taux de gain élevé signifie une stratégie de négociation de renversement

Plus de

- Stratégie de rejet de la MA avec filtre ADX

- Stratégie Bollinger Bands: négociation de précision pour des gains maximaux

- Stratégie de rupture moyenne ATR

- Stratégie d'apprentissage automatique KNN: Système de trading de prédiction de tendance basé sur l'algorithme K-Nearest Neighbors

- La valeur de l'échange est la valeur de l'échange à l'échelle de l'échange.

- Stratégie de rupture du BMSB

- Stratégie de rupture de la SR

- Stratégie de rupture dynamique des bandes de Bollinger

- 8 heures de travail

- RSI Stratégie de négociation quantitative

- Stratégie de négociation du volume delta avec les niveaux de Fibonacci

- Stratégie différentielle RSI double

- Stratégie RSI stochastique pour les crypto-monnaies

- Indice de force relative triple Stratégie de négociation quantitative

- Stratégie d'optimisation MACD double combinant le suivi de tendance et le trading dynamique

- Stratégie de négociation basée sur trois bougies baissières consécutives et deux moyennes mobiles

- Stratégie de rupture de session de la DZ

- Han Yue - Stratégie de négociation basée sur des EMA multiples, ATR et RSI

- 200 EMA, VWAP, MFI Tendance à la suite de la stratégie

- Stratégie croisée EMA avec divergence RSI, identification de tendance de 30 minutes et épuisement des prix