布林带动量优化策略

Author: ChaoZhang, Date: 2024-07-29 17:22:38Tags: BBSMAATROCA

概述

布林带动量优化策略是一种结合了布林带指标和动量概念的量化交易策略。该策略利用布林带的上下轨作为市场波动的参考,同时引入了均线和ATR指标来优化入场和出场时机。这种方法旨在捕捉市场的短期趋势反转和动量变化,通过精确的进出场信号来获取潜在的交易机会。

策略原理

布林带设置:策略使用20周期的简单移动平均线(SMA)作为布林带的中轨,标准差乘数为2.0。这个设置可以根据不同市场和时间框架进行调整。

入场信号:

- 买入信号:当价格从下方穿越布林带下轨时触发。

- 卖出信号:当价格从上方穿越布林带上轨时触发。

风险管理:

- 使用OCA(One-Cancels-All)订单组来管理交易,确保在一个方向上只有一个活跃的交易。

- 入场订单使用止损单,买入时以下轨为止损,卖出时以上轨为止损。

出场策略:

- 采用基于ATR(Average True Range)的动态止损和止盈。

- ATR周期设为14,用于计算止损和止盈水平。

仓位管理:策略在触发信号时开仓,并在反向信号出现或达到止损/止盈水平时平仓。

策略优势

动态适应性:布林带能够根据市场波动性自动调整,使策略具有良好的适应性。

趋势捕捉:通过布林带突破信号,策略能够有效捕捉短期趋势的开始。

风险控制:使用OCA订单和ATR止损,提供了多层次的风险管理机制。

灵活性:策略参数可以根据不同市场和时间框架进行优化调整。

自动化潜力:策略逻辑清晰,易于在各种交易平台上实现自动化。

策略风险

假突破:在横盘市场中,可能会出现频繁的假突破信号,导致过度交易。

滑点风险:在快速市场中,止损单可能无法以预期价格执行,增加实际损失。

参数敏感性:策略性能对SMA长度和标准差乘数等参数变化较为敏感。

趋势依赖:在没有明确趋势的市场中,策略可能表现不佳。

过度优化:存在过度拟合历史数据的风险,可能导致未来表现不佳。

策略优化方向

引入趋势过滤器:可以添加长期移动平均线或ADX指标,以确保只在强趋势市场中交易。

优化入场时机:考虑结合RSI或随机指标,在布林带突破的基础上进一步确认动量。

动态参数调整:实现布林带参数的自适应,如根据市场波动性动态调整标准差乘数。

改进出场策略:可以考虑使用trailing stop或基于价格行为的出场规则,以更好地锁定利润。

增加交易量过滤:在低交易量时避免交易,可以减少假突破带来的风险。

多时间框架分析:结合更长时间周期的市场结构分析,提高交易的成功率。

总结

布林带动量优化策略是一种结合技术分析和统计学原理的量化交易方法。通过布林带的动态特性和ATR的波动性测量,该策略旨在捕捉市场的短期反转和动量变化。虽然策略展现了promising的潜力,但仍需要交易者密切关注市场条件,并根据实际交易表现不断优化参数和规则。通过持续的回测和前向验证,结合严格的风险管理,这个策略有望在各种市场环境中取得稳定的表现。然而,交易者应始终牢记,没有完美的策略,持续的学习和适应是量化交易成功的关键。

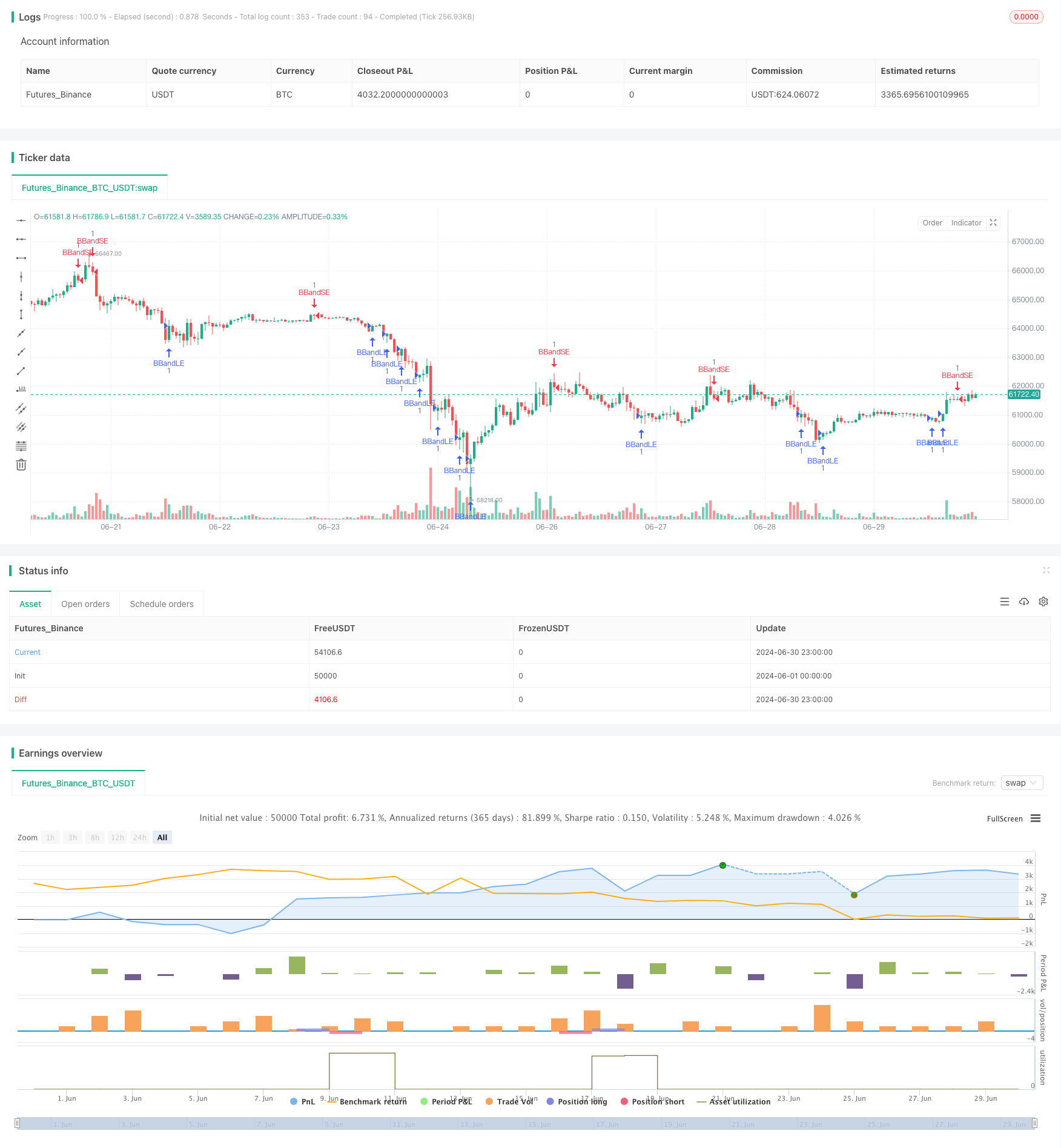

/*backtest

start: 2024-06-01 00:00:00

end: 2024-06-30 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Optimized Bollinger Bands Strategy", overlay=true)

// Input parameters

source = close

length = input.int(20, minval=1, title="SMA Length")

mult = input.float(2.0, minval=0.001, maxval=50, title="Standard Deviation Multiplier")

// Calculate Bollinger Bands

basis = ta.sma(source, length)

dev = mult * ta.stdev(source, length)

upper = basis + dev

lower = basis - dev

// Entry conditions

buyEntry = ta.crossover(source, lower)

sellEntry = ta.crossunder(source, upper)

// Strategy entries with stops and OCA groups

if buyEntry

strategy.entry("BBandLE", strategy.long, stop=lower, oca_name="BollingerBands", comment="BBandLE")

if sellEntry

strategy.entry("BBandSE", strategy.short, stop=upper, oca_name="BollingerBands", comment="BBandSE")

// Exit logic

// Implement exit conditions based on your risk management strategy

// Example: Use ATR-based stops and take profits

atrLength = input.int(14, minval=1, title="ATR Length")

atrStop = ta.atr(atrLength)

if strategy.opentrades > 0

if strategy.position_size > 0

strategy.exit("Take Profit/Stop Loss", "BBandLE", stop=close - atrStop, limit=close + atrStop)

else if strategy.position_size < 0

strategy.exit("Take Profit/Stop Loss", "BBandSE", stop=close + atrStop, limit=close - atrStop)

// Optional: Plot equity curve

// plot(strategy.equity, title="equity", color=color.red, linewidth=2, style=plot.style_area)

- 布林带ATR趋势跟踪策略

- 多周期布林带触碰趋势反转量化交易策略

- 基于斐波那契序列的自适应布林带策略解析

- RSI与布林带交叉双向回归策略

- 高精度RSI和布林带突破策略与优化风险比

- 智能时间周期多空轮动均衡交易策略

- 双重标准差布林带动量突破量化策略

- 强化波林格均值回归量化策略

- 动态均线与布林带交叉策略结合固定止损优化模型

- 三重超趋势与布林带融合的多指标趋势跟踪策略

- 改进型双重 EMA 回撤突破交易策略

- 多时间周期指数移动平均交叉策略

- 多周期动态通道交叉策略

- 全面价格缺口短期趋势捕捉策略

- 多重随机震荡策略与动量分析系统

- 多周期确认的移动平均线与RSI趋势交易策略

- 多周期均线交叉趋势跟踪策略

- 三周期高低点动量交易策略

- 自适应移动平均线交叉策略

- 技术指标策略, 风险管理策略, 自适应趋势跟踪策略

- 多层级动态趋势跟随系统

- 高级均值回归交易策略:基于标准差的动态区间突破系统

- EMA交叉与布林带双重入场策略:结合趋势跟踪与波动突破的量化交易系统

- 自适应趋势跟踪交易策略:200均线突破与动态风险管理系统

- 多周期市场动量交叉策略

- 多重指标趋势追踪策略

- ChandelierExit-EMA动态止损趋势跟踪策略

- 多指标背离买卖策略与自适应止盈止损

- 突破区间动量交易策略

- 基于超级趋势指标的精准交易策略与风险管理系统