Strategi Pelacakan

Penulis:ChaoZhang, Tanggal: 2023-10-17 16:36:49Tag:

Gambaran umum

Strategi ini terutama menggunakan indikator

Logika Strategi

-

Set parameter untuk indikator

Donchian Channel , periode default adalah 20; -

Setel EMA moving average, periode default adalah 200;

-

Rasio risiko / imbalan yang ditetapkan, default adalah 1.5;

-

Atur parameter pullback setelah breakout untuk panjang dan pendek;

-

Catat apakah pecah sebelumnya adalah titik tinggi atau rendah;

-

Sinyal panjang: jika terobosan sebelumnya adalah rendah, harga pecah di atas band atas Donchian dan di atas garis EMA;

-

Sinyal pendek: jika terobosan sebelumnya adalah tinggi, harga pecah di bawah band bawah Donchian dan di bawah garis EMA;

-

Setelah masuk panjang, tetapkan stop loss di band bawah Donchian minus 5 poin, ambil keuntungan pada rasio risiko / imbalan kali jarak stop loss;

-

Setelah masuk pendek, atur stop loss di band atas Donchian ditambah 5 poin, ambil keuntungan pada rasio risiko / imbalan kali jarak stop loss.

Dengan cara ini, strategi menggabungkan tren mengikuti dan perdagangan breakout, untuk perdagangan bersama dengan tren utama. sementara itu, stop loss dan mengambil keuntungan mengendalikan risiko / imbalan dari setiap perdagangan.

Analisis Keuntungan

-

Ikuti tren utama, hindari perdagangan melawan tren.

-

Saluran Donchian sebagai indikator jangka panjang, dikombinasikan dengan filter EMA, dapat secara efektif mengidentifikasi tren.

-

Stop loss dan take profit mengendalikan risiko per perdagangan, membatasi potensi kerugian.

-

Mengoptimalkan rasio risiko / imbalan dapat meningkatkan faktor keuntungan, mengejar keuntungan yang berlebihan.

-

Fleksibel backtest parameter, dapat mengoptimalkan parameter untuk pasar yang berbeda.

Analisis Risiko

-

Saluran Donchian dan EMA bisa memberikan sinyal yang salah kadang-kadang.

-

Perdagangan breakout dapat dengan mudah terperangkap, perlu mengidentifikasi latar belakang tren dengan jelas.

-

Stop loss dan take profit tetap tidak dapat disesuaikan berdasarkan volatilitas pasar.

-

Ruang optimasi terbatas untuk parameter, kinerja langsung tidak dijamin.

-

Sistem perdagangan rentan terhadap peristiwa angsa hitam, dapat menyebabkan kerugian besar.

Arahan Optimasi

-

Pertimbangkan untuk menambahkan lebih banyak filter seperti osilator untuk meningkatkan kualitas sinyal.

-

Atur stop loss adaptif dan ambil keuntungan berdasarkan volatilitas pasar dan ATR.

-

Gunakan pembelajaran mesin untuk menguji dan mengoptimalkan parameter agar sesuai dengan pasar nyata.

-

Mengoptimalkan logika masuk dengan volume atau volatilitas sebagai kondisi untuk menghindari perangkap.

-

Gabungkan dengan sistem trend atau pembelajaran mesin untuk menciptakan model hibrida untuk ketahanan.

Kesimpulan

Strategi ini adalah strategi breakout pelacakan, dengan logika perdagangan di sepanjang tren utama yang diidentifikasi, dan mengambil breakout sebagai sinyal masuk, sambil mengatur stop loss dan mengambil keuntungan untuk mengendalikan risiko per perdagangan. Strategi ini memiliki beberapa keuntungan, tetapi juga ruang untuk perbaikan. Secara keseluruhan, dengan penyesuaian parameter yang tepat, waktu masuk, dan peningkatan dengan teknik lain, itu dapat menjadi strategi tren praktis. Tetapi investor harus selalu ingat bahwa tidak ada sistem perdagangan yang dapat menghilangkan risiko pasar sepenuhnya, dan manajemen risiko sangat penting.

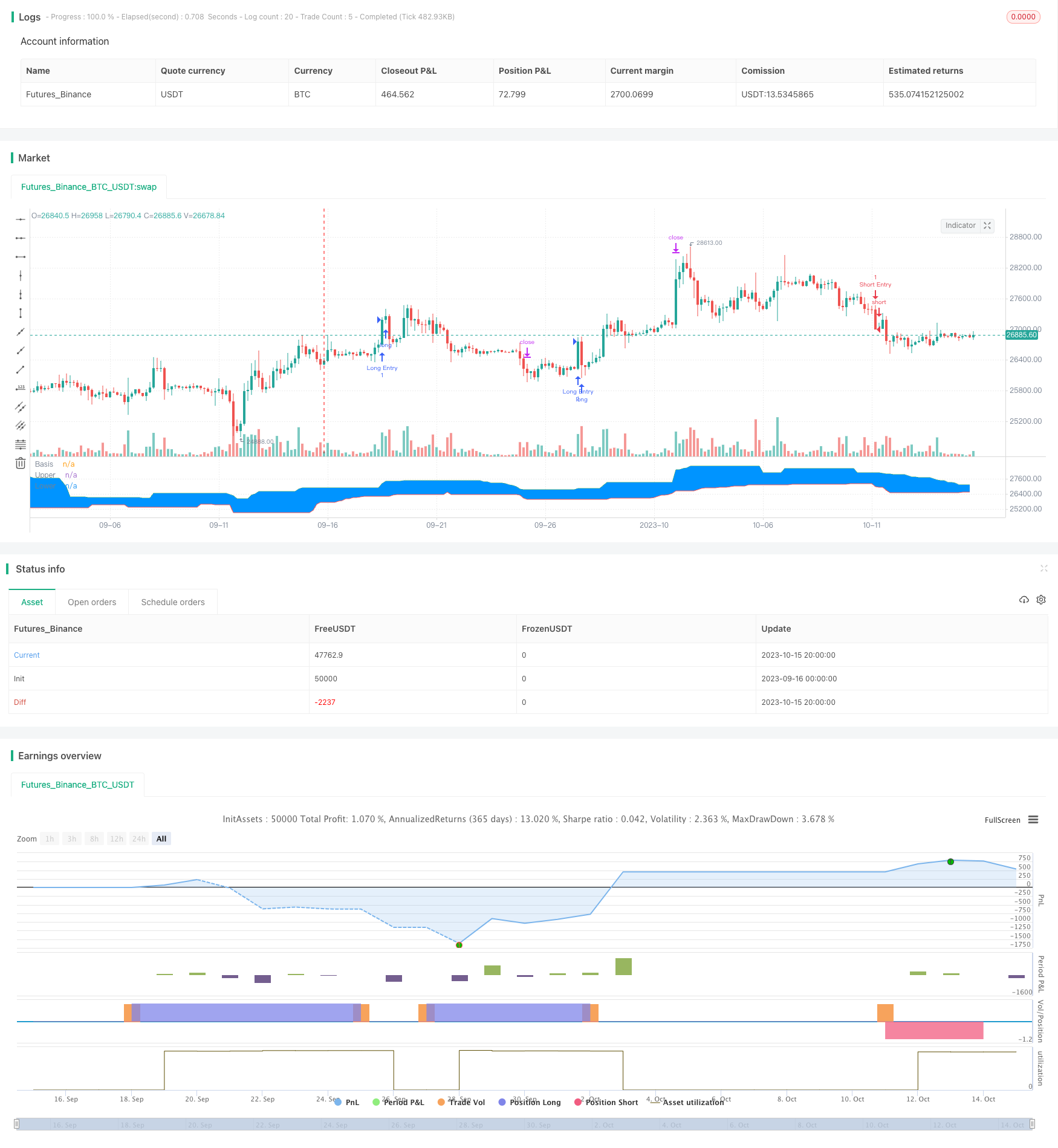

/*backtest

start: 2023-09-16 00:00:00

end: 2023-10-16 00:00:00

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

// Welcome to my second script on Tradingview with Pinescript

// First of, I'm sorry for the amount of comments on this script, this script was a challenge for me, fun one for sure, but I wanted to thoroughly go through every step before making the script public

// Glad I did so because I fixed some weird things and I ended up forgetting to add the EMA into the equation so our entry signals were a mess

// This one was a lot tougher to complete compared to my MACD crossover trend strategy but I learned a ton from it, which is always good and fun

// Also I'll explain the strategy and how I got there through some creative coding(I'm saying creative because I had to figure this stuff out by myself as I couldn't find any reference codes)

// First things first. This is a Donchian Channel Breakout strategy which follows the following rules

// If the price hits the upperband of the Donchian Channel + price is above EMA and the price previously hit the lowerband of the Donchian Channel it's a buy signal

// If the price hits the lowerband of the Donchian Channel + price is below EMA and the price prevbiously hit the upper band of the Donchian Channel it's a sell signal

// Stop losses are set at the lower or upper band with a 0.5% deviation because we are acting as if those two bands are the resistance in this case

// Last but not least(yes, this gave BY FAR the most trouble to code), the profit target is set with a 1.5 risk to reward ratio

// If you have any suggestions to make my code more efficient, I'll be happy to hear so from you

// So without further ado, let's walk through the code

// The first line is basically standard because it makes backtesting so much more easy, commission value is based on Binance futures fees when you're using BNB to pay those fees in the futures market

// strategy(title="Donchian Channels", shorttitle="DC", overlay=true, default_qty_type = strategy.cash, default_qty_value = 150, initial_capital = 1000, currency = currency.USD, commission_type = "percent", commission_value = 0.036)

// The built-in Donchian Channels + an added EMA input which I grouped with the historical bars from the Donchian Channels

length = input(20, minval=1, group = "Indicators")

lower = lowest(length)

upper = highest(length)

basis = avg(upper, lower)

emaInput = input(title = "EMA Input", type = input.integer, defval = 200, minval = 10, maxval = 400, step = 1, group = "Indicators")

// I've made three new inputs, for risk/reward ratio and for the standard pullback deviation. My advise is to not use the pullback inputs as I'm not 100% sure if they work as intended or not

riskreward = input(title = "Risk/Reward Ratio", type = input.float, defval = 1.50, minval = 0.01, maxval = 100, step = 0.01, group = "Risk/Reward")

pullbackLong = input(title = "Distance from Long pullback %", type = input.float, defval = 0.995, minval = 0.001, maxval = 2, step = 0.001, group = "Risk/Reward")

pullbackShort = input(title = "Distance from Short pullback %", type = input.float, defval = 1.005, minval = 0.001, maxval = 2, step = 0.001, group = "Risk/Reward")

// Input backtest range, you can adjust these in the input options, just standard stuff

fromMonth = input(defval = 1, title = "From Month", type = input.integer, minval = 1, maxval = 12, group = "Backtest Date Range")

fromDay = input(defval = 1, title = "From Day", type = input.integer, minval = 1, maxval = 31, group = "Backtest Date Range")

fromYear = input(defval = 2000, title = "From Year", type = input.integer, minval = 1970, group = "Backtest Date Range")

thruMonth = input(defval = 1, title = "Thru Month", type = input.integer, minval = 1, maxval = 12, group = "Backtest Date Range")

thruDay = input(defval = 1, title = "Thru Day", type = input.integer, minval = 1, maxval = 31, group = "Backtest Date Range")

thruYear = input(defval = 2099, title = "Thru Year", type = input.integer, minval = 1970, group = "Backtest Date Range")

// Date variable also standard stuff

inDataRange = (time >= timestamp(syminfo.timezone, fromYear, fromMonth, fromDay, 0, 0)) and (time < timestamp(syminfo.timezone, thruYear, thruMonth, thruDay, 0, 0))

// I had to makes these variables because the system has to remember whether the previous 'breakout' was a high or a low

// Also, because I based my stoploss on the upper/lower band of the indicator I had to find a way to change this value just once without losing the value, that was added, on the next bar

var previousishigh = false

var previousislow = false

var longprofit = 0.0

var shortprofit = 0.0

var stoplossLong = 0.0

var stoplossShort = 0.0

// These are used as our entry variables

emaCheck = ema(close, emaInput)

longcond = high >= upper and close > emaCheck

shortcond = low <= lower and close < emaCheck

// With these two if statements I'm changing the boolean variable above to true, we need this to decide out entry position

if high >= upper

previousishigh := true

if low <= lower

previousislow := true

// Made a last minute change on this part. To clean up our entry signals we don't want our breakouts, while IN a position, to change. This way we do not instantly open a new position, almost always in the opposite direction, upon exiting one

if strategy.position_size > 0 or strategy.position_size < 0

previousishigh := false

previousislow := false

// Strategy inputs

// Long - previous 'breakout' has to be a low, the current price has to be a new high and above the EMA, we're not allowed to be in a position and ofcourse it has to be within our given data for backtesting purposes

if previousislow == true and longcond and strategy.position_size == 0 and inDataRange

strategy.entry("Long Entry", strategy.long, comment = "Entry Long")

stoplossLong := lower * pullbackLong

longprofit := ((((1 - stoplossLong / close) * riskreward) + 1) * close)

strategy.exit("Long Exit", "Long Entry", limit = longprofit, stop = stoplossLong, comment = "Long Exit")

// Short - Previous 'breakout' has to be a high, current price has to be a new low and lowe than the 200EMA, we're not allowed to trade when we're in a position and it has to be within our given data for backtesting purposes

if previousishigh == true and shortcond and strategy.position_size == 0 and inDataRange

strategy.entry("Short Entry", strategy.short, comment = "Entry Short")

stoplossShort := upper * pullbackShort

shortprofit := (close - ((((1 - close / stoplossShort) * riskreward) * close)))

strategy.exit("Short Exit", "Short Entry", limit = shortprofit, stop = stoplossShort, comment = "Short Exit")

// This plots the Donchian Channels on the chart which is just using the built-in Donchian Channels

plot(basis, "Basis", color=color.blue)

u = plot(upper, "Upper", color=color.green)

l = plot(lower, "Lower", color=color.red)

fill(u, l, color=#0094FF, transp=95, title="Background")

// These plots are to show if the variables are working as intended, it's a mess I know but I didn't have any better ideas, they work well enough for me

// plot(previousislow ? close * 0.95 : na, color=color.red, linewidth=2, style=plot.style_linebr)

// plot(previousishigh ? close * 1.05 : na, color=color.green, style=plot.style_linebr)

// plot(longprofit, color=color.purple)

// plot(shortprofit, color=color.silver)

// plot(stoplossLong)

// plot(stoplossShort)

// plot(strategy.position_size)

- Strategi Sistem Band Bollinger Dual Moving Average

- Strategi Backtesting Terobosan Arsitektur

- Strategi Breakout Berdasarkan Perdagangan Penyu

- Tren DEMA Mengikuti Strategi

- Algoritma RSI Range Breakout Strategi

- RSI Rising Crypto Trending Strategi

- EMA Slope Cross Trend Mengikuti Strategi

- Strategi perdagangan RSI intraday TAM

- Strategi Crossover Rata-rata Bergerak Eksponensial

- Strategi Crossover Rata-rata Bergerak

- Model Pemantauan Rata-rata Bergerak Ganda

- Strategi Reversi Rata-rata Berdasarkan ATR

- Tren Volume Relatif Setelah Strategi Perdagangan

- Strategi Pengimbangan Tren MACD

- EMA dan Heikin Ashi Trading Strategy

- Tren Mengikuti Strategi Hanya Lama

- Strategi kombinasi pola candlestick multi-model

- Analisis Strategi Perdagangan Reversi Saluran

- Strategi perdagangan pembalikan kecil indikator ganda

- Strategi Surf Rider