Tren Mengikuti Strategi Berdasarkan Beberapa Indikator

Penulis:ChaoZhang, Tanggal: 2024-01-30 17:51:04Tag:

Gambaran umum

Strategi ini mengidentifikasi tren dengan menggabungkan beberapa indikator dan mengatur trend tracking stop loss untuk mengunci keuntungan.

Prinsip Strategi

Indikator penilaian utama dari strategi ini adalah Bollinger Bands, RSI dan ADX. Ketika harga mendekati rel bawah Bollinger Bands dan RSI di bawah 30, itu dinilai sebagai oversold dan posisi panjang diambil; ketika harga mendekati rel atas Bollinger Bands dan RSI di atas 70, itu dinilai sebagai overbought dan posisi pendek diambil. Selain itu, jika ADX di atas 25, itu berarti bahwa tren telah terbentuk, yang membuat sinyal panjang dan pendek lebih efektif.

Setelah membuka posisi, strategi menggunakan indikator ATR dan rel Bollinger Bands untuk mengatur stop loss. Secara khusus, ATR menetapkan kisaran stop loss maksimum. Ketika harga mencapai titik stop loss maksimum, tutup posisi; rel Bollinger Bands menetapkan titik stop loss trailing yang diperbarui sesuai dengan pergerakan harga.

Analisis Keuntungan

Strategi ini menggabungkan beberapa indikator untuk penilaian dan menggunakan mekanisme stop loss untuk mengunci keuntungan dan mengurangi risiko.

- Menggunakan Bollinger Bands untuk menilai situasi overbought dan oversold untuk peluang pembalikan

- Menggabungkan dengan indikator RSI meningkatkan keakuratan penilaian

- Indikator ADX menentukan pembentukan tren untuk memastikan arah perdagangan yang benar

- ATR dan Bollinger Bands yang mengikuti stop loss dapat memaksimalkan penguncian keuntungan

Analisis Risiko

Ada juga beberapa risiko untuk strategi ini:

- Penghakiman atas beberapa indikator mengarah pada kemungkinan optimasi yang berlebihan

- Sinyal kurang efektif ketika rentang Bollinger Bands terlalu luas

- Stop loss trailing yang tidak tepat dapat menyebabkan kerugian yang diperluas

Untuk mengatasi risiko ini, kita dapat mengambil langkah-langkah berikut:

- Optimasi multi-parameter untuk mencegah over-optimasi

- Sesuaikan parameter Bollinger Bands berdasarkan volatilitas pasar

- Parameter jarak stop loss uji untuk menahan fluktuasi normal

Arahan Optimasi

Strategi ini juga dapat dioptimalkan dalam aspek berikut:

- Tambahkan ukuran posisi untuk menyesuaikan skala posisi berdasarkan stop loss multiplier

- Tambahkan modul pengelolaan uang untuk mengontrol secara ketat jumlah stop loss tunggal

- Uji indikator stop loss lainnya seperti DMI, Envelop dll

- Tambahkan model pembelajaran mesin untuk menentukan probabilitas tren dan meningkatkan kinerja

Ringkasan

Singkatnya, ini adalah tren yang relatif kuat mengikuti strategi. Dengan menentukan arah tren melalui beberapa indikator dan mengendalikan risiko melalui langkah-langkah stop loss, itu dapat mencapai laba atas investasi yang baik. Kami juga telah mengusulkan beberapa aspek yang dapat dioptimalkan oleh strategi. Optimasi lebih lanjut dapat menyebabkan hasil yang lebih baik.

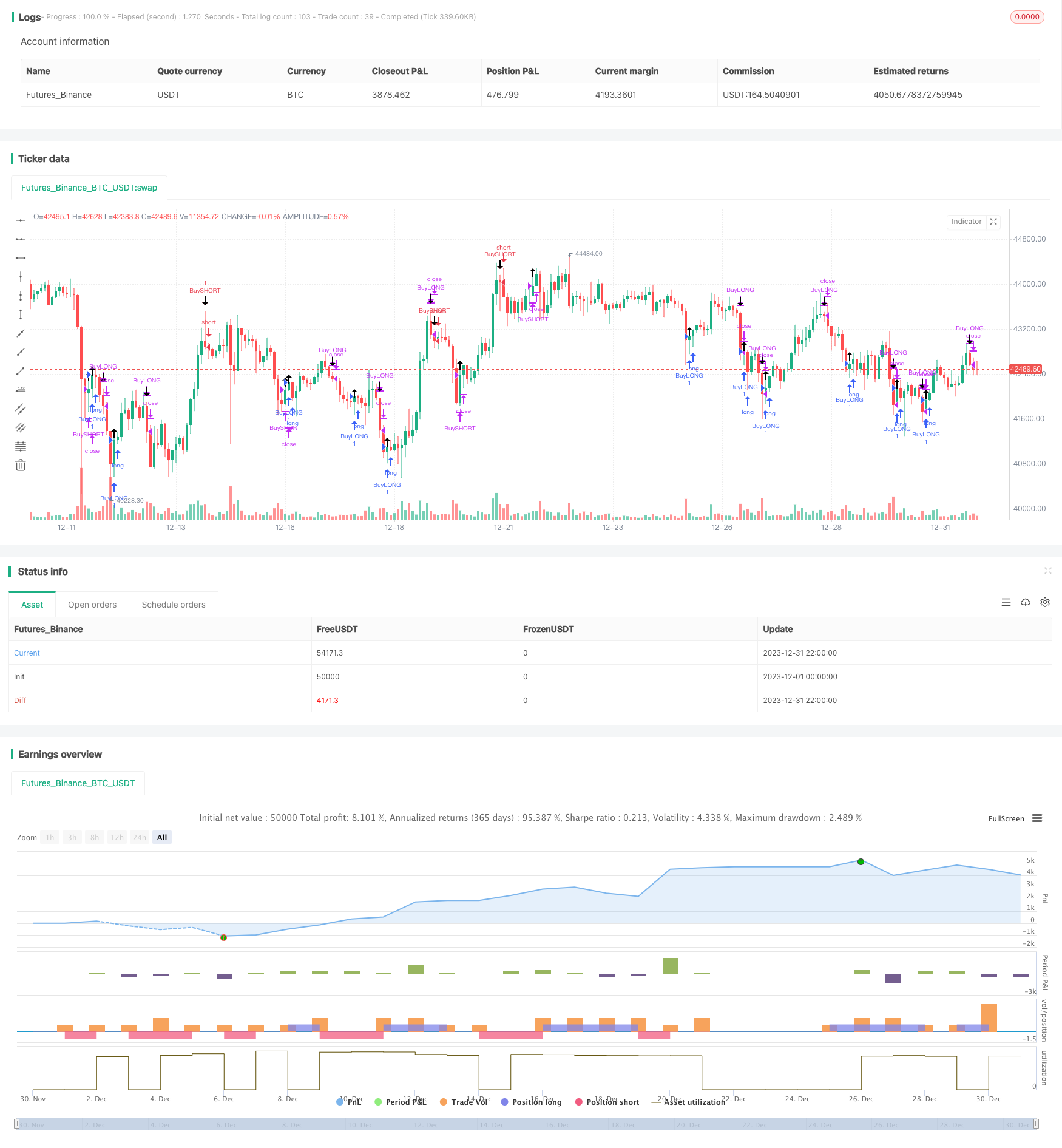

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

// THIS SCRIPT IS MEANT TO ACCOMPANY COMMAND EXECUTION BOTS

// THE INCLUDED STRATEGY IS NOT MEANT FOR LIVE TRADING

// THIS STRATEGY IS PURELY AN EXAMLE TO START EXPERIMENTATING WITH YOUR OWN IDEAS

/////////////////////////////////////////////////////////////////////////////////

// comment out the next line to use this script as an alert script

strategy(title="Dragon Bot - Default Script", overlay=true)

// remove the // in the next line to use this script as an alert script

// study(title="Dragon Bot - Default Script", overlay=true)

// Dragon-Bot default script version 2.0

// This can also be used with bot that reacts to tradingview alerts.

// Use the script as "strategy" for backtesting

// Comment out line 8 and de-comment line 10 to be able to set tradingview alerts.

// You should also comment out (place // before it) the lines 360, 364, 368 and 372 (strategy.entry and strategy.close) to be able to set the alerts.

/////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

// In this first part of the script we setup variables and make sure the script keeps all information it used in the past. //

/////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

longs = 0

longs := nz(longs[1])

shorts = 0

shorts := nz(shorts[1])

buyprice = 0.0

buyprice := buyprice[1]

sellprice = 0.0

sellprice := sellprice[1]

scaler = 0.0

scaler := scaler[1]

sellprofit = input(1.0, minval=0.0, step=0.1, title="main strat profit")

sellproffinal = sellprofit/100

enable_shorts = input(1, minval=0, maxval=1, title="Shorts on/off")

enable_flipping = input(0, minval=0, maxval=1, title="Flipping on/off -> Go directly from long -> short or short -> long without closing ")

enable_stoploss = input(0, minval=0, maxval=1, title="Stoploss on/off")

sellstoploss = input(30.0, minval=0.0, step=1.0, title="Stoploss %")

sellstoplossfinal = sellstoploss/100

enable_trailing = input(1, minval=0, maxval=1, title="Trailing on/off")

enable_trailing_ATR = input(1, minval=0, maxval=1, title="Trailing use ATR on/off")

ATR_Multi = input(1.0, minval=0.0, step=0.1, title="Multiplier for ATR")

selltrailing = input(10.0, minval=0.0, step=1.0, title="Trailing %")

selltrailingfinal = selltrailing/100

Backtestdate = input(0, minval=0, maxval=1, title="backtest date on/off")

// Component Code by pbergden - Start backtest dates

// The following code snippet is taken from an example by pbergen

// All rights to this snippet remain with pbergden

testStartYear = input(2018, "Backtest Start Year")

testStartMonth = input(1, "Backtest Start Month")

testStartDay = input(1, "Backtest Start Day")

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testStopYear = input(2019, "Backtest Stop Year")

testStopMonth = input(1, "Backtest Stop Month")

testStopDay = input(1, "Backtest Stop Day")

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

// A switch to control background coloring of the test period

testPeriodBackground = input(title="Color Background?", type=bool, defval=true)

testPeriodBackgroundColor = testPeriodBackground and (time >= testPeriodStart) and (time <= testPeriodStop) ? #00FF00 : na

bgcolor(testPeriodBackgroundColor, transp=97)

testPeriod() => true

/////////////////////////////////////////////////////////////////////////////////////////////////////

// In this second part of the script we setup indicators that we can use for our actual algorithm. //

/////////////////////////////////////////////////////////////////////////////////////////////////////

//ATR

lengthtr = input(20, minval=1, title="ATR Length")

ATRsell = input(0, minval=0, title="1 for added ATR when selling")

ATR=rma(tr(true), lengthtr)

Trail_ATR=rma(tr(true), 10) * ATR_Multi

atr = 0.0

if ATRsell == 1

atr := ATR

//OC2

lengthoc2 = input(20, minval=1, title="OC2 Length")

OC2sell = input(0, minval=0, title="1 for added OC2 when selling")

OC2mult = input(1, minval=1, title="OC2 multiplayer")

OC= abs(open[1]-close)

OC2=rma(OC, lengthoc2)

oc2 = 0.0

if OC2sell == 1

oc2 := OC2*OC2mult

//ADX

lenadx = input(10, minval=1, title="DI Length")

lensig = input(10, title="ADX Smoothing", minval=1, maxval=50)

up = change(high)

down = -change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

trur = rma(tr, lenadx)

plus = fixnan(100 * rma(plusDM, lenadx) / trur)

minus = fixnan(100 * rma(minusDM, lenadx) / trur)

sum = plus + minus

sigadx = 100 * rma(abs(plus - minus) / (sum == 0 ? 1 : sum), lensig)

//StochRSI

smoothKRSI = input(3, minval=1)

smoothDRSI = input(3, minval=1)

lengthRSI = input(14, minval=1)

lengthStochRSI = input(14, minval=1)

srcRSI = input(close, title="RSI Source")

buyRSI = input(30, minval=1, title="RSI Buy Value")

sellRSI = input(70, minval=1, title="RSI Sell Value")

rsi1 = rsi(srcRSI, lengthRSI)

krsi = sma(stoch(rsi1, rsi1, rsi1, lengthStochRSI), smoothKRSI)

drsi = sma(krsi, smoothDRSI)

// Bollinger bands

lengthbb = input(20, minval=1)

srcbb = input(close, title="Sourcebb")

multbb = input(2.0, minval=0.001, maxval=50)

bb_buy_value = input(0.5, step=0.1, title="BB Buy Value")

bb_sell_value = input(0.5, step=0.1, title="BB Sell Value")

basisbb = sma(srcbb, lengthbb)

devbb = multbb * stdev(srcbb, lengthbb)

upperbb = basisbb + devbb

lowerbb = basisbb - devbb

bbr = (srcbb - lowerbb)/(upperbb - lowerbb)

bbbuy = basisbb - (devbb*bb_buy_value)

bbsell = basisbb + (devbb*bb_sell_value)

//ema very short

shorter = ema(close, 2)

shorterlong = ema(close, 5)

//ema short

short = ema(close, 10)

long = ema(close, 30)

//ema long

shortday = ema(close, 110)

longday = ema(close, 360)

//ema even longer

shortlongerday = ema(close, 240)

longlongerday = ema(close, 720)

//declaring extra timeframe value

profit = request.security(syminfo.tickerid, timeframe.period, close)

////////////////////////////////////////////////////////////////////////

// In the 3rd part of the script we define all the entries and exits //

///////// This third part is basically the acual algorithm ////////////

///////////////////////////////////////////////////////////////////////

//Declaring function with the long entries

OPENLONG_funct() =>

// You can add more buy entries to the script

longentry1 = false

longentry2 = false

longentry3 = false

longentry4 = false

longentry5 = false

makelong_funct = false

if close<bbbuy and krsi<buyRSI // You could for instance add "and shortday > longday"

longentry1 := close>close[1]

// longentry2 := ...

// if another thing we want to buy on happens

// longentry3 := ...

//All the buy entries go above, this last variable is what the function puts out

// if you add more entries, add them in the following list too

makelong_funct := longentry1 or longentry2 or longentry3 or longentry4 or longentry5

//Declaring function wit the short entries

OPENSHORT_funct() =>

// You can add more buy entries to the script

shortentry1 = false

shortentry2 = false

shortentry3 = false

shortentry4 = false

shortentry5 = false

makeshort_funct = false

if close>bbsell and krsi>sellRSI // You could for instance add "and shortday < longday"

shortentry1 := close<close[1]

// shortentry2 := ...

// if another thing we want to buy on happens

// shortentry3 := ...

//All the buy entries go above, this last variable is what the function puts out

// if you add more entries, add them in the following list too

makeshort_funct := shortentry1 or shortentry2 or shortentry3 or shortentry4 or shortentry5

//Declaring function with the long exits

CLOSELONG_funct() =>

// You can add more buy entries to the script

longexit1 = false

longexit2 = false

longexit3 = false

longexit4 = false

longexit5 = false

closelong_funct = false

if close>bbsell and krsi>sellRSI

longexit1 := close<close[1]

// longexit2 := ...

// if another thing we want to close on on happens you can add them here...

// longexit3 := ...

//All the buy entries go above, this last variable is what the function puts out

// if you add more exits, add them in the following list too

closelong_funct := longexit1 or longexit2 or longexit3 or longexit4 or longexit5

//Declaring function wit the short exits

CLOSESHORT_funct() =>

// You can add more buy entries to the script

shortexit1 = false

shortexit2 = false

shortexit3 = false

shortexit4 = false

shortexit5 = false

closeshort_funct = false

if close<bbsell and krsi<sellRSI

shortexit1 := close>close[1]

// shortexit2 := ...

// if another thing we want to close on on happens you can add them here...

// shortexit3 := ...

//All the buy entries go above, this last variable is what the function puts out

// if you add more exits, add them in the following list too

closeshort_funct := shortexit1 or shortexit2 or shortexit3 or shortexit4 or shortexit5

/////////////////////////////////////////////////////////////////////////////////////

////////////// End of "entries" and "exits" definition code /////////////////////////

/////////////////////////////////////////////////////////////////////////////////////

/// In the fourth part we do the actual work, as defined in the part before this ////

////////////////////// This part does not need to be changed ////////////////////////

/////////////////////////////////////////////////////////////////////////////////////

//OPEN LONG LOGIC

makelong = false

//buy with backtesting on specific dates

if Backtestdate > 0 and testPeriod()

if (longs < 1 and shorts < 1) or (short > 0 and enable_flipping > 0 and enable_shorts > 0)

makelong := OPENLONG_funct()

//buy without backtesting on specific dates

if Backtestdate < 1

if (longs < 1 and shorts < 1) or (short > 0 and enable_flipping > 0 and enable_shorts > 0)

makelong := OPENLONG_funct()

if makelong

buyprice := close

scaler := close

longs := 1

shorts := 0

//OPEN SHORT LOGIC

makeshort = false

//buy with backtesting on specific dates

if Backtestdate > 0 and testPeriod()

if (shorts < 1 and longs < 1 and enable_shorts > 0) or (longs > 0 and enable_flipping > 0 and enable_shorts > 0)

makeshort := OPENSHORT_funct()

//buy without backtesting on specific dates

if Backtestdate < 1

if (shorts < 1 and longs < 1 and enable_shorts > 0) or (longs > 0 and enable_flipping > 0 and enable_shorts > 0)

makeshort := OPENSHORT_funct()

if makeshort

buyprice := close

scaler := close

shorts := 1

longs := 0

//Calculating values for traling stop

if longs > 0 and enable_flipping < 1

if close > scaler+Trail_ATR and enable_trailing_ATR > 0

scaler := close

if close > scaler * (1.0 + selltrailingfinal) and enable_trailing_ATR < 1

scaler := close

if shorts > 0 and enable_flipping < 1

if close < scaler-Trail_ATR and enable_trailing_ATR > 0

scaler := close

if close < scaler * (1.0 - selltrailingfinal) and enable_trailing_ATR < 1

scaler := close

long_exit = false

long_security1 = false

long_security2 = false

long_security3 = false

//CLOSE LONG LOGIC

if longs > 0 and enable_flipping < 1

if ( (buyprice + (buyprice*sellproffinal) + atr + oc2) < close) and ( (buyprice + (buyprice*sellproffinal) ) < profit)

long_exit := CLOSELONG_funct()

//security

if enable_stoploss > 0

long_security1 := close < ( buyprice * (1.0 - sellstoplossfinal) )

if enable_trailing > 0 and enable_trailing_ATR < 1

long_security2 := close < ( scaler * (1.0 - selltrailingfinal) )

if enable_trailing > 0 and enable_trailing_ATR > 0

long_security2 := close < ( scaler - Trail_ATR)

//CLOSE LONG LOGIC

if longs > 0 and enable_flipping > 0

//security

if enable_stoploss > 0

long_security1 := close < ( buyprice * (1.0 - sellstoplossfinal) )

if enable_trailing > 0 and enable_trailing_ATR < 1

long_security2 := close < ( scaler * (1.0 - selltrailingfinal) )

if enable_trailing > 0 and enable_trailing_ATR > 0

long_security2 := close < ( scaler - Trail_ATR)

closelong = long_exit or long_security1 or long_security2 or long_security3

short_exit = false

short_security1 = false

short_security2 = false

short_security3 = false

if closelong

longs := 0

//CLOSE SHORT LOGIC

if shorts > 0 and enable_flipping < 1

if ( (buyprice - (buyprice*(sellproffinal) - atr - oc2) > close) and ( (buyprice - (buyprice*sellproffinal) ) > profit) )

short_exit := CLOSESHORT_funct()

//security

if enable_stoploss > 0

short_security1 := close > ( buyprice * (1.0 + sellstoplossfinal) )

if enable_trailing > 0 and enable_trailing_ATR < 1

short_security2 := close > ( scaler * (1.0 + selltrailingfinal) )

if enable_trailing > 0 and enable_trailing_ATR > 0

short_security2 := close > ( scaler + Trail_ATR)

if shorts > 0 and enable_flipping > 0

//security

if enable_stoploss > 0

short_security1 := close > ( buyprice * (1.0 + sellstoplossfinal) )

if enable_trailing > 0 and enable_trailing_ATR < 1

short_security2 := close > ( scaler * (1.0 + selltrailingfinal) )

if enable_trailing > 0 and enable_trailing_ATR > 0

short_security2 := close > ( scaler + Trail_ATR)

closeshort = short_exit or short_security1 or short_security2 or short_security3

if closeshort

shorts := 0

///////////////////////////////////////////////////////////////////////////////////////

///////////// The last section takes care of the alerts //////////////////////////////

//////////////////////////////////////////////////////////////////////////////////////

plotshape(makelong, style=shape.arrowup)

alertcondition(makelong, title="openlong", message="openlong")

strategy.entry("BuyLONG", strategy.long, oca_name="DBCross", when= makelong, comment="Open Long")

plotshape(makeshort, style=shape.arrowdown)

alertcondition(makeshort, title="openshort", message="openshort")

strategy.entry("BuySHORT", strategy.short, oca_name="DBCross", when= makeshort, comment="Open Short")

plotshape(closelong, style=shape.arrowdown)

alertcondition(closelong, title="closelong", message="closelong")

strategy.close("BuyLONG", when=closelong)

plotshape(closeshort, style=shape.arrowup)

alertcondition(closeshort, title="closeshort", message="closeshort")

strategy.close("BuySHORT", when=closeshort)

- Strategi Perdagangan Kuantitatif Berbagai Faktor

- Strategi Crossover Rata-rata Bergerak Ganda

- Strategi Pelacakan Tren Dinamis dengan Mekanisme Ganda

- Strategi Perdagangan Bitcoin Berdasarkan Ichimoku Cloud

- Sistem Pelacakan Pasar Banteng

- Strategi perdagangan intraday untuk saham berdasarkan Retracement Renko Low Point

- Strategi Trading Trend Berdasarkan Saluran Harga Rata-rata Bergerak Ganda

- Dual MA Momentum Breakout Strategi

- SMART Profesional Strategi Perdagangan Kuantitatif

- Strategi Saluran Volatilitas Penembusan Ganda

- Multi Timeframe MACD Strategi Perdagangan

- Strategi Pengembalian Bulanan dengan Benchmark

- Squeeze Momentum Breakout Strategi

- Strategi Terobosan Ganda

- Momentum Breakout and Engulfing Pattern Strategi Perdagangan Algoritma

- Strategi konvergensi rata-rata bergerak ganda

- Strategi Perdagangan Reversal RSI

- Strategi perdagangan ADX dua arah

- Vix Fix Linear Regression Bottom Fishing Strategi

- Tiga Eksponensial Moving Averages dan Stochastic Relative Strength Index Trading Strategy