Strategi Dynamic Adaptive Momentum Breakout

Penulis:ChaoZhang, Tanggal: 2024-07-29 14:36:32Tag:ATREMAIbu

Gambaran umum

Strategi Dynamic Adaptive Momentum Breakout adalah pendekatan perdagangan kuantitatif canggih yang memanfaatkan indikator momentum adaptif dan pengenalan pola lilin. Strategi ini secara dinamis menyesuaikan periode momentumnya untuk beradaptasi dengan volatilitas pasar dan menggabungkan beberapa kondisi penyaringan untuk mengidentifikasi peluang tren breakout dengan probabilitas tinggi. Inti dari strategi ini terletak pada menangkap perubahan momentum pasar sambil menggunakan pola engulfing sebagai sinyal masuk untuk meningkatkan akurasi dan profitabilitas perdagangan.

Prinsip Strategi

-

Penyesuaian Periode Dinamis:

- Strategi ini menggunakan indikator momentum adaptif, secara dinamis menyesuaikan periode perhitungan berdasarkan volatilitas pasar.

- Selama periode volatilitas tinggi, periode diperpendek untuk merespons perubahan pasar dengan cepat; selama volatilitas rendah, periode diperpanjang untuk menghindari overtrading.

- Rentang periode ditetapkan antara 10 dan 40, dengan keadaan volatilitas ditentukan oleh indikator ATR.

-

Perhitungan Momentum dan Smoothing:

- Momentum dihitung dengan menggunakan periode dinamis.

- Opsional EMA smoothing momentum, default untuk 7-periode EMA.

-

Penentuan Arah Tren:

- Arah tren ditentukan dengan menghitung kemiringan momentum (perbedaan antara nilai saat ini dan nilai sebelumnya).

- Kemiringan positif menunjukkan tren naik, kemiringan negatif menunjukkan tren turun.

-

Pengakuan pola yang meluap:

- Fungsi khusus mengidentifikasi pola bullish dan bearish engulfing.

- Mempertimbangkan hubungan antara harga buka dan tutup lilin saat ini dan sebelumnya.

- Menggabungkan ukuran tubuh minimal penyaringan untuk meningkatkan keandalan pola.

-

Generasi sinyal perdagangan:

- Sinyal panjang: pola bullish engulfing + kemiringan momentum positif.

- Sinyal pendek: pola penyerapan bearish + kemiringan momentum negatif.

-

Manajemen Perdagangan:

- Masuk pada pembukaan lilin setelah konfirmasi sinyal.

- Penarikan otomatis setelah periode penantian yang ditetapkan (default 3 lilin).

Keuntungan Strategi

-

Kemampuan Beradaptasi yang Kuat:

- Dinamis menyesuaikan periode momentum agar sesuai dengan lingkungan pasar yang berbeda.

- Merespons dengan cepat dalam volatilitas tinggi dan menghindari overtrading dalam volatilitas rendah.

-

Mekanisme konfirmasi ganda:

- Mengkombinasikan indikator teknis (momentum) dan pola harga (engulfing), meningkatkan keandalan sinyal.

- Menggunakan kemiringan dan ukuran tubuh penyaringan untuk mengurangi sinyal palsu.

-

Waktu masuk yang tepat:

- Menggunakan pola engulfing untuk menangkap titik pembalikan tren potensial.

- Bergabung dengan momentum slope untuk memastikan masuk ke tren yang muncul.

-

Manajemen Risiko yang Tepat:

- Periode penyimpanan tetap menghindari penyimpanan yang berlebihan yang mengarah pada penarikan.

- Penyaringan ukuran tubuh mengurangi kesalahan penilaian yang disebabkan oleh fluktuasi kecil.

-

Fleksibel dan Disesuaikan:

- Beberapa parameter yang dapat disesuaikan untuk optimasi di pasar dan kerangka waktu yang berbeda.

- Opsional EMA smoothing menyeimbangkan sensitivitas dan stabilitas.

Risiko Strategi

-

Risiko Pencegahan Palsu:

- Dapat menghasilkan sinyal pecah palsu yang sering di pasar yang berbeda.

- Mitigasi: Masukkan indikator konfirmasi tren tambahan, seperti crossover rata-rata bergerak.

-

Masalah Lag:

- EMA smoothing dapat menyebabkan sinyal lag, kehilangan titik masuk yang optimal.

- Mitigasi: Sesuaikan periode EMA atau pertimbangkan metode perataan yang lebih sensitif.

-

Pembatasan mekanisme keluar tetap:

- Penarikan periode tetap dapat mengakhiri tren yang menguntungkan atau memperpanjang kerugian.

- Mitigasi: Memperkenalkan profit-taking dan stop-loss dinamis, seperti trailing stops atau exit berbasis volatilitas.

-

Terlalu bergantung pada Single Timeframe:

- Strategi dapat mengabaikan tren keseluruhan dalam kerangka waktu yang lebih besar.

- Mitigasi: Masukkan analisis multi-frame waktu untuk memastikan arah perdagangan selaras dengan tren yang lebih besar.

-

Sensitivitas parameter:

- Banyak parameter yang dapat disesuaikan dapat menyebabkan data historis yang berlebihan.

- Mitigasi: Gunakan optimasi berjalan ke depan dan pengujian di luar sampel untuk memvalidasi stabilitas parameter.

Arah Optimasi Strategi

-

Integrasi Multi-Timeframe:

- Memperkenalkan penilaian tren jangka waktu yang lebih besar, hanya berdagang ke arah tren utama.

- Alasan: Meningkatkan tingkat keberhasilan perdagangan secara keseluruhan, menghindari perdagangan melawan tren utama.

-

Pengambilan Keuntungan Dinamis dan Stop-Loss:

- Mengimplementasikan pemberhentian dinamis berdasarkan perubahan ATR atau momentum.

- Gunakan trailing stop untuk memaksimalkan keuntungan tren.

- Alasan: Beradaptasi dengan volatilitas pasar, melindungi keuntungan, mengurangi penarikan.

-

Analisis Profil Volume:

- Mengintegrasikan profil volume untuk mengidentifikasi level support dan resistance utama.

- Alasan: Meningkatkan presisi posisi masuk, menghindari perdagangan di titik breakout yang tidak efektif.

-

Optimasi Pembelajaran Mesin:

- Gunakan algoritma pembelajaran mesin untuk menyesuaikan parameter secara dinamis.

- Alasan: Mencapai adaptasi strategi yang berkelanjutan, meningkatkan stabilitas jangka panjang.

-

Integrasi Indikator Sentimen:

- Sertakan indikator sentimen pasar seperti VIX atau volatilitas pilihan yang tersirat.

- Alasan: Sesuaikan perilaku strategi saat sentimen ekstrem, hindari overtrading.

-

Analisis korelasi:

- Pertimbangkan pergerakan aset yang berhubungan.

- Alasan: Meningkatkan keandalan sinyal, mengidentifikasi tren pasar yang lebih kuat.

Kesimpulan

Strategi Dynamic Adaptive Momentum Breakout adalah sistem perdagangan canggih yang menggabungkan analisis teknis dan metode kuantitatif. Dengan menyesuaikan periode momentum secara dinamis, mengidentifikasi pola penyerapan, dan menggabungkan beberapa kondisi penyaringan, strategi ini dapat menangkap peluang tren breakout probabilitas tinggi secara adaptif di berbagai lingkungan pasar. Meskipun ada risiko yang melekat, seperti breakout palsu dan sensitivitas parameter, arah optimasi yang diusulkan, termasuk analisis multi-frame time, manajemen risiko dinamis, dan aplikasi pembelajaran mesin, menawarkan potensi untuk meningkatkan stabilitas dan profitabilitas strategi. Secara keseluruhan, ini adalah strategi kuantitatif yang matang, logis ketat yang menyediakan para pedagang dengan alat yang kuat untuk memanfaatkan momentum pasar dan perubahan tren.

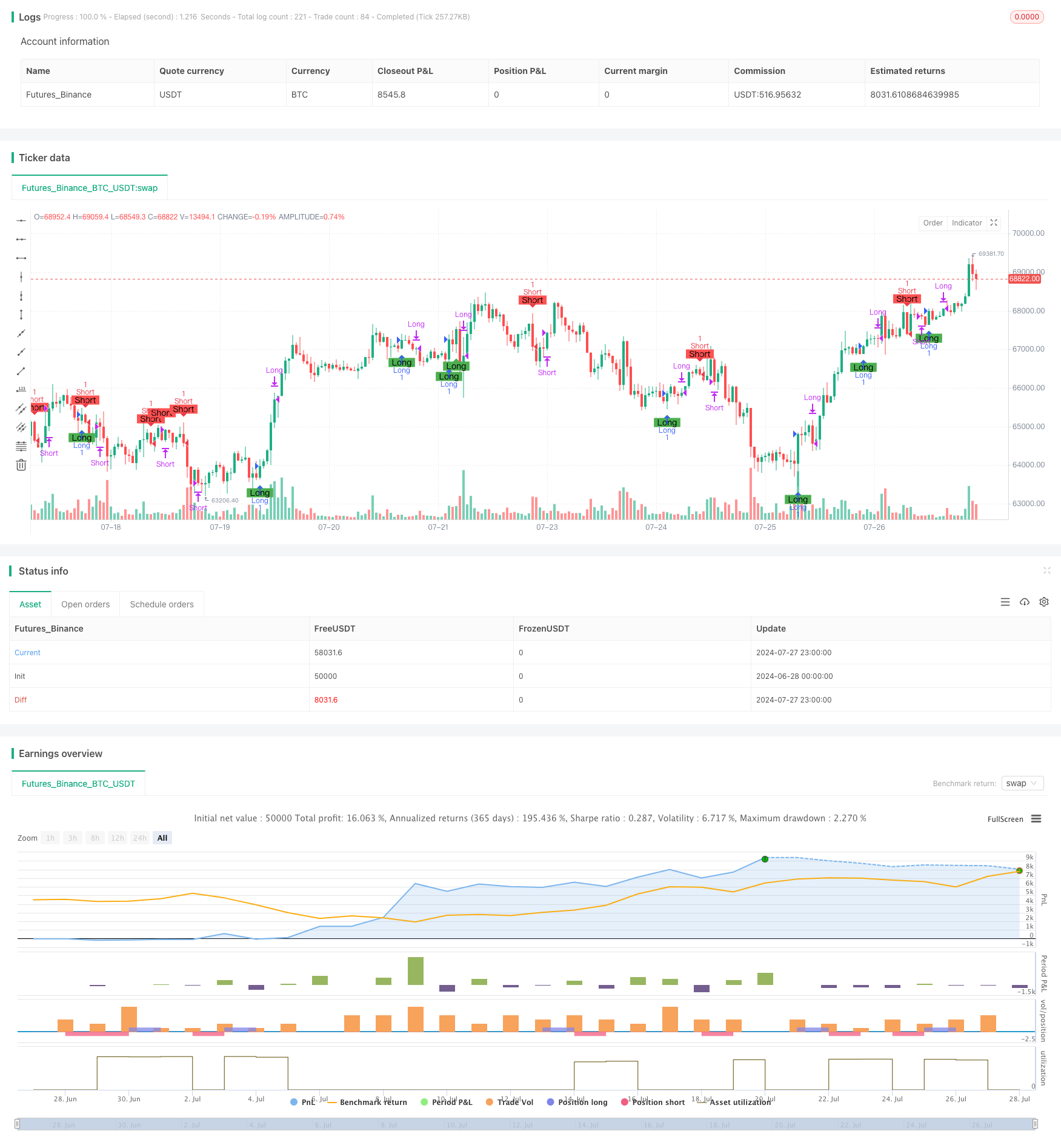

/*backtest

start: 2024-06-28 00:00:00

end: 2024-07-28 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ironperol

//@version=5

strategy("Adaptive Momentum Strategy", overlay=true, margin_long=100, margin_short=100)

// Input parameters for customization

src = input.source(close, title="Source")

min_length = input.int(10, minval=1, title="Minimum Length")

max_length = input.int(40, minval=1, title="Maximum Length")

ema_smoothing = input.bool(true, title="EMA Smoothing")

ema_length = input.int(7, title="EMA Length")

percent = input.float(2, title="Percent of Change", minval=0, maxval=100) / 100.0

// Separate body size filters for current and previous candles

min_body_size_current = input.float(0.5, title="Minimum Body Size for Current Candle (as a fraction of previous body size)", minval=0)

min_body_size_previous = input.float(0.5, title="Minimum Body Size for Previous Candle (as a fraction of average body size of last 5 candles)", minval=0)

close_bars = input.int(3, title="Number of Bars to Hold Position", minval=1) // User-defined input for holding period

//######################## Calculations ##########################

// Initialize dynamic length variable

startingLen = (min_length + max_length) / 2.0

var float dynamicLen = na

if na(dynamicLen)

dynamicLen := startingLen

high_Volatility = ta.atr(7) > ta.atr(14)

if high_Volatility

dynamicLen := math.max(min_length, dynamicLen * (1 - percent))

else

dynamicLen := math.min(max_length, dynamicLen * (1 + percent))

momentum = ta.mom(src, int(dynamicLen))

value = ema_smoothing ? ta.ema(momentum, ema_length) : momentum

// Calculate slope as the difference between current and previous value

slope = value - value[1]

// Calculate body sizes

currentBodySize = math.abs(close - open)

previousBodySize = math.abs(close[1] - open[1])

// Calculate average body size of the last 5 candles

avgBodySizeLast5 = math.avg(math.abs(close[1] - open[1]), math.abs(close[2] - open[2]), math.abs(close[3] - open[3]), math.abs(close[4] - open[4]), math.abs(close[5] - open[5]))

//######################## Long Signal Condition ##########################

// Function to determine if the candle is a bullish engulfing

isBullishEngulfing() =>

currentOpen = open

currentClose = close

previousOpen = open[1]

previousClose = close[1]

isBullish = currentClose >= currentOpen

wasBearish = previousClose <= previousOpen

engulfing = currentOpen <= previousClose and currentClose >= previousOpen

bodySizeCheckCurrent = currentBodySize >= min_body_size_current * previousBodySize

bodySizeCheckPrevious = previousBodySize >= min_body_size_previous * avgBodySizeLast5

isBullish and wasBearish and engulfing and bodySizeCheckCurrent and bodySizeCheckPrevious

// Long signal condition

longCondition = isBullishEngulfing() and slope > 0

// Plotting long signals on chart

plotshape(series=longCondition, location=location.belowbar, color=color.green, style=shape.labelup, text="Long", title="Long Condition")

// Alerts for long condition

if (longCondition)

alert("Long condition met", alert.freq_once_per_bar_close)

//######################## Short Signal Condition ##########################

// Function to determine if the candle is a bearish engulfing

isBearishEngulfing() =>

currentOpen = open

currentClose = close

previousOpen = open[1]

previousClose = close[1]

isBearish = currentClose <= currentOpen

wasBullish = previousClose >= previousOpen

engulfing = currentOpen >= previousClose and currentClose <= previousOpen

bodySizeCheckCurrent = currentBodySize >= min_body_size_current * previousBodySize

bodySizeCheckPrevious = previousBodySize >= min_body_size_previous * avgBodySizeLast5

isBearish and wasBullish and engulfing and bodySizeCheckCurrent and bodySizeCheckPrevious

// Short signal condition

shortCondition = isBearishEngulfing() and slope < 0

// Plotting short signals on chart

plotshape(series=shortCondition, location=location.abovebar, color=color.red, style=shape.labeldown, text="Short", title="Short Condition")

// Alerts for short condition

if (shortCondition)

alert("Short condition met", alert.freq_once_per_bar_close)

//######################## Trading Logic ##########################

// Track the bar number when the position was opened

var int longEntryBar = na

var int shortEntryBar = na

// Enter long trade on the next candle after a long signal

if (longCondition and na(longEntryBar))

strategy.entry("Long", strategy.long)

longEntryBar := bar_index + 1

// Enter short trade on the next candle after a short signal

if (shortCondition and na(shortEntryBar))

strategy.entry("Short", strategy.short)

shortEntryBar := bar_index + 1

// Close long trades `close_bars` candles after entry

if (not na(longEntryBar) and bar_index - longEntryBar >= close_bars)

strategy.close("Long")

longEntryBar := na

// Close short trades `close_bars` candles after entry

if (not na(shortEntryBar) and bar_index - shortEntryBar >= close_bars)

strategy.close("Short")

shortEntryBar := na

- Strategi Perdagangan Momentum Multi-Indikator yang Ditingkatkan

- Strategi Crossover Rata-rata Gerak Multi-Eksponensial dengan Optimasi Stop-Loss Dinamis ATR Berbasis Volume

- K Lilin Berturut-turut Bull Bear Strategi

- Keltner Channels EMA Strategi ATR

- Trend Multi-Timeframe Mengikuti Strategi dengan Take Profit dan Stop Loss berbasis ATR

- Strategi Adaptif Take Profit dan Stop Loss Dinamis berbasis ATR dan EMA

- Strategi Optimisasi Rezim Pasar Jangka Pendek Berbasis Volatilitas dan Regresi Linear

- Tren Dinamis EMA Mengikuti Strategi Perdagangan

- Triple EMA Crossover Strategi

- Tren Multi-Indikator Mengikuti Strategi dengan Saluran Dinamis dan Sistem Perdagangan Rata-rata Bergerak

- Strategi Crossover dengan Sistem Optimasi Manajemen Risiko

- Tren Heiken Ashi Gamping Ganda Mengikuti Strategi

- RSI Reversal Cross Momentum Profit Target Strategi Perdagangan Kuantitatif

- Trend Adaptif Multi-Indikator Mengikuti Strategi

- Strategi Perdagangan Komprehensif Multi-Indikator: Kombinasi sempurna dari Momentum, Overbought/Oversold, dan Volatility

- Strategi RSI dan Bollinger Bands Breakout dengan presisi tinggi dengan rasio risiko-imbalan yang dioptimalkan

- Advanced EMA Crossover Strategy: Adaptive Trading System dengan Target Stop-Loss dan Take-Profit yang Dinamis

- EMA Crossover dengan Dual Take Profit dan Stop Loss Strategy

- Strategi Crossover Rata-rata Bergerak Hull Multi-Timeframe

- Dinamis Trailing Stop Dual Target Moving Rata-rata strategi crossover

- Adaptive Moving Average Crossover dengan Trailing Stop-Loss Strategy

- Strategi perdagangan otomatis EMA yang mengikuti tren

- Darvas Box Breakout dan Strategi Manajemen Risiko

- Strategi Crossover Rata-rata Bergerak Eksponensial Multi-Timeframe dengan Optimasi Risiko-Reward

- SMA Crossover Long-Short Strategy dengan Peak Drawdown Control dan Auto-Termination

- Strategi Momentum Pelacakan Persentase Flip Frekuensi Tinggi

- SMI dan Pivot Point Momentum Crossover Strategy

- Strategi Dukungan dan Resistensi dengan Sistem Manajemen Risiko Dinamis

- Strategi Integrasi RSI-Bollinger Bands: Sistem Perdagangan Multi-Indikator yang Dinamis dan Beradaptasi Sendiri

- Strategi Trading Kuantitatif Mengikuti Tren Multi-Timeframe dan Blok Order