Trend Rata-rata Bergerak Ganda Mengikuti Strategi dengan Sistem Manajemen Risiko Berbasis ATR

Penulis:ChaoZhang, Tanggal: 2024-11-29 14:56:43Tag:SMAATRTPSLHTF

Gambaran umum

Strategi ini menggabungkan dua mode perdagangan, yaitu mode dasar yang menggunakan crossover rata-rata bergerak sederhana untuk mengikuti tren, dan mode lanjutan yang menggabungkan penyaringan tren jangka waktu yang lebih tinggi dan mekanisme stop-loss dinamis berbasis ATR. Pedagang dapat beralih antara mode melalui menu dropdown sederhana, memenuhi kebutuhan pemula

Prinsip Strategi

Strategi 1 (Mode Dasar) menggunakan sistem rata-rata bergerak ganda 21 dan 49 hari, menghasilkan sinyal panjang ketika MA cepat melintasi di atas MA lambat. Target keuntungan dapat ditetapkan baik sebagai persentase atau poin, dengan stop trailing opsional untuk mengunci keuntungan. Strategi 2 (Mode Lanjutan) menambahkan penyaringan tren kerangka waktu harian, yang memungkinkan entri hanya ketika harga di atas rata-rata bergerak kerangka waktu yang lebih tinggi.

Keuntungan Strategi

- Strategi yang sangat fleksibel yang dapat fleksibel dengan pengalaman pedagang dan kondisi pasar

- Analisis multi-timeframe dalam mode lanjutan meningkatkan kualitas sinyal

- Stop dinamis berbasis ATR beradaptasi dengan volatilitas pasar yang bervariasi

- Saldo keuntungan parsial perlindungan keuntungan dengan kelanjutan tren

- Konfigurasi parameter yang fleksibel untuk karakteristik pasar yang berbeda

Risiko Strategi

- Sistem MA ganda dapat menghasilkan sinyal palsu yang sering terjadi di berbagai pasar

- Penyaringan tren dapat menyebabkan keterlambatan sinyal, kehilangan beberapa peluang perdagangan

- Penghentian ATR mungkin tidak cukup cepat menyesuaikan dengan lonjakan volatilitas

- Mengambil keuntungan sebagian mungkin mengurangi ukuran posisi terlalu awal dalam tren yang kuat

Arah Optimasi Strategi

- Menambahkan indikator volume dan volatilitas untuk menyaring sinyal palsu

- Pertimbangkan untuk menerapkan adaptasi parameter dinamis berdasarkan kondisi pasar

- Mengoptimalkan periode perhitungan ATR untuk menyeimbangkan sensitivitas dan stabilitas

- Tambahkan modul pengenalan keadaan pasar untuk pemilihan mode strategi otomatis

- Memperkenalkan lebih banyak opsi stop-loss seperti trailing stop dan time-based exits

Ringkasan

Ini adalah sistem perdagangan yang dirancang dengan baik dan komprehensif. Kombinasi dari dua trend moving average berikut dan manajemen risiko berbasis ATR memastikan keandalan dan pengendalian risiko yang efektif. Desain dual-mode memenuhi kebutuhan berbagai tingkat trader, sementara pengaturan parameter yang kaya memberikan banyak peluang pengoptimalan. Pedagang disarankan untuk memulai dengan parameter konservatif dalam perdagangan langsung dan secara bertahap mengoptimalkan untuk hasil terbaik.

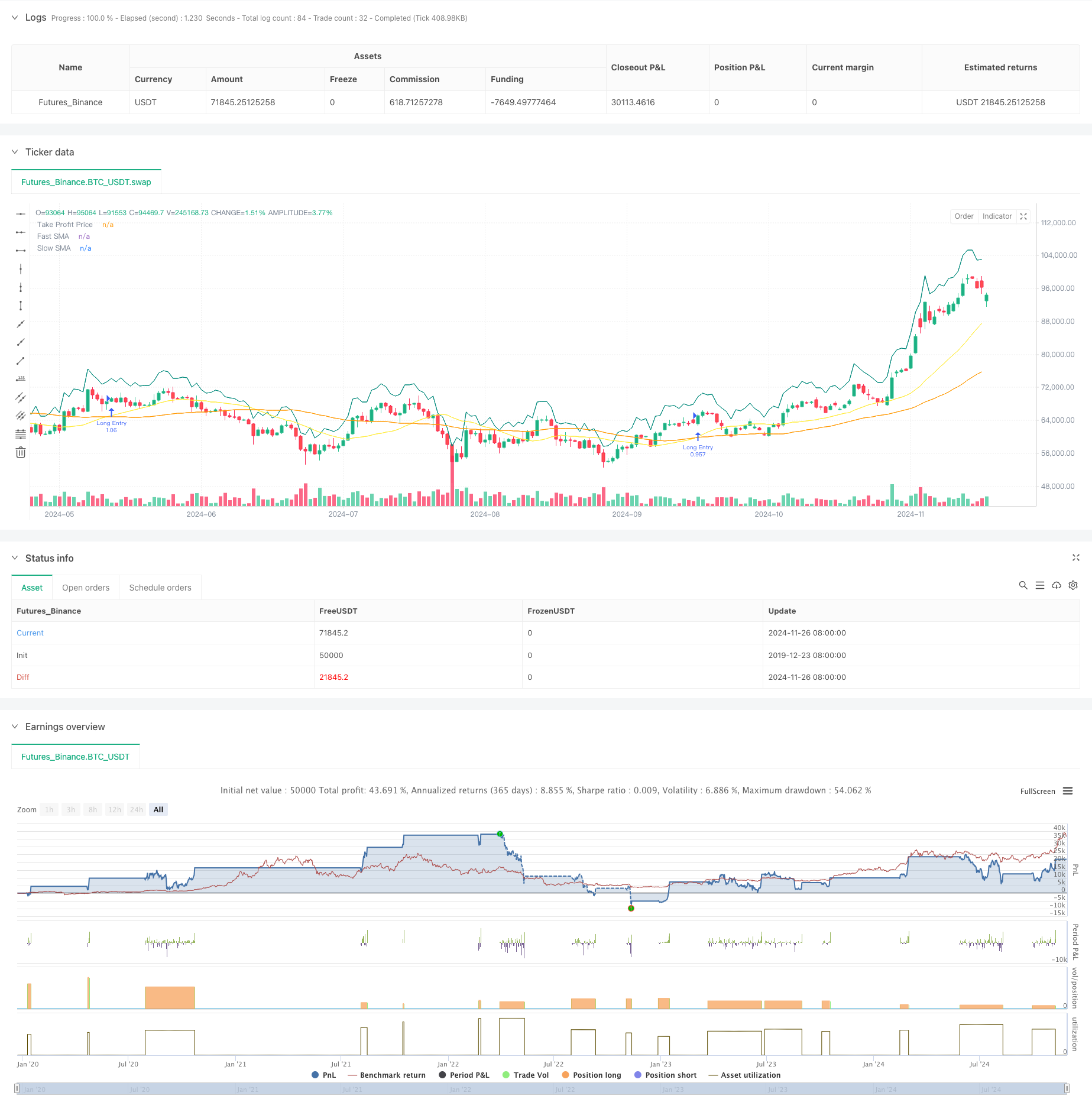

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-27 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © shaashish1

//@version=5

strategy("Dual Strategy Selector V2 - Cryptogyani", overlay=true, pyramiding=0,

default_qty_type=strategy.percent_of_equity, default_qty_value=100, initial_capital=100000)

//#region STRATEGY SELECTION

strategyOptions = input.string(title="Select Strategy", defval="Strategy 1", options=["Strategy 1", "Strategy 2"], group="Strategy Selection")

//#endregion STRATEGY SELECTION

// ####################### STRATEGY 1: Original Logic ########################

//#region STRATEGY 1 INPUTS

s1_fastMALen = input.int(defval=21, title="Fast SMA Length (S1)", minval=1, group="Strategy 1 Settings", inline="S1 MA")

s1_slowMALen = input.int(defval=49, title="Slow SMA Length (S1)", minval=1, group="Strategy 1 Settings", inline="S1 MA")

s1_takeProfitMode = input.string(defval="Percentage", title="Take Profit Mode (S1)", options=["Percentage", "Pips"], group="Strategy 1 Settings")

s1_takeProfitPerc = input.float(defval=7.0, title="Take Profit % (S1)", minval=0.05, step=0.05, group="Strategy 1 Settings") / 100

s1_takeProfitPips = input.float(defval=50, title="Take Profit Pips (S1)", minval=1, step=1, group="Strategy 1 Settings")

s1_trailingTakeProfitEnabled = input.bool(defval=false, title="Enable Trailing (S1)", group="Strategy 1 Settings")

//#endregion STRATEGY 1 INPUTS

// ####################### STRATEGY 2: Enhanced with Recommendations ########################

//#region STRATEGY 2 INPUTS

s2_fastMALen = input.int(defval=20, title="Fast SMA Length (S2)", minval=1, group="Strategy 2 Settings", inline="S2 MA")

s2_slowMALen = input.int(defval=50, title="Slow SMA Length (S2)", minval=1, group="Strategy 2 Settings", inline="S2 MA")

s2_atrLength = input.int(defval=14, title="ATR Length (S2)", group="Strategy 2 Settings", inline="ATR")

s2_atrMultiplier = input.float(defval=1.5, title="ATR Multiplier for Stop-Loss (S2)", group="Strategy 2 Settings", inline="ATR")

s2_partialTakeProfitPerc = input.float(defval=50.0, title="Partial Take Profit % (S2)", minval=10, maxval=100, step=10, group="Strategy 2 Settings")

s2_timeframeTrend = input.timeframe(defval="1D", title="Higher Timeframe for Trend Filter (S2)", group="Strategy 2 Settings")

//#endregion STRATEGY 2 INPUTS

// ####################### GLOBAL VARIABLES ########################

var float takeProfitPrice = na

var float stopLossPrice = na

var float trailingStopPrice = na

var float fastMA = na

var float slowMA = na

var float higherTimeframeTrendMA = na

var bool validOpenLongPosition = false

// Precalculate higher timeframe values (global scope for Strategy 2)

higherTimeframeTrendMA := request.security(syminfo.tickerid, s2_timeframeTrend, ta.sma(close, s2_slowMALen))

// ####################### LOGIC ########################

if (strategyOptions == "Strategy 1")

// Strategy 1 Logic (Original Logic Preserved)

fastMA := ta.sma(close, s1_fastMALen)

slowMA := ta.sma(close, s1_slowMALen)

openLongPosition = ta.crossover(fastMA, slowMA)

validOpenLongPosition := openLongPosition and strategy.opentrades.size(strategy.opentrades - 1) == 0

// Take Profit Price

takeProfitPrice := if (s1_takeProfitMode == "Percentage")

close * (1 + s1_takeProfitPerc)

else

close + (s1_takeProfitPips * syminfo.mintick)

// Trailing Stop Price (if enabled)

if (strategy.position_size > 0 and s1_trailingTakeProfitEnabled)

trailingStopPrice := high - (s1_takeProfitPips * syminfo.mintick)

else

trailingStopPrice := na

else if (strategyOptions == "Strategy 2")

// Strategy 2 Logic with Recommendations

fastMA := ta.sma(close, s2_fastMALen)

slowMA := ta.sma(close, s2_slowMALen)

openLongPosition = ta.crossover(fastMA, slowMA) and close > higherTimeframeTrendMA

validOpenLongPosition := openLongPosition and strategy.opentrades.size(strategy.opentrades - 1) == 0

// ATR-Based Stop-Loss

atr = ta.atr(s2_atrLength)

stopLossPrice := close - (atr * s2_atrMultiplier)

// Partial Take Profit Logic

takeProfitPrice := close * (1 + (s2_partialTakeProfitPerc / 100))

//#endregion STRATEGY LOGIC

// ####################### PLOTTING ########################

plot(series=fastMA, title="Fast SMA", color=color.yellow, linewidth=1)

plot(series=slowMA, title="Slow SMA", color=color.orange, linewidth=1)

plot(series=takeProfitPrice, title="Take Profit Price", color=color.teal, linewidth=1, style=plot.style_linebr)

// Trailing Stop and ATR Stop-Loss Plots (Global Scope)

plot(series=(strategyOptions == "Strategy 1" and s1_trailingTakeProfitEnabled) ? trailingStopPrice : na, title="Trailing Stop", color=color.red, linewidth=1, style=plot.style_linebr)

plot(series=(strategyOptions == "Strategy 2") ? stopLossPrice : na, title="ATR Stop-Loss", color=color.red, linewidth=1, style=plot.style_linebr)

//#endregion PLOTTING

// ####################### POSITION ORDERS ########################

//#region POSITION ORDERS

if (validOpenLongPosition)

strategy.entry(id="Long Entry", direction=strategy.long)

if (strategyOptions == "Strategy 1")

if (strategy.position_size > 0)

if (s1_trailingTakeProfitEnabled)

strategy.exit(id="Trailing Take Profit", from_entry="Long Entry", stop=trailingStopPrice)

else

strategy.exit(id="Take Profit", from_entry="Long Entry", limit=takeProfitPrice)

else if (strategyOptions == "Strategy 2")

if (strategy.position_size > 0)

strategy.exit(id="Partial Take Profit", from_entry="Long Entry", qty_percent=s2_partialTakeProfitPerc, limit=takeProfitPrice)

strategy.exit(id="Stop Loss", from_entry="Long Entry", stop=stopLossPrice)

//#endregion POSITION ORDERS

- Strategi crossover rata-rata bergerak ganda dengan manajemen risiko dinamis

- Strategi kuantitatif rebound over-sold RSI stop-loss ATR dinamis

- Tren Dual-SMA yang Dinamis Mengikuti Strategi dengan Manajemen Risiko Cerdas

- Strategi Breakout Trendline Dinamis Lang-Only Advanced

- Pemecahan Struktur dengan Konfirmasi Volume Multi-kondisi Strategi Perdagangan Cerdas

- Adaptive Volatility and Momentum Quantitative Trading System (AVMQTS) (Sistem Perdagangan Kuantitatif Volatilitas dan Momentum Adaptif)

- Strategi Model Optimasi Tren Fusi ATR

- Strategi Trading Intensitas Tren Multi-MA - Sistem Trading Pintar Fleksibel Berdasarkan Penyimpangan MA

- Strategi lintas rata-rata bergerak dinamis dan Bollinger Bands dengan model optimasi stop-loss tetap

- Adaptive Moving Average Crossover dengan Trailing Stop-Loss Strategy

- Multi-Trend Following dan Struktur Breakout Strategy

- TRAMA Dual Moving Average Crossover Strategi Perdagangan Kuantitatif Cerdas

- Strategi Perdagangan Momentum RSI-EMA Multi-Timeframe dengan Scaling Posisi

- Tren Multi-MA Mengikuti dengan Strategi Momentum RSI

- Trend EMA Multi-Level Fibonacci Mengikuti Strategi

- Sistem Trading Gap Breakout Trend-Following dengan Filter SMA

- Trend Crossover EMA Dual Mengikuti Strategi dengan Manajemen Risiko dan Sistem Penyaringan Waktu

- Trend Rata-rata Gerak Ganda yang Dihaluskan Mengikuti Strategi - Berdasarkan Heikin-Ashi yang Dimodifikasi

- Sistem Perdagangan Stop-Loss dan Take-Profit Multi-Interval

- Sistem Perdagangan Dinamis dengan RSI Stochastic dan Konfirmasi Candlestick

- Multi-Technical Indicator Dynamic Adaptive Trading Strategy (MTDAT)

- Adaptive FVG Detection dan MA Trend Trading Strategy dengan Resistance Dinamis

- Sistem Strategi Kuantitatif Pembalikan Momentum Multi-Frekwensi

- Sistem Perdagangan Kuantitatif Otomatis dengan Crossover EMA Dual dan Manajemen Risiko

- Tren Dual-SMA yang Dinamis Mengikuti Strategi dengan Manajemen Risiko Cerdas

- Tren Parameter Adaptif Berbasis KNN Mengikuti Strategi

- Trend Multi-Periode Mengikuti Sistem Perdagangan Berdasarkan Band Volatilitas EMA

- Generator transaksi acak sistem retesting

- Multi-Timeframe EMA Cross High-Win Rate Trend Mengikuti Strategi (Advanced)

- Adaptive Range Volatility Trend Mengikuti Strategi Trading