QQEのモメンタム・トレード戦略

作者: リン・ハーンチャオチャン,日付: 2024-01-22 16:32:19タグ:

概要

この戦略は,QQE (質量的な定量估算) 指標に基づいたモメント取引戦略です.QQE指標を使用して,株式価格の機会と移動平均を識別し,誤った信号をフィルタリングします.

戦略の論理

この戦略は,購入/売却の機会を特定するために,3種類のQQE指標の交差を用います.

-

QQE曲線が0軸 (XZ) を横切る: 過買い/過売の際の価格逆転の早期信号.

-

QQE曲線が高速QQE線 (XQ) を横切る: 短期的な価格調整の機会.

-

QQE曲線 RSIチャネル (XC) を終了: 中期価格調整の機会

買い/売るシグナルが特定された場合,戦略は,トレンドではない状況で間違った取引を避けるための追加のフィルターとして移動平均指標もチェックします.

-

速度のMAは中程度のMAより高く 中程度のMAは遅いMAより高く

-

中程度のMA方向は上 (長い信号) または下 (短い信号)

利点

この戦略は,機会の特定のためのQQEと信号品質の改善のための移動平均を組み合わせ,以下の主な利点があります.

-

QQEは価格逆転の異なるレベルでの機会を捉える.

-

移動平均は誤差を効果的にフィルターします

-

柔軟なパラメータは 異なる製品と時間枠に適しています

-

QQEクロスは単独または他のフィルターと組み合わせて使用できます.

リスク

戦略の主なリスクは以下の通りである.

-

バランス市場では 誤った信号が増える可能性があります

-

遅延指標としての移動平均値は,いくつかの有効な信号をフィルタリングする可能性があります.

-

パラメータの調整が不適切で 引き上げが長くなり 機会が逃れられる

-

取引ごとに損失を制限するために必要な適切なストップ損失/利益の取り取りメカニズム

改良

戦略は次の側面から強化される:

1.QQEパラメータを異なる変動レベルの証券に合わせて調整する.

2. 移動平均パラメータを最適化して,より優れたフィルタリング性能を実現する.

3.他のフィルター,例えばボリュームフィルターを追加する.

4.ストップ・ロスを導入し,取引リスクをコントロールするために利益を引き出す.

5.実際の取引結果を評価し,主要なパラメータを調整する.

概要

この戦略は,QQE信号識別と移動平均方向フィルタリングを質の高いモメント取引システムに統合している. 異なるニーズに合わせて構成可能なパラメータを通じて適応可能である.適切なストップ損失/利益採取により,安定した利益が期待できる.

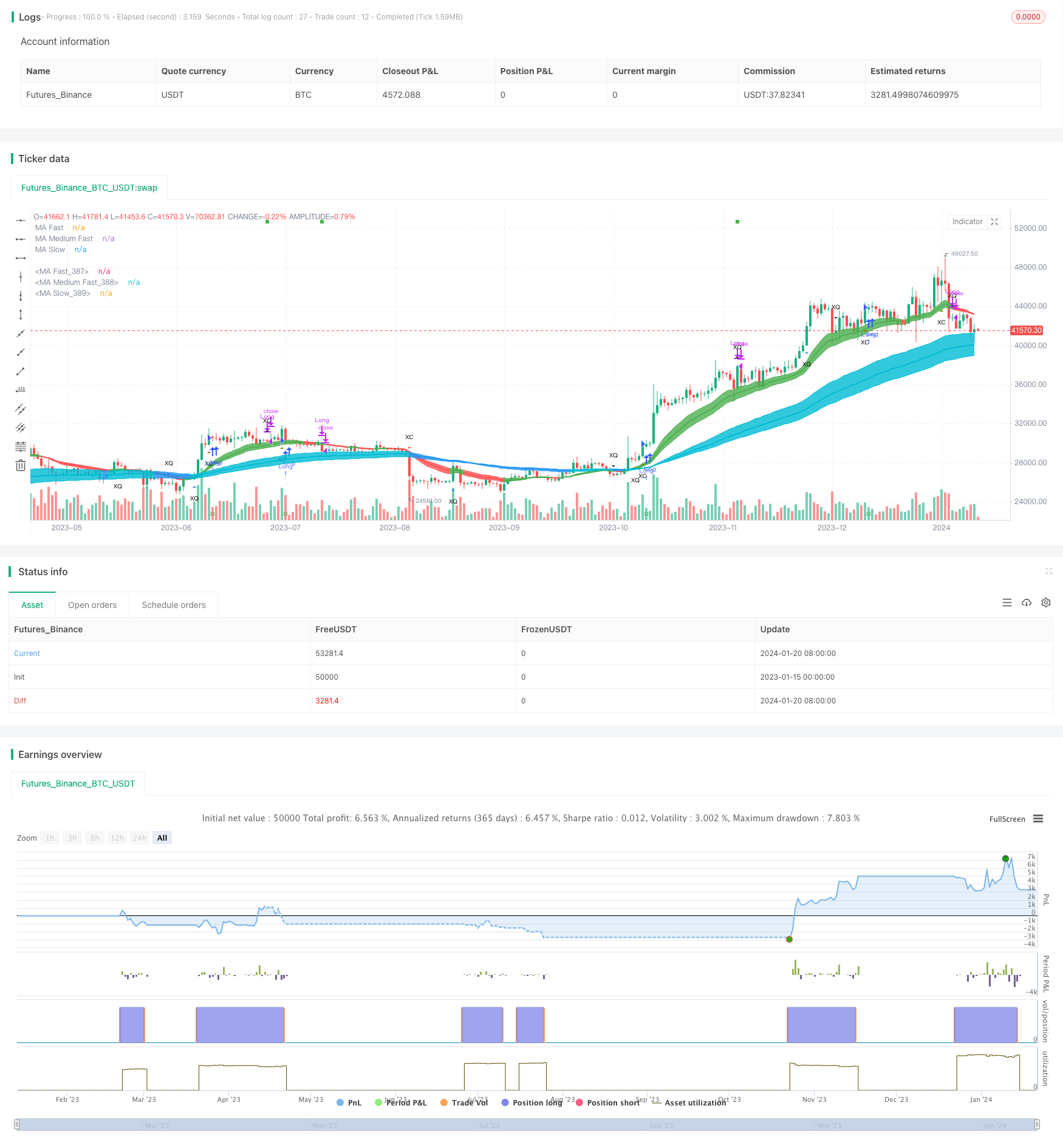

/*backtest

start: 2023-01-15 00:00:00

end: 2024-01-21 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

//

//*** START of COMMENT OUT [Alerts]

strategy(title="Momentum Trading By Mahfuz Azim", shorttitle="Momentum Trading v1.6 By Mahfuz Azim", overlay=true)

//*** END of COMMENT OUT [Alerts]

//<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<//

//>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>//

//*** START of COMMENT OUT [BackTest]

//study(title="[Alerts]QQE Cross v6.0 by Mahfuz Azim", shorttitle="[AL]QQEX v6.0", overlay=true,max_bars_back=2000)

//*** END of COMMENT OUT [BackTest]

//

// Author: Mahfuz Azim

// Date: 21-April-2021

// Version: v 0.1.5 , Major Release July-2021

//

// Description:

// A following indicator is Trend following that uses fast QQE crosses with Moving Averages

// for trend direction filtering. QQE or Qualitative Quantitative Estimation is based

// on the relative strength index (RSI), but uses a smoothing technique as an additional

// transformation. Three crosses can be selected (all selected by default):

// - Smooth RSI signal crossing ZERO (XZ)

// - Smooth RSI signal crossing Fast QQE line (XQ), this is like an early warning swing signal.

// - Smooth RSI signal exiting the RSI Threshhold Channel (XC), this is like a confirmed swing signal.

// An optimumal Smooth RSI threshold level is between 5% and 10% (default=10), it helps reduce

// the false swings.

// These signals can be selected to Open Short/Long and/or Close a trade, default is XC open

// trade and XQ (or opposite open) to Close trade.

//

// The (LONG/SHORT) alerts can be optionally filtered by the Moving Average Ribbons:

// - For LONG alert the Close must be above the fast MA Ribbon and

// fast MA Ribbon must be above the slow MA Ribbon.

// - For SHORT alert the Close must be below the fast MA Ribbon and

// fast MA Ribbon must be below the slow MA Ribbon.

// and/or directional filter:

// - For LONG alert the Close must be above the medium MA and the

// directional of both MA ribbons must be Bullish.

// - For SELL alert the Close must be below the medium MA and the

// directional of both MA ribbons must be Bearish.

//

// This indicator is designed to be used as a Signal to Signal trading BOT

// in automatic or semi-automatic way (start and stop when conditions are suitable).

// - For LONG and SHORT alerts I recommend you use "Once per Bar" alarm option

// - For CLOSE alerts I recommend you use "Once per Bar Close" alarm option

// (* The script has been designed so that long/short signals come at start of candles *)

// (* and close signals come at the end of candles *)

//

// Mofidifications:

// 0.1.5 - Major Release Version

// - Added second MA ribbon to help filter signals to the trend direction.

// - Modified Alert filtering to include second MA Ribbon

// - Change default settings to reflect Signal to Signal BOT parameters.

// - Removed older redunant alerts.

//

// 0.1.4 - Development series

//

// 0.1.3 - Fix bug with painting Buy/Sell arrows when non-repaint shunt mode selected.

// - Added option to alert just the first Buy/Sell alert after a trend swing

// - Added Long and Short Alarms. When combined with the "first Buy/Sell" in trend option,

// It is now possible to use this indicator to interface with AutoView

// or ProfitView. I suggest using the "QQEX XZ Alert" alarm to exit Long or Short

// trade. Use only "Once per bar Close" option for Alarms. This is not a full

// fledged trading BOT though with TP/SL settings.

//

// - Changed QQE defaults to be a bit smoother (8, 5, 3) instead of (6, 3, 2.618).

//

// 0.1.21 - Added implied GPL copyright notice.

// - Changed defaults to use HullMAs instead of EMAs.

// 0.1.2 - No repaint on BUY/SELL alert, however, now trades should be taken when the BUY/SELL

// Alert is displayed. The alarm is still generated on the previous candle so you can

// still get a pre-warning, this enables you time to analyse the pending alert.

// - Added option to test success of alerted trades, highlight successful and failed trade bars

// and show simple stats: success rate and number of trades (out of 5000), this will help

// tune the settings for timeframe and currency PAIR.

// 0.1.1 - Added code to use the medium moving average (EMA20) rising/falling for additional

// trend direction filter.

// - Remove Moving Average cross over signals and other options not used in this indicator.

// - Added code to distinguish between the crosses, now only show Thresh Hold crosses as BUY/SELL

// alerts.

// - Modidied default settings to more well known MA's and slightly different QQE settings, these

// work well at lower timeframes.

// - Added circle plots at bottom of chart to show when actual BUY/SELL alerts occur.

// 0.1 - original

//

// References:

// Some Code borrowed from:

// - "Scalp Jockey - MTF MA Cross Visual Strategizer by JayRogers"

// - "QQE MT4 by glaz"

// Inspiration from:

// - http://www.forexstrategiesresources.com/binary-options-strategies-ii/189-aurora-binary-trading/

// - http://www.forexstrategiesresources.com/metatrader-4-trading-systems-v/652-qqe-smoothed-trading/

// - http://dewinforex.com/forex-indicators/qqe-indicator-not-quite-grail-but-accurately-defines-trend-and-flat.html

// - "Binary option trading by two previous bars" by radixvinni

//

//

// -----------------------------------------------------------------------------

//

//

// Copyright 2021 Mahfuz Azim

//

// This program is free software: you can redistribute it and/or modify

// it under the terms of the GNU General Public License as published by

// the Free Software Foundation, either version 3 of the License, or

// any later version.

//

// This program is distributed in the hope that it will be useful,

// but WITHOUT ANY WARRANTY; without even the implied warranty of

// MERCHANTABILITY or FITNESS FOR A PARTICULAR PURPOSE. See the

// GNU General Public License for more details.

//

// The GNU General Public License can be found here

// <http://www.gnu.org/licenses/>.

//

// -----------------------------------------------------------------------------

//

// Use Alternate Anchor TF for MAs

anchor = input(4,minval=0,maxval=100,title="Relative TimeFrame Multiplier for Second MA Ribbon (0=none, max=100)")

//

// - INPUTS START

// Fast MA - type, source, length

showAvgs = input(true,title="Show Moving Average Lines")

type1 = input(defval="EMA", title="Fast MA Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "HullMA", "ZEMA", "TMA", "SSMA"])

len1 = input(defval=16, title="Fast - Length", minval=1)

gamma1 = 0.33

// Medium Fast MA - type, source, length

type2 = input(defval="EMA", title="Medium MA Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "HullMA", "ZEMA", "TMA", "SSMA"])

len2 = input(defval=21, title="Medium - Length", minval=1)

gamma2 = 0.55

// Slow MA - type, source, length

type3 = input(defval="EMA", title="Slow MA Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "HullMA", "ZEMA", "TMA", "SSMA"])

len3 = input(defval=26, title="Slow Length", minval=1)

gamma3 = 0.77

//

// QQE rsi Length, Smoothing, fast ATR factor, source

RSILen = input(14,title='RSI Length')

SF = input(8,title='RSI Smoothing Factor')

QQEfactor = input(5.0,type=float,title='Fast QQE Factor')

threshhold = input(10, title="RSI Threshhold")

//

sQQEx = input(true,title="Show QQE Signal crosses")

sQQEz = input(false,title="Show QQE Zero crosses")

sQQEc = input(true,title="Show QQE Thresh Hold Channel Exits")

//

tradeSignal = input("XC", title="Select which QQE signal to Buy/Sell", options=["XC","XQ","XZ"])

closeSignal = input("XQ", title="Select which QQE signal to Close Order", options=["XC","XQ","XZ"])

//

xfilter = input(true, title="Filter XQ Buy/Sell Orders by Threshold" )

filter = input(false,title="Use Moving Average Filter")

dfilter = input(true, title="Use Trend Directional Filter" )

ufirst = input(false, title="Only Alert First Buy/Sell in a new Trend")

RSIsrc = input(close,title="Source")

src = RSIsrc // MA source

srcclose= RSIsrc

///////////////////////////////////////////////

//* Backtesting Period Selector | Component *//

///////////////////////////////////////////////

//* https://www.tradingview.com/script/eCC1cvxQ-Backtesting-Period-Selector-Component *//

//* https://www.tradingview.com/u/pbergden/ *//

//* Modifications made by Mahfuz Azim*//

//>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>//

//*** START of COMMENT OUT [Alerts]

testStartYear = input(2018, "Backtest Start Year",minval=1980)

testStartMonth = input(6, "Backtest Start Month",minval=1,maxval=12)

testStartDay = input(12, "Backtest Start Day",minval=1,maxval=31)

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testStopYear = 9999 //input(9999, "Backtest Stop Year",minval=1980)

testStopMonth = 12 // input(12, "Backtest Stop Month",minval=1,maxval=12)

testStopDay = 31 //input(31, "Backtest Stop Day",minval=1,maxval=31)

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

testPeriod = true

//*** END of COMMENT OUT [Alerts]

//<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<//

// - INPUTS END

gold = #FFD700

AQUA = #00FFFFFF

BLUE = #0000FFFF

RED = #FF0000FF

LIME = #00FF00FF

GRAY = #808080FF

// - FUNCTIONS

// - variant(type, src, len, gamma)

// Returns MA input selection variant, default to SMA if blank or typo.

// SuperSmoother filter

// © 2013 John F. Ehlers

variant_supersmoother(src,len) =>

a1 = exp(-1.414*3.14159 / len)

b1 = 2*a1*cos(1.414*3.14159 / len)

c2 = b1

c3 = (-a1)*a1

c1 = 1 - c2 - c3

v9 = 0.0

v9 := c1*(src + nz(src[1])) / 2 + c2*nz(v9[1]) + c3*nz(v9[2])

v9

variant_smoothed(src,len) =>

v5 = 0.0

v5 := na(v5[1]) ? sma(src, len) : (v5[1] * (len - 1) + src) / len

v5

variant_zerolagema(src,len) =>

ema1 = ema(src, len)

ema2 = ema(ema1, len)

v10 = ema1+(ema1-ema2)

v10

variant_doubleema(src,len) =>

v2 = ema(src, len)

v6 = 2 * v2 - ema(v2, len)

v6

variant_tripleema(src,len) =>

v2 = ema(src, len)

v7 = 3 * (v2 - ema(v2, len)) + ema(ema(v2, len), len) // Triple Exponential

v7

//calc Laguerre

variant_lag(p,g) =>

L0 = 0.0

L1 = 0.0

L2 = 0.0

L3 = 0.0

L0 := (1 - g)*p+g*nz(L0[1])

L1 := -g*L0+nz(L0[1])+g*nz(L1[1])

L2 := -g*L1+nz(L1[1])+g*nz(L2[1])

L3 := -g*L2+nz(L2[1])+g*nz(L3[1])

f = (L0 + 2*L1 + 2*L2 + L3)/6

f

// return variant, defaults to SMA

variant(type, src, len, g) =>

type=="EMA" ? ema(src,len) :

type=="WMA" ? wma(src,len):

type=="VWMA" ? vwma(src,len) :

type=="SMMA" ? variant_smoothed(src,len) :

type=="DEMA" ? variant_doubleema(src,len):

type=="TEMA" ? variant_tripleema(src,len):

type=="LAGMA" ? variant_lag(src,g) :

type=="HullMA"? wma(2 * wma(src, len / 2) - wma(src, len), round(sqrt(len))) :

type=="SSMA" ? variant_supersmoother(src,len) :

type=="ZEMA" ? variant_zerolagema(src,len) :

type=="TMA" ? sma(sma(src,len),len) :

sma(src,len)

// - /variant

// If have anchor specified, calculate the base multiplier, base on time in mins

//mult = isintraday ? anchor==0 or interval<=0 or interval>=anchor or anchor>1440? 1 : round(anchor/interval) : 1

//mult := not isintraday? 1 : mult // Only available Daily or less

// Anchor is a relative multiplier based on current TF.

mult = anchor>0 ? anchor : 1

// - FUNCTIONS END

// - Fast ATR QQE

//

Wilders_Period = RSILen * 2 - 1

//

Rsi = rsi(RSIsrc,RSILen)

RSIndex = ema(Rsi, SF)

AtrRsi = abs(RSIndex[1] - RSIndex)

MaAtrRsi = ema(AtrRsi, Wilders_Period)

DeltaFastAtrRsi = ema(MaAtrRsi,Wilders_Period) * QQEfactor

//

newshortband= RSIndex + DeltaFastAtrRsi

newlongband= RSIndex - DeltaFastAtrRsi

longband = 0.0

shortband=0.0

trend = 0

longband:=RSIndex[1] > longband[1] and RSIndex > longband[1] ? max(longband[1],newlongband) : newlongband

shortband:=RSIndex[1] < shortband[1] and RSIndex < shortband[1] ? min(shortband[1],newshortband) : newshortband

trend:=cross(RSIndex, shortband[1])? 1 : cross(longband[1], RSIndex) ? -1 : nz(trend[1],1)

FastAtrRsiTL = trend==1 ? longband : shortband

// - SERIES VARIABLES

// MA's

ma_fast = variant(type1, srcclose, len1, gamma1)

ma_medium = variant(type2, srcclose, len2, gamma2)

ma_slow = variant(type3, srcclose, len3, gamma3)

// MA's

ma_fast_alt = variant(type1, srcclose, len1*mult, gamma1)

ma_medium_alt = variant(type2, srcclose, len2*mult, gamma2)

ma_slow_alt = variant(type3, srcclose, len3*mult, gamma3)

// Get Direction From Medium Moving Average

direction = rising(ma_medium,3) ? 1 : falling(ma_medium,3) ? -1 : 0

altDirection = rising(ma_medium_alt,3) ? 1 : falling(ma_medium_alt,3) ? -1 : 0

//

// Find all the QQE Crosses

QQExlong = 0, QQExlong := nz(QQExlong[1])

QQExshort = 0, QQExshort := nz(QQExshort[1])

QQExlong := FastAtrRsiTL< RSIndex ? QQExlong+1 : 0

QQExshort := FastAtrRsiTL> RSIndex ? QQExshort+1 : 0

// Zero cross

QQEzlong = 0, QQEzlong := nz(QQEzlong[1])

QQEzshort = 0, QQEzshort := nz(QQEzshort[1])

QQEzlong := RSIndex>=50 ? QQEzlong+1 : 0

QQEzshort := RSIndex<50 ? QQEzshort+1 : 0

//

// Thresh Hold channel Crosses give the BUY/SELL alerts.

QQEclong = 0, QQEclong := nz(QQEclong[1])

QQEcshort = 0, QQEcshort := nz(QQEcshort[1])

QQEclong := RSIndex>(50+threshhold) ? QQEclong+1 : 0

QQEcshort := RSIndex<(50-threshhold) ? QQEcshort+1 : 0

//

// Check Filtering.

QQEflong = mult == 1 ? (not filter or (srcclose>ma_medium and ma_medium>ma_slow and ma_fast>ma_medium)) and (not dfilter or (direction>0 )) :

(not filter or (ma_medium>ma_medium_alt and srcclose>ma_fast and ma_fast>ma_medium)) and (not dfilter or (direction>0 and altDirection>0 and srcclose>ma_medium))

QQEfshort = mult == 1 ? (not filter or (srcclose<ma_medium and ma_medium<ma_slow and ma_fast<ma_medium)) and (not dfilter or (direction<0 )) :

(not filter or (ma_medium<ma_medium_alt and srcclose<ma_fast and ma_fast<ma_medium)) and (not dfilter or (direction<0 and altDirection<0 and srcclose<ma_medium))

QQExfilter = (not xfilter or RSIndex>(50+threshhold) or RSIndex<(50-threshhold))

//

// Get final BUY / SELL alert determination

buy_ = 0, buy_ := nz(buy_[1])

sell_ = 0, sell_ := nz(sell_[1])

// Make sure Buy/Sell are non-repaint and occur after close signal.

buy_ := tradeSignal=="XC"? (QQEclong[1]==1 and QQEflong[1] ? buy_+1 : 0) :

tradeSignal=="XQ"? (QQExlong[1]==1 and QQEflong[1] and QQExfilter[1]? buy_+1 : 0) :

tradeSignal=="XZ"? (QQEzlong[1]==1 and QQEflong[1] ? buy_+1 : 0) : 0

sell_ := tradeSignal=="XC"? (QQEcshort[1]==1 and QQEfshort[1] ? sell_+1 : 0) :

tradeSignal=="XQ"? (QQExshort[1]==1 and QQEfshort[1] and QQExfilter[1]? sell_+1 : 0) :

tradeSignal=="XZ"? (QQEzshort[1]==1 and QQEfshort[1] ? sell_+1 : 0) : 0

//

// Find the first Buy/Sell in trend swing.

Buy = 0, Buy := nz(Buy[1])

Sell = 0, Sell := nz(Sell[1])

Buy := sell_>0 ? 0 : buy_==1 or Buy>0 ? Buy+1 : Buy

Sell := buy_>0 ? 0 : sell_==1 or Sell>0 ? Sell+1 : Sell

// Select First or all buy/sell alerts.

buy = ufirst ? Buy : buy_

sell = ufirst ? Sell : sell_

closeLong = 0, closeLong := nz(closeLong[1])

closeShort = 0, closeShort := nz(closeShort[1])

closeLong := closeSignal=="XC" ? (QQEcshort==1 ? closeLong+1 : 0) :

closeSignal=="XQ" ? tradeSignal=="XQ" ? (QQExshort==1 ? closeLong+1 : 0) : ((QQExshort==1 or QQEzshort or QQEcshort) ? closeLong+1 : 0) :

closeSignal=="XZ" ? (QQEzshort==1 ? closeLong+1 : 0) : 0

closeShort := closeSignal=="XC" ? (QQEclong==1 ? closeShort+1 : 0) :

closeSignal=="XQ" ? tradeSignal=="XQ" ? (QQExlong==1 ? closeShort+1 : 0) : ((QQExlong==1 or QQEzlong or QQEclong==1) ? closeShort+1 : 0) :

closeSignal=="XZ" ? (QQEzlong==1 ? closeShort+1 : 0) : 0

tradestate = 0, tradestate := nz(tradestate[1])

tradestate := tradestate==0 ? (buy==1 ? 1 : sell==1 ? 2 : 0) : (tradestate==1 and closeLong==1) or (tradestate==2 and closeShort==1)? 0 : tradestate

isLong = change(tradestate) and tradestate==1

isShort = change(tradestate) and tradestate==2

isCloseLong = change(tradestate) and tradestate==0 and nz(tradestate[1])==1

isCloseShort = change(tradestate) and tradestate==0 and nz(tradestate[1])==2

// - SERIES VARIABLES END

// - PLOTTING

// Ma's

tcolor = direction<0?red:green

ma1=plot(showAvgs?ma_fast:na, title="MA Fast", color=tcolor, linewidth=1, transp=0)

ma2=plot(showAvgs?ma_medium:na, title="MA Medium Fast", color=tcolor, linewidth=2, transp=0)

ma3=plot(showAvgs?ma_slow:na, title="MA Slow", color=tcolor, linewidth=1, transp=0)

fill(ma1,ma3,color=tcolor,transp=90)

// Ma's

altTcolor=altDirection<0?blue:aqua

ma4=plot(showAvgs and mult>1?ma_fast_alt:na, title="MA Fast", color=altTcolor, linewidth=1, transp=0)

ma5=plot(showAvgs and mult>1?ma_medium_alt:na, title="MA Medium Fast", color=altTcolor, linewidth=2, transp=0)

ma6=plot(showAvgs and mult>1?ma_slow_alt:na, title="MA Slow", color=altTcolor, linewidth=1, transp=0)

fill(ma4,ma6,color=altTcolor,transp=90)

// QQE exit from Thresh Hold Channel

plotshape(sQQEc and QQEclong==1 and not isLong, title="QQE X Over Channel", style=shape.triangleup, location=location.belowbar, text="XC", color=olive, transp=20, size=size.tiny)

plotshape(sQQEc and QQEcshort==1 and not isShort, title="QQE X Under Channel", style=shape.triangledown, location=location.abovebar, text="XC", color=red, transp=20, size=size.tiny)

// QQE crosses

plotshape(sQQEx and QQExlong==1 and QQEclong!=1 and not isLong, title="QQE Cross Over", style=shape.triangleup, location=location.belowbar, text="XQ", color=blue, transp=20, size=size.tiny)

plotshape(sQQEx and QQExshort==1 and QQEcshort!=1 and not isShort, title="QQE Cross Under", style=shape.triangledown, location=location.abovebar, text="XQ", color=black, transp=20, size=size.tiny)

// Signal crosses zero line

plotshape(sQQEz and QQEzlong==1 and QQEclong!=1 and not isLong and QQExlong!=1, title="QQE Zero Cross Over", style=shape.triangleup, location=location.belowbar, text="XZ", color=aqua, transp=20, size=size.tiny)

plotshape(sQQEz and QQEzshort==1 and QQEcshort!=1 and not isShort and QQExshort!=1, title="QQE Zero Cross Under", style=shape.triangledown, location=location.abovebar, text="XZ", color=fuchsia, transp=20, size=size.tiny)

//

//*** START of COMMENT OUT [BackTest]

//plotshape(isLong, title="QQEX Long", style=shape.arrowup, location=location.belowbar, text="Open\nLONG", color=lime, textcolor=green, transp=0, size=size.small)

//plotshape(isShort, title="QQEX Short", style=shape.arrowdown, location=location.abovebar, text="Open\nSHORT", color=red, textcolor=maroon, transp=0, size=size.small)

//plotshape(isCloseLong, title="QQEX Close Long", style=shape.arrowdown, location=location.abovebar, text="Close\nLONG", color=gray, textcolor=gray, transp=0, size=size.small)

//plotshape(isCloseShort, title="QQEX Close Short", style=shape.arrowup, location=location.belowbar, text="Close\nSHORT", color=gray, textcolor=gray, transp=0, size=size.small)

//*** END of COMMENT OUT [BackTest]

// - PLOTTING END

// - ALERTING

//*** START of COMMENT OUT [Alerts]

if testPeriod

strategy.entry("Long", 1, when=isLong)

strategy.close("Long", when=isCloseLong )

strategy.entry("Short", 0, when=isShort)

strategy.close("Short", when=isCloseShort )

//end if

//*** END of COMMENT OUT [Alerts]

//*** START of COMMENT OUT [BackTest]

//

// Signal to Signal BOT Alerts.

//

//alertcondition(isLong, title="QQEX Long", message="QQEX LONG") // use "Once per Bar" option

//alertcondition(isShort, title="QQEX Short", message="QQEX SHORT") // use "Once per Bar" option

//alertcondition(isCloseLong, title="QQEX Close Long", message="QQEX CLOSE LONG") // use "Once per Bar Close" option

//alertcondition(isCloseShort, title="QQEX Close Short", message="QQEX CLOSE SHORT") // use "Once per Bar Close" option

//

//*** END of COMMENT OUT [BackTest]

// show only when alert condition is met and bar closed.

plotshape(isLong or isShort,title= "Cross Alert Completed", location=location.bottom, color=isShort?red:green, transp=0, style=shape.circle,size=size.auto,offset=0)

plotshape(isCloseShort[1] or isCloseLong[1],title= "Close Order", location=location.top, color=isCloseShort[1]?red:green, transp=0, style=shape.square,size=size.auto,offset=-1)

// - ALERTING END

//EOF

- クリプト RSI ミニスナイパー 迅速対応 トレンド 戦略をフォローする

- この戦略は移動平均線に基づいたモメント戦略です

- 需要供給の勢いを逆転させる取引戦略

- ダイナミック・モメント・オシレーター取引戦略

- 動向平均に基づく戦略をフォローする傾向

- トレンドトラッキング ブレイクアウト戦略

- 逆転RSIトレンド追跡ETF取引戦略

- ADX指標に基づくトレンド追跡と短期取引戦略

- モメント トレンド 双重戦略

- ダイナミックなCCI支援と抵抗戦略

- ガウス波予測戦略

- ダイナミック・ムービング・EMAのコンビネーション・量子戦略

- ドンチアン運河の傾向 戦略をフォローする

- EMAのリボン戦略

- 正確なトレンド逆転移動平均クロスオーバー戦略

- マルチEMAの上昇傾向戦略

- S&P500 ハイブリッド 季節性取引戦略

- 偏差に基づくトレンド追跡戦略

- RSI ダイバージェンツ・トレーディング戦略

- 多指標決定樹戦略:IMACD,EMA,イチモク