戦略をフォローする二重逆転振動帯の傾向

作者: リン・ハーンチャオチャン開催日:2024年01月25日16時04分タグ:

概要

戦略原則

123 逆転システム

フラクタル・カオス・バンド指標

価格が上方レールを突破したときに購入し,価格が下方レールを突破したときに販売します.

このセクションは,主にトレンドフィルターとして機能し,123の逆転信号と組み合わせます. 両方の信号が一貫している場合にのみ,ポジションが開かれます.

戦略 の 利点

- 逆転とトレンドを組み合わせて 機会を全面的に捉える

- 誤った信号を減らして 勝利率を上げる

この戦略は単一指標と比較して 誤った信号を大幅に削減し 双重指標の組み合わせをフィルタリングすることで 実際の取引の勝率と利益率を向上させることができます

- 柔軟なパラメータ調整と強い適応性

リスク と 最適化

- 主要な動向に適応できない

戦略自体は,中期取引機会により依存している.主要な市場動向下で,戦略は逆信号をあまりにも多く生成し,損失で停止する可能性があります. これはパラメータ調整によって最適化することができます.

- マージン・キャピタル・サポートが必要

- フィルタリングのためのより多くの指標を組み合わせることができます

戦略は,信号源を豊かにし,戦略の強度を向上させるために,既存のベースでより多くの異なるタイプの指標を導入することができる.例えば,回転およびトレンド信号を確認するために,ボリューム,変動指数などの指標を追加する.

結論

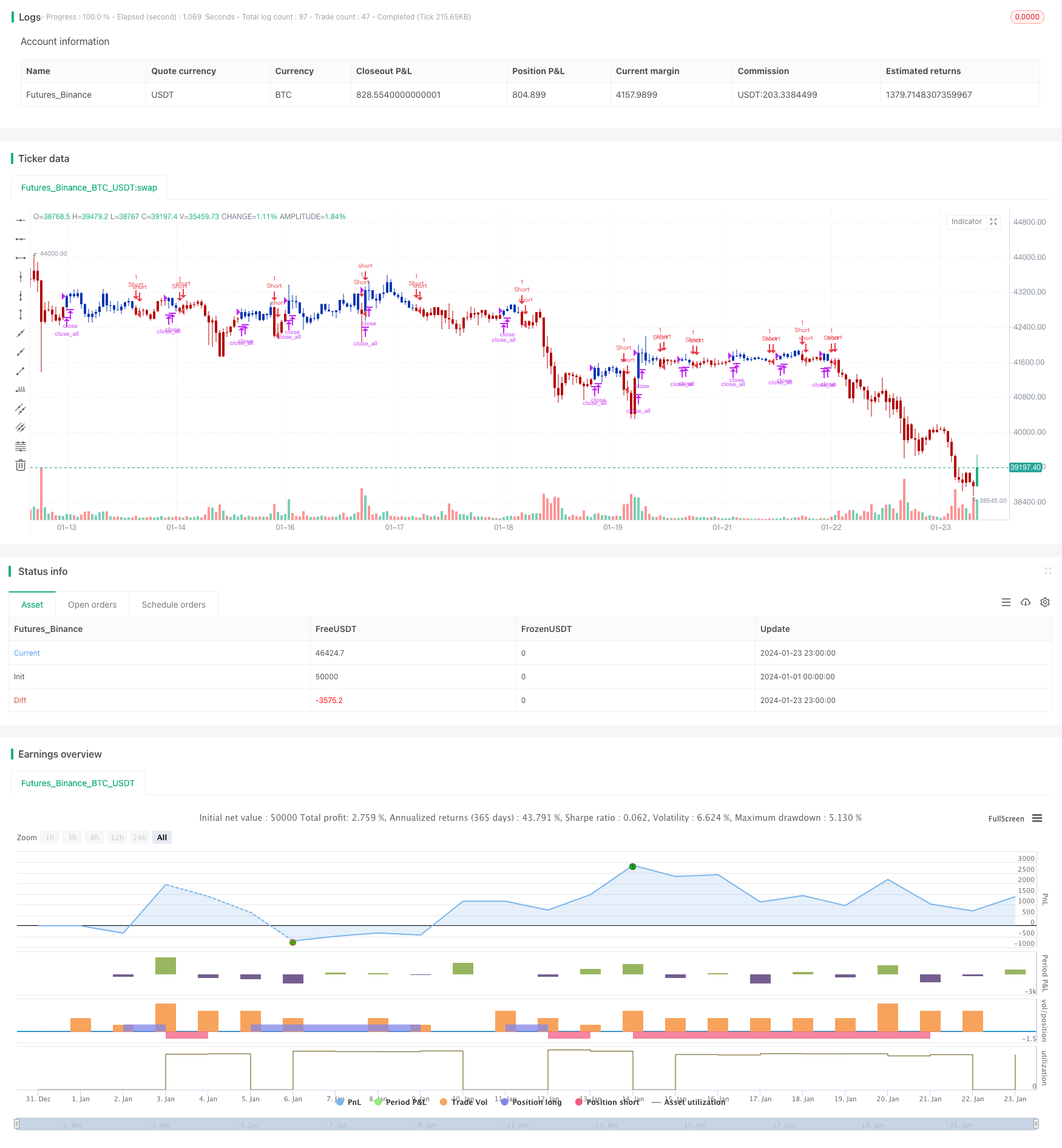

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-24 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 21/09/2020

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// Stock market moves in a highly chaotic way, but at a larger scale, the movements

// follow a certain pattern that can be applied to shorter or longer periods of time

// and we can use Fractal Chaos Bands Indicator to identify those patterns. Basically,

// the Fractal Chaos Bands Indicator helps us to identify whether the stock market is

// trending or not. When a market is trending, the bands will have a slope and if market

// is not trending the bands will flatten out. As the slope of the bands decreases, it

// signifies that the market is choppy, insecure and variable. As the graph becomes more

// and more abrupt, be it going up or down, the significance is that the market becomes

// trendy, or stable. Fractal Chaos Bands Indicator is used similarly to other bands-indicator

// (Bollinger bands for instance), offering trading opportunities when price moves above or

// under the fractal lines.

//

// The FCB indicator looks back in time depending on the number of time periods trader selected

// to plot the indicator. The upper fractal line is made by plotting stock price highs and the

// lower fractal line is made by plotting stock price lows. Essentially, the Fractal Chaos Bands

// show an overall panorama of the price movement, as they filter out the insignificant fluctuations

// of the stock price.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

fractalUp(pattern) =>

p = high[pattern+1]

okl = 1

okr = 1

res = 0.0

for i = pattern to 1

okl := iff(high[i] < high[i+1] and okl == 1 , 1, 0)

for i = pattern+2 to pattern*2+1

okr := iff(high[i] < high[i-1] and okr == 1, 1, 0)

res := iff(okl == 1 and okr == 1, p, res[1])

res

fractalDn(pattern) =>

p = low[pattern+1]

okl = 1

okr = 1

res =0.0

for i = pattern to 1

okl := iff(low[i] > low[i+1] and okl == 1 , 1, 0)

for i = pattern+2 to pattern*2+1

okr := iff(low[i] > low[i-1] and okr == 1, 1, 0)

res := iff(okl == 1 and okr == 1, p, res[1])

res

FCB(Pattern) =>

pos = 0.0

xUpper = fractalUp(Pattern)

xLower = fractalDn(Pattern)

pos := iff(close > xUpper, 1,

iff(close < xLower, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Fractal Chaos Bands", shorttitle="Combo", overlay = true)

Length = input(15, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

Pattern = input(1, minval=1)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posFCB = FCB(Pattern)

pos = iff(posReversal123 == 1 and posFCB == 1 , 1,

iff(posReversal123 == -1 and posFCB == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )

もっと

- 線形回帰と二重移動平均の短期戦略

- ストカスティック・モメンタム戦略の三重重複

- モメント トレンド 戦略

- モメント移動平均クロスオーバー量子戦略

- 2つの移動平均逆転とATRトライルストップの組み合わせ戦略

- マルティンゲールフューチャー取引戦略

- モメント・プルバック・戦略

- ダブルキャンドルスタイク予測 接近戦略

- ストカスティック・スーパートレンド・トラッキング・ストップ・ロスの取引戦略

- 3つの EMA,DMI,MACD を含むトレンドフォロー戦略

- 二重指標の突破戦略

- ピート・ウェーブ・トレーディング・システム戦略

- 指数関数移動平均と量重量化に基づいた定量戦略

- オリジックス・アシ戦略 滑らかな移動平均値に基づく

- BlackBit Trader XO マクロトレンドスキャナー戦略

- 原油ADXの動向 戦略をフォローする

- MT-調整取引戦略