Vix Fix 線形回帰底釣り戦略

作者: リン・ハーンチャオチャン,日付: 2024-01-30 16:56:39タグ:

概要

この戦略の核心思想は,市場底部を正確に把握するために,Vix Fix指標とその線形回帰を組み合わせることです.この戦略は"Fix Regression Bottom Fishing Strategy"と呼ばれています.

戦略の論理

- 市場の底辺を判断するのに良いVix Fix指標を計算する

- 線形回帰ヒストグラムの色が緑色になると,それはVix Fixの線形回帰が上昇し始めることを意味します.

- エントリーのタイミングをさらに確認するために,Vix Fix指標の緑色の列と組み合わせます.

- 線形回帰ヒストグラムの色が赤くなると,Vix Fixの線形回帰が減少し始めると,売り信号が起動します.

上記のプロセスは,Vix Fix信号の正確性とタイミングを向上させ,いくつかの偽信号をフィルタリングし,したがって底部を正確に捕捉するために線形回帰を使用します.

利点分析

- 戦略は,線形回帰を使用して,バイックス・フィックス指標のいくつかの偽信号をフィルタリングし,購入/販売信号をより正確かつ信頼性のあるものにする

- 線形回帰は,信号の敏感性とタイミングを向上させ,市場の転換点を迅速に把握することができます.

- 戦略の論理は単純で明確で,理解し実行しやすい.

- 市場変化に適応するために柔軟に調整できる多くの設定可能なパラメータがあります

リスク と 解決策

- この戦略は主に市場全体の底部を決定するために使用され,個々のストックに適していません.

- 線形回帰は,誤った信号を完全にフィルタリングすることはできません.

- 市場の変化に適応し,失敗を避けるためにパラメータを適切に調整する必要性

- 信号をさらに確認するために他の指標と組み合わせることを推奨します.

オプティマイゼーションの方向性

- 波動性指標やバランス上のボリューム指標と組み合わせてシグナルをさらにフィルタリングすることを検討する

- 戦略をよりスマートにするためのパラメータ適応最適化方法を研究する

- より複雑なモデルでVix Fixのトレンドを予測するための機械学習方法を探求する

- 偽信号をフィルタリングする方法の研究のために,個々の株に同様の方法を適用しようとします.

結論

この戦略は,シグナル品質を改善するために線形回帰を導入しながら,ボトムを判断するためにVix Fixインジケーターを使用し,それによって効果的に市場のボトムを捕獲する.この戦略はシンプルで,実践的で,立派な結果を生む.主なリスクは完全にフィルタリングできない偽信号にあります.我々はまだパラメータ設定を最適化し,戦略をより堅牢にするために信号をさらに確認するための他の手段を導入することを検討する必要があります.全体として,この戦略は市場のボトムを決定する新しい効果的な方法を提供し,さらなる研究に価値がある.

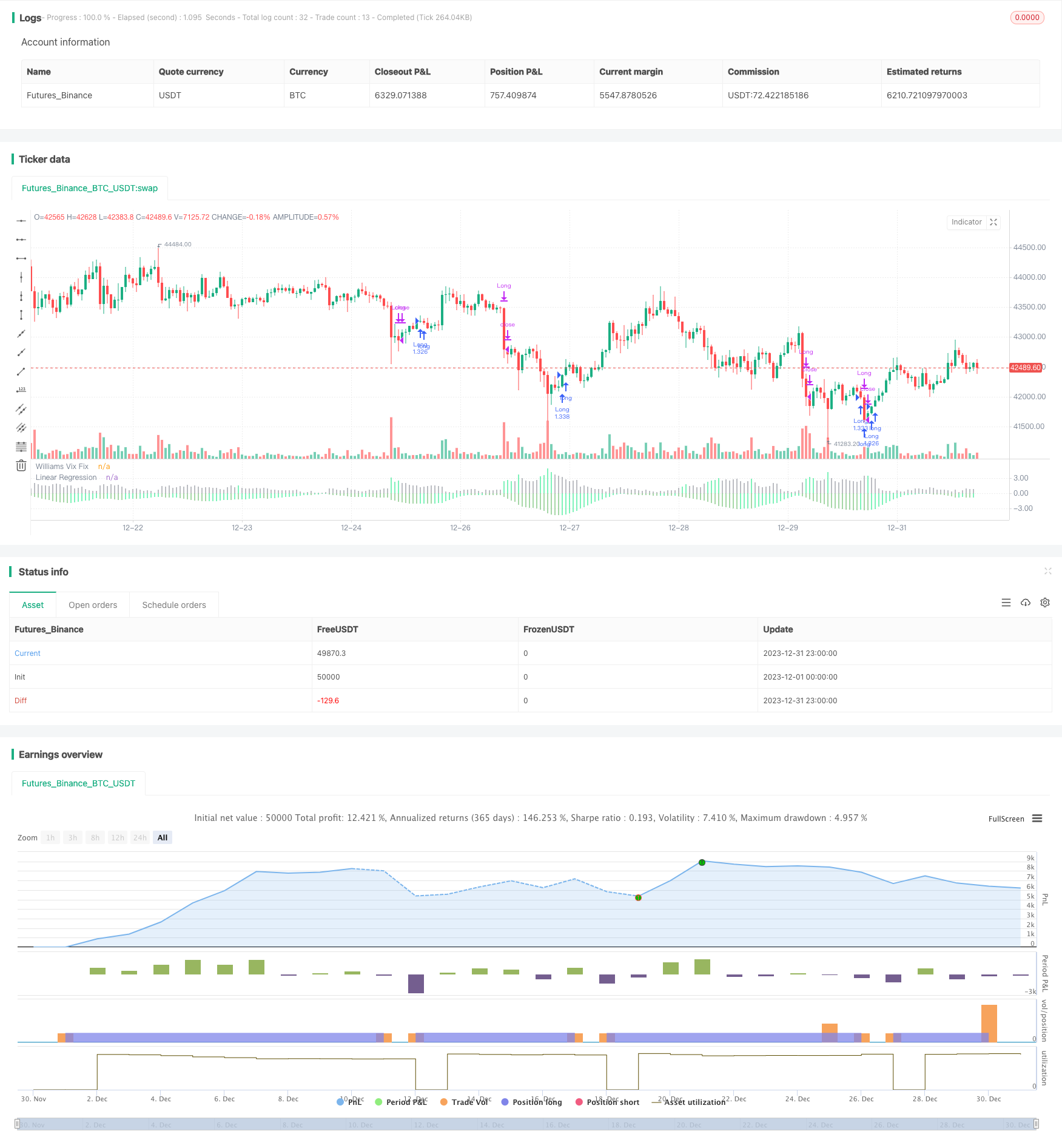

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © HeWhoMustNotBeNamed

//@version=4

strategy("VixFixLinReg-Strategy", shorttitle="VixFixLinReg - Strategy",

overlay=false, initial_capital = 100000,

default_qty_type = strategy.percent_of_equity, default_qty_value = 100, commission_type = strategy.commission.percent, pyramiding = 1,

commission_value = 0.01)

pd = input(22, title="LookBack Period Standard Deviation High")

bbl = input(20, title="Bolinger Band Length")

mult = input(2.0 , minval=1, maxval=5, title="Bollinger Band Standard Devaition Up")

lb = input(50 , title="Look Back Period Percentile High")

ph = input(.85, title="Highest Percentile - 0.90=90%, 0.95=95%, 0.99=99%")

pl = input(1.01, title="Lowest Percentile - 1.10=90%, 1.05=95%, 1.01=99%")

hp = input(false, title="Show High Range - Based on Percentile and LookBack Period?")

sd = input(false, title="Show Standard Deviation Line?")

i_startTime = input(defval = timestamp("01 Jan 2010 00:00 +0000"), title = "Start Time", type = input.time)

i_endTime = input(defval = timestamp("01 Jan 2099 00:00 +0000"), title = "End Time", type = input.time)

inDateRange = true

considerVIXFixClose = input(false)

lengthKC=input(20, title="KC Length")

multKC = input(1.5, title="KC MultFactor")

atrLen = input(22)

atrMult = input(5)

initialStopBar = input(5)

waitForCloseBeforeStop = input(true)

f_getStop(atrLen, atrMult)=>

stop = strategy.position_size > 0 ? close - (atrMult * atr(atrLen)) : lowest(initialStopBar)

stop := strategy.position_size > 0 ? max(stop,nz(stop[1], stop)) : lowest(initialStopBar)

stop

wvf = ((highest(close, pd)-low)/(highest(close, pd)))*100

sDev = mult * stdev(wvf, bbl)

midLine = sma(wvf, bbl)

lowerBand = midLine - sDev

upperBand = midLine + sDev

rangeHigh = (highest(wvf, lb)) * ph

rangeLow = (lowest(wvf, lb)) * pl

col = wvf >= upperBand or wvf >= rangeHigh ? color.lime : color.gray

val = linreg(wvf, pd, 0)

absVal = abs(val)

linRegColor = val>val[1]? (val > 0 ? color.green : color.orange): (val > 0 ? color.lime : color.red)

plot(hp and rangeHigh ? rangeHigh : na, title="Range High Percentile", style=plot.style_line, linewidth=4, color=color.orange)

plot(hp and rangeLow ? rangeLow : na, title="Range High Percentile", style=plot.style_line, linewidth=4, color=color.orange)

plot(wvf, title="Williams Vix Fix", style=plot.style_histogram, linewidth = 4, color=col)

plot(sd and upperBand ? upperBand : na, title="Upper Band", style=plot.style_line, linewidth = 3, color=color.aqua)

plot(-absVal, title="Linear Regression", style=plot.style_histogram, linewidth=4, color=linRegColor)

vixFixState = (col == color.lime) ? 1: 0

vixFixState := strategy.position_size == 0? max(vixFixState, nz(vixFixState[1],0)) : vixFixState

longCondition = (vixFixState == 1 and linRegColor == color.lime) and inDateRange

exitLongCondition = (linRegColor == color.orange or linRegColor == color.red) and considerVIXFixClose

stop = f_getStop(atrLen, atrMult)

label_x = time+(60*60*24*1000*20)

myLabel = label.new(x=label_x, y=0, text="Stop : "+tostring(stop), xloc=xloc.bar_time, style=label.style_none, textcolor=color.black, size=size.normal)

label.delete(myLabel[1])

strategy.entry("Long", strategy.long, when=longCondition, oca_name="oca_buy")

strategy.close("Long", when=exitLongCondition or (close < stop and waitForCloseBeforeStop and linRegColor == color.green))

strategy.exit("ExitLong", "Long", stop = stop, when=not waitForCloseBeforeStop and linRegColor == color.green)

もっと

- 双重ブレイク・ボラティリティ・チャネル戦略

- 複数の指標に基づいた戦略をフォローする傾向

- マルチタイムフレームMACD取引戦略

- ベンチマークによる月間リターン戦略

- スプレッシュ・モメンタム・ブレイクアウト戦略

- 双面的な突破戦略

- モメントブレイクとエングルフィング パターン アルゴリズム取引戦略

- 2つの移動平均の収束戦略

- RSI の逆転 取引 戦略

- 双方向のADX取引戦略

- 3つの指数関数移動平均値とストカスティック相対強度指標の取引戦略

- 7日間の脱出戦略だ

- 双重MACD量的な取引戦略

- Bollinger Band Moving Average クロスオーバー戦略について

- スカルピング・ディプス・イン・ブル・マーケット・戦略

- アダプティブ・ムービング・メアディアに基づく戦略をフォローする傾向

- 真の相対的移動移動平均戦略

- MACDとRSIをベースにした5分間のモメンタム・トレード戦略

- ダブル・フラクタル・ブレイクアウト戦略

- ノロは移動平均ストップ損失戦略を変えた