여러 지표에 기초한 전략에 따른 경향

저자:차오장, 날짜: 2024-01-30 17:51:04태그:

전반적인 설명

이 전략은 여러 지표를 결합하여 트렌드를 식별하고 트렌드 추적 스톱 손실을 설정하여 이익을 잠금합니다. 주로 볼링거 밴드, RSI, ADX 및 기타 지표를 사용하여 엔트리 타이밍을 결정하고, ATR 및 볼링거 밴드를 사용하여 스톱 손실을 사용합니다.

전략 원칙

전략의 주요 판단 지표는 볼링거 밴드, RSI 및 ADX입니다. 가격이 볼링거 밴드의 하부 레일에 접근하고 RSI가 30 이하일 때, 그것은 과판된 것으로 판단되고 긴 지위가 취득됩니다. 가격이 볼링거 밴드의 상부 레일에 접근하고 RSI가 70 이상일 때, 그것은 과반된 것으로 판단되며 짧은 지위가 취득됩니다. 또한, ADX가 25 이상이라면, 긴 신호와 짧은 신호를 더 효과적으로 만드는 추세가 형성되었다고 의미합니다.

포지션 개척 후 전략은 ATR 지표와 볼링거 밴드 레일을 사용하여 스톱 로스를 설정합니다. 구체적으로, ATR는 최대 스톱 로스 범위를 설정합니다. 가격이 최대 스톱 로스 포인트에 도달하면 포지션을 닫습니다. 볼링거 밴드 레일은 가격 움직임에 따라 업데이트되는 후속 스톱 로스 포인트를 설정합니다.

이점 분석

이 전략은 판단을 위해 여러 지표를 결합하고 수익을 차단하고 위험을 줄이기 위해 스톱 로스 메커니즘을 사용합니다. 주요 장점은 다음과 같습니다.

- 오버구입 및 오버판매 상황을 판단하기 위해 볼링거 밴드를 사용하여 역전 기회를 사용

- RSI 지표와 결합하면 판단 정확도가 높아집니다.

- ADX 지표는 올바른 거래 방향을 보장하기 위해 트렌드 형성을 결정합니다.

- ATR 및 볼링거 밴드 후속 스톱 손실은 수익 잠금 최대화 할 수 있습니다

위험 분석

이 전략에는 몇 가지 위험도 있습니다.

- 다중 지표 판단은 과도한 최적화 가능성이 높습니다.

- 볼링거 밴드 범위가 너무 넓으면 신호는 덜 효과적입니다.

- 부적절한 스톱 로스 트레일링은 손실 증가를 초래할 수 있습니다.

이러한 위험을 해결하기 위해 우리는 다음과 같은 조치를 취할 수 있습니다.

- 과잉 최적화를 방지하기 위한 다중 매개 변수 최적화

- 시장 변동성에 따라 볼링거 밴드 매개 변수를 조정합니다

- 정상 변동에 견딜 수 있는 시험 중지 손실 거리 매개 변수

최적화 방향

이 전략은 다음 측면에서도 최적화 될 수 있습니다.

- 중지 손실 곱자에 기초한 위치 스케일을 조정하기 위해 위치 크기를 추가

- 단일 스톱 손실 금액을 엄격하게 제어하기 위해 돈 관리 모듈을 추가

- DMI, 앙플루어 등과 같은 다른 중지 손실 지표를 테스트

- 추세 확률을 결정하고 성능을 향상시키기 위해 기계 학습 모델을 추가하십시오.

요약

요약하자면, 이것은 전략에 따른 비교적 견고한 추세입니다. 여러 지표를 통해 추세 방향을 결정하고 스톱 로스 조치를 통해 위험을 제어함으로써 투자 수익률을 높일 수 있습니다. 또한 전략이 최적화 할 수있는 몇 가지 측면을 제안했습니다. 추가 최적화는 더 나은 결과를 가져올 수 있습니다.

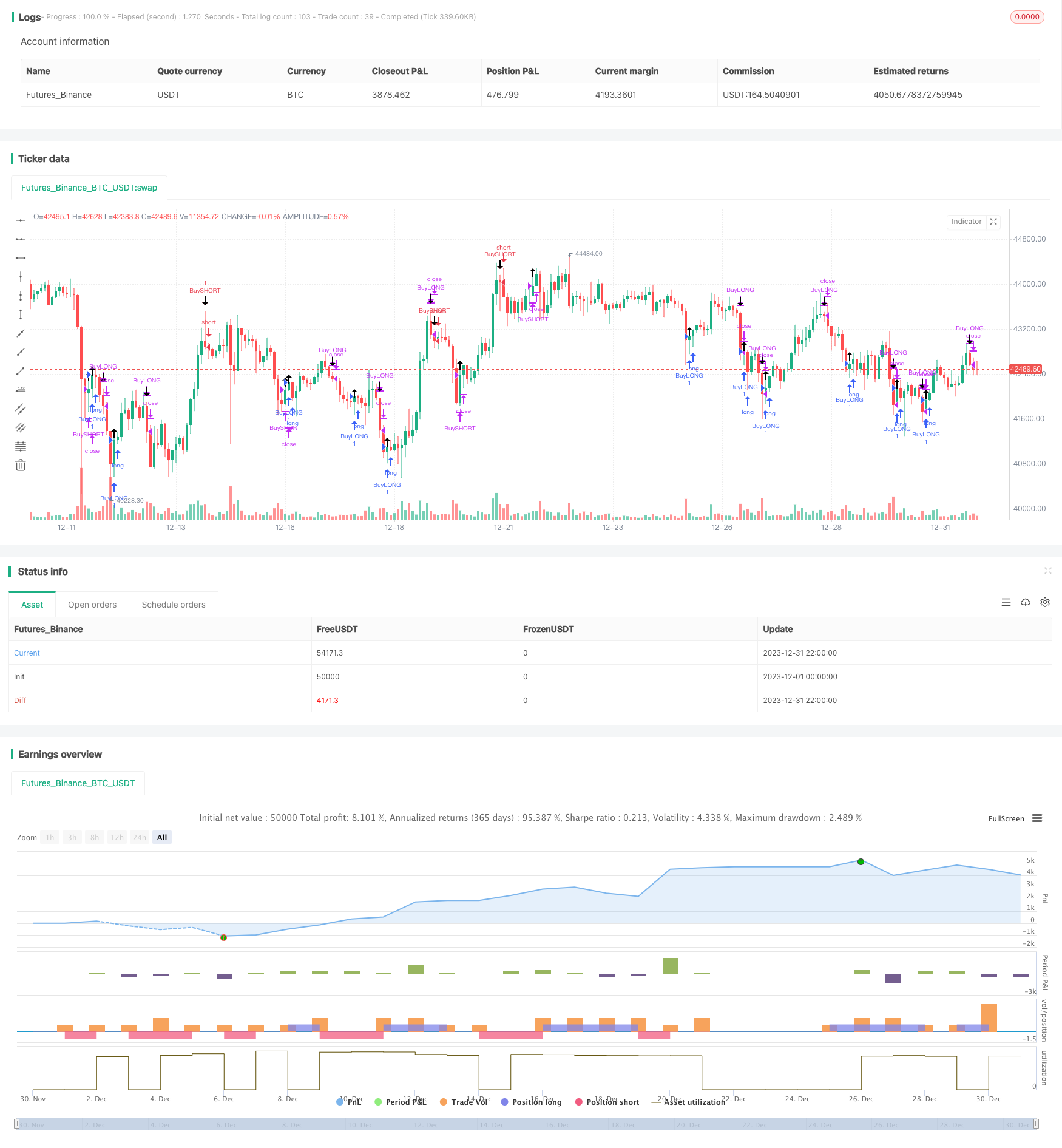

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

// THIS SCRIPT IS MEANT TO ACCOMPANY COMMAND EXECUTION BOTS

// THE INCLUDED STRATEGY IS NOT MEANT FOR LIVE TRADING

// THIS STRATEGY IS PURELY AN EXAMLE TO START EXPERIMENTATING WITH YOUR OWN IDEAS

/////////////////////////////////////////////////////////////////////////////////

// comment out the next line to use this script as an alert script

strategy(title="Dragon Bot - Default Script", overlay=true)

// remove the // in the next line to use this script as an alert script

// study(title="Dragon Bot - Default Script", overlay=true)

// Dragon-Bot default script version 2.0

// This can also be used with bot that reacts to tradingview alerts.

// Use the script as "strategy" for backtesting

// Comment out line 8 and de-comment line 10 to be able to set tradingview alerts.

// You should also comment out (place // before it) the lines 360, 364, 368 and 372 (strategy.entry and strategy.close) to be able to set the alerts.

/////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

// In this first part of the script we setup variables and make sure the script keeps all information it used in the past. //

/////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

longs = 0

longs := nz(longs[1])

shorts = 0

shorts := nz(shorts[1])

buyprice = 0.0

buyprice := buyprice[1]

sellprice = 0.0

sellprice := sellprice[1]

scaler = 0.0

scaler := scaler[1]

sellprofit = input(1.0, minval=0.0, step=0.1, title="main strat profit")

sellproffinal = sellprofit/100

enable_shorts = input(1, minval=0, maxval=1, title="Shorts on/off")

enable_flipping = input(0, minval=0, maxval=1, title="Flipping on/off -> Go directly from long -> short or short -> long without closing ")

enable_stoploss = input(0, minval=0, maxval=1, title="Stoploss on/off")

sellstoploss = input(30.0, minval=0.0, step=1.0, title="Stoploss %")

sellstoplossfinal = sellstoploss/100

enable_trailing = input(1, minval=0, maxval=1, title="Trailing on/off")

enable_trailing_ATR = input(1, minval=0, maxval=1, title="Trailing use ATR on/off")

ATR_Multi = input(1.0, minval=0.0, step=0.1, title="Multiplier for ATR")

selltrailing = input(10.0, minval=0.0, step=1.0, title="Trailing %")

selltrailingfinal = selltrailing/100

Backtestdate = input(0, minval=0, maxval=1, title="backtest date on/off")

// Component Code by pbergden - Start backtest dates

// The following code snippet is taken from an example by pbergen

// All rights to this snippet remain with pbergden

testStartYear = input(2018, "Backtest Start Year")

testStartMonth = input(1, "Backtest Start Month")

testStartDay = input(1, "Backtest Start Day")

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testStopYear = input(2019, "Backtest Stop Year")

testStopMonth = input(1, "Backtest Stop Month")

testStopDay = input(1, "Backtest Stop Day")

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

// A switch to control background coloring of the test period

testPeriodBackground = input(title="Color Background?", type=bool, defval=true)

testPeriodBackgroundColor = testPeriodBackground and (time >= testPeriodStart) and (time <= testPeriodStop) ? #00FF00 : na

bgcolor(testPeriodBackgroundColor, transp=97)

testPeriod() => true

/////////////////////////////////////////////////////////////////////////////////////////////////////

// In this second part of the script we setup indicators that we can use for our actual algorithm. //

/////////////////////////////////////////////////////////////////////////////////////////////////////

//ATR

lengthtr = input(20, minval=1, title="ATR Length")

ATRsell = input(0, minval=0, title="1 for added ATR when selling")

ATR=rma(tr(true), lengthtr)

Trail_ATR=rma(tr(true), 10) * ATR_Multi

atr = 0.0

if ATRsell == 1

atr := ATR

//OC2

lengthoc2 = input(20, minval=1, title="OC2 Length")

OC2sell = input(0, minval=0, title="1 for added OC2 when selling")

OC2mult = input(1, minval=1, title="OC2 multiplayer")

OC= abs(open[1]-close)

OC2=rma(OC, lengthoc2)

oc2 = 0.0

if OC2sell == 1

oc2 := OC2*OC2mult

//ADX

lenadx = input(10, minval=1, title="DI Length")

lensig = input(10, title="ADX Smoothing", minval=1, maxval=50)

up = change(high)

down = -change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

trur = rma(tr, lenadx)

plus = fixnan(100 * rma(plusDM, lenadx) / trur)

minus = fixnan(100 * rma(minusDM, lenadx) / trur)

sum = plus + minus

sigadx = 100 * rma(abs(plus - minus) / (sum == 0 ? 1 : sum), lensig)

//StochRSI

smoothKRSI = input(3, minval=1)

smoothDRSI = input(3, minval=1)

lengthRSI = input(14, minval=1)

lengthStochRSI = input(14, minval=1)

srcRSI = input(close, title="RSI Source")

buyRSI = input(30, minval=1, title="RSI Buy Value")

sellRSI = input(70, minval=1, title="RSI Sell Value")

rsi1 = rsi(srcRSI, lengthRSI)

krsi = sma(stoch(rsi1, rsi1, rsi1, lengthStochRSI), smoothKRSI)

drsi = sma(krsi, smoothDRSI)

// Bollinger bands

lengthbb = input(20, minval=1)

srcbb = input(close, title="Sourcebb")

multbb = input(2.0, minval=0.001, maxval=50)

bb_buy_value = input(0.5, step=0.1, title="BB Buy Value")

bb_sell_value = input(0.5, step=0.1, title="BB Sell Value")

basisbb = sma(srcbb, lengthbb)

devbb = multbb * stdev(srcbb, lengthbb)

upperbb = basisbb + devbb

lowerbb = basisbb - devbb

bbr = (srcbb - lowerbb)/(upperbb - lowerbb)

bbbuy = basisbb - (devbb*bb_buy_value)

bbsell = basisbb + (devbb*bb_sell_value)

//ema very short

shorter = ema(close, 2)

shorterlong = ema(close, 5)

//ema short

short = ema(close, 10)

long = ema(close, 30)

//ema long

shortday = ema(close, 110)

longday = ema(close, 360)

//ema even longer

shortlongerday = ema(close, 240)

longlongerday = ema(close, 720)

//declaring extra timeframe value

profit = request.security(syminfo.tickerid, timeframe.period, close)

////////////////////////////////////////////////////////////////////////

// In the 3rd part of the script we define all the entries and exits //

///////// This third part is basically the acual algorithm ////////////

///////////////////////////////////////////////////////////////////////

//Declaring function with the long entries

OPENLONG_funct() =>

// You can add more buy entries to the script

longentry1 = false

longentry2 = false

longentry3 = false

longentry4 = false

longentry5 = false

makelong_funct = false

if close<bbbuy and krsi<buyRSI // You could for instance add "and shortday > longday"

longentry1 := close>close[1]

// longentry2 := ...

// if another thing we want to buy on happens

// longentry3 := ...

//All the buy entries go above, this last variable is what the function puts out

// if you add more entries, add them in the following list too

makelong_funct := longentry1 or longentry2 or longentry3 or longentry4 or longentry5

//Declaring function wit the short entries

OPENSHORT_funct() =>

// You can add more buy entries to the script

shortentry1 = false

shortentry2 = false

shortentry3 = false

shortentry4 = false

shortentry5 = false

makeshort_funct = false

if close>bbsell and krsi>sellRSI // You could for instance add "and shortday < longday"

shortentry1 := close<close[1]

// shortentry2 := ...

// if another thing we want to buy on happens

// shortentry3 := ...

//All the buy entries go above, this last variable is what the function puts out

// if you add more entries, add them in the following list too

makeshort_funct := shortentry1 or shortentry2 or shortentry3 or shortentry4 or shortentry5

//Declaring function with the long exits

CLOSELONG_funct() =>

// You can add more buy entries to the script

longexit1 = false

longexit2 = false

longexit3 = false

longexit4 = false

longexit5 = false

closelong_funct = false

if close>bbsell and krsi>sellRSI

longexit1 := close<close[1]

// longexit2 := ...

// if another thing we want to close on on happens you can add them here...

// longexit3 := ...

//All the buy entries go above, this last variable is what the function puts out

// if you add more exits, add them in the following list too

closelong_funct := longexit1 or longexit2 or longexit3 or longexit4 or longexit5

//Declaring function wit the short exits

CLOSESHORT_funct() =>

// You can add more buy entries to the script

shortexit1 = false

shortexit2 = false

shortexit3 = false

shortexit4 = false

shortexit5 = false

closeshort_funct = false

if close<bbsell and krsi<sellRSI

shortexit1 := close>close[1]

// shortexit2 := ...

// if another thing we want to close on on happens you can add them here...

// shortexit3 := ...

//All the buy entries go above, this last variable is what the function puts out

// if you add more exits, add them in the following list too

closeshort_funct := shortexit1 or shortexit2 or shortexit3 or shortexit4 or shortexit5

/////////////////////////////////////////////////////////////////////////////////////

////////////// End of "entries" and "exits" definition code /////////////////////////

/////////////////////////////////////////////////////////////////////////////////////

/// In the fourth part we do the actual work, as defined in the part before this ////

////////////////////// This part does not need to be changed ////////////////////////

/////////////////////////////////////////////////////////////////////////////////////

//OPEN LONG LOGIC

makelong = false

//buy with backtesting on specific dates

if Backtestdate > 0 and testPeriod()

if (longs < 1 and shorts < 1) or (short > 0 and enable_flipping > 0 and enable_shorts > 0)

makelong := OPENLONG_funct()

//buy without backtesting on specific dates

if Backtestdate < 1

if (longs < 1 and shorts < 1) or (short > 0 and enable_flipping > 0 and enable_shorts > 0)

makelong := OPENLONG_funct()

if makelong

buyprice := close

scaler := close

longs := 1

shorts := 0

//OPEN SHORT LOGIC

makeshort = false

//buy with backtesting on specific dates

if Backtestdate > 0 and testPeriod()

if (shorts < 1 and longs < 1 and enable_shorts > 0) or (longs > 0 and enable_flipping > 0 and enable_shorts > 0)

makeshort := OPENSHORT_funct()

//buy without backtesting on specific dates

if Backtestdate < 1

if (shorts < 1 and longs < 1 and enable_shorts > 0) or (longs > 0 and enable_flipping > 0 and enable_shorts > 0)

makeshort := OPENSHORT_funct()

if makeshort

buyprice := close

scaler := close

shorts := 1

longs := 0

//Calculating values for traling stop

if longs > 0 and enable_flipping < 1

if close > scaler+Trail_ATR and enable_trailing_ATR > 0

scaler := close

if close > scaler * (1.0 + selltrailingfinal) and enable_trailing_ATR < 1

scaler := close

if shorts > 0 and enable_flipping < 1

if close < scaler-Trail_ATR and enable_trailing_ATR > 0

scaler := close

if close < scaler * (1.0 - selltrailingfinal) and enable_trailing_ATR < 1

scaler := close

long_exit = false

long_security1 = false

long_security2 = false

long_security3 = false

//CLOSE LONG LOGIC

if longs > 0 and enable_flipping < 1

if ( (buyprice + (buyprice*sellproffinal) + atr + oc2) < close) and ( (buyprice + (buyprice*sellproffinal) ) < profit)

long_exit := CLOSELONG_funct()

//security

if enable_stoploss > 0

long_security1 := close < ( buyprice * (1.0 - sellstoplossfinal) )

if enable_trailing > 0 and enable_trailing_ATR < 1

long_security2 := close < ( scaler * (1.0 - selltrailingfinal) )

if enable_trailing > 0 and enable_trailing_ATR > 0

long_security2 := close < ( scaler - Trail_ATR)

//CLOSE LONG LOGIC

if longs > 0 and enable_flipping > 0

//security

if enable_stoploss > 0

long_security1 := close < ( buyprice * (1.0 - sellstoplossfinal) )

if enable_trailing > 0 and enable_trailing_ATR < 1

long_security2 := close < ( scaler * (1.0 - selltrailingfinal) )

if enable_trailing > 0 and enable_trailing_ATR > 0

long_security2 := close < ( scaler - Trail_ATR)

closelong = long_exit or long_security1 or long_security2 or long_security3

short_exit = false

short_security1 = false

short_security2 = false

short_security3 = false

if closelong

longs := 0

//CLOSE SHORT LOGIC

if shorts > 0 and enable_flipping < 1

if ( (buyprice - (buyprice*(sellproffinal) - atr - oc2) > close) and ( (buyprice - (buyprice*sellproffinal) ) > profit) )

short_exit := CLOSESHORT_funct()

//security

if enable_stoploss > 0

short_security1 := close > ( buyprice * (1.0 + sellstoplossfinal) )

if enable_trailing > 0 and enable_trailing_ATR < 1

short_security2 := close > ( scaler * (1.0 + selltrailingfinal) )

if enable_trailing > 0 and enable_trailing_ATR > 0

short_security2 := close > ( scaler + Trail_ATR)

if shorts > 0 and enable_flipping > 0

//security

if enable_stoploss > 0

short_security1 := close > ( buyprice * (1.0 + sellstoplossfinal) )

if enable_trailing > 0 and enable_trailing_ATR < 1

short_security2 := close > ( scaler * (1.0 + selltrailingfinal) )

if enable_trailing > 0 and enable_trailing_ATR > 0

short_security2 := close > ( scaler + Trail_ATR)

closeshort = short_exit or short_security1 or short_security2 or short_security3

if closeshort

shorts := 0

///////////////////////////////////////////////////////////////////////////////////////

///////////// The last section takes care of the alerts //////////////////////////////

//////////////////////////////////////////////////////////////////////////////////////

plotshape(makelong, style=shape.arrowup)

alertcondition(makelong, title="openlong", message="openlong")

strategy.entry("BuyLONG", strategy.long, oca_name="DBCross", when= makelong, comment="Open Long")

plotshape(makeshort, style=shape.arrowdown)

alertcondition(makeshort, title="openshort", message="openshort")

strategy.entry("BuySHORT", strategy.short, oca_name="DBCross", when= makeshort, comment="Open Short")

plotshape(closelong, style=shape.arrowdown)

alertcondition(closelong, title="closelong", message="closelong")

strategy.close("BuyLONG", when=closelong)

plotshape(closeshort, style=shape.arrowup)

alertcondition(closeshort, title="closeshort", message="closeshort")

strategy.close("BuySHORT", when=closeshort)

- 다중 요인 양적 거래 전략

- 이중 이동 평균의 크로스오버 전략

- 이중 메커니즘 동적 트렌드 추적 전략

- 이치모쿠 클라우드 기반의 비트코인 거래 전략

- 황소시장 추적 시스템

- 렌코 로프 포인트 리트레이싱에 기반한 주식 내 하루 거래 전략

- 트렌드 트레이딩 전략, 이중 이동 평균의 가격 채널을 기반으로

- 이중 MA 모멘텀 브레이크업 전략

- SMART 전문 양적 거래 전략

- 이중 파업 변동성 채널 전략

- 멀티 타임프레임 MACD 거래 전략

- 벤치마크와 함께 월간 수익 전략

- 스프레시 모멘텀 브레이크업 전략

- 이중적 돌파구 전략

- 모멘텀 브레이크업 및 잉글링 패턴 알고리즘 거래 전략

- 이중 이동평균 합동 전략

- RSI 역전 거래 전략

- 양방향 ADX 거래 전략

- Vix Fix 선형 회귀 하위 낚시 전략

- 세 개의 기하급수적인 이동 평균 및 스토카스틱 상대 강도 지수 거래 전략