MOST 지표 이중 위치 적응 전략

저자:차오장, 날짜: 2024-05-24 17:28:39태그:대부분SMARSICCI

전반적인 설명

이 전략은 MOST 지표에 기반한 이중 포지션 적응적 양적 거래 전략이다. MOST 지표의 긴 및 짧은 기간 라인을 계산하고 가격 및 거래량과 같은 요소를 고려함으로써 전략은 안정적인 수익을 얻기 위해 개척 방향, 포지션 크기, 영업점 및 스톱 로스 포인트를 적응적으로 조정합니다. 전략은 트렌드 및 오스실레이션 시장 상태를 모두 고려하고 매개 변수를 동적으로 조정하여 다른 시장 환경에 적응합니다.

전략 원칙

- MOST 지표의 길고 짧은 기간 라인을 계산하고, 현재 가격과 MOST 지표의 위치 사이의 관계를 비교하여 길고 짧은 방향을 결정합니다.

- 트렌드 방향 및 강도에 따라 개척 위치 크기를 적응적으로 조정하십시오. 트렌드가 강하다면 위치를 적절히 증가 시키십시오. 트렌드가 약하다면 위치를 적절히 감소하십시오.

- 이윤을 취하고 손실을 멈추는 여러 지점을 설정하고, 위험을 통제하기 위해 시장 변동성에 따라 이윤을 취하고 손실을 멈추는 지점을 동적으로 조정합니다.

- 거래 시간 창과 필터를 도입하여 시장 변동성이 높거나 추세가 불분명할 때 거래를 피하여 전략의 안정성을 향상시킵니다.

- RSI와 CCI와 같은 여러 지표를 종합적으로 고려하여 개시 조건을 필터링하고 개시 포지션의 정확성을 향상시킵니다.

전략적 장점

- 적응형 위치 조정: 트렌드 강도와 시장 변동성에 따라 오픈 포지션 크기를 동적으로 조정하고, 트렌드가 강할 때 더 많은 수익을 얻고, 트렌드가 약할 때 위험을 제어합니다.

- 동적 취득 및 스톱-러스: 시장 변동성에 따라 동적으로 취득 및 스톱-러스 포인트를 조정하여 적시에 수익을 확보하고 마감량을 효과적으로 제어 할 수 있습니다.

- 다중 지표 필터링: RSI와 CCI와 같은 여러 지표를 포괄적으로 고려하여 오픈 조건을 필터링하고 오픈 포지션의 정확성을 향상시키고 잘못된 판단의 위험을 줄이십시오.

- 강력한 적응력: 거래 시간 창과 필터를 설정함으로써 시장 변동성이 높거나 추세가 불분명할 때 거래를 피하여 전략의 적응력을 향상시킵니다.

- 매개 변수 최적화: 전략은 최적화 가능한 여러 매개 변수를 가지고 있습니다. 예를 들어 MOST 지표 기간, 수익 및 스톱-러스 포인트, 포지션 크기 등이 있습니다. 매개 변수는 다른 시장 환경과 자산 특성에 따라 최적화되어 전략 수익을 향상시킬 수 있습니다.

전략 위험

- 매개 변수 최적화 위험: 전략은 최적화해야 하는 여러 매개 변수를 가지고 있으며, 다른 매개 변수 설정은 전략 성능에 큰 차이를 초래할 수 있으며, 그 결과 매개 변수 최적화 위험이 발생합니다.

- 과도한 적합성 위험: 매개 변수 최적화가 너무 복잡하다면 전략 과도한 적합성 및 샘플 외부 데이터의 낮은 성능으로 이어질 수 있습니다.

- 블랙 스완 이벤트 리스크: 전략은 역사적 데이터에 기반하여 최적화되어 있으며 블랙 스완 이벤트와 같은 극단적인 시장 조건에 대처할 수 없을 수 있습니다.

- 시장 위험: 트렌드가 불분명하거나 시장 변동성이 높을 때 전략은 큰 마감률을 경험할 수 있습니다.

전략 최적화 방향

- 지원 벡터 기계와 무작위 숲과 같은 기계 학습 알고리즘을 도입하여 개척 조건과 위치 크기를 최적화하여 전략 수익성과 안정성을 향상시킵니다.

- 공황 지수와 같은 시장 감정 지표를 도입하여 시장 정서를 정량화하고 시장 정서가 극단적 인 경우 위험을 통제하기 위해 위치를 적시에 조정합니다.

- 기본 요인 및 기술 요인 같은 다중 요인 모델을 도입하여 자산을 정량적으로 평가하고 전략 수익을 향상시키기 위해 고품질 자산을 선택하십시오.

- 자본 관리 모듈을 도입하여 회계 이익과 손실에 따라 지점 크기를 동적으로 조정하고, 마감량을 제어하고 전략 안정성을 향상시킵니다.

- 시장 환경의 변화에 따라 전략 매개 변수를 적응적으로 조정하기 위해 매개 변수 적응 최적화를 수행하여 전략 적응력을 향상시킵니다.

요약

이 전략은 MOST 지표에 기반한 이중 위치 적응적 양적 거래 전략이다. 포지션 크기와 취익 및 스톱 로스 포인트를 동적으로 조정함으로써 다른 시장 환경에 적응하고 안정적인 수익을 얻는다. 동시에, 전략은 개설 포지션의 정확성을 향상시키고 인출 위험을 제어하기 위해 여러 필터링 조건을 도입한다. 미래에는 머신 러닝 알고리즘, 시장 정서 지표, 멀티 팩터 모델 등을 도입하여 전략을 최적화하고 전략 수익과 탄력성을 향상시킬 수 있다. 요약하자면, 이 전략은 특정 장점과 최적화 여지가 있는 양적 거래 전략이다.

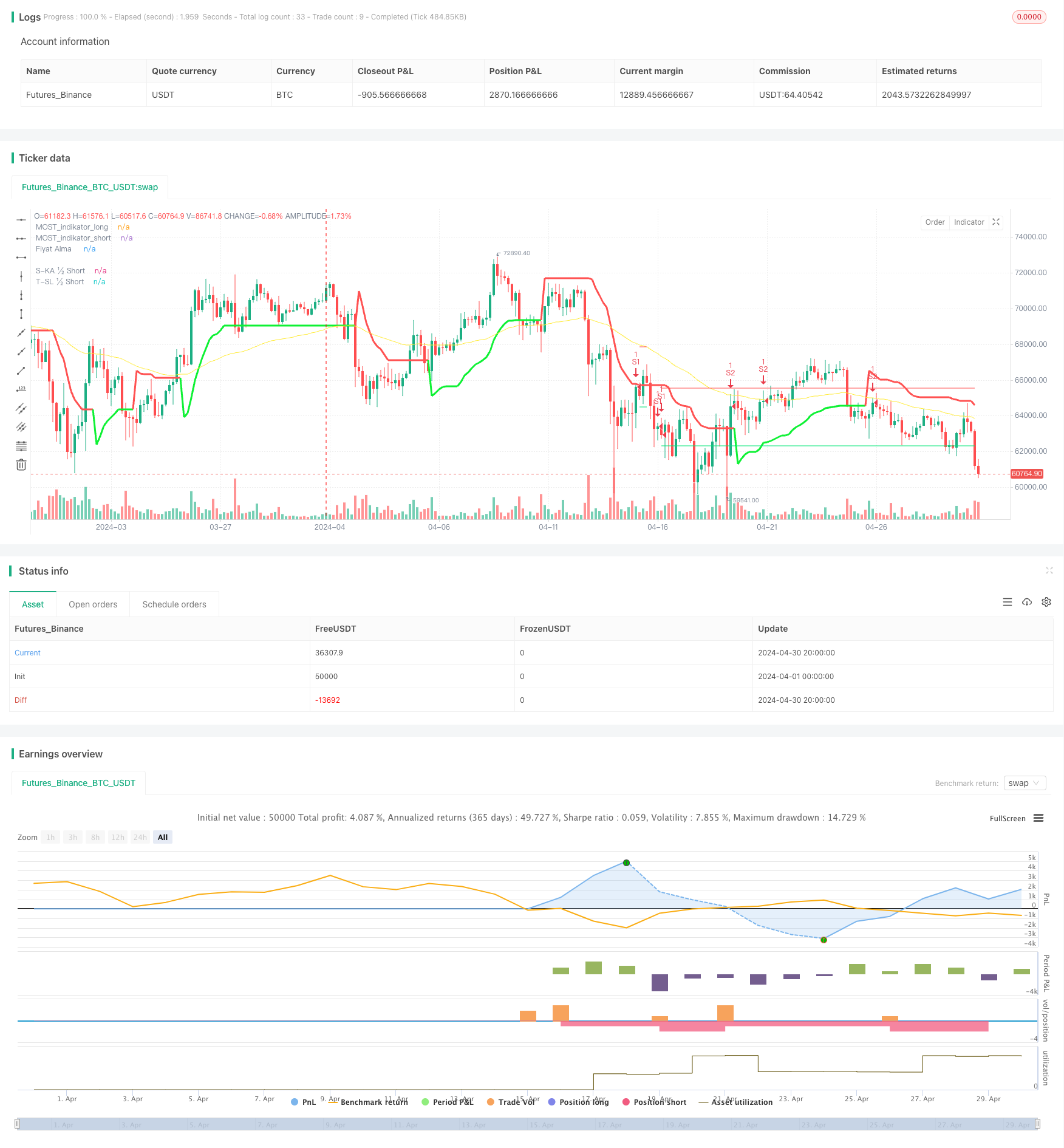

/*backtest

start: 2024-04-01 00:00:00

end: 2024-04-30 23:59:59

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//@strategy_alert_message {{strategy.order.alert_message}}

//bu yukardaki otomatik olarak alarma ekleniyormus, diger turlu her seferinde bunu yapistirman gerekiyordu..

//19.05.2024

///////////////////////////////////////////////////////

// code combiner and developer @ Mustafa Özbakır mozbakir

// thank all other code owners

strategy('mge-auto okx', pyramiding=3,close_entries_rule ="FIFO" , use_bar_magnifier = false ,process_orders_on_close=false,calc_on_order_fills = false,calc_on_every_tick= false,format=format.price, overlay=true, default_qty_type=strategy.percent_of_equity , default_qty_value=100, initial_capital=50, currency=currency.USD, commission_value=0.05, commission_type=strategy.commission.percent)

//Fiyat Tick hesabi

RoundToTick( _price) => math.round(_price/syminfo.mintick)*syminfo.mintick

open_fiyat = RoundToTick(open)

close_fiyat = RoundToTick(close)

high_fiyat = RoundToTick(high)

low_fiyat = RoundToTick(low)

hlc3_fiyat = RoundToTick(hlc3)

var float percenval_most_indikator_long = 0.

var float percenval_most_indikator_short = 0.

var float ikinci_giris_long = 0.

var float ikinci_giris_short = 0.

percenval_most_indikator_long := input.float(defval=3.4, minval=0, step=0.1, title='most percent long') / 100 //değeri 0,034 1000 üzerinden

percenval_most_indikator_short := input.float(defval=3.4, minval=0, step=0.1, title='most percent short') / 100

slen_long = input.int(defval=20, title='Long Fiyat MA Period', minval=2)

slen_short = input.int(defval=20, title='Short Fiyat MA Period', minval=2)

sabit_tp_yl = percenval_most_indikator_long / 2 //input.float(defval = 1.9 , title = "_long Sabit Kar-aL Long (%)" , step=0.1, minval=0.1) / 100

sabit_tp_ys = percenval_most_indikator_short / 2 //input.float(defval = 1.9 , title = "_short Sabit Kar-aL Short (%)" , step=0.1, minval=0.1) / 100

ikinci_giris_long := 0.009//(percenval_most_indikator_long) - 0.009 //input.float(defval=0.8, minval=0, step=0.1, title='2.Long Fiyat % Kac Düştüğünde',tooltip = 'İlk pozisyon girişi botun %50 bütçesi ile açılır. İlk açılış fiyatı % kaç düşerse geri kalan %50bütçe ile 2. giriş yapılsın?') / 100

ikinci_giris_short := 0.009//(percenval_most_indikator_short) - 0.009//input.float(defval=0.8, minval=0, step=0.1, title='2.Short Fiyat % Kac Yükseldiğinde',tooltip = 'İlk pozisyon girişi botun %50 bütçesi ile açılır. İlk açılış fiyatı % kaç yükselirse geri kalan %50bütçe ile 2. giriş yapılsın?') / 100

//risk_trail_stop = input.float(defval=1.8, minval=0, step=0.1, title='Trail StopLoss % Kar Çarpanı')

//takipli_sloss_yl = sabit_tp_yl * risk_trail_stop

//takipli_sloss_ys = sabit_tp_ys * risk_trail_stop

//takipli_sloss_yl = input.float(defval = 3.8 , title = "_long Takipli Stop-loss Long (%)" , step=0.1, minval=0.1) / 100

//takipli_sloss_ys = input.float(defval = 3.8 , title = "_short Takipli Stop-loss Short (%)" , step=0.1, minval=0.1) / 100

sabit_loss_yl = percenval_most_indikator_long//input.float(defval = 1.9 , title = "_long zarar (%)" , step=0.1, minval=0.1) / 100

sabit_loss_ys = percenval_most_indikator_short//input.float(defval = 1.9 , title = "_short zarar (%)" , step=0.1, minval=0.1) / 100

vwap_gosterge_filtre_long_most = input.bool(true,'Vwap MOST Long filtre => Aktif / Değil', inline="rc2")

vwap_gosterge_secimi_long_most = input.bool(true,'Vwap MOST Long => rsi / cci', inline="rc2")

vwap_gosterge_filtre_short_most = input.bool(true,'Vwap MOST Short filtre => Aktif / Değil', inline="rc3")

vwap_gosterge_secimi_short_most = input.bool(true,'Vwap MOST Short => rsi / cci', inline="rc3")

stop_loss_secimi_long = input.bool(true,'Long Zarar => Sabit / Takipli', inline="rc3")

stop_loss_secimi_short = input.bool(true,'Short Zarar => Sabit / Takipli', inline="rc3")

//slen = 20//input.int(defval=20, title='MA Period', minval=1)

//////////////////////___trade_gunleri_long__//////////////////////////////////////////////

InSession_long (sessionTimes_long , sessionTimeZone_long =syminfo.timezone) =>

not na(time(timeframe.period, sessionTimes_long , sessionTimeZone_long ))

// Create the session and string inputs

sessionInput = "0000-2359"//input.session("0000-2345", title="Session Times")//, group="Trading Session")

// Create the session string

//weekdays_long = "Long Günleri"

sadece_yer_icin_long = input.bool(defval=false, title="L_Gün :", inline="dL1")

on_mon_long = input.bool(defval=true, title="Psi", inline="dL1")

on_tue_long = input.bool(defval=true, title="S", inline="dL1")

on_wed_long = input.bool(defval=true, title="Ç", inline="dL1")

on_thu_long = input.bool(defval=true, title="P", inline="dL1")

on_fri_long = input.bool(defval=true, title="C", inline="dL1")

on_sat_long = input.bool(defval=true, title="Csi", inline="dL1")

on_sun_long = input.bool(defval=true, title="P", inline="dL1")

session_weekdays_long = ':'

if on_sun_long

session_weekdays_long := session_weekdays_long + "1"

if on_mon_long

session_weekdays_long := session_weekdays_long + "2"

if on_tue_long

session_weekdays_long := session_weekdays_long + "3"

if on_wed_long

session_weekdays_long := session_weekdays_long + "4"

if on_thu_long

session_weekdays_long := session_weekdays_long + "5"

if on_fri_long

session_weekdays_long := session_weekdays_long + "6"

if on_sat_long

session_weekdays_long := session_weekdays_long + "7"

tradingSession_long = sessionInput + session_weekdays_long//":" + daysInput_long

// Highlight background of bars inside the specified session

bgcolor(InSession_long (tradingSession_long ) ? na : color.new(color.teal, 80))

trade_yap_zaman_long = InSession_long(tradingSession_long ) ? true : false

//////////////////////___trade_gunleri_long__bitti___/////////////////////////////////////////////////

/////////////////___trade_gunleri_short__//////////////////////////////////////////////////////

InSession_short (sessionTimes_short , sessionTimeZone_short =syminfo.timezone) =>

not na(time(timeframe.period, sessionTimes_short , sessionTimeZone_short ))

//weekdays_short = "Short Günleri"

sadece_yer_icin_short = input.bool(defval=false, title="S_Gün :", inline="ds1")

on_mon_short = input.bool(defval=true, title="Psi", inline="ds1")

on_tue_short = input.bool(defval=true, title="S", inline="ds1")

on_wed_short = input.bool(defval=true, title="Ç", inline="ds1")

on_thu_short = input.bool(defval=true, title="P", inline="ds1")

on_fri_short = input.bool(defval=true, title="C", inline="ds1")

on_sat_short = input.bool(defval=true, title="Csi", inline="ds1")

on_sun_short = input.bool(defval=true, title="P", inline="ds1")

session_weekdays_short = ':'

if on_sun_short

session_weekdays_short := session_weekdays_short + "1"

if on_mon_short

session_weekdays_short := session_weekdays_short + "2"

if on_tue_short

session_weekdays_short := session_weekdays_short + "3"

if on_wed_short

session_weekdays_short := session_weekdays_short + "4"

if on_thu_short

session_weekdays_short := session_weekdays_short + "5"

if on_fri_short

session_weekdays_short := session_weekdays_short + "6"

if on_sat_short

session_weekdays_short := session_weekdays_short + "7"

tradingSession_short = sessionInput + session_weekdays_short//":" + daysInput_short

// Highlight background of bars inside the specified session

bgcolor(InSession_short (tradingSession_short ) ? na :color.new(color.purple, 80) )

trade_yap_zaman_short = InSession_short(tradingSession_short ) ? true : false

/////////////////___trade_gunleri_short__bitti//////////////////////////////////////////////////////

//////////////////////////////////////////////////////////////

Amount_1a = input.float(51, "1. Giris %Bütce", minval = 0.01, inline = "31")//, group = ALERTGRP_CRED) //pozisyon_1_yuzde

Amount_2a = input.float(49, "2. Giris %Bütce", minval = 0.01, inline = "31")//, group = ALERTGRP_CRED) //pozisyon_2_yuzde

okx_bot_butcesi = input.int(50,'Okx Bot Bütcesi $', inline = "bb1")

okx_bot_kaldirac = input.int(2,'Okx Bot Kaldirac x', inline = "bb1")

/////////////////////////////////////

OpenDirection = input.string(defval="BIRLIKTE", title="ISLEM SECIMI", options=["BIRLIKTE", "LONG", "SHORT"])

///////////////////////////////////////////////////////////////////////

Zlema_Func(src, length) =>

zxLag = length / 2 == math.round(length / 2) ? length / 2 : (length - 1) / 2

zxEMAData = src + src - src[zxLag]

ZLEMA = ta.ema(zxEMAData, length)

ZLEMA

fiyat_zlema = Zlema_Func(close_fiyat,20)

fiyat_alma =ta.alma(close_fiyat,96,8,0.6185)//ta.roc(fiyat_alma2,20) //math.sum(ta.roc(fiyat_alma2,1),1) == -3 and math.sum(ta.roc(fiyat_alma3,1),1) == -2

plot(fiyat_alma,'Fiyat Alma ',color.yellow)

//////////////////////////////////////////

cro_anatrend= ta.crossover(fiyat_zlema,fiyat_alma)//ta.crossover(anatrend_fiyat, mtf_fiyat_alma)

cru_anatrend= ta.crossunder(fiyat_zlema,fiyat_alma)//ta.crossunder(anatrend_fiyat, mtf_fiyat_alma)

direction_anatrend = 0

direction_anatrend := cro_anatrend ? 1 : cru_anatrend ? -1 : direction_anatrend[1]

//////////////////////////////////////////

vwap_cci_Length = 20//input.int(20, minval=1)

vwap_sma_Length = 9//input.int(9, minval=1)

vwap_cci = ta.cci(ta.vwap(close_fiyat[1]),vwap_cci_Length)

vwap_rsi = ta.rsi(ta.vwap(close_fiyat[1]),vwap_cci_Length)

vwap_sma_gosterge_cci = ta.sma(vwap_cci,vwap_sma_Length) // Most momentum icin

vwap_sma_gosterge_rsi = ta.sma(vwap_rsi,vwap_sma_Length) // Most momentum icin

vwap_gosterge_cci = vwap_sma_gosterge_cci

vwap_gosterge_rsi = vwap_sma_gosterge_rsi

vwap_gosterge_long_most = vwap_gosterge_secimi_long_most ? vwap_gosterge_rsi : vwap_gosterge_cci

vwap_gosterge_short_most = vwap_gosterge_secimi_short_most ? vwap_gosterge_rsi : vwap_gosterge_cci

vwap_long_most = vwap_gosterge_secimi_long_most ? (vwap_gosterge_long_most > 70) : (vwap_gosterge_long_most > 50)

vwap_short_most = vwap_gosterge_secimi_short_most ? (vwap_gosterge_short_most < 30) and not(vwap_gosterge_short_most < 10) : (vwap_gosterge_short_most < -50)

///////////////////////////////////

//calculation of the most trend price

/////////////////////////////////////

averprice_long = Zlema_Func(close_fiyat, slen_long)//averprice//input(close)

averprice_short = Zlema_Func(close_fiyat, slen_short)

//plot(plot_goster_fiyat ? averprice : na ,title = 'fiyat')

////////////////////////////////////

exMov_indikator_long = averprice_long

fark_indikator_long = exMov_indikator_long * percenval_most_indikator_long //* 0.01

longStop_indikator_long = exMov_indikator_long - fark_indikator_long

longStopPrev_indikator_long = nz(longStop_indikator_long[1], longStop_indikator_long)

longStop_indikator_long := exMov_indikator_long > longStopPrev_indikator_long ? math.max(longStop_indikator_long, longStopPrev_indikator_long) : longStop_indikator_long

shortStop_indikator_long = exMov_indikator_long + fark_indikator_long

shortStopPrev_indikator_long = nz(shortStop_indikator_long[1], shortStop_indikator_long)

shortStop_indikator_long := exMov_indikator_long < shortStopPrev_indikator_long ? math.min(shortStop_indikator_long, shortStopPrev_indikator_long) : shortStop_indikator_long

dir_indikator_long = 1

dir_indikator_long := nz(dir_indikator_long[1], dir_indikator_long)

dir_indikator_long := dir_indikator_long == -1 and exMov_indikator_long > shortStopPrev_indikator_long ? 1 : dir_indikator_long == 1 and exMov_indikator_long < longStopPrev_indikator_long ? -1 : dir_indikator_long

MOST_indikator_long = dir_indikator_long == 1 ? longStop_indikator_long : shortStop_indikator_long

cro_indikator_long = ta.crossover(exMov_indikator_long, MOST_indikator_long)

cru_indikator_long = ta.crossunder(exMov_indikator_long, MOST_indikator_long)

direction_indikator_long = 0

direction_indikator_long := cro_indikator_long ? 1 : cru_indikator_long ? -1 : direction_indikator_long[1]

colorM_indikator_long = direction_indikator_long == 1 ? color.rgb(14, 241, 52) : direction_indikator_long == -1 ? color.red : color.rgb(59, 248, 255)

plot( MOST_indikator_long, color = colorM_indikator_long, linewidth=3, title='MOST_indikator_long')

//plot(exMov_indikator_long, color=colorM_indikator_long, linewidth=2, title='exMov_indikator_long')

////////////////////////////

exMov_indikator_short = averprice_short

fark_indikator_short = exMov_indikator_short * percenval_most_indikator_short //* 0.01

longStop_indikator_short = exMov_indikator_short - fark_indikator_short

longStopPrev_indikator_short = nz(longStop_indikator_short[1], longStop_indikator_short)

longStop_indikator_short := exMov_indikator_short > longStopPrev_indikator_short ? math.max(longStop_indikator_short, longStopPrev_indikator_short) : longStop_indikator_short

shortStop_indikator_short = exMov_indikator_short + fark_indikator_short

shortStopPrev_indikator_short = nz(shortStop_indikator_short[1], shortStop_indikator_short)

shortStop_indikator_short := exMov_indikator_short < shortStopPrev_indikator_short ? math.min(shortStop_indikator_short, shortStopPrev_indikator_short) : shortStop_indikator_short

dir_indikator_short = 1

dir_indikator_short := nz(dir_indikator_short[1], dir_indikator_short)

dir_indikator_short := dir_indikator_short == -1 and exMov_indikator_short > shortStopPrev_indikator_short ? 1 : dir_indikator_short == 1 and exMov_indikator_short < longStopPrev_indikator_short ? -1 : dir_indikator_short

MOST_indikator_short = dir_indikator_short == 1 ? longStop_indikator_short : shortStop_indikator_short

cro_indikator_short= ta.crossover(exMov_indikator_short, MOST_indikator_short)

cru_indikator_short= ta.crossunder(exMov_indikator_short, MOST_indikator_short)

direction_indikator_short = 0

direction_indikator_short := cro_indikator_short ? 1 : cru_indikator_short ? -1 : direction_indikator_short[1]

colorM_indikator_short = direction_indikator_short == 1 ? color.rgb(14, 241, 52) : direction_indikator_short == -1 ? color.red : color.rgb(59, 248, 255)

plot( MOST_indikator_short, color=colorM_indikator_short, linewidth=3, title='MOST_indikator_short')

//plot(exMov_indikator_short, color=colorM_indikator_short, linewidth=2, title='exMov_indikator_short')

/////////////////////////////////

trend_yonu_oto = input.bool(true,'Ana Trend Indikator Pozisyon Sekli (Yonu Devam Eden - Tersi Tekli) => Auto / Manuel', inline="rb")

indikator_long_sekli = input.bool(true,'Indikator Long Manuel => Devam Eden / Tekli', inline="rc")

indikator_short_sekli = input.bool(true,'Indikator Short Manuel => Devam Eden / Tekli', inline="rc")

longCondition_most_indikator = (indikator_long_sekli == true and not(trend_yonu_oto == true)) or (trend_yonu_oto == true and direction_anatrend == 1) ? direction_indikator_long == 1 and not(low <= MOST_indikator_long): cro_indikator_long and not(low <= MOST_indikator_long)//ta.crossover(averprice, trendprice) //and (averprice[1] < trendprice[1]) //and ( close[1] < averprice[1])

shortCondition_most_indikator = (indikator_short_sekli == true and not(trend_yonu_oto == true)) or (trend_yonu_oto == true and direction_anatrend == -1) ? direction_indikator_short == -1 and not(high >= MOST_indikator_short): cru_indikator_short and not(high >= MOST_indikator_short)//ta.crossunder(averprice , trendprice_short) //and (averprice[1] > trendprice_short[1]) //and ( close[1] > averprice[1])

//////////////////////////////

////////////////////////////

//longCondition_most_indikator = cro_indikator_long//(indikator_long_sekli == true and not(trend_yonu_oto == true)) or (trend_yonu_oto == true and direction_anatrend == 1) ? direction_indikator_long == 1 : cro_indikator_long//ta.crossover(averprice, trendprice) //and (averprice[1] < trendprice[1]) //and ( close[1] < averprice[1])

//shortCondition_most_indikator = cru_indikator_short// or (direction_indikator_short == -1 and ta.crossunder(open,MOST_indikator_short))//(indikator_short_sekli == true and not(trend_yonu_oto == true)) or (trend_yonu_oto == true and direction_anatrend == -1) ? direction_indikator_short == -1 : cru_indikator_short//ta.crossunder(averprice , trendprice_short) //and (averprice[1] > trendprice_short[1]) //and ( close[1] > averprice[1])

//////////////////////////////

//////////////////////////////

tahmin_uzunlugu_1 = 20//input.int(5,title =' 1=' , minval=1,inline='tu')

tahmin_uzunlugu_2 = 40//input.int(8,title =' 2=' , minval=1,inline='tu')

tahmin_uzunlugu_3 = 96//input.int(20,title =' 3=' , minval=1,inline='tu')

//tahmin_kaynak_secimi = ' close '// input.string(' close ',title="TOlası Tepe/Dip Fiyat Kaynak", options=[' close ', ' Zlema '])

tahmin_kaynak_fiyat = close_fiyat// tahmin_kaynak_secimi == ' close ' ? close : Zlema_Func(close,8)

fonk_tepe_dip_tahmin(string gozuksunmu,float tahmin_kaynak_fiyat,string tepe_dip,int tahmin_uzunluk,int gosterge_yeri) =>

sitil_shape = tepe_dip == "tepe" ? shape.triangledown : tepe_dip == "dip" ? shape.triangleup : na

sitil_label = tepe_dip == "tepe" ? label.style_triangledown : tepe_dip == "dip" ? label.style_triangleup : na

//philo = input.string("Lows", "Highs or Lows?", options=["Highs", "Lows"])

linecolor = color.gray//input.color(color.new(color.gray,0), "Label/Line Color")

ptransp = 33//input.int(33, "Radar Transparency", minval=0, maxval=100)

ltransp = 100//input.int(100, "Line Transparency", minval=0, maxval=100)

n = bar_index

// Input/2 (Default 5) Length Pivot Cycle

hcol = tepe_dip == "tepe" ?color.purple : color.green//input.color(color.purple, "Half Cycle Color", inline="hc")

cych = tahmin_uzunluk//input.int(5, "Length", inline="hc")

labh = true//input.bool(true, "Label?", inline="hc")

labhf = true//input.bool(true, "Forecast?", inline="hc")

plh = tepe_dip == "tepe" ? ta.pivothigh(tahmin_kaynak_fiyat,cych, cych) : ta.pivotlow(tahmin_kaynak_fiyat,cych, cych) // Define a PL or PH based on L/H Switch in settings

plhy = tepe_dip == "tepe" ? gosterge_yeri : -(math.abs(gosterge_yeri)) // Position the pivot on the Y axis of the oscillator

plhi = ta.barssince(plh) // Bars since pivot occured?

plhp = plhi>cych // Bars since pivot occured greater than cycle length?

lowhin = tepe_dip == "tepe" ? ta.highest(tahmin_kaynak_fiyat, cych*2) : ta.lowest(tahmin_kaynak_fiyat, cych*2) // Highest/Lowest for the cycle

lowh = ta.barssince(plh)>cych ? lowhin : na // If the barssince pivot are greater than cycle length, show the uncomnfirmed "pivot tracker"

//plot(plhy, "Half Cycle Radar Line", color=plhp?hcol:color.new(linecolor,ltransp), offset=(cych*-1), display=display.none) // Cycle detection lines v1

//plotshape(plh ? plhy : na, "Half Cycle Confirmed", style=sitil_shape, location=location.absolute, color=hcol, size = size.tiny, offset=(cych*-1)) // Past Pivots

//plotshape(lowh ? plhy : na, "Half Cycle Radar", style=shape.circle, location=location.absolute, color=color.new(hcol, ptransp), size = size.tiny, offset=(cych*-1), show_last=1, display=display.none) // AKA the "Tracker/Radar" v1

// LuxAlgo pivot average calculation used for the forecast

barssince_ph = 0

ph_x2 = ta.valuewhen(plh, n - cych, 1) // x values for pivot

if plh

barssince_ph := (n - cych) - ph_x2 // if there is a pivot, then BarsSincePivot = (BarIndex - Cycle Length) - x values for pivot

avg_barssince_ph = ta.cum(barssince_ph) / ta.cum(math.sign(barssince_ph)) // AvgBarsSincePivot = Sum of the BarsSincePivot divided by (Sum of the number of signs of BarsSincePivot, AKA the number of BarsSincePivots)

// Draw a diamond forecast label and forecast range line

tooltiph = "🔄 Pivot Cycle: " + str.tostring(cych) + " bars" +

"\n⏱ Last Pivot: " + str.tostring(plhi + cych) + " bars ago" +

"\n🧮 Average Pivot: " + str.tostring(math.round(avg_barssince_ph)) + " bars" +

"\n🔮 Next Pivot: " + str.tostring(math.round(avg_barssince_ph)-(plhi + cych)) + " bars" +

"\n📏 Range: +/- " + str.tostring(math.round(avg_barssince_ph/2)) + " bars"

var label fh = na

var line lh = na

if labhf and gozuksunmu == "gozuksun"

fh := label.new(n + math.min((math.round(avg_barssince_ph) - (plhi+cych)), 500), y=plhy, size=size.tiny, style=sitil_label, color=color.new(hcol,ptransp),tooltip =tooltiph)

label.delete(fh[1])

lh := line.new(x1=n + math.min(math.round((avg_barssince_ph - (plhi+cych))-(avg_barssince_ph/2)), 500), x2=n + math.min(math.round((avg_barssince_ph - (plhi+cych))+(avg_barssince_ph/2)), 500), y1=plhy, y2=plhy, color=color.new(hcol,ptransp))

line.delete(lh[1])

var label ch = na // Create a label

if labh and gozuksunmu == "gozuksun"// Define the label

ch := label.new(bar_index, y=plhy, text=str.tostring(cych), size=size.small, style=label.style_label_left, color=color.new(color.white,100), textcolor=color.new(plhp?hcol:linecolor,0), tooltip=tooltiph)

label.delete(ch[1])

int sonraki_pivot = math.round(avg_barssince_ph)-(plhi + cych)

[sonraki_pivot]

[tepe_1_uzaklik] = fonk_tepe_dip_tahmin('',tahmin_kaynak_fiyat,'tepe',tahmin_uzunlugu_1,50)

[tepe_2_uzaklik] = fonk_tepe_dip_tahmin('',tahmin_kaynak_fiyat,'tepe',tahmin_uzunlugu_2,100)

[tepe_3_uzaklik] = fonk_tepe_dip_tahmin('',tahmin_kaynak_fiyat,'tepe',tahmin_uzunlugu_3,150)

[dip_1_uzaklik] = fonk_tepe_dip_tahmin('',tahmin_kaynak_fiyat,'dip',tahmin_uzunlugu_1,50)

[dip_2_uzaklik] = fonk_tepe_dip_tahmin('',tahmin_kaynak_fiyat,'dip',tahmin_uzunlugu_2,100)

[dip_3_uzaklik] = fonk_tepe_dip_tahmin('',tahmin_kaynak_fiyat,'dip',tahmin_uzunlugu_3,150)

gelecek_tepe_adet = 0

gelecek_tepe_adet := tepe_1_uzaklik > 0 ? gelecek_tepe_adet + 1 : gelecek_tepe_adet

gelecek_tepe_adet := tepe_2_uzaklik > 0 ? gelecek_tepe_adet + 1 : gelecek_tepe_adet

gelecek_tepe_adet := tepe_3_uzaklik > 0 ? gelecek_tepe_adet + 1 : gelecek_tepe_adet

gelecek_tepe_uzaklik_toplami = 0

gelecek_tepe_uzaklik_toplami := tepe_1_uzaklik > 0 ? gelecek_tepe_uzaklik_toplami + tepe_1_uzaklik : gelecek_tepe_uzaklik_toplami

gelecek_tepe_uzaklik_toplami := tepe_2_uzaklik > 0 ? gelecek_tepe_uzaklik_toplami + tepe_2_uzaklik : gelecek_tepe_uzaklik_toplami

gelecek_tepe_uzaklik_toplami := tepe_3_uzaklik > 0 ? gelecek_tepe_uzaklik_toplami + tepe_3_uzaklik : gelecek_tepe_uzaklik_toplami

//tepe_xo_text_sayac = str.tostring(gelecek_tepe_adet)//"1. kosul sayısı : " + str.tostring(kss7) + "\n\2. Kosul Sayisi : " + str.tostring(kss14) + "\n\3. Kosul sayisi : " + str.tostring(kss21) + "\n\En yuksek Dongu sayısına sahip kosul -kontrol amacli- : " +str.tostring(istedigim_rsi) + "\n\En yuksek Dongu sayısına sahip kosul degeri -kontrol amacli- : " +str.tostring(istedigim_rsi_deger)

//tepe_l_sayac = label.new(x = bar_index-10, y = high, style = label.style_label_left, text = tepe_xo_text_sayac,color=color.green,textcolor = color.white)

//label.delete(tepe_l_sayac[1])

//tepe_u_xo_text_sayac = str.tostring(gelecek_tepe_uzaklik_toplami)//"1. kosul sayısı : " + str.tostring(kss7) + "\n\2. Kosul Sayisi : " + str.tostring(kss14) + "\n\3. Kosul sayisi : " + str.tostring(kss21) + "\n\En yuksek Dongu sayısına sahip kosul -kontrol amacli- : " +str.tostring(istedigim_rsi) + "\n\En yuksek Dongu sayısına sahip kosul degeri -kontrol amacli- : " +str.tostring(istedigim_rsi_deger)

//tepe_u_l_sayac = label.new(x = bar_index, y = low, style = label.style_label_left, text = tepe_u_xo_text_sayac,color=color.red,textcolor = color.white)

//label.delete(tepe_u_l_sayac[1])

gelecek_dip_adet = 0

gelecek_dip_adet := dip_1_uzaklik > 0 ? gelecek_dip_adet + 1 : gelecek_dip_adet

gelecek_dip_adet := dip_2_uzaklik > 0 ? gelecek_dip_adet + 1 : gelecek_dip_adet

gelecek_dip_adet := dip_3_uzaklik > 0 ? gelecek_dip_adet + 1 : gelecek_dip_adet

gelecek_dip_uzaklik_toplami = 0

gelecek_dip_uzaklik_toplami := dip_1_uzaklik > 0 ? gelecek_dip_uzaklik_toplami + dip_1_uzaklik : gelecek_dip_uzaklik_toplami

gelecek_dip_uzaklik_toplami := dip_2_uzaklik > 0 ? gelecek_dip_uzaklik_toplami + dip_2_uzaklik : gelecek_dip_uzaklik_toplami

gelecek_dip_uzaklik_toplami := dip_3_uzaklik > 0 ? gelecek_dip_uzaklik_toplami + dip_3_uzaklik : gelecek_dip_uzaklik_toplami

//dip_xo_text_sayac = str.tostring(gelecek_dip_adet)//"1. kosul sayısı : " + str.tostring(kss7) + "\n\2. Kosul Sayisi : " + str.tostring(kss14) + "\n\3. Kosul sayisi : " + str.tostring(kss21) + "\n\En yuksek Dongu sayısına sahip kosul -kontrol amacli- : " +str.tostring(istedigim_rsi) + "\n\En yuksek Dongu sayısına sahip kosul degeri -kontrol amacli- : " +str.tostring(istedigim_rsi_deger)

//dip_l_sayac = label.new(x = bar_index-5, y = high, style = label.style_label_left, text = dip_xo_text_sayac,color=color.aqua,textcolor = color.white)

//label.delete(dip_l_sayac[1])

//dip_u_xo_text_sayac = str.tostring(gelecek_dip_uzaklik_toplami)//"1. kosul sayısı : " + str.tostring(kss7) + "\n\2. Kosul Sayisi : " + str.tostring(kss14) + "\n\3. Kosul sayisi : " + str.tostring(kss21) + "\n\En yuksek Dongu sayısına sahip kosul -kontrol amacli- : " +str.tostring(istedigim_rsi) + "\n\En yuksek Dongu sayısına sahip kosul degeri -kontrol amacli- : " +str.tostring(istedigim_rsi_deger)

//dip_u_l_sayac = label.new(x = bar_index+5, y = low, style = label.style_label_left, text = dip_u_xo_text_sayac,color=color.gray,textcolor = color.white)

//label.delete(dip_u_l_sayac[1])

olasi_long_ihtimali = ((gelecek_tepe_adet > 0) and (gelecek_tepe_uzaklik_toplami > 0)) and ((gelecek_tepe_adet > gelecek_dip_adet) and (gelecek_tepe_uzaklik_toplami > gelecek_dip_uzaklik_toplami)) ? true : false

olasi_short_ihtimali = ((gelecek_dip_adet > 0) and (gelecek_dip_uzaklik_toplami > 0)) and ((gelecek_tepe_adet < gelecek_dip_adet) and (gelecek_tepe_uzaklik_toplami < gelecek_dip_uzaklik_toplami)) ? true : false

gelecek_long_tahmini_aktif = input.bool(false,'gelecek long tahmini aktif')

gelecek_short_tahmini_aktif = input.bool(false,'gelecek short tahmini aktif')

////////////////////////////////////////

//pozisyon seçimi

//OpenDirection = input.string(defval="BIRLIKTE", title="ISLEM SECIMI", options=["BIRLIKTE", "LONG", "SHORT"])

open_all = OpenDirection == "BIRLIKTE"

open_all_longs = OpenDirection != "SHORT"

open_all_shorts = OpenDirection != "LONG"

longaktif = bool(na)

shortaktif = bool(na)

longaktif := open_all ? true : open_all_longs ? true : open_all_shorts ? false : na

shortaktif := open_all ? true : open_all_longs ? false : open_all_shorts ? true : na

//Long-Short entry conditions....

/////////////////////////////////////////////////////////////////

////////////____backtest__zaman__baslangic__//////////////////

group_backtest = "Backtest Tarih Aralığı"

stday = input.int(defval=4, title='start Day', minval=1, maxval=31,group = group_backtest)

stmon = input.int(defval=1, title='start Month', minval=1, maxval=12,group = group_backtest)

styear = input.int(defval=2024, title='start Year', minval=2000,group = group_backtest)

fnday = input.int(defval=1, title='Finish Day', minval=1, maxval=31,group = group_backtest)

fnmon = input.int(defval=1, title='finish Month', minval=1, maxval=12,group = group_backtest)

fnyear = input.int(defval=2030, title='finish Year', minval=2000,group = group_backtest)

starttime = timestamp(styear, stmon, stday, 00, 00)

finishtime = timestamp(fnyear, fnmon, fnday, 23, 59)

backtest() =>

time >= starttime and time <= finishtime ? true : false

////////////____backtest__zaman__bitti__///////////////////

indikator_long = longCondition_most_indikator

if vwap_gosterge_filtre_long_most

indikator_long := (vwap_long_most) and indikator_long

if gelecek_long_tahmini_aktif

indikator_long := (olasi_long_ihtimali == true) and indikator_long

indikator_short = shortCondition_most_indikator

if vwap_gosterge_filtre_short_most

indikator_short := (vwap_short_most) and indikator_short

if gelecek_short_tahmini_aktif

indikator_short := (olasi_short_ihtimali == true) and indikator_short

long_giris_baslangic = indikator_long and longaktif == true and (trade_yap_zaman_long ==true) and not(strategy.position_size > 0) //(strategy.position_size == 0) //and

short_giris_baslangic = indikator_short and shortaktif == true and (trade_yap_zaman_short ==true) and not(strategy.position_size < 0) //and //(strategy.position_size == 0)

long_pozisyon_giris = long_giris_baslangic[1]

short_pozisyon_giris = short_giris_baslangic[1]

var float long_pozisyon_giris_fiyati = 0.

var float short_pozisyon_giris_fiyati = 0.

long_pozisyon_giris_fiyati := ta.valuewhen(long_pozisyon_giris and not(str.contains(strategy.opentrades.entry_id(0), "L1") or str.contains(strategy.opentrades.entry_id(0), "L2") or str.contains(strategy.opentrades.entry_id(0), "L3") or str.contains(strategy.opentrades.entry_id(0), "S1") or str.contains(strategy.opentrades.entry_id(0), "S2") or str.contains(strategy.opentrades.entry_id(0), "S3")),close_fiyat,0)

short_pozisyon_giris_fiyati := ta.valuewhen(short_pozisyon_giris and not(str.contains(strategy.opentrades.entry_id(0), "L1") or str.contains(strategy.opentrades.entry_id(0), "L2") or str.contains(strategy.opentrades.entry_id(0), "L3") or str.contains(strategy.opentrades.entry_id(0), "S1") or str.contains(strategy.opentrades.entry_id(0), "S2") or str.contains(strategy.opentrades.entry_id(0), "S3")),close_fiyat,0)

var float sabit_tp_long_fiyat = 0.

var float sabit_tp_short_fiyat = 0.

sabit_tp_long_fiyat := long_pozisyon_giris_fiyati * (1 + sabit_tp_yl)

sabit_tp_short_fiyat := short_pozisyon_giris_fiyati * (1 - sabit_tp_ys)

var float sabit_loss_long_fiyat = 0.

var float sabit_loss_short_fiyat = 0.

sabit_loss_long_fiyat := long_pozisyon_giris_fiyati * (1 - sabit_loss_yl)

sabit_loss_short_fiyat := short_pozisyon_giris_fiyati * (1 + sabit_loss_ys)

////////////////////////////////////////

//Takip stop kodu (TRAILING STOP CODE)

traillongStopPrice = 0., trailshortStopPrice = 0.

traillongStopPrice := if (strategy.position_size > 0)

long_stopValue = low_fiyat * (1 - sabit_loss_yl )

math.max(long_stopValue , traillongStopPrice[1])

else

0

trailshortStopPrice := if (strategy.position_size < 0)

short_stopValue = high_fiyat * (1 + sabit_loss_ys)

math.min(short_stopValue, trailshortStopPrice[1])

else

999999

//Takip stop kodu BITTI (TRAILING STOP CODE)

stop_loss_long_fiyat = stop_loss_secimi_long ? sabit_loss_long_fiyat : traillongStopPrice

stop_loss_short_fiyat = stop_loss_secimi_short ? sabit_loss_short_fiyat : trailshortStopPrice

var float Long_2_giris_fiyati = 0.

Long_2_giris_fiyati := stop_loss_long_fiyat * (1 + ikinci_giris_long)//strategy.position_size > 0 and (str.contains(strategy.opentrades.entry_id(0), "L1")) ? strategy.opentrades.entry_price(strategy.opentrades - 1) * (1 - ikinci_giris_long) : na//sonra bir değişken olarak bakabiliriz.

//var float Long_3_giris_fiyati = 0.

//Long_3_giris_fiyati := most_long_oldugunda_fiyat * (1 - 0.015)

var float Short_2_giris_fiyati = 0.

Short_2_giris_fiyati := stop_loss_short_fiyat * (1 - ikinci_giris_short)//strategy.position_size < 0 and (str.contains(strategy.opentrades.entry_id(0), "S1")) ? strategy.opentrades.entry_price(strategy.opentrades - 1) * (1 + ikinci_giris_short) : na // * (1 + ikinci_girisler)

//var float Short_3_giris_fiyati = 0.

//Short_3_giris_fiyati := most_short_oldugunda_fiyat * (1 + 0.015)

/////___qty__miktari_____/////

//Amount_1 = input.float(51, "Amount İlk Pozisyon", minval = 0.01, inline = "31")//, group = ALERTGRP_CRED) //pozisyon_1_yuzde

//Amount_2 = input.float(49, "Amount 2. Giris", minval = 0.01, inline = "31")//, group = ALERTGRP_CRED) //pozisyon_2_yuzde

//RoundToTick( _price) => math.round(_price/syminfo.mintick)*syminfo.mintick

Amount_1_long = (indikator_long_sekli == true and not(trend_yonu_oto == true)) or (trend_yonu_oto == true and direction_anatrend == 1) ? Amount_1a / 2 : Amount_1a

Amount_1_short = (indikator_short_sekli == true and not(trend_yonu_oto == true)) or (trend_yonu_oto == true and direction_anatrend == -1) ? Amount_1a / 2 : Amount_1a

kontrakt_buyuklugu_long_1 = (indikator_long_sekli == true and not(trend_yonu_oto == true)) or (trend_yonu_oto == true and direction_anatrend == 1) ? (((okx_bot_butcesi*(Amount_1a/100)) * okx_bot_kaldirac) / RoundToTick(long_pozisyon_giris_fiyati)) / 2 : ((okx_bot_butcesi*(Amount_1a/100)) * okx_bot_kaldirac) / RoundToTick(long_pozisyon_giris_fiyati)

//math.round(((okx_bot_butcesi*(Amount_1/100)) * okx_bot_kaldirac) / long_pozisyon_giris_fiyati)

kontrakt_buyuklugu_short_1 = (indikator_short_sekli == true and not(trend_yonu_oto == true)) or (trend_yonu_oto == true and direction_anatrend == -1) ? (((okx_bot_butcesi*(Amount_1a/100)) * okx_bot_kaldirac) / RoundToTick(short_pozisyon_giris_fiyati)) / 2 : ((okx_bot_butcesi*(Amount_1a/100)) * okx_bot_kaldirac) / RoundToTick(short_pozisyon_giris_fiyati)

//math.round(((okx_bot_butcesi*(Amount_1/100)) * okx_bot_kaldirac) / short_pozisyon_giris_fiyati)

Amount_2_long = (indikator_long_sekli == true and not(trend_yonu_oto == true)) or (trend_yonu_oto == true and direction_anatrend == 1) ? Amount_2a : Amount_2a / 2

Amount_2_short = (indikator_short_sekli == true and not(trend_yonu_oto == true)) or (trend_yonu_oto == true and direction_anatrend == -1) ? Amount_2a : Amount_2a / 2

kontrakt_buyuklugu_long_2 = (indikator_long_sekli == true and not(trend_yonu_oto == true)) or (trend_yonu_oto == true and direction_anatrend == 1) ? (((okx_bot_butcesi*(Amount_2a/100)) * okx_bot_kaldirac) / RoundToTick(long_pozisyon_giris_fiyati)) : (((okx_bot_butcesi*(Amount_2a/100)) * okx_bot_kaldirac) / RoundToTick(long_pozisyon_giris_fiyati)) / 2

//math.round(((okx_bot_butcesi*(Amount_2/100)) * okx_bot_kaldirac) / long_pozisyon_giris_fiyati)

kontrakt_buyuklugu_short_2 = (indikator_short_sekli == true and not(trend_yonu_oto == true)) or (trend_yonu_oto == true and direction_anatrend == -1) ? (((okx_bot_butcesi*(Amount_2a/100)) * okx_bot_kaldirac) / RoundToTick(short_pozisyon_giris_fiyati)) : (((okx_bot_butcesi*(Amount_2a/100)) * okx_bot_kaldirac) / RoundToTick(short_pozisyon_giris_fiyati)) / 2

//math.round(((okx_bot_butcesi*(Amount_2/100)) * okx_bot_kaldirac) / short_pozisyon_giris_fiyati)

////////////_____okx_borsa_ayar__///////////////////

var ALERTGRP_CRED = "OKX Perpetual-Futures Ayar"

signalToken = "C3sPzbAmZnMpCDnePJziYTF1QNh/Q/VCHcdHIkPc4LU/0HrMGIv1In3dk3O9yLrbDMjqMHkZClQxSZqIUJpdgg=="//input("", "Signal Token", inline = "11", group = ALERTGRP_CRED)

OrderType = "market"//input.string("market", "Order Type", options = ["market", "limit"], inline = "21", group = ALERTGRP_CRED)

OrderPriceOffset = 0//input.float(0, "Order Price Offset", minval = 0, maxval = 100, step = 0.01, inline = "21", group = ALERTGRP_CRED)

InvestmentType = "percentage_investment"//input.string("margin", "Investment Type", options = ["margin", "contract", "percentage_balance", "percentage_investment"], inline = "31", group = ALERTGRP_CRED)

//Amount_1 = input.float(51, "Amount İlk Pozisyon", minval = 0.01, inline = "31", group = ALERTGRP_CRED) //pozisyon_1_yuzde

//Amount_2 = input.float(49, "Amount 2. Giris", minval = 0.01, inline = "31", group = ALERTGRP_CRED) //pozisyon_2_yuzde

getOrderAlertMsgEntry(action, instrument, signalToken, orderType, orderPriceOffset, investmentType, amount) =>

str = '{'

str := str + '"action": "' + action + '", '

str := str + '"instrument": "' + instrument + '", '

str := str + '"signalToken": "' + signalToken + '", '

//str := str + '"timestamp": "' + str.format_time(timenow, "yyyy-MM-dd'T'HH:mm:ssZ", "UTC+0") + '", '

str := str + '"timestamp": "' + '{{timenow}}' + '", '

str := str + '"orderType": "' + orderType + '", '

str := str + '"orderPriceOffset": "' + str.tostring(orderPriceOffset) + '", '

str := str + '"investmentType": "' + investmentType + '", '

str := str + '"amount": "' + str.tostring(amount) + '"'

str := str + '}'

str

getOrderAlertMsgExit(action, instrument, signalToken) =>

str = '{'

str := str + '"action": "' + action + '", '

str := str + '"instrument": "' + instrument + '", '

str := str + '"signalToken": "' + signalToken + '", '

str := str + '"timestamp": "' + '{{timenow}}' + '", '

str := str + '}'

str

buyAlertMsgExit = getOrderAlertMsgExit(action = 'EXIT_LONG', instrument = syminfo.ticker, signalToken = signalToken)

buyAlertMsgEntry_1 = getOrderAlertMsgEntry(action = 'ENTER_LONG', instrument = syminfo.ticker, signalToken = signalToken, orderType = OrderType, orderPriceOffset = OrderPriceOffset, investmentType = InvestmentType, amount = Amount_1_long)

buyAlertMsgEntry_2 = getOrderAlertMsgEntry(action = 'ENTER_LONG', instrument = syminfo.ticker, signalToken = signalToken, orderType = OrderType, orderPriceOffset = OrderPriceOffset, investmentType = InvestmentType, amount = Amount_2_long)

sellAlertMsgExit = getOrderAlertMsgExit(action = 'EXIT_SHORT', instrument = syminfo.ticker, signalToken = signalToken)

sellAlertMsgEntry_1 = getOrderAlertMsgEntry(action = 'ENTER_SHORT', instrument = syminfo.ticker, signalToken = signalToken, orderType = OrderType, orderPriceOffset = OrderPriceOffset, investmentType = InvestmentType, amount = Amount_1_short)

sellAlertMsgEntry_2 = getOrderAlertMsgEntry(action = 'ENTER_SHORT', instrument = syminfo.ticker, signalToken = signalToken, orderType = OrderType, orderPriceOffset = OrderPriceOffset, investmentType = InvestmentType, amount = Amount_2_short)

////////////_____okx_borsa_ayar_bitti_____///////////////////

if backtest()

////________________________pozisyon__________girislersi______________________///////

if long_giris_baslangic and str.contains(strategy.opentrades.entry_id(0), "S1") or str.contains(strategy.opentrades.entry_id(0), "S2") //and (zarar_sonrasi_yeni_gun == true)

strategy.close('S1',comment = "L-B S-Ex_O",immediately = true,alert_message = sellAlertMsgExit)

strategy.close('S2',comment = "L-B S-Ex_O",immediately = true)//alarm mesaji tek yeter mi? canlı test

if (long_pozisyon_giris)

strategy.entry('L1', strategy.long,comment='Gir Long_1',alert_message =buyAlertMsgEntry_1,qty=kontrakt_buyuklugu_long_1)//,comment = '{"symbol":"{{ticker}}","side":"{{strategy.order.action}}","qty":"{{strategy.order.contracts}}","price":"{{close}}","signalId":"f4e95251-7896-4f","uid":"6e6d9668de5c60acecd733524ff66c5edac3c1fe65933ef0abf358b369a2f666"}')

if short_giris_baslangic and str.contains(strategy.opentrades.entry_id(0), "L1") or str.contains(strategy.opentrades.entry_id(0), "L2") //and (zarar_sonrasi_yeni_gun == true)

strategy.close('L1',comment = "S-B L-Ex_O",immediately = true,alert_message = buyAlertMsgExit)

strategy.close('L2',comment = "S-B L-Ex_O",immediately = true)//alarm mesaji tek yeter mi? canlı test

if (short_pozisyon_giris) //and (zarar_sonrasi_yeni_gun == true)

strategy.entry('S1', strategy.short,comment='Gir Short_1',alert_message =sellAlertMsgEntry_1,qty=kontrakt_buyuklugu_short_1)//qty=kontrakt_buyuklugu_short)//,comment = '{"symbol":"{{ticker}}","side":"{{strategy.order.action}}","qty":"{{strategy.order.contracts}}","price":"{{close}}","signalId":"f4e95251-7896-4f","uid":"6e6d9668de5c60acecd733524ff66c5edac3c1fe65933ef0abf358b369a2f666"}')

////________________________pozisyon____cikislari______________________//////////

if (strategy.position_size > 0) and str.contains(strategy.opentrades.entry_id(0), "L1") and ta.crossunder(low_fiyat, Long_2_giris_fiyati) //and not(ta.crossunder(low, Long_3_giris_fiyati)) and not( ta.crossunder(low, Long_4_giris_fiyati))

strategy.entry('L2', strategy.long,comment='Gir Long_2',alert_message =buyAlertMsgEntry_2,qty=kontrakt_buyuklugu_long_2)

if (strategy.position_size > 0) and (short_giris_baslangic)

strategy.close('L1',comment = "S-B L-Ex_O",immediately = true,alert_message = buyAlertMsgExit)

strategy.close('L2',comment = "S-B L-Ex_O",immediately = true)

if (strategy.position_size > 0) and not(short_giris_baslangic)//and (low <= traillongStopPrice) or (high >= sabit_tp_long_fiyat) or (pozisyon_short)

strategy.exit('xL1', from_entry = 'L1',comment='EXIT Long_1-Li/St',alert_message = buyAlertMsgExit, limit = sabit_tp_long_fiyat, stop = stop_loss_long_fiyat)//,qty=21)

strategy.exit('xL2', from_entry = 'L2',comment='EXIT Long_2-Li/St',alert_message = buyAlertMsgExit, limit = sabit_tp_long_fiyat, stop = stop_loss_long_fiyat)//,qty=22)

//strategy.exit('xL3', from_entry = 'L3',comment='EXIT Long_3-Li/St',alert_message = buyAlertMsgExit, limit = sabit_tp_long_fiyat, stop = traillongStopPrice)//,qty=22)

if (strategy.position_size < 0) and str.contains(strategy.opentrades.entry_id(0), "S1") and ta.crossover(high_fiyat, Short_2_giris_fiyati) //and not(ta.crossunder(low, Long_3_giris_fiyati)) and not( ta.crossunder(low, Long_4_giris_fiyati))

strategy.entry('S2', strategy.short,comment='Gir Short_2',alert_message =sellAlertMsgEntry_2,qty=kontrakt_buyuklugu_short_2)

if (strategy.position_size < 0) and (long_giris_baslangic)

strategy.close('S1',comment = "L-B S-Ex_O",immediately = true,alert_message = sellAlertMsgExit)

strategy.close('S2',comment = "L-B S-Ex_O",immediately = true)

if (strategy.position_size < 0) and not(long_giris_baslangic)//and (low <= traillongStopPrice) or (high >= sabit_tp_long_fiyat) or (pozisyon_short)

strategy.exit('xS1', from_entry = 'S1',comment='EXIT Short_1-Li/St',alert_message = sellAlertMsgExit, limit = sabit_tp_short_fiyat, stop = stop_loss_short_fiyat)//,qty=21)

strategy.exit('xS2', from_entry = 'S2',comment='EXIT Short_2-Li/St',alert_message = sellAlertMsgExit, limit = sabit_tp_short_fiyat, stop = stop_loss_short_fiyat)//,qty=22)

//strategy.exit('xS3', from_entry = 'S3',comment='EXIT Short_3-Li/St',alert_message = sellAlertMsgExit, limit = sabit_tp_short_fiyat, stop = trailshortStopPrice)//,qty=22)

sabit_tp_long_plot = plot((strategy.position_size > 0) ? sabit_tp_long_fiyat : na, color=color.lime, style=plot.style_linebr, title="S-KA ½ Long")

takipli_stop_long_plot = plot( (strategy.position_size > 0) ? stop_loss_long_fiyat : na, color=color.red, style=plot.style_linebr, title="T-SL ½ Long")

sabit_tp_short_plot = plot((strategy.position_size < 0) ? sabit_tp_short_fiyat : na, color=color.lime, style=plot.style_linebr, title="S-KA ½ Short")

takipli_stop_short_plot = plot( (strategy.position_size < 0) ? stop_loss_short_fiyat : na, color=color.red, style=plot.style_linebr, title="T-SL ½ Short")

//

관련

- EMA/SMA 다중 지표 포괄적 동향 전략

- CCI+RSI+KC 트렌드 필터 양방향 거래 전략

- RSI 필터와 알림을 가진 SMA 크로스오버 전략

- RSI2 전략 내일 반전 승률 역시험

- 볼링거 밴드 RSI 시장 중립 양적 거래 전략

- 내일 구매/판매

- 상대 강도 지수 평균 역전 전략

- CCI 동력 격차 트렌드 거래 전략

- 동적 스톱 로스 및 취득 이중 이동 평균 트렌드 촛불 반응과 전략에 따라

- 3차 상대적 강도 지수 양적 거래 전략

더 많은

- 다중 요인 융합 전략

- 볼링거 밴드 + RSI + 멀티 MA 트렌드 전략

- QQE와 RSI를 기반으로 한 장기 단기 신호 전략

- 제로 라그 MACD 듀얼 크로스오버 거래 전략 - 단기 트렌드 캡처에 기반한 고주파 거래

- 평균 실제 범위 후속 정지 전략을 따르는 경향

- P&L 예측과 함께 SMC & EMA 전략

- 나다라야-워튼 앙벨로프 다중 확인 동적 스톱 로스 전략

- 동적 취득 볼링거 밴드 전략

- CCI + MA 크로스오버 풀백 구매 전략

- 유동성 높은 통화 쌍을 위한 단기 단기 판매 전략

- 볼링거 밴드 RSI 거래 전략

- 실시간 가격 전략으로 구매 및 판매 부피 열 지도

- 이중 이동 평균 회귀 거래 전략

- 다중 지표 양적 거래 전략 - 슈퍼 지표 7대1 전략

- SMK ULTRA TREND 이중 이동 평균 크로스오버 전략

- 5배 강한 이동 평균 전략

- EMA-SMA 크로스오버 황소 시장 지원 밴드 전략

- 200 EMA 필터와 함께 전략에 따른 다중 시간 프레임 트렌드 - 길게만

- SMC 시장의 높은 낮은 브레이크업 전략

- 동적 트렌드 모멘텀 거래 전략