Strategi Pengesanan Penarikan

Penulis:ChaoZhang, Tarikh: 2023-10-17 16:36:49Tag:

Ringkasan

Strategi ini terutamanya menggunakan indikator

Logika Strategi

-

Tetapkan parameter untuk petunjuk

Donchian Channel , tempoh lalai adalah 20; -

Tetapkan purata bergerak EMA, tempoh lalai adalah 200;

-

Tetapkan nisbah risiko / ganjaran, lalai adalah 1.5;

-

Tetapkan parameter tarik balik selepas breakout untuk panjang dan pendek;

-

Mencatatkan sama ada pecah sebelumnya adalah titik tinggi atau rendah;

-

Isyarat panjang: jika penembusan sebelumnya adalah rendah, harga pecah di atas jalur atas Donchian dan di atas garis EMA;

-

Isyarat pendek: jika pecah sebelumnya adalah tinggi, harga pecah di bawah jalur bawah Donchian dan di bawah garis EMA;

-

Selepas masuk panjang, tetapkan stop loss pada band bawah Donchian tolak 5 mata, mengambil keuntungan pada nisbah risiko / ganjaran kali jarak stop loss;

-

Selepas masuk pendek, tetapkan stop loss di band atas Donchian ditambah 5 mata, ambil keuntungan pada nisbah risiko / ganjaran kali jarak stop loss.

Dengan cara ini, strategi menggabungkan trend mengikuti dan perdagangan pecah, untuk berdagang bersama dengan trend utama. Sementara itu, hentikan kerugian dan ambil keuntungan mengawal risiko / ganjaran setiap perdagangan.

Analisis Kelebihan

-

Ikuti trend utama, elakkan berdagang menentang trend.

-

Saluran Donchian sebagai penunjuk jangka panjang, digabungkan dengan penapis EMA, dapat mengenal pasti trend dengan berkesan.

-

Hentikan kerugian dan ambil keuntungan mengawal risiko setiap perdagangan, mengehadkan potensi kerugian.

-

Mengoptimumkan nisbah risiko / ganjaran boleh meningkatkan faktor keuntungan, mengejar pulangan yang berlebihan.

-

Parameter backtest yang fleksibel, boleh mengoptimumkan parameter untuk pasaran yang berbeza.

Analisis Risiko

-

Saluran Donchian dan EMA mungkin memberi isyarat yang salah kadang-kadang.

-

Perdagangan breakout boleh mudah terperangkap, perlu mengenal pasti latar belakang trend dengan jelas.

-

Stop loss tetap dan mengambil keuntungan tidak boleh diselaraskan berdasarkan turun naik pasaran.

-

Terhad ruang pengoptimuman untuk parameter, prestasi langsung tidak dijamin.

-

Sistem perdagangan yang terdedah kepada peristiwa black swan, boleh membawa kepada kerugian yang teruk.

Arahan pengoptimuman

-

Pertimbangkan untuk menambah lebih banyak penapis seperti osilator untuk meningkatkan kualiti isyarat.

-

Tetapkan stop loss adaptif dan ambil keuntungan berdasarkan turun naik pasaran dan ATR.

-

Gunakan pembelajaran mesin untuk menguji dan mengoptimumkan parameter untuk sesuai dengan pasaran sebenar.

-

Mengoptimumkan logik kemasukan dengan jumlah atau turun naik sebagai syarat untuk mengelakkan perangkap.

-

Gabungkan dengan sistem trend atau pembelajaran mesin untuk membuat model hibrid untuk ketahanan.

Kesimpulan

Strategi ini adalah strategi pelacakan, dengan logik perdagangan mengikut trend utama yang dikenal pasti, dan mengambil breakout sebagai isyarat kemasukan, sambil menetapkan stop loss dan mengambil keuntungan untuk mengawal risiko setiap perdagangan. Strategi ini mempunyai beberapa kelebihan, tetapi juga ruang untuk penambahbaikan. Secara keseluruhan, dengan penyesuaian parameter yang betul, masa kemasukan, dan peningkatan dengan teknik lain, ia boleh menjadi strategi trend berikut yang praktikal. Tetapi pelabur harus sentiasa ingat bahawa tidak ada sistem perdagangan yang dapat menghilangkan risiko pasaran sepenuhnya, dan pengurusan risiko adalah penting.

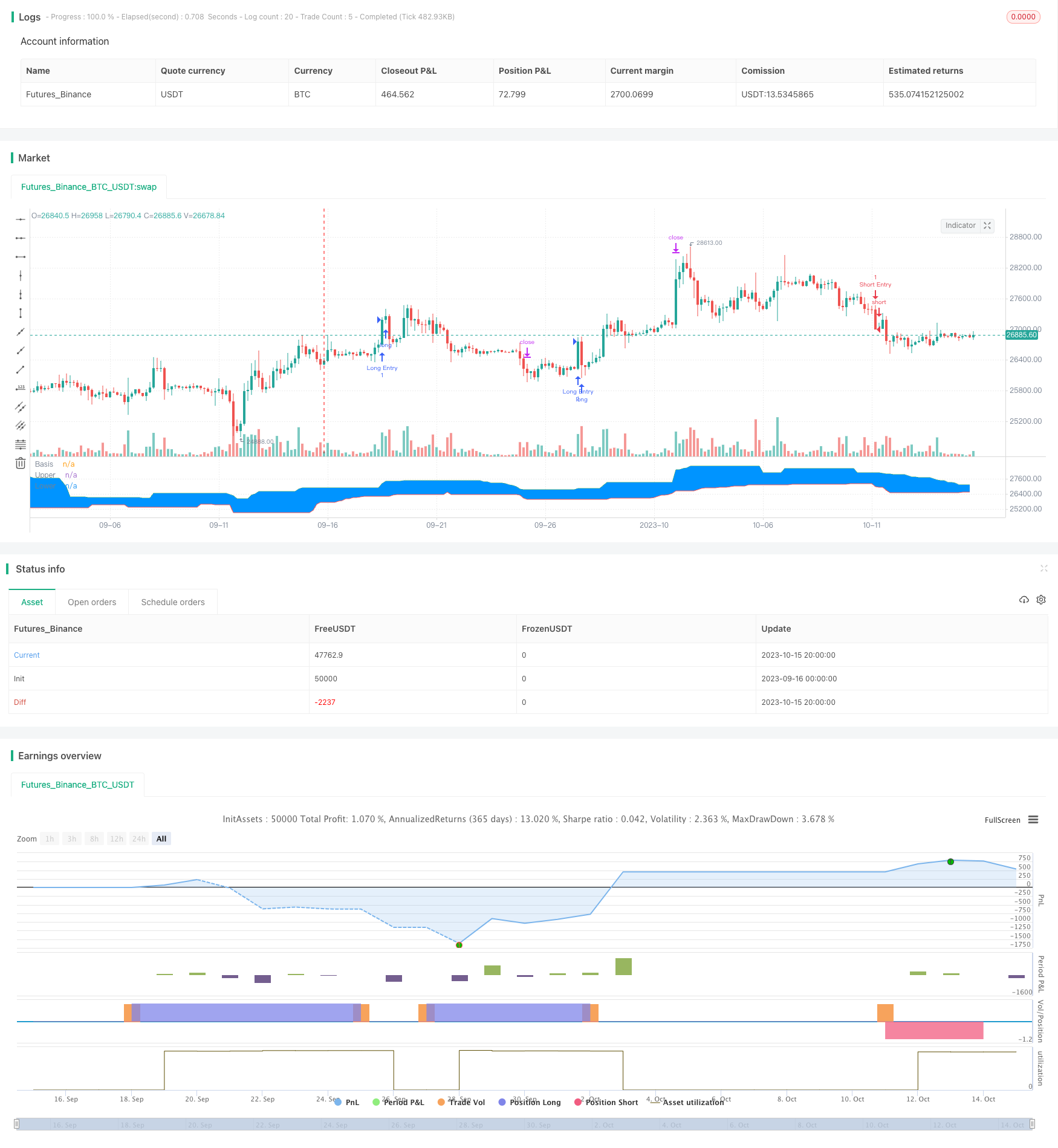

/*backtest

start: 2023-09-16 00:00:00

end: 2023-10-16 00:00:00

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

// Welcome to my second script on Tradingview with Pinescript

// First of, I'm sorry for the amount of comments on this script, this script was a challenge for me, fun one for sure, but I wanted to thoroughly go through every step before making the script public

// Glad I did so because I fixed some weird things and I ended up forgetting to add the EMA into the equation so our entry signals were a mess

// This one was a lot tougher to complete compared to my MACD crossover trend strategy but I learned a ton from it, which is always good and fun

// Also I'll explain the strategy and how I got there through some creative coding(I'm saying creative because I had to figure this stuff out by myself as I couldn't find any reference codes)

// First things first. This is a Donchian Channel Breakout strategy which follows the following rules

// If the price hits the upperband of the Donchian Channel + price is above EMA and the price previously hit the lowerband of the Donchian Channel it's a buy signal

// If the price hits the lowerband of the Donchian Channel + price is below EMA and the price prevbiously hit the upper band of the Donchian Channel it's a sell signal

// Stop losses are set at the lower or upper band with a 0.5% deviation because we are acting as if those two bands are the resistance in this case

// Last but not least(yes, this gave BY FAR the most trouble to code), the profit target is set with a 1.5 risk to reward ratio

// If you have any suggestions to make my code more efficient, I'll be happy to hear so from you

// So without further ado, let's walk through the code

// The first line is basically standard because it makes backtesting so much more easy, commission value is based on Binance futures fees when you're using BNB to pay those fees in the futures market

// strategy(title="Donchian Channels", shorttitle="DC", overlay=true, default_qty_type = strategy.cash, default_qty_value = 150, initial_capital = 1000, currency = currency.USD, commission_type = "percent", commission_value = 0.036)

// The built-in Donchian Channels + an added EMA input which I grouped with the historical bars from the Donchian Channels

length = input(20, minval=1, group = "Indicators")

lower = lowest(length)

upper = highest(length)

basis = avg(upper, lower)

emaInput = input(title = "EMA Input", type = input.integer, defval = 200, minval = 10, maxval = 400, step = 1, group = "Indicators")

// I've made three new inputs, for risk/reward ratio and for the standard pullback deviation. My advise is to not use the pullback inputs as I'm not 100% sure if they work as intended or not

riskreward = input(title = "Risk/Reward Ratio", type = input.float, defval = 1.50, minval = 0.01, maxval = 100, step = 0.01, group = "Risk/Reward")

pullbackLong = input(title = "Distance from Long pullback %", type = input.float, defval = 0.995, minval = 0.001, maxval = 2, step = 0.001, group = "Risk/Reward")

pullbackShort = input(title = "Distance from Short pullback %", type = input.float, defval = 1.005, minval = 0.001, maxval = 2, step = 0.001, group = "Risk/Reward")

// Input backtest range, you can adjust these in the input options, just standard stuff

fromMonth = input(defval = 1, title = "From Month", type = input.integer, minval = 1, maxval = 12, group = "Backtest Date Range")

fromDay = input(defval = 1, title = "From Day", type = input.integer, minval = 1, maxval = 31, group = "Backtest Date Range")

fromYear = input(defval = 2000, title = "From Year", type = input.integer, minval = 1970, group = "Backtest Date Range")

thruMonth = input(defval = 1, title = "Thru Month", type = input.integer, minval = 1, maxval = 12, group = "Backtest Date Range")

thruDay = input(defval = 1, title = "Thru Day", type = input.integer, minval = 1, maxval = 31, group = "Backtest Date Range")

thruYear = input(defval = 2099, title = "Thru Year", type = input.integer, minval = 1970, group = "Backtest Date Range")

// Date variable also standard stuff

inDataRange = (time >= timestamp(syminfo.timezone, fromYear, fromMonth, fromDay, 0, 0)) and (time < timestamp(syminfo.timezone, thruYear, thruMonth, thruDay, 0, 0))

// I had to makes these variables because the system has to remember whether the previous 'breakout' was a high or a low

// Also, because I based my stoploss on the upper/lower band of the indicator I had to find a way to change this value just once without losing the value, that was added, on the next bar

var previousishigh = false

var previousislow = false

var longprofit = 0.0

var shortprofit = 0.0

var stoplossLong = 0.0

var stoplossShort = 0.0

// These are used as our entry variables

emaCheck = ema(close, emaInput)

longcond = high >= upper and close > emaCheck

shortcond = low <= lower and close < emaCheck

// With these two if statements I'm changing the boolean variable above to true, we need this to decide out entry position

if high >= upper

previousishigh := true

if low <= lower

previousislow := true

// Made a last minute change on this part. To clean up our entry signals we don't want our breakouts, while IN a position, to change. This way we do not instantly open a new position, almost always in the opposite direction, upon exiting one

if strategy.position_size > 0 or strategy.position_size < 0

previousishigh := false

previousislow := false

// Strategy inputs

// Long - previous 'breakout' has to be a low, the current price has to be a new high and above the EMA, we're not allowed to be in a position and ofcourse it has to be within our given data for backtesting purposes

if previousislow == true and longcond and strategy.position_size == 0 and inDataRange

strategy.entry("Long Entry", strategy.long, comment = "Entry Long")

stoplossLong := lower * pullbackLong

longprofit := ((((1 - stoplossLong / close) * riskreward) + 1) * close)

strategy.exit("Long Exit", "Long Entry", limit = longprofit, stop = stoplossLong, comment = "Long Exit")

// Short - Previous 'breakout' has to be a high, current price has to be a new low and lowe than the 200EMA, we're not allowed to trade when we're in a position and it has to be within our given data for backtesting purposes

if previousishigh == true and shortcond and strategy.position_size == 0 and inDataRange

strategy.entry("Short Entry", strategy.short, comment = "Entry Short")

stoplossShort := upper * pullbackShort

shortprofit := (close - ((((1 - close / stoplossShort) * riskreward) * close)))

strategy.exit("Short Exit", "Short Entry", limit = shortprofit, stop = stoplossShort, comment = "Short Exit")

// This plots the Donchian Channels on the chart which is just using the built-in Donchian Channels

plot(basis, "Basis", color=color.blue)

u = plot(upper, "Upper", color=color.green)

l = plot(lower, "Lower", color=color.red)

fill(u, l, color=#0094FF, transp=95, title="Background")

// These plots are to show if the variables are working as intended, it's a mess I know but I didn't have any better ideas, they work well enough for me

// plot(previousislow ? close * 0.95 : na, color=color.red, linewidth=2, style=plot.style_linebr)

// plot(previousishigh ? close * 1.05 : na, color=color.green, style=plot.style_linebr)

// plot(longprofit, color=color.purple)

// plot(shortprofit, color=color.silver)

// plot(stoplossLong)

// plot(stoplossShort)

// plot(strategy.position_size)

- Strategi Sistem Garis Bollinger Band Pergerakan Purata Berganda

- Strategi Ujian Kembali Terobosan Senibina

- Strategi Pecah Berdasarkan Perdagangan Penyu

- Trend DEMA Mengikut Strategi

- Algoritma RSI Range Breakout Strategi

- RSI Rising Strategi Tren Crypto

- EMA Slope Cross Trend Mengikut Strategi

- Strategi Perdagangan RSI Intraday TAM

- Strategi Crossover Purata Bergerak Eksponen

- Strategi Crossover Purata Bergerak

- Model pemantauan purata bergerak berganda

- Strategi pembalikan purata berdasarkan ATR

- Trend Volume Relatif Berikutan Strategi Dagangan

- Strategi Pengimbangan Trend MACD

- EMA dan Strategi Dagangan Heikin Ashi

- Trend Mengikut Strategi Lama Hanya

- Strategi Gabungan corak candlestick pelbagai model

- Analisis Strategi Dagangan Pembalikan Saluran

- Strategi Dagangan Pembalikan Ringan Indikator Dua

- Strategi Surf Rider