Strategi gabungan pembalikan faktor ganda dan peningkatan trend jumlah harga

Penulis:ChaoZhang, Tarikh: 2024-01-25 14:46:36Tag:

Ringkasan

Prinsip Strategi

Strategi combo secara komprehensif mempertimbangkan isyarat kedua-dua sub-strategi. Apabila pembalikan faktor ganda dan peningkatan trend jumlah harga adalah menaik atau menurun, isyarat panjang dan pendek yang sepadan dihasilkan.

Analisis Kelebihan

- Kedua-dua strategi saling mengesahkan untuk meningkatkan kestabilan dan mengelakkan isyarat yang salah.

- Menggunakan parameter jangka sederhana 9 atau 14 hari sesuai untuk operasi intraday dan jangka pendek.

Risiko dan Pengoptimuman

- Strategi harga kuantiti boleh meningkatkan pengeluaran jika arah pasaran dinilai dengan salah.

- Ia boleh diuji sama ada berat faktor PriceFactor dan CumPVT adalah optimum untuk pengoptimuman lanjut.

Kesimpulan

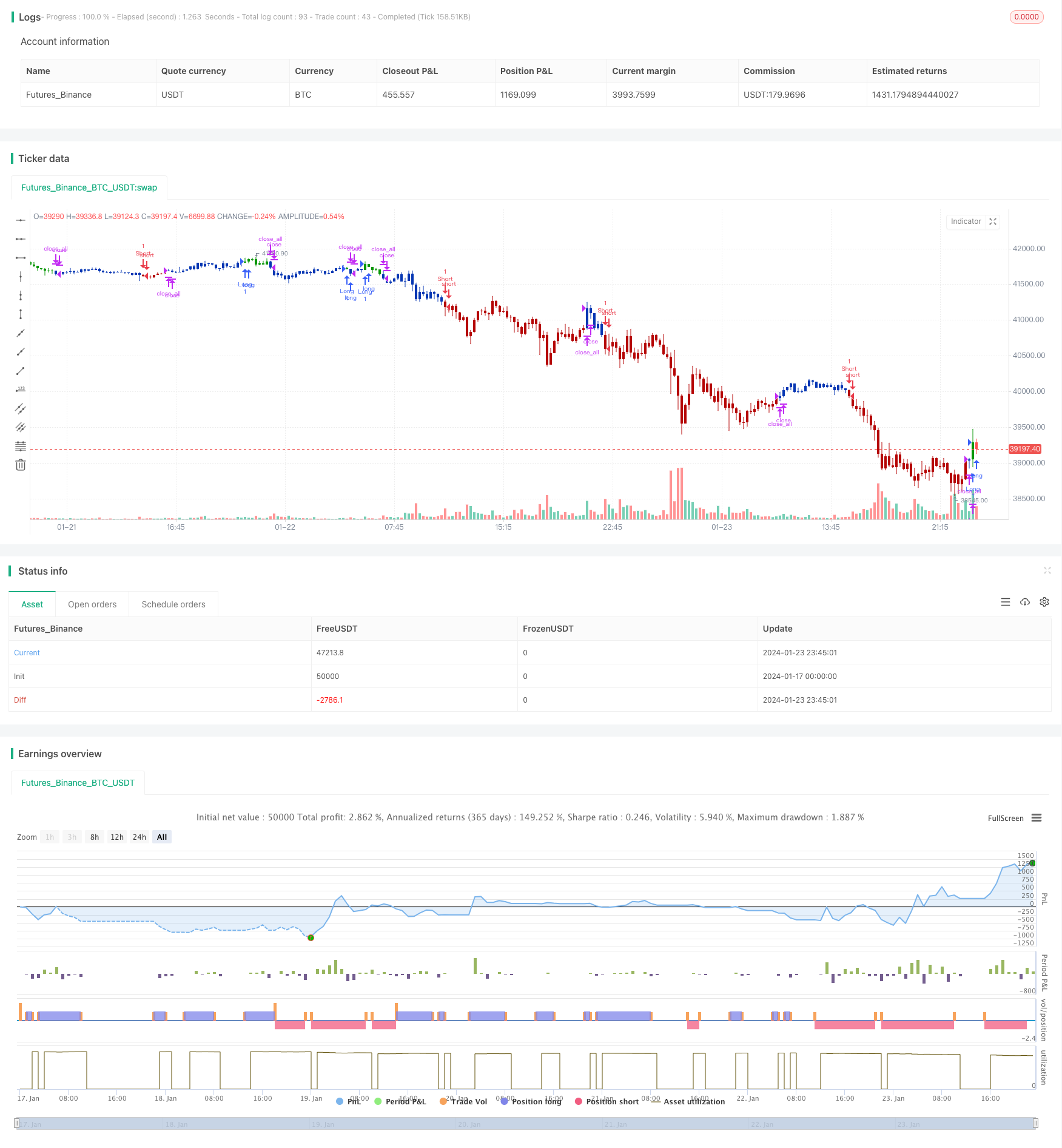

/*backtest

start: 2024-01-17 00:00:00

end: 2024-01-24 00:00:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 23/02/2021

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// The related article is copyrighted material from

// Stocks & Commodities.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

MPVT(Level,Scale,Length) =>

pos = 0.0

xCumPVT = 0.0

xOHLC4 = ohlc4

xV = volume

rV = xV / 50000

xCumPVT := nz(xCumPVT[1]) + (rV * (xOHLC4 - xOHLC4[1]) / xOHLC4[1])

nRes = Level + Scale * xCumPVT

xMARes = sma(nRes, Length)

pos:= iff(nRes > xMARes, 1,

iff(nRes < xMARes, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Modified Price-Volume Trend", shorttitle="Combo", overlay = true)

line1 = input(true, "---- 123 Reversal ----")

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

line2 = input(true, "---- Price-Volume Trend ----")

LevelPVT = input(1)

Scale = input(1)

LengthPVT = input(23)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posMPVT = MPVT(LevelPVT,Scale,LengthPVT)

pos = iff(posReversal123 == 1 and posMPVT == 1 , 1,

iff(posReversal123 == -1 and posMPVT == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1 )

strategy.entry("Long", strategy.long)

if (possig == -1 )

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )

Lebih lanjut

- Trend Mengikut Strategi Berdasarkan DMI dan RSI

- Strategi Guncangan Sokongan dan Rintangan Kuantitatif

- Strategi Mengikuti Trend dengan 3 EMA, DMI dan MACD

- Dual Indikator Strategi Terobosan

- Strategi Sistem Perdagangan Pete Wave

- Strategi Kuantitatif Berdasarkan Purata Bergerak Eksponensial dan Berat Volume

- Strategi Origix Ashi Berdasarkan Purata Bergerak Lesu

- BlackBit Trader XO Macro Trend Scanner Strategi

- Trend ADX Minyak mentah Mengikut Strategi

- Strategi Perdagangan Penyelarasan MT

- Trend Angle Moving Average Crossover Strategi

- Strategi ini membuat keputusan dagangan berdasarkan trend histogram MACD

- Osilator Momentum & Strategi corak 123

- Strategi Ujian Kembali Berdasarkan Penunjuk Transform Fisher

- Strategi Perdagangan Rata-rata Bergerak Spektrum Guncangan

- Strategi Dagangan Pembalikan Berdasarkan Julat Purata Bergerak

- Strategi Pengesanan Trend Berasaskan Penapis Kalman

- Strategi Perdagangan Antara Masa Peralihan Musim

- Strategi Dagangan Algoritma Crossover Rata-rata Bergerak Eksponensial Berganda