Strategi Dagangan MACD Multi Timeframe

Penulis:ChaoZhang, Tarikh: 2024-01-30 17:44:36Tag:

Ringkasan

Strategi ini berdasarkan kepada penunjuk MACD klasik, digabungkan dengan penunjuk penilaian trend, kaedah berhenti kerugian dan mengambil kaedah keuntungan untuk membentuk strategi perdagangan penjejakan trend yang agak lengkap.

Logik Perdagangan

-

Indikator MACD

- Perbezaan antara EMA tempoh FASTLENGTH dan EMA tempoh SLOWLENGTH membentuk histogram MACD

- MACDLENGTH tempoh EMA meluruskan histogram MACD untuk membentuk garis MACD

- Histogram MACD melintasi paksi 0 membentuk isyarat perdagangan

-

Penapis Trend

- ADX: Indeks Arah Purata, untuk menilai sama ada trend wujud

- MA: Moving Average, harga di atas dan di bawah MA membentuk trend

- SAR: SAR Parabolik, SAR bergerak di atas dan di bawah harga menunjukkan trend

-

Hentikan Kerugian

- Penghentian Trailing ATR: Tetapkan stop loss berdasarkan peratusan ATR

- SAR Stop Loss: Gunakan SAR sebagai stop loss yang menjurus

-

Ambil Manfaat

- ATR Fixed Take Profit Distance: Set fixed take profit distance berdasarkan ATR

- Peratusan mengambil keuntungan: Tetapkan peratusan mengambil keuntungan jarak

-

Keluar Berwaktu

- Boleh menetapkan keluar selepas bilangan bar tertentu

Analisis Kelebihan

-

Keputusan Bantuan Berganda

- Penghakiman trend, sokongan dan rintangan mengelakkan isyarat palsu

- Pengendalian risiko kehilangan henti ATR/SAR yang lebih baik

-

Konfigurasi Fleksibel

- Pilih sama ada untuk menggunakan penapis trend

- Pilih ATR atau SAR stop loss

- Pilih ATR atau standard mengambil keuntungan

- Parameter boleh dikonfigurasi

-

Analisis Perbezaan Disediakan

- Menampilkan perbezaan biasa/tersembunyi dalam sejarah

- Menyediakan pemberitahuan teks

-

Mudah Dioptimumkan

- Banyak parameter yang boleh dikonfigurasikan

- Mudah untuk menguji kombinasi parameter yang berbeza

Analisis Risiko

-

Parameter yang Tidak Betul Boleh Meningkatkan Kerugian

- Parameter ATR, SAR yang tidak betul boleh menyebabkan stop loss awal

- Rasio mengambil keuntungan yang berlebihan boleh mengambil keuntungan lebih awal

-

Risiko kegagalan trend

- Parameter penunjuk trend yang tidak betul boleh menyebabkan penilaian yang salah

- Peristiwa Black Swan boleh menyebabkan kegagalan trend

-

Risiko Keluar Berkala

- Risiko keluar berjangka waktu tetap kerugian

Arahan pengoptimuman

- Sesuaikan parameter ATR, SAR untuk hentian yang lebih lancar

- Uji tempoh MA yang berbeza untuk mengoptimumkan penilaian trend

- Ujian disesuaikan mengambil nisbah keuntungan untuk meningkatkan kadar keuntungan

- Memasukkan penunjuk turun naik untuk mengoptimumkan konfigurasi

Kesimpulan

Strategi ini secara komprehensif mempertimbangkan trend, stop loss, mengambil keuntungan, pengenalan pulback untuk membentuk strategi perdagangan mata wang kripto yang agak lengkap. Ia menggabungkan kelebihan penunjuk MACD, menambah penapisan trend untuk mengelakkan perdagangan palsu; menambah ATR / SAR stop loss untuk kawalan risiko yang lebih baik; pengenalan pullback memberikan rujukan tambahan. Beberapa parameter yang boleh dikonfigurasikan dapat dengan mudah diuji dan dioptimumkan. Secara keseluruhan, strategi ini boleh menjadi contoh yang baik untuk penyelidikan strategi mata wang kripto.

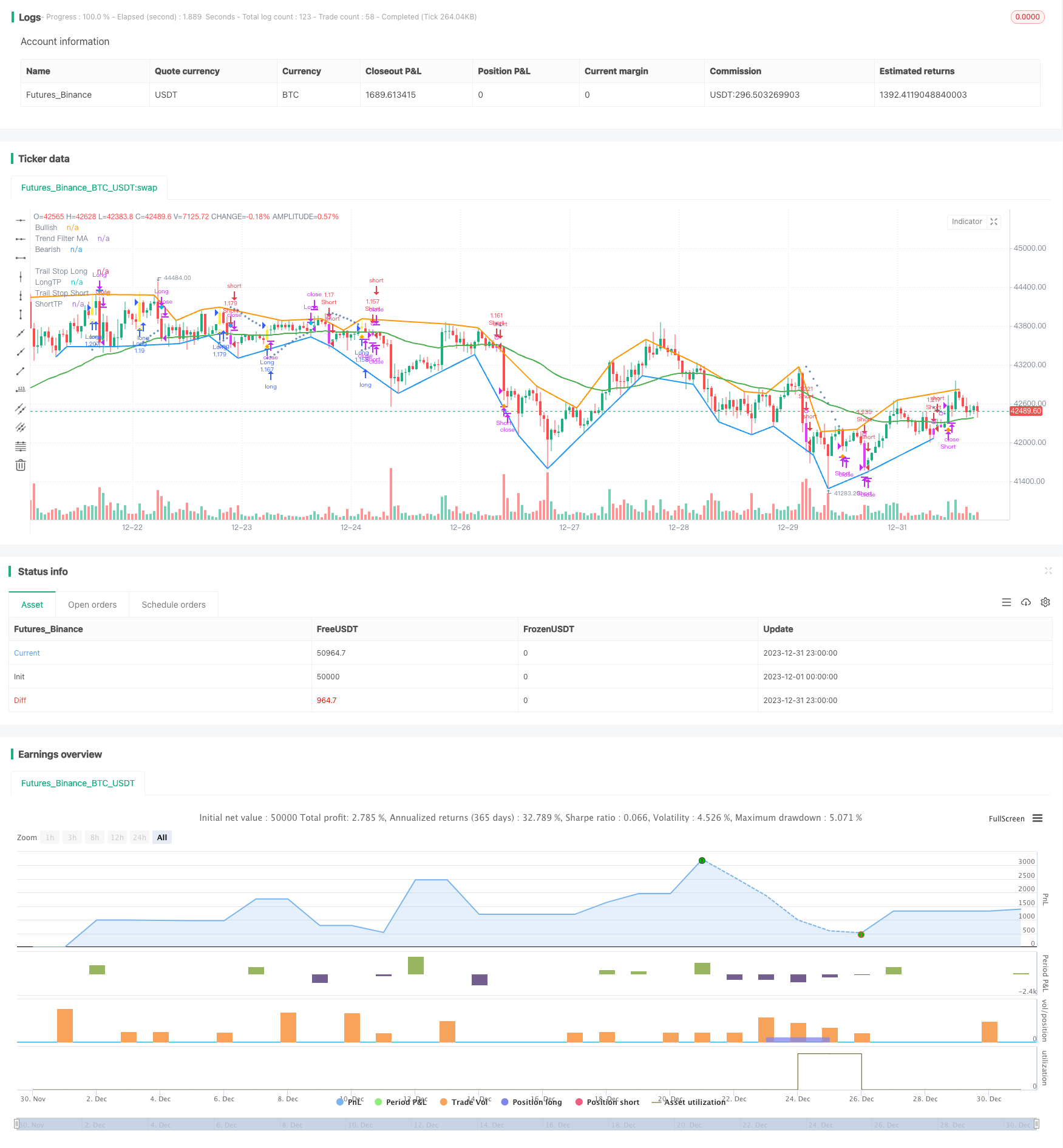

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © systemalphatrader

//@version=4

strategy(title="MACD+ Strategy [SystemAlpha]", shorttitle="MACD+ Strategy [SA]", overlay=true, initial_capital=10000, currency='USD',

default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type=strategy.commission.percent, commission_value=0.04)

// == MAIN INPUT ==

// TREND FILTER

// Make input option to configure trend filter

trendFilter = input(title="Trend Filter", defval='MA', options=['ADX', 'MA', 'SAR', 'All', 'None'])

// Translate input into trend filters

useADXFilter = (trendFilter == 'ADX') or (trendFilter == 'All')

useSARFilter = (trendFilter == 'SAR') or (trendFilter == 'All')

useMAFilter = (trendFilter == 'MA') or (trendFilter == 'All')

// TRAIL STOP

// Make input option to configure trail stop

trailStop = input(title="Trailing Stop Loss", defval='SAR', options=['ATR', 'SAR', 'None'])

// Translate input

useATRStop = (trailStop == 'ATR')

useSARStop = (trailStop == 'SAR')

// TAKE PROFIT TARGET

// Make input option to configure trail stop

TPtarget = input(title="Take Profit Type", defval='ATR', options=['ATR', 'Percent', 'None'])

// Translate input

useATRTP = (TPtarget == 'ATR')

usePercentTP = (TPtarget == 'Percent')

// ALERTS and BAR COLOR

// Make input option to configure alerts

alerts = input(title="Select Alerts to Display", defval='None', options=['Buy/Sell', 'Exit', 'Both', 'None'])

// Translate input

showsignals = (alerts == 'Buy/Sell') or (alerts == 'Both')

showexitsignals = (alerts == 'Exit') or (alerts == 'Both')

showBarColor = input(true, title="Show Bar Color")

// == /MAIN INPUT ==

/////////////////////////////////////

//*STRATEGY LOGIC *//

/////////////////////////////////////

// == MACD ==

fastLength = input(12, title="Fast Length")

slowlength = input(26, title="Slow Length")

MACDLength = input(9, title="MACD Length")

MACD = ema(close, fastLength) - ema(close, slowlength)

aMACD = ema(MACD, MACDLength)

delta = MACD - aMACD

// Calc breakouts

break_up = crossover(delta, 0)

break_down = crossunder(delta,0)

// == /MACD ==

// == DIVERGENCE ==

method = input(title="Divergence Method", defval='Hist', options=['Hist', 'MACD'])

divtype = input(title="Divergence Type", defval='None', options=['Regular', 'Hidden', 'Both', 'None'])

uReg = divtype == 'Regular' or divtype == 'Both'

uHid = divtype == 'Hidden' or divtype == 'Both'

showlabel = input(true, title="Show Divergence Label")

v_show_last = input(500, "Plotting Lookback Bars Length")

high_src = high

low_src = low

// || Functions:

f_top_fractal(_src) =>

_src[4] < _src[2] and _src[3] < _src[2] and _src[2] > _src[1] and

_src[2] > _src[0]

f_bot_fractal(_src) =>

_src[4] > _src[2] and _src[3] > _src[2] and _src[2] < _src[1] and

_src[2] < _src[0]

f_fractalize(_src) =>

f_bot_fractal__1 = f_bot_fractal(_src)

f_top_fractal(_src) ? 1 : f_bot_fractal__1 ? -1 : 0

// === End of Functions

// || Method selection

oscilator_high = float(na)

oscilator_low = float(na)

if method == 'MACD'

oscilator_high := MACD

oscilator_low := MACD

if method == 'Hist'

oscilator_high := delta

oscilator_low := delta

//

fractal_top = f_fractalize(oscilator_high) > 0 ? oscilator_high[2] : na

fractal_bot = f_fractalize(oscilator_low) < 0 ? oscilator_low[2] : na

high_prev = valuewhen(fractal_top, oscilator_high[2], 0)[2]

high_price = valuewhen(fractal_top, high[2], 0)[2]

low_prev = valuewhen(fractal_bot, oscilator_low[2], 0)[2]

low_price = valuewhen(fractal_bot, low[2], 0)[2]

regular_bearish_div = fractal_top and high[2] > high_price and oscilator_high[2] < high_prev

hidden_bearish_div = fractal_top and high[2] < high_price and oscilator_high[2] > high_prev

regular_bullish_div = fractal_bot and low[2] < low_price and oscilator_low[2] > low_prev

hidden_bullish_div = fractal_bot and low[2] > low_price and oscilator_low[2] < low_prev

// Plotting

plot(title='Bullish', series=fractal_top ? high[2] : na, color = regular_bearish_div and uReg or hidden_bearish_div and uHid ? color.red : na, linewidth = 2, transp=50, offset=-2, show_last = v_show_last)

plot(title='Bearish', series=fractal_bot ? low[2] : na, color = regular_bullish_div and uReg or hidden_bullish_div and uHid ? color.green : na, linewidth = 2, transp=50, offset=-2, show_last = v_show_last)

plotshape(title='Regular Bearish', series=not showlabel or not uReg ? na : regular_bearish_div ? high[2] : na, text='R', style=shape.labeldown, location=location.absolute, color=color.red, textcolor=color.white, transp=50, offset=-2, show_last = v_show_last)

plotshape(title='Hidden Bearish', series=not showlabel or not uHid ? na : hidden_bearish_div ? high[2] : na, text='H', style=shape.labeldown, location=location.absolute, color=color.red, textcolor=color.white, transp=80, offset=-2, show_last = v_show_last)

plotshape(title='Regular Bullish', series=not showlabel or not uReg ? na : regular_bullish_div ? low[2] : na, text='R', style=shape.labelup, location=location.absolute, color=color.green, textcolor=color.white, transp=50, offset=-2, show_last = v_show_last)

plotshape(title='Hidden Bullish', series=not showlabel or not uHid ? na : hidden_bullish_div ? low[2] : na, text='H', style=shape.labelup, location=location.absolute, color=color.green, textcolor=color.white, transp=80, offset=-2, show_last = v_show_last)

// == /DIVERGENCE ==

// == ENTRY ==

// == ADX FILTERING ==

// Look at ADX when it is above a user-defined key level (23 default) and this is to identify when it is trending.

// It then looks at the DMI levels. If D+ is above D- and the ADX is sloping upwards and above the key level, it triggers a buy condition. Opposite for short.

adxlen = 13 //input(13, title="TF ADX Smoothing")

dilen = 13 //input(13, title="TF DI Period")

keyLevel = 23 //input(23, title="TF Keylevel for ADX")

// == USE BUILT-IN DMI FUNCTION TO DETERMINE ADX AND BULL/BEAR STRENGTH

[diplus, diminus, adx] = dmi(dilen, adxlen)

//Buy and Sell Filter

ADXBuyCheck = useADXFilter? diplus > diminus : true

ADXSellCheck = useADXFilter? diplus < diminus : true

// == /ADX FILTERING ==

// == MOVING AVERAGE FILTERING ==

// MA FILTER: Use a user-defined moving average to filter long/short if desried.

maType = input(defval="EMA", options=["EMA", "SMA"], title = "TF MA Type")

maLength = input(defval = 50, title = "TF MA Period", minval = 1)

// Declare function to be able to swap out EMA/SMA

ma(maType, src, length) =>

maType == "EMA" ? ema(src, length) : sma(src, length)

maFilter = ma(maType, close, maLength)

// Check to see if the useMaFilter check box is checked, this then inputs this conditional "maFilterCheck" variable into the strategy entry

maFilterCheck = if useMAFilter == true

maFilter

else

close

// == /MOVING AVERAGE FILTERING ==

// == PARABOLIC SAR AS AN ENTRY and EXIT OPTION ==

// SAR FILTER: The Parabolic SAR (Stop and Reverse) is a time and price technical analysis tool primarily used to identify points of potential stops and reverses.

// Go long when is located below price (BULLISH) and go short when is located above price (BEARISH).

sarStart = 0.04 //input(0.04, "SAR Start")

sarIncrement = 0.02 //input(0.02, "SAR Increment")

sarMaximum = 0.5 //input(0.5, "SAR Max Value")

htclose = close

sarOut = useSARFilter or useSARStop ? sar(sarStart, sarIncrement, sarMaximum) : na

Trend = sarOut < htclose ? 1 : -1

//Buy and Sell Filter

sarBuyCheck = useSARFilter? Trend == 1: true

sarSellCheck = useSARFilter? Trend == -1: true

// Trigger stop based on High/Low

trigResistance = high

trigSupport = low

// Determine if price is above resistance or below support

sarResistanceHit = close >= sarOut and useSARStop == true

sarSupportHit = close <= sarOut and useSARStop == true

// == /PARABOLIC SAR AS AN ENTRY and EXIT OPTION ==

// == EXITS ==

// == ATR TRAILING STOPS ==

// The ATR % stop method can be used by any type of trader because the width of the stop is determined by the percentage of average true range (ATR).

// ATR is a measure of volatility over a specified period of time.

// Exit with ATR support/resistance is hit.

atrLookback = 14 //input(defval=14,title="ATR Lookback Period",type=input.integer)

multiplier = input(defval=2,title="ATR Trailing Stop Multiplier",type=input.float, step=0.1, minval=0.5, maxval=5)

// Calculate the trailing ATR

atrValue = atr(atrLookback)

atrMultiplied = atrValue * multiplier

// Plot the price plus or minus the ATR

atrLow = low - atrMultiplied

atrHigh = high + atrMultiplied

// Calculate both the low and high trailing ATRs every time. The low one never goes down, and the high one never goes up

// Set them to something to start with

trailAtrLow = atrLow

trailAtrHigh = atrHigh

// If the ATR Low has gone up AND it has gone above the trail, the low trailing ATR should also go up. If the ATR Low has gone up or down, but not below the trail, the ATR trail stays where it is

trailAtrLow := na(trailAtrLow[1]) ? trailAtrLow : atrLow >= trailAtrLow[1] ? atrLow : trailAtrLow[1]

// Same for the High

trailAtrHigh := na(trailAtrHigh[1]) ? trailAtrHigh : atrHigh <= trailAtrHigh[1] ? atrHigh : trailAtrHigh[1]

// Determine if price is above resistance or below support

atrResistanceHit = trigResistance >= trailAtrHigh and useATRStop == true

atrSupportHit = trigSupport <= trailAtrLow and useATRStop == true

// If price is above resistance or below support, reset the trailing ATR

trailAtrLow := atrSupportHit ? atrLow : trailAtrLow

trailAtrHigh := atrResistanceHit ? atrHigh : trailAtrHigh

// == /ATR TRAILING STOPS ==

// == INITIAL TP==

// ATR

tpmultiplier = input(defval=3,title="ATR Take Profit Multiplier",type=input.float, step=0.1, minval=0.5, maxval=5)

ema = ema(close, atrLookback)

atr = rma(tr(true), atrLookback)

longATRTP = ema + (atr * tpmultiplier)

shortATRTP = ema - (atr * tpmultiplier)

// Determine if price is above resistance or below support

longATRTPHit = high >= longATRTP and useATRTP == true

shortATRTPHit = low <= shortATRTP and useATRTP == true

// STANDARD TAKE PROFIT %

// User Options to Change Inputs (%)

takePer = input(10, title='Take Profit %', type=input.float, step=0.1, minval=0.5, maxval=100) / 100

//fixed TP prices

longPercentTP = ema * (1 + takePer)

shortPercentTP = ema * (1 - takePer)

// Determine if price is above resistance or below support

longPercentTPHit = high >= longPercentTP and usePercentTP == true

shortPercentTPHit = low <= shortPercentTP and usePercentTP == true

// Set Stop and TP Values

buyStop = trailStop == 'ATR'? trailAtrLow : trailStop == 'SAR'? sarOut : na

sellStop = trailStop == 'ATR'? trailAtrHigh : trailStop == 'SAR'? sarOut : na

longTP = TPtarget == 'ATR'? longATRTP : TPtarget == 'Percent'? longPercentTP : na

shortTP = TPtarget == 'ATR'? shortATRTP : TPtarget == 'Percent'? shortPercentTP : na

// == /EXITS ==

// == PLOTTING ==

buySignal = break_up and ADXBuyCheck and close >= maFilterCheck and sarBuyCheck

shortSignal = break_down and ADXSellCheck and close <= maFilterCheck and sarSellCheck

sellSignal = atrSupportHit or sarSupportHit or longPercentTPHit or longATRTPHit

coverSignal = atrResistanceHit or sarResistanceHit or shortPercentTPHit or shortATRTPHit

//Set BarSince counter

barsSinceLong = 0

barsSinceShort = 0

barsSinceLong := nz(barsSinceLong[1])

barsSinceShort := nz(barsSinceShort[1])

//Plot Sell and Cover Signal

plotshape(not showexitsignals and sellSignal and barsSinceLong == 1? sellSignal : na, title="Sell Long", location=location.abovebar, style=shape.diamond, size=size.auto, color=color.aqua, transp=0, show_last = v_show_last, editable = false)

plotshape(not showexitsignals and coverSignal and barsSinceShort == 1 ? coverSignal : na, title="Cover Short", location=location.belowbar, style=shape.diamond, size=size.auto, color=color.orange, transp=0, show_last = v_show_last, editable = false)

plotshape(showexitsignals and sellSignal and barsSinceLong == 1? sellSignal : na, title="Close Long Text", location=location.abovebar, style=shape.diamond, size=size.auto, color=color.aqua, transp=0, show_last = v_show_last, textcolor=color.aqua, text = "Close\nLong", editable = false)

plotshape(showexitsignals and coverSignal and barsSinceShort == 1 ? coverSignal : na, title="Cover Short Text", location=location.belowbar, style=shape.diamond, size=size.auto, color=color.orange, transp=0, show_last = v_show_last, textcolor=color.orange, text = "Cover\nShort", editable = false)

// Reset BarSince counter

if buySignal

barsSinceLong := 1

barsSinceShort := 0

if shortSignal

barsSinceShort := 1

barsSinceLong := 0

if sellSignal

barsSinceLong := 0

if coverSignal

barsSinceShort := 0

// Show bar color

barcolor(showBarColor? (buySignal or shortSignal ? (shortSignal ? color.fuchsia : color.yellow) : na) : na)

// Plot Buy Alerts

plotshape(buySignal ? buySignal : na, title="Breakout Up", location=location.belowbar, style=shape.circle, size=size.auto, color=color.yellow, transp=0, editable = false)

plotshape(showsignals and buySignal, title= "Long", color=color.green, style=shape.labelup, location=location.belowbar, size=size.auto, show_last = v_show_last, text = "BUY", textcolor=color.white, editable = false)

// Plot Sell Alerts

plotshape(shortSignal ? shortSignal : na, title="Breakout Down", location=location.abovebar, style=shape.circle, size=size.auto, color=color.fuchsia, transp=0, editable = false)

plotshape(showsignals and shortSignal, title= "Short", color=color.red, style=shape.labeldown, location=location.abovebar, size=size.auto, show_last = v_show_last, text = "SELL", textcolor=color.white, editable = false)

// Plot MA Trend Filter

plot(useMAFilter? maFilter : na, title = "Trend Filter MA", color = color.green, linewidth = 2, style = plot.style_line, transp = 20, editable = true)

// Plot Initial Stop

plot(trailStop != 'None' and barsSinceLong >= 1? buyStop : na, color=#3A6CA8, title="Trail Stop Long", style = plot.style_cross, linewidth = 1, transp = 20, editable = true)

plot(trailStop != 'None' and barsSinceShort >= 1? sellStop : na, color=#3A6CA8, title="Trail Stop Short", style = plot.style_cross, linewidth = 1, transp = 20, editable = true)

// Plot Initial Target Profit

plot(TPtarget != 'None' and buySignal? longTP : na, color=color.green, title="LongTP", style = plot.style_linebr, linewidth = 1, editable = false)

plot(TPtarget != 'None' and shortSignal? shortTP : na, color=color.green, title="ShortTP", style = plot.style_linebr, linewidth = 1, editable = false)

// == /PLOTTING ==

// == ALERTS ==

// Buy and Sell Signal

alertcondition(buySignal, title='MACD Long', message='MACD {{exchange}}:{{ticker}} TF: {{interval}}. LONG (TRADE). ENTRY: {{close}}, Target Profit: {{plot("LongTP")}}, STOP LOSS: {{plot("Trail Stop Long")}}')

alertcondition(shortSignal, title='MACD Short', message='MACD {{exchange}}:{{ticker}} TF: {{interval}}. SHORT (TRADE). ENTRY: {{close}}, Target Profit: {{plot("ShortTP")}}, STOP LOSS: {{plot("Trail Stop Short")}}')

alertcondition(sellSignal, title='MACD Close Long', message='MACD {{exchange}}:{{ticker}} Close Long, Price = {{close}}')

alertcondition(coverSignal, title='MACD Cover Short', message='MACD {{exchange}}:{{ticker}} Cover Short, Price = {{close}}')

alertcondition(sellSignal or coverSignal, title="MACD Close Orders", message="{{ticker}} Close Orders")

// Initial SL and TP Hit

stophit = low <= buyStop or high >= sellStop

tphit = low <= shortTP or high >= longTP

alertcondition(stophit, title='MACD SL Hit', message='MACD {{exchange}}:{{ticker}} Stop Loss Hit, Price = {{close}}')

alertcondition(tphit, title='MACD TP Hit', message='MACD {{exchange}}:{{ticker}} Target Profit Hit, Price = {{close}}')

//Divergence Alerts

alertcondition(regular_bullish_div, title='MACD Bullish Divergence', message='MACD Regular Bullish Divergence')

alertcondition(regular_bearish_div, title='MACD Bearish Divergence', message='MACD Regular Bearish Divergence')

alertcondition(hidden_bullish_div, title='MACD Hidden Bullish Divergence', message='MACD Hidden Bullish Divergence')

alertcondition(hidden_bearish_div, title='MACD Hidden Bearish Divergence', message='MACD Hidden Bearish Divergence')

// == /ALERTS ==

//////////////////////////

//* STRATEGY COMPONENT *//

//////////////////////////

// === BACKTEST RANGE ===

From_Year = input(defval = 2017, title = "BACKTEST: From Year")

From_Month = input(defval = 1, title = "BACKTEST: From Month", minval = 1, maxval = 12)

From_Day = input(defval = 1, title = "BACKTEST: From Day", minval = 1, maxval = 31)

To_Year = input(defval = 9999, title = "BACKTEST: To Year")

To_Month = input(defval = 1, title = "BACKTEST: To Month", minval = 1, maxval = 12)

To_Day = input(defval = 1, title = "BACKTEST: To Day", minval = 1, maxval = 31)

Start = timestamp(From_Year, From_Month, From_Day, 00, 00) // backtest start window

Finish = timestamp(To_Year, To_Month, To_Day, 23, 59) // backtest finish window

testPeriod() => true

// === /BACKTEST RANGE ===

// === STRATEGY ===

// Make input option to configure trade direction

tradeDirection = input(title="Trade Direction", defval="Both", options=["Long", "Short", "Both"])

// Translate input into trading conditions

longOK = (tradeDirection == "Long") or (tradeDirection == "Both")

shortOK = (tradeDirection == "Short") or (tradeDirection == "Both")

// == STRATEGY ENTRIES/EXITS ==

timedExit = input(title = "Use Timed Exit", type = input.bool, defval = true)

exitmethod = input(title="Timed Exit Method", defval='3', options=['1', '2', '3'])

bse = input(10, "Bar Since Entry") // Bars to exit after entry

barsSinceEntry = 0

barsSinceEntry := nz(barsSinceEntry[1]) + 1

longCondition = longOK and buySignal and testPeriod()

shortcondition = shortOK and shortSignal and testPeriod()

if strategy.position_size == 0

barsSinceEntry := 0

// === STRATEGY - LONG POSITION EXECUTION ===

if longCondition

strategy.entry("Long", strategy.long)

barsSinceEntry := 0

// === STRATEGY - SHORT POSITION EXECUTION ===

if shortcondition

strategy.entry("Short", strategy.short)

barsSinceEntry := 0

// == STRATEGY EXITS ==

if sellSignal

strategy.close("Long")

barsSinceEntry := 0

if coverSignal

strategy.close("Short")

barsSinceEntry := 0

// Enable Timed Exit

// Exit after specified number of bars.

if timedExit and exitmethod == '1' and barsSinceEntry > bse

strategy.close_all()

barsSinceEntry := 0

// Exit after specified number of bars, ONLY if position is currently profitable.

if timedExit and exitmethod == '2' and strategy.openprofit > 0 and barsSinceEntry > bse

strategy.close_all()

barsSinceEntry := 0

// Exit after specified number of bars, ONLY if position is currently losing.

if timedExit and exitmethod == '3' and strategy.openprofit < 0 and barsSinceEntry > bse

strategy.close_all()

barsSinceEntry := 0

// === /STRATEGY ===

//EOF

- Strategi Crossover Purata Bergerak Berganda

- Strategi Pengesanan Trend Dinamik Dual-Mekanisme

- Strategi Perdagangan Bitcoin Berdasarkan Awan Ichimoku

- Sistem Pengesanan Pasaran Bull

- Strategi Dagangan Intraday untuk Saham Berdasarkan Retracement Titik Rendah Renko

- Strategi Dagangan Trend Berdasarkan Saluran Harga Purata Bergerak Berganda

- Dual MA Momentum Breakout Strategi

- SMART Strategi Perdagangan Kuantitatif Profesional

- Strategi Saluran Volatiliti Penembusan Berganda

- Trend Mengikut Strategi Berdasarkan Pelbagai Penunjuk

- Strategi pulangan bulanan dengan penanda aras

- Squeeze Momentum Breakout Strategi

- Strategi Penembusan Berganda

- Strategi Dagangan Algorithmic Momentum Breakout dan Mengambil corak

- Strategi Confluence Purata Bergerak Berganda

- Strategi Perdagangan Pembalikan RSI

- Strategi Dagangan ADX dua arah

- Vix Fix Strategi Penangkapan Ikan Dasar Regresi Linear

- Tiga Exponential Moving Averages dan Strategi Dagangan Indeks Kekuatan Relatif Stochastic

- Double 7 Days Breakout Strategi