Strategi Penembusan Momentum Adaptif Dinamik

Penulis:ChaoZhang, Tarikh: 2024-07-29 14:36:32Tag:ATREMAIbu

Ringkasan

Strategy Dynamic Adaptive Momentum Breakout adalah pendekatan perdagangan kuantitatif canggih yang menggunakan penunjuk momentum adaptif dan pengenalan corak candlestick. Strategi ini secara dinamik menyesuaikan tempoh momentumnya untuk menyesuaikan diri dengan turun naik pasaran dan menggabungkan pelbagai keadaan penapisan untuk mengenal pasti peluang pecah trend yang berkemungkinan tinggi. Inti strategi terletak pada menangkap perubahan momentum pasaran sambil menggunakan corak engulfing sebagai isyarat masuk untuk meningkatkan ketepatan dan keuntungan perdagangan.

Prinsip Strategi

-

Penyesuaian Tempoh Dinamik:

- Strategi ini menggunakan penunjuk momentum adaptif, menyesuaikan tempoh pengiraan secara dinamik berdasarkan turun naik pasaran.

- Semasa tempoh turun naik yang tinggi, tempoh itu diperpendek untuk bertindak balas dengan cepat terhadap perubahan pasaran; semasa turun naik yang rendah, ia dilanjutkan untuk mengelakkan perdagangan berlebihan.

- Julat tempoh ditetapkan antara 10 dan 40, dengan keadaan turun naik ditentukan oleh penunjuk ATR.

-

Pengiraan Momentum dan Smoothing:

- Momentum dikira menggunakan tempoh dinamik.

- Pembaikan momentum EMA pilihan, lalai kepada EMA 7 tempoh.

-

Penentuan Arah Trend:

- Arah trend ditentukan dengan mengira cerun momentum (perbezaan antara nilai semasa dan sebelumnya).

- Kemiringan positif menunjukkan aliran menaik, kemiringan negatif menunjukkan aliran menurun.

-

Pengiktirafan corak yang meluap:

- Fungsi tersuai mengenal pasti corak kenaikan dan penurunan.

- Mengkaji hubungan antara harga buka dan tutup lilin semasa dan sebelumnya.

- Merangkumi penapisan saiz badan minimum untuk meningkatkan kebolehpercayaan corak.

-

Generasi Isyarat Perdagangan:

- Isyarat panjang: corak bullish engulfing + kemiringan momentum positif.

- Isyarat pendek: corak penyerapan bearish + kemiringan momentum negatif.

-

Pengurusan Perdagangan:

- Masuk pada pembukaan lilin selepas pengesahan isyarat.

- Keluar secara automatik selepas tempoh tahan tetap (default 3 lilin).

Kelebihan Strategi

-

Kebolehsesuaian yang kuat:

- Dinamis menyesuaikan tempoh momentum untuk memenuhi persekitaran pasaran yang berbeza.

- Menjawab dengan cepat dalam turun naik yang tinggi dan mengelakkan overtrading dalam turun naik yang rendah.

-

Mekanisme pengesahan berbilang:

- Menggabungkan penunjuk teknikal (momentum) dan corak harga (mengambil), meningkatkan kebolehpercayaan isyarat.

- Menggunakan cerun dan ukuran badan penapisan untuk mengurangkan isyarat palsu.

-

Waktu kemasukan yang tepat:

- Menggunakan corak menelan untuk menangkap titik pembalikan trend yang berpotensi.

- Menggabungkan dengan kemiringan momentum untuk memastikan kemasukan ke trend yang muncul.

-

Pengurusan Risiko yang Betul:

- Tempoh penahanan tetap mengelakkan penahanan berlebihan yang membawa kepada penggunaan.

- Penapisan saiz badan mengurangkan salah penilaian yang disebabkan oleh turun naik kecil.

-

Fleksibel dan disesuaikan:

- Pelbagai parameter yang boleh diselaraskan untuk pengoptimuman di pasaran dan jangka masa yang berbeza.

- Pembersihan EMA pilihan menyeimbangkan kepekaan dan kestabilan.

Risiko Strategi

-

Risiko Pembebasan Palsu:

- Boleh menghasilkan isyarat pecah palsu yang kerap di pasaran yang berbeza.

- Pengurangan: Sertakan penunjuk pengesahan trend tambahan, seperti persilangan purata bergerak.

-

Masalah Lag:

- EMA smoothing boleh menyebabkan lag isyarat, kehilangan titik masuk yang optimum.

- Pengurangan: Sesuaikan tempoh EMA atau pertimbangkan kaedah pelembap yang lebih sensitif.

-

Pengecualian mekanisme keluar tetap:

- Keluar jangka tetap boleh menamatkan aliran yang menguntungkan atau memanjangkan kerugian.

- Pengurangan: Memperkenalkan keuntungan dinamik dan menghentikan kerugian, seperti berhenti atau keluar berdasarkan turun naik.

-

Kepercayaan yang berlebihan pada Tempoh Satu:

- Strategi boleh mengabaikan trend keseluruhan dalam jangka masa yang lebih besar.

- Pengurangan: Sertakan analisis pelbagai jangka masa untuk memastikan arah perdagangan sejajar dengan trend yang lebih besar.

-

Sensitiviti parameter:

- Banyak parameter yang boleh diselaraskan boleh membawa kepada data sejarah yang terlalu sesuai.

- Pengurangan: Gunakan pengoptimuman berjalan maju dan ujian di luar sampel untuk mengesahkan kestabilan parameter.

Arahan Pengoptimuman Strategi

-

Integrasi Pelbagai Tempoh:

- Memperkenalkan penilaian trend jangka masa yang lebih besar, hanya berdagang ke arah trend utama.

- Sebab: Meningkatkan kadar kejayaan perdagangan secara keseluruhan, mengelakkan perdagangan menentang trend utama.

-

Pendapatan Dinamis dan Stop-Loss:

- Melaksanakan hentian dinamik berdasarkan perubahan ATR atau momentum.

- Gunakan penangguhan untuk memaksimumkan keuntungan trend.

- Alasan: Sesuaikan dengan turun naik pasaran, melindungi keuntungan, mengurangkan pengeluaran.

-

Analisis Profil Volume:

- Mengintegrasikan profil jumlah untuk mengenal pasti tahap sokongan dan rintangan utama.

- Sebab: Meningkatkan ketepatan kedudukan kemasukan, mengelakkan perdagangan di titik pecah yang tidak berkesan.

-

Pengoptimuman pembelajaran mesin:

- Gunakan algoritma pembelajaran mesin untuk menyesuaikan parameter secara dinamik.

- Alasan: Mencapai penyesuaian strategi yang berterusan, meningkatkan kestabilan jangka panjang.

-

Integrasi Penunjuk Sentimen:

- Sertakan penunjuk sentimen pasaran seperti VIX atau volatiliti pilihan tersirat.

- Alasan: Sesuaikan tingkah laku strategi semasa sentimen yang melampau, elakkan overtrading.

-

Analisis korelasi:

- Pertimbangkan pergerakan aset yang berkaitan.

- Alasan: Meningkatkan kebolehpercayaan isyarat, mengenal pasti trend pasaran yang lebih kuat.

Kesimpulan

Strategy Dynamic Adaptive Momentum Breakout adalah sistem perdagangan canggih yang menggabungkan analisis teknikal dan kaedah kuantitatif. Dengan menyesuaikan tempoh momentum secara dinamik, mengenal pasti corak pelupusan, dan menggabungkan pelbagai keadaan penapisan, strategi ini dapat menangkap peluang pecah trend kebarangkalian tinggi di pelbagai persekitaran pasaran. Walaupun terdapat risiko yang melekat, seperti pecah palsu dan sensitiviti parameter, arah pengoptimuman yang dicadangkan, termasuk analisis pelbagai jangka masa, pengurusan risiko dinamik, dan aplikasi pembelajaran mesin, menawarkan potensi untuk meningkatkan lagi kestabilan dan keuntungan strategi. Secara keseluruhan, ini adalah strategi kuantitatif yang terfikir dengan baik, logik yang ketat yang menyediakan pedagang dengan alat yang kuat untuk memanfaatkan momentum pasaran dan perubahan trend.

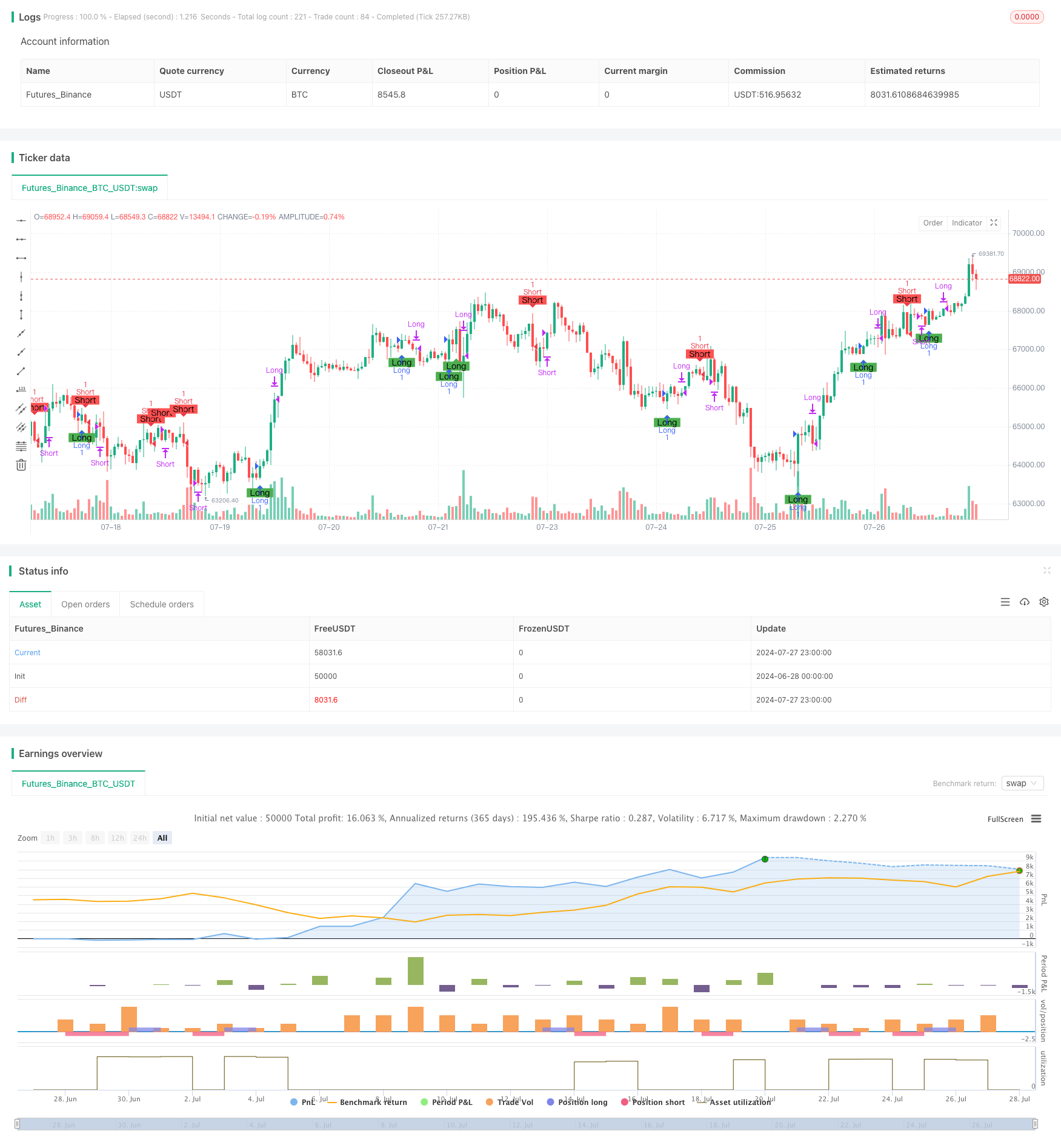

/*backtest

start: 2024-06-28 00:00:00

end: 2024-07-28 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ironperol

//@version=5

strategy("Adaptive Momentum Strategy", overlay=true, margin_long=100, margin_short=100)

// Input parameters for customization

src = input.source(close, title="Source")

min_length = input.int(10, minval=1, title="Minimum Length")

max_length = input.int(40, minval=1, title="Maximum Length")

ema_smoothing = input.bool(true, title="EMA Smoothing")

ema_length = input.int(7, title="EMA Length")

percent = input.float(2, title="Percent of Change", minval=0, maxval=100) / 100.0

// Separate body size filters for current and previous candles

min_body_size_current = input.float(0.5, title="Minimum Body Size for Current Candle (as a fraction of previous body size)", minval=0)

min_body_size_previous = input.float(0.5, title="Minimum Body Size for Previous Candle (as a fraction of average body size of last 5 candles)", minval=0)

close_bars = input.int(3, title="Number of Bars to Hold Position", minval=1) // User-defined input for holding period

//######################## Calculations ##########################

// Initialize dynamic length variable

startingLen = (min_length + max_length) / 2.0

var float dynamicLen = na

if na(dynamicLen)

dynamicLen := startingLen

high_Volatility = ta.atr(7) > ta.atr(14)

if high_Volatility

dynamicLen := math.max(min_length, dynamicLen * (1 - percent))

else

dynamicLen := math.min(max_length, dynamicLen * (1 + percent))

momentum = ta.mom(src, int(dynamicLen))

value = ema_smoothing ? ta.ema(momentum, ema_length) : momentum

// Calculate slope as the difference between current and previous value

slope = value - value[1]

// Calculate body sizes

currentBodySize = math.abs(close - open)

previousBodySize = math.abs(close[1] - open[1])

// Calculate average body size of the last 5 candles

avgBodySizeLast5 = math.avg(math.abs(close[1] - open[1]), math.abs(close[2] - open[2]), math.abs(close[3] - open[3]), math.abs(close[4] - open[4]), math.abs(close[5] - open[5]))

//######################## Long Signal Condition ##########################

// Function to determine if the candle is a bullish engulfing

isBullishEngulfing() =>

currentOpen = open

currentClose = close

previousOpen = open[1]

previousClose = close[1]

isBullish = currentClose >= currentOpen

wasBearish = previousClose <= previousOpen

engulfing = currentOpen <= previousClose and currentClose >= previousOpen

bodySizeCheckCurrent = currentBodySize >= min_body_size_current * previousBodySize

bodySizeCheckPrevious = previousBodySize >= min_body_size_previous * avgBodySizeLast5

isBullish and wasBearish and engulfing and bodySizeCheckCurrent and bodySizeCheckPrevious

// Long signal condition

longCondition = isBullishEngulfing() and slope > 0

// Plotting long signals on chart

plotshape(series=longCondition, location=location.belowbar, color=color.green, style=shape.labelup, text="Long", title="Long Condition")

// Alerts for long condition

if (longCondition)

alert("Long condition met", alert.freq_once_per_bar_close)

//######################## Short Signal Condition ##########################

// Function to determine if the candle is a bearish engulfing

isBearishEngulfing() =>

currentOpen = open

currentClose = close

previousOpen = open[1]

previousClose = close[1]

isBearish = currentClose <= currentOpen

wasBullish = previousClose >= previousOpen

engulfing = currentOpen >= previousClose and currentClose <= previousOpen

bodySizeCheckCurrent = currentBodySize >= min_body_size_current * previousBodySize

bodySizeCheckPrevious = previousBodySize >= min_body_size_previous * avgBodySizeLast5

isBearish and wasBullish and engulfing and bodySizeCheckCurrent and bodySizeCheckPrevious

// Short signal condition

shortCondition = isBearishEngulfing() and slope < 0

// Plotting short signals on chart

plotshape(series=shortCondition, location=location.abovebar, color=color.red, style=shape.labeldown, text="Short", title="Short Condition")

// Alerts for short condition

if (shortCondition)

alert("Short condition met", alert.freq_once_per_bar_close)

//######################## Trading Logic ##########################

// Track the bar number when the position was opened

var int longEntryBar = na

var int shortEntryBar = na

// Enter long trade on the next candle after a long signal

if (longCondition and na(longEntryBar))

strategy.entry("Long", strategy.long)

longEntryBar := bar_index + 1

// Enter short trade on the next candle after a short signal

if (shortCondition and na(shortEntryBar))

strategy.entry("Short", strategy.short)

shortEntryBar := bar_index + 1

// Close long trades `close_bars` candles after entry

if (not na(longEntryBar) and bar_index - longEntryBar >= close_bars)

strategy.close("Long")

longEntryBar := na

// Close short trades `close_bars` candles after entry

if (not na(shortEntryBar) and bar_index - shortEntryBar >= close_bars)

strategy.close("Short")

shortEntryBar := na

- Strategi Dagangan Momentum Multi-Indikator yang Dipertingkatkan

- K Lilin berturut-turut Bull Bear Strategi

- Keltner Saluran EMA ATR Strategi

- Strategi crossover purata bergerak berbilang eksponen dengan pengoptimuman stop-loss dinamik ATR berasaskan jumlah

- Trend Multi-Timeframe Mengikut Strategi dengan mengambil keuntungan dan menghentikan kerugian berasaskan ATR

- Strategi adaptif mengambil keuntungan dinamik dan menghentikan kerugian berdasarkan ATR dan EMA

- Strategi Pengoptimuman Rejimen Pasaran Jangka Pendek Berasaskan Volatiliti dan Regresi Linear

- Trend Dinamik EMA Berikutan Strategi Dagangan

- Strategi Crossover EMA Bertiga

- Trend Multi-Indikator Mengikuti Strategi dengan Saluran Dinamik dan Sistem Dagangan Purata Bergerak

- Rata-rata Bergerak Bertimbang dan Indeks Kekuatan Relatif Strategi Crossover dengan Sistem Pengurusan Risiko

- Trend Heiken Ashi yang dihaluskan dua kali mengikut strategi

- RSI Peralihan Pelancongan Salib Keuntungan Sasaran Strategi Dagangan Kuantitatif

- Trend penyesuaian pelbagai penunjuk mengikut strategi

- Strategi Dagangan Komprehensif Multi-Indikator: Gabungan sempurna Momentum, Overbought/Oversold, dan Volatility

- Strategi RSI dan Bollinger Bands Breakout dengan ketepatan tinggi dengan nisbah risiko-balasan yang dioptimumkan

- EMA Advanced Crossover Strategy: Sistem Dagangan Bersesuaian dengan Matlamat Stop-Loss dan Take-Profit Dinamik

- EMA Crossover dengan strategi mengambil keuntungan berganda dan berhenti kerugian

- Strategi Crossover Purata Bergerak Hull Berbilang Jangka Masa

- Dinamis Trailing Stop Dual Sasaran Moving Purata strategi crossover

- Adaptive Moving Average Crossover dengan strategi Stop-Loss yang mengikut

- EMA Mengikuti Strategi Dagangan Automatik

- Strategi Penembusan dan Pengurusan Risiko Darvas Box

- Strategi Crossover Purata Bergerak Eksponensial Berbilang Jangka Masa dengan Pengoptimuman Risiko-Hadiah

- Strategi jangka pendek SMA Crossover dengan Kawalan Penarikan Puncak dan Pengakhiran Otomatik

- Strategy Momentum Pengesanan Peratusan Flip Frekuensi Tinggi

- SMI dan Pivot Point Momentum Crossover Strategy

- Strategi sokongan dan rintangan dengan sistem pengurusan risiko dinamik

- Strategi Integrasi RSI-Bollinger Bands: Sistem Dagangan Multi-Indikator yang Dinamis dan Sesuai Sendiri

- Strategi Dagangan Kuantitatif Pengikut Trend dan Blok Perintah