Rata-rata bergerak berganda mengikut strategi dengan sistem pengurusan risiko berasaskan ATR

Penulis:ChaoZhang, Tarikh: 2024-11-29 14:56:43Tag:SMAATRTPSLHTF

Ringkasan

Strategi ini menggabungkan dua trend trend yang bergerak klasik dengan pengurusan risiko dinamik berasaskan ATR. Ia menawarkan dua mod perdagangan: mod asas menggunakan silang rata-rata bergerak mudah untuk mengikuti trend, dan mod lanjutan yang menggabungkan penapisan trend jangka masa yang lebih tinggi dan mekanisme stop-loss dinamik berasaskan ATR. Pedagang boleh beralih antara mod melalui menu dropdown yang mudah, memenuhi kedua-dua pemula

Prinsip Strategi

Strategi 1 (Mode Asas) menggunakan sistem purata bergerak berganda 21 dan 49 hari, menghasilkan isyarat panjang apabila MA pantas melintasi di atas MA perlahan. Sasaran keuntungan boleh ditetapkan sama ada sebagai peratusan atau mata, dengan hentian trailing pilihan untuk mengunci keuntungan. Strategi 2 (Mode Lanjutan) menambah penapisan trend jangka masa harian, membenarkan entri hanya apabila harga di atas purata bergerak jangka masa yang lebih tinggi. Ia menggabungkan stop-loss dinamik berasaskan ATR 14 tempoh yang menyesuaikan dengan turun naik pasaran, dan termasuk fungsi mengambil keuntungan separa untuk melindungi keuntungan.

Kelebihan Strategi

- Strategi yang sangat mudah disesuaikan yang boleh fleksibel dengan pengalaman peniaga dan keadaan pasaran

- Analisis pelbagai jangka masa dalam mod lanjutan meningkatkan kualiti isyarat

- Perhentian dinamik berasaskan ATR disesuaikan dengan turun naik pasaran yang berbeza

- Saldo mengambil keuntungan separa perlindungan keuntungan dengan kesinambungan trend

- Konfigurasi parameter yang fleksibel untuk ciri pasaran yang berbeza

Risiko Strategi

- Sistem MA berganda boleh menghasilkan isyarat palsu yang kerap di pasaran yang berbeza

- Penapisan trend boleh menyebabkan kelewatan isyarat, kehilangan beberapa peluang perdagangan

- Hentian ATR mungkin tidak disesuaikan dengan cepat dengan lonjakan turun naik

- Mengambil keuntungan separa mungkin mengurangkan saiz kedudukan terlalu awal dalam trend yang kuat

Arahan Pengoptimuman Strategi

- Tambah penunjuk jumlah dan turun naik untuk menapis isyarat palsu

- Mempertimbangkan untuk melaksanakan penyesuaian parameter dinamik berdasarkan keadaan pasaran

- Mengoptimumkan tempoh pengiraan ATR untuk mengimbangi kepekaan dan kestabilan

- Tambah modul pengiktirafan keadaan pasaran untuk pemilihan mod strategi automatik

- Memperkenalkan lebih banyak pilihan stop-loss seperti hentian trailing dan keluar berdasarkan masa

Ringkasan

Ini adalah sistem dagangan yang direka dengan baik dan komprehensif. Gabungan dua trend pergerakan purata berikut dan pengurusan risiko berasaskan ATR memastikan kebolehpercayaan dan kawalan risiko yang berkesan. Reka bentuk mod dua memenuhi keperluan tahap peniaga yang berbeza, sementara tetapan parameter yang kaya menyediakan banyak peluang pengoptimuman. Pedagang dinasihatkan untuk memulakan dengan parameter konservatif dalam perdagangan langsung dan secara beransur-ansur mengoptimumkan untuk hasil yang terbaik.

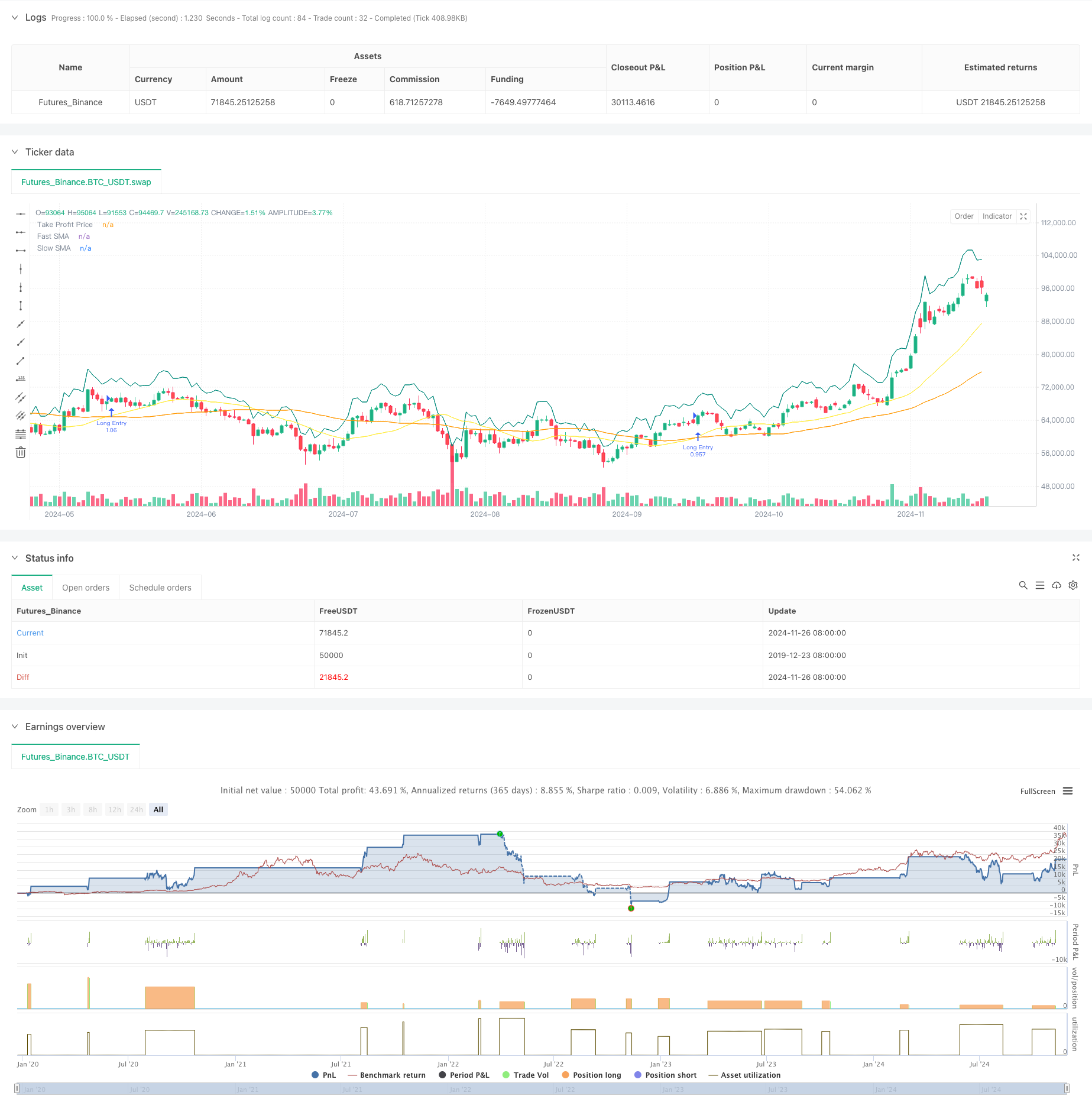

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-27 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © shaashish1

//@version=5

strategy("Dual Strategy Selector V2 - Cryptogyani", overlay=true, pyramiding=0,

default_qty_type=strategy.percent_of_equity, default_qty_value=100, initial_capital=100000)

//#region STRATEGY SELECTION

strategyOptions = input.string(title="Select Strategy", defval="Strategy 1", options=["Strategy 1", "Strategy 2"], group="Strategy Selection")

//#endregion STRATEGY SELECTION

// ####################### STRATEGY 1: Original Logic ########################

//#region STRATEGY 1 INPUTS

s1_fastMALen = input.int(defval=21, title="Fast SMA Length (S1)", minval=1, group="Strategy 1 Settings", inline="S1 MA")

s1_slowMALen = input.int(defval=49, title="Slow SMA Length (S1)", minval=1, group="Strategy 1 Settings", inline="S1 MA")

s1_takeProfitMode = input.string(defval="Percentage", title="Take Profit Mode (S1)", options=["Percentage", "Pips"], group="Strategy 1 Settings")

s1_takeProfitPerc = input.float(defval=7.0, title="Take Profit % (S1)", minval=0.05, step=0.05, group="Strategy 1 Settings") / 100

s1_takeProfitPips = input.float(defval=50, title="Take Profit Pips (S1)", minval=1, step=1, group="Strategy 1 Settings")

s1_trailingTakeProfitEnabled = input.bool(defval=false, title="Enable Trailing (S1)", group="Strategy 1 Settings")

//#endregion STRATEGY 1 INPUTS

// ####################### STRATEGY 2: Enhanced with Recommendations ########################

//#region STRATEGY 2 INPUTS

s2_fastMALen = input.int(defval=20, title="Fast SMA Length (S2)", minval=1, group="Strategy 2 Settings", inline="S2 MA")

s2_slowMALen = input.int(defval=50, title="Slow SMA Length (S2)", minval=1, group="Strategy 2 Settings", inline="S2 MA")

s2_atrLength = input.int(defval=14, title="ATR Length (S2)", group="Strategy 2 Settings", inline="ATR")

s2_atrMultiplier = input.float(defval=1.5, title="ATR Multiplier for Stop-Loss (S2)", group="Strategy 2 Settings", inline="ATR")

s2_partialTakeProfitPerc = input.float(defval=50.0, title="Partial Take Profit % (S2)", minval=10, maxval=100, step=10, group="Strategy 2 Settings")

s2_timeframeTrend = input.timeframe(defval="1D", title="Higher Timeframe for Trend Filter (S2)", group="Strategy 2 Settings")

//#endregion STRATEGY 2 INPUTS

// ####################### GLOBAL VARIABLES ########################

var float takeProfitPrice = na

var float stopLossPrice = na

var float trailingStopPrice = na

var float fastMA = na

var float slowMA = na

var float higherTimeframeTrendMA = na

var bool validOpenLongPosition = false

// Precalculate higher timeframe values (global scope for Strategy 2)

higherTimeframeTrendMA := request.security(syminfo.tickerid, s2_timeframeTrend, ta.sma(close, s2_slowMALen))

// ####################### LOGIC ########################

if (strategyOptions == "Strategy 1")

// Strategy 1 Logic (Original Logic Preserved)

fastMA := ta.sma(close, s1_fastMALen)

slowMA := ta.sma(close, s1_slowMALen)

openLongPosition = ta.crossover(fastMA, slowMA)

validOpenLongPosition := openLongPosition and strategy.opentrades.size(strategy.opentrades - 1) == 0

// Take Profit Price

takeProfitPrice := if (s1_takeProfitMode == "Percentage")

close * (1 + s1_takeProfitPerc)

else

close + (s1_takeProfitPips * syminfo.mintick)

// Trailing Stop Price (if enabled)

if (strategy.position_size > 0 and s1_trailingTakeProfitEnabled)

trailingStopPrice := high - (s1_takeProfitPips * syminfo.mintick)

else

trailingStopPrice := na

else if (strategyOptions == "Strategy 2")

// Strategy 2 Logic with Recommendations

fastMA := ta.sma(close, s2_fastMALen)

slowMA := ta.sma(close, s2_slowMALen)

openLongPosition = ta.crossover(fastMA, slowMA) and close > higherTimeframeTrendMA

validOpenLongPosition := openLongPosition and strategy.opentrades.size(strategy.opentrades - 1) == 0

// ATR-Based Stop-Loss

atr = ta.atr(s2_atrLength)

stopLossPrice := close - (atr * s2_atrMultiplier)

// Partial Take Profit Logic

takeProfitPrice := close * (1 + (s2_partialTakeProfitPerc / 100))

//#endregion STRATEGY LOGIC

// ####################### PLOTTING ########################

plot(series=fastMA, title="Fast SMA", color=color.yellow, linewidth=1)

plot(series=slowMA, title="Slow SMA", color=color.orange, linewidth=1)

plot(series=takeProfitPrice, title="Take Profit Price", color=color.teal, linewidth=1, style=plot.style_linebr)

// Trailing Stop and ATR Stop-Loss Plots (Global Scope)

plot(series=(strategyOptions == "Strategy 1" and s1_trailingTakeProfitEnabled) ? trailingStopPrice : na, title="Trailing Stop", color=color.red, linewidth=1, style=plot.style_linebr)

plot(series=(strategyOptions == "Strategy 2") ? stopLossPrice : na, title="ATR Stop-Loss", color=color.red, linewidth=1, style=plot.style_linebr)

//#endregion PLOTTING

// ####################### POSITION ORDERS ########################

//#region POSITION ORDERS

if (validOpenLongPosition)

strategy.entry(id="Long Entry", direction=strategy.long)

if (strategyOptions == "Strategy 1")

if (strategy.position_size > 0)

if (s1_trailingTakeProfitEnabled)

strategy.exit(id="Trailing Take Profit", from_entry="Long Entry", stop=trailingStopPrice)

else

strategy.exit(id="Take Profit", from_entry="Long Entry", limit=takeProfitPrice)

else if (strategyOptions == "Strategy 2")

if (strategy.position_size > 0)

strategy.exit(id="Partial Take Profit", from_entry="Long Entry", qty_percent=s2_partialTakeProfitPerc, limit=takeProfitPrice)

strategy.exit(id="Stop Loss", from_entry="Long Entry", stop=stopLossPrice)

//#endregion POSITION ORDERS

- Strategi crossover purata bergerak berganda dengan pengurusan risiko dinamik

- RSI Stop-Loss Dinamis ATR

- Trend Dual-SMA yang Dinamis Mengikut Strategi dengan Pengurusan Risiko Pintar

- Strategi Penembusan Garis Trend Dinamik Yang Lanjutan

- Pemecahan Struktur dengan Pengesahan Volume Multi-Kondisi Strategi Dagangan Pintar

- Adaptive Volatility and Momentum Quantitative Trading System (AVMQTS)

- Strategi Model Pengoptimuman Trend Fusi ATR

- Strategi Dagangan Intensiti Trend Multi-MA - Sistem Dagangan Pintar Fleksibel Berdasarkan Penyimpangan MA

- Pergerakan purata dinamik dan Bollinger Bands strategi silang dengan model optimum stop-loss tetap

- Adaptive Moving Average Crossover dengan strategi Stop-Loss yang mengikut

- Multi-Trend Following dan Struktur Breakout Strategy

- TRAMA Dual Moving Average Crossover Strategi Perdagangan Kuantitatif Pintar

- Strategi Dagangan Momentum RSI-EMA Berbilang Jangka Masa dengan Scaling Posisi

- Trend Multi-MA Berikutan dengan RSI Momentum Strategy

- Trend EMA Multi-Level Fibonacci Mengikut Strategi

- Sistem Perdagangan Penembusan Jurang Berikut Trend dengan Penapis SMA

- Trend Crossover EMA Dual Mengikuti Strategi dengan Pengurusan Risiko dan Sistem Penapisan Masa

- Trend purata bergerak yang dihaluskan dua kali mengikut strategi - Berdasarkan Heikin-Ashi yang diubah suai

- Sistem Dagangan Stop-Loss dan Take-Profit Multi-Interval MACD

- Sistem Dagangan Dinamis dengan RSI Stochastic dan Pengesahan Candlestick

- Strategi Dagangan Dinamis Beradaptasi Indikator Multi-Teknik (MTDAT)

- Pengesanan FVG adaptif dan strategi perdagangan trend MA dengan rintangan dinamik

- Sistem Strategi Kuantitatif Pembalikan Momentum Berbilang Frekuensi

- Sistem Dagangan Kuantitatif Automatik dengan Crossover EMA Dual dan Pengurusan Risiko

- Trend Dual-SMA yang Dinamis Mengikut Strategi dengan Pengurusan Risiko Pintar

- Trend Parameter Adaptif Berasaskan KNN Mengikut Strategi

- Trend Multi-Period Mengikut Sistem Dagangan Berdasarkan Band Volatiliti EMA

- Penjana Pergerakan Rawak Sistem Pemindaian

- EMA Multi-Timeframe Cross High-Win Rate Trend Mengikut Strategi (Langsung)

- Trend Volatiliti Julat Penyesuaian Berikutan Strategi Dagangan