Strategi Dagangan Momentum Trend Multi-Indikator: Sistem Dagangan Kuantitatif yang Dioptimumkan Berdasarkan Bollinger Bands, Fibonacci dan ATR

Penulis:ChaoZhang, Tarikh: 2025-01-10 16:22:55Tag:MACDRSIEMABBATRFIBOSMAMSD

Ringkasan

Strategi ini adalah sistem perdagangan analisis teknikal berbilang dimensi yang menggabungkan penunjuk momentum (RSI, MACD), penunjuk trend (EMA), penunjuk turun naik (Bollinger Bands, ATR), dan penunjuk struktur harga (retracements Fibonacci) untuk menangkap peluang pasaran melalui penyelarasan isyarat berbilang dimensi.

Prinsip Strategi

Logik teras merangkumi dimensi berikut: 1. Pengesahan Trend: Menggunakan9⁄21Pembebasan EMA tempoh untuk menentukan arah trend 2. Pengesahan Momentum: Menggabungkan RSI overbought/oversold (55⁄45) dan histogram MACD untuk pengesahan momentum Referensi Volatiliti: Menggunakan Bollinger Bands (20 tempoh, 2 penyimpangan standard) untuk mengukur turun naik harga 4. Sokongan/Rintangan: Fibonacci 0.382⁄0.618⁄0.786 tahap yang dikira dari 100 tempoh tinggi/rendah 5. Pengurusan Risiko: 1.5x ATR stop-loss dan 3x ATR mengambil keuntungan berdasarkan ATR 14 tempoh

Perdagangan hanya berlaku apabila isyarat berbilang dimensi sejajar, meningkatkan ketepatan perdagangan.

Kelebihan Strategi

- Penyelidikan silang isyarat berbilang dimensi mengurangkan isyarat palsu

- Pendapatan dan keuntungan berhenti yang berasaskan ATR dinamik disesuaikan dengan keadaan pasaran yang berbeza

- Integrasi penunjuk teknikal klasik memudahkan pemahaman dan penyelenggaraan

- Masa masuk yang tepat meningkatkan kadar kemenangan

- Nisbah risiko-balasan 1:2 memenuhi piawaian perdagangan profesional

- Sesuai untuk persekitaran pasaran yang sangat tidak menentu

Risiko Strategi

- Pengoptimuman parameter boleh membawa kepada overfit

- Keadaan isyarat berbilang mungkin terlepas beberapa pergerakan pasaran

- Hentian pengganda tetap mungkin gagal dalam keadaan pasaran yang melampau

- Keperluan sumber pengiraan yang tinggi

- Kos dagangan boleh memberi kesan kepada prestasi strategi

Arahan Pengoptimuman Strategi

- Memperkenalkan faktor kelantangan untuk mengesahkan kekuatan isyarat

- Sesuaikan ambang RSI secara dinamik untuk pasaran yang berbeza

- Tambah penapis kekuatan trend

- Mengoptimumkan pengganda stop-loss dan mengambil keuntungan

- Tambah penapis masa untuk mengelakkan pasaran yang berbeza

- Pertimbangkan untuk melaksanakan pembelajaran mesin untuk pengoptimuman parameter dinamik

Ringkasan

Strategi ini membina sistem perdagangan yang kukuh melalui penyelarasan penunjuk teknikal berbilang dimensi. Kelebihannya utama terletak pada pengesahan silang isyarat dan kawalan risiko dinamik, tetapi perhatian mesti diberikan kepada pengoptimuman parameter dan kemampuan menyesuaikan diri dengan persekitaran pasaran. Pengoptimuman masa depan harus memberi tumpuan kepada penyesuaian parameter dinamik dan peningkatan kualiti isyarat.

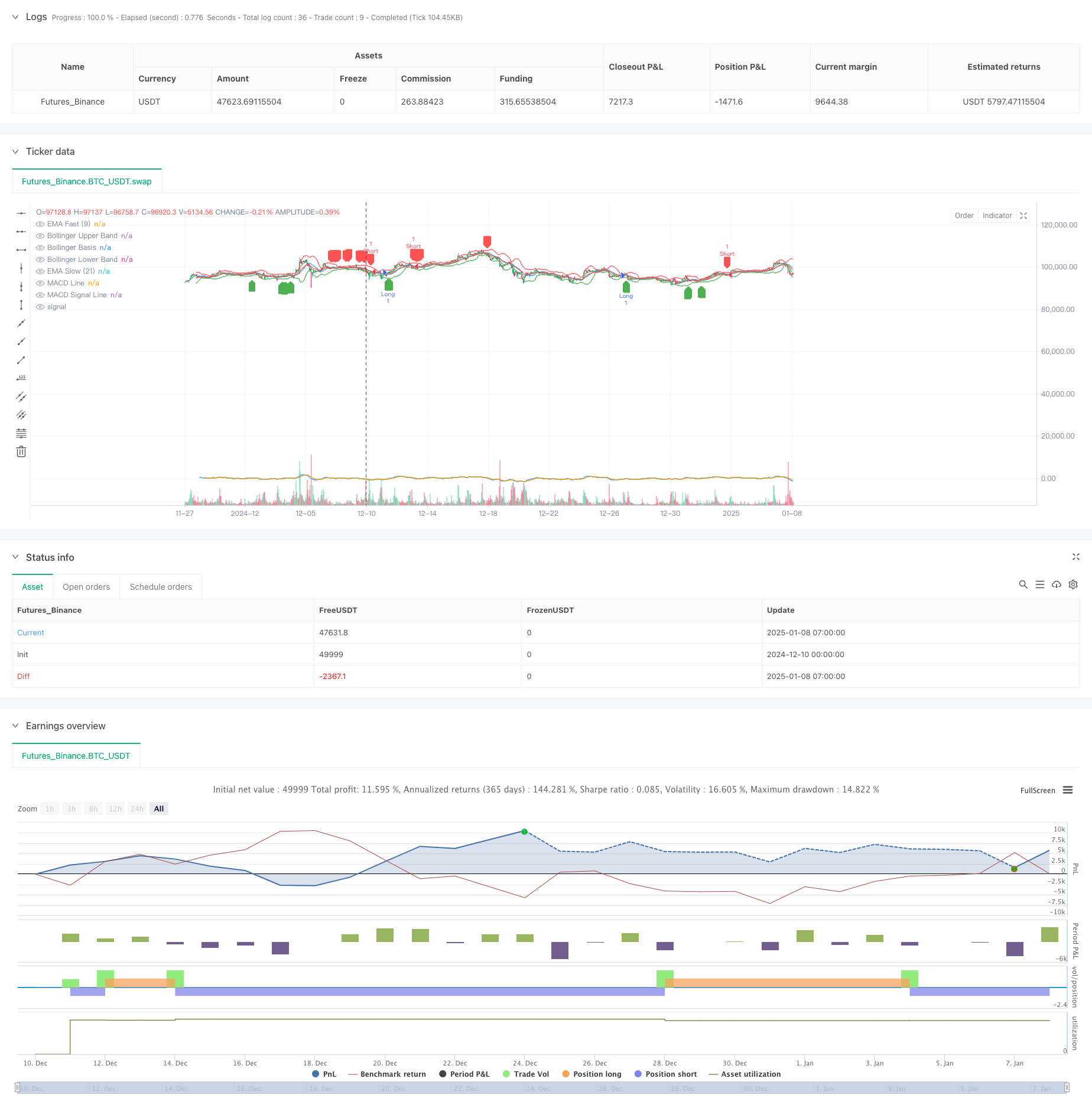

/*backtest

start: 2024-12-10 00:00:00

end: 2025-01-08 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":49999}]

*/

//@version=5

strategy("Optimized Advanced Strategy", overlay=true)

// Bollinger Bandı

length = input(20, title="Bollinger Band Length")

src = close

mult = input.float(2.0, title="Bollinger Band Multiplier")

basis = ta.sma(src, length)

dev = mult * ta.stdev(src, length)

upper = basis + dev

lower = basis - dev

// RSI

rsi = ta.rsi(close, 14)

// MACD

[macdLine, signalLine, _] = ta.macd(close, 12, 26, 9)

// EMA

emaFast = ta.ema(close, 9)

emaSlow = ta.ema(close, 21)

// ATR

atr = ta.atr(14)

// Fibonacci Seviyeleri

lookback = input(100, title="Fibonacci Lookback Period")

highPrice = ta.highest(high, lookback)

lowPrice = ta.lowest(low, lookback)

fiboLevel618 = lowPrice + (highPrice - lowPrice) * 0.618

fiboLevel382 = lowPrice + (highPrice - lowPrice) * 0.382

fiboLevel786 = lowPrice + (highPrice - lowPrice) * 0.786

// Kullanıcı Ayarlı Stop-Loss ve Take-Profit

stopLossATR = atr * 1.5

takeProfitATR = atr * 3

// İşlem Koşulları

longCondition = (rsi < 55) and (macdLine > signalLine) and (emaFast > emaSlow) and (close >= fiboLevel382 and close <= fiboLevel618)

shortCondition = (rsi > 45) and (macdLine < signalLine) and (emaFast < emaSlow) and (close >= fiboLevel618 and close <= fiboLevel786)

// İşlem Girişleri

if (longCondition)

strategy.entry("Long", strategy.long, stop=close - stopLossATR, limit=close + takeProfitATR, comment="LONG SIGNAL")

if (shortCondition)

strategy.entry("Short", strategy.short, stop=close + stopLossATR, limit=close - takeProfitATR, comment="SHORT SIGNAL")

// Bollinger Bandını Çizdir

plot(upper, color=color.red, title="Bollinger Upper Band")

plot(basis, color=color.blue, title="Bollinger Basis")

plot(lower, color=color.green, title="Bollinger Lower Band")

// Fibonacci Seviyelerini Çizdir

// line.new(x1=bar_index[1], y1=fiboLevel382, x2=bar_index, y2=fiboLevel382, color=color.blue, width=1, style=line.style_dotted)

// line.new(x1=bar_index[1], y1=fiboLevel618, x2=bar_index, y2=fiboLevel618, color=color.orange, width=1, style=line.style_dotted)

// line.new(x1=bar_index[1], y1=fiboLevel786, x2=bar_index, y2=fiboLevel786, color=color.purple, width=1, style=line.style_dotted)

// Göstergeleri Görselleştir

plot(macdLine, color=color.blue, title="MACD Line")

plot(signalLine, color=color.orange, title="MACD Signal Line")

plot(emaFast, color=color.green, title="EMA Fast (9)")

plot(emaSlow, color=color.red, title="EMA Slow (21)")

// İşlem İşaretleri

plotshape(series=longCondition, location=location.belowbar, color=color.green, style=shape.labelup, title="Long Entry")

plotshape(series=shortCondition, location=location.abovebar, color=color.red, style=shape.labeldown, title="Short Entry")

- Tiada Upper Wick Bullish Candle Breakout Strategi

- Strategi Dagangan Trend Trend Stop-Loss Dinamik Berbilang Penunjuk

- Strategi Dagangan Komprehensif Multi-Indikator: Gabungan sempurna Momentum, Overbought/Oversold, dan Volatility

- Strategi Crossover Purata Bergerak Eksponensial Berbilang Tempoh dengan Sistem Cadangan Perdagangan Pilihan

- Strategi Penangkapan Momentum Emas: Sistem Crossover Purata Bergerak Eksponensial Berbilang Jangka Masa

- Trend Indikator Multi-Teknik Mengikuti Strategi dengan Penapis Momentum RSI

- Trend Multi-EMA Mengikut Strategi dengan Sasaran ATR Dinamik

- Strategi Jualan Pendek Jangka Pendek untuk Pasangan Mata Wang Likuiditi Tinggi

- Sistem Perdagangan Sinergis Indikator Multi-Teknik

- Strategi Dagangan Dinamis Beradaptasi Indikator Multi-Teknik (MTDAT)

- Trend Crossover Multi-EMA Berikutan Strategi Dagangan Kuantitatif

- Strategi Perdagangan RSI yang bertindih dengan penunjuk pelbagai peringkat

- Bollinger Bands dan Fibonacci Intraday Trend Mengikut Strategi

- Trend Dinamik Berikutan Strategi Saluran Rata-rata Bergerak Berganda dengan Sistem Pengurusan Risiko

- Trend mengambil keuntungan/berhenti kehilangan pelbagai mod mengikut strategi berdasarkan EMA, Ribbon Madrid dan Saluran Donchian

- Sistem Pengesanan Divergensi Harga RSI Dinamis dan Strategi Dagangan Adaptif

- Trend Berbilang Dimensi Mengikut Strategi Perdagangan Piramid

- Triple Bottom Rebound Momentum Strategy Terobosan

- Dual Timeframe Trend Reversal Candlestick Pattern Strategi Dagangan Kuantitatif

- Trend Harga-Volume Frekuensi Tinggi Berikutan dengan Analisis Volume Strategi Penyesuaian

- Strategi Momentum Trend Harga-Jumlah yang Dipertingkatkan

- Strategi silang purata bergerak pintar dengan sistem pengurusan keuntungan / kerugian dinamik

- Strategi Dagangan Penembusan Multi-MA

- Adaptive Momentum Mean-Reversion Crossover Strategy

- Sistem Dagangan Trend EMA Beradaptif Dua Arah dengan Strategi Optimum Dagangan Berbalik