金叉动量捕捉策略:多重时间框架指数移动平均线交叉系统

Author: ChaoZhang, Date: 2024-07-31 15:00:12Tags: EMAMACDRSISMAATR

概述

金叉动量捕捉策略是一种基于多重时间框架分析的交易系统,利用三条指数移动平均线(EMA)的交叉来识别市场趋势和潜在的交易机会。该策略结合了短期(9周期)、中期(26周期)和长期(55周期)EMA,通过观察它们之间的相对位置和交叉情况来判断市场动量和趋势的变化。策略的核心在于在较高时间框架确定整体趋势方向,然后在较低时间框架寻找精确的入场和出场点,从而提高交易的成功率和盈利能力。

策略原理

多重时间框架分析:

- 在较高时间框架(如日线或4小时线)上分析EMA 9、EMA 26和EMA 55的走势,确定整体市场趋势。

- 如果EMA 55在高时间框架上呈上升趋势,则视为牛市环境;如果呈下降趋势,则视为熊市环境。

低时间框架执行:

- 在确定高时间框架趋势后,转向较低时间框架(如15分钟或1小时)寻找具体的交易信号。

- 买入信号:当EMA 9从下方穿过EMA 26,且两者都位于EMA 55上方时,产生买入信号。

- 卖出信号:当EMA 9从上方穿过EMA 26,且两者都位于EMA 55下方时,产生卖出信号。

信号确认:

- 买入确认:除了EMA交叉外,还需要EMA 9和EMA 26都位于EMA 55上方,并且与高时间框架的牛市趋势一致。

- 卖出确认:除了EMA交叉外,还需要EMA 9和EMA 26都位于EMA 55下方,并且与高时间框架的熊市趋势一致。

代码实现:

- 使用Pine Script语言编写,可在交易视图平台上运行。

- 通过request.security()函数实现多时间框架数据的获取和分析。

- 使用ta.crossover()和ta.crossunder()函数检测EMA的交叉情况。

- 通过strategy.entry()函数执行买入和卖出操作。

策略优势

趋势跟踪:通过结合多个时间框架的EMA,策略能够有效捕捉市场的主要趋势,减少逆势交易的风险。

动量捕捉:EMA交叉信号有助于及时发现市场动量的变化,使交易者能够在趋势初期进场。

信号过滤:要求EMA 9和EMA 26相对于EMA 55的特定位置,可以过滤掉一些潜在的虚假信号。

灵活性:策略允许用户自定义EMA的时间框架,可以根据不同的交易品种和个人偏好进行调整。

客观性:基于明确的数学指标和规则,减少了主观判断带来的偏差。

自动化潜力:策略逻辑清晰,易于编程实现,具有良好的自动化交易潜力。

策略风险

滞后性:EMA本质上是滞后指标,可能在快速变化的市场中反应不够迅速。

假突破:在震荡市场中,可能会出现频繁的假突破信号,导致过度交易。

趋势依赖:在无明显趋势的横盘市场中,策略的表现可能不佳。

参数敏感性:EMA的周期选择对策略性能有显著影响,不同市场可能需要不同的参数设置。

过度依赖技术分析:忽视基本面和其他市场因素可能导致误判。

回撤风险:在趋势反转时,策略可能无法及时识别,导致较大回撤。

策略优化方向

引入额外过滤器:

- 考虑加入成交量指标,确保交易信号得到足够的成交量支持。

- 结合相对强弱指数(RSI)或随机指标(Stochastic)等动量指标,进一步确认趋势强度。

动态参数调整:

- 实现EMA周期的动态调整,根据市场波动性自动优化参数。

- 可以考虑使用自适应移动平均线(AMA)替代传统EMA,以更好地适应不同市场条件。

止损和获利策略改进:

- 引入跟踪止损,如基于ATR(平均真实范围)的动态止损。

- 实现部分利润锁定机制,在趋势中途获利。

市场环境识别:

- 开发算法识别当前是趋势市还是震荡市,在不同市场环境下采用不同的交易策略。

多因子模型:

- 将EMA交叉策略作为多因子模型中的一个组成部分,结合其他技术和基本面因子。

机器学习优化:

- 使用机器学习算法优化参数选择和信号生成过程。

- 探索深度学习模型,如LSTM网络,预测EMA的未来走势。

总结

金叉动量捕捉策略是一个结合了多重时间框架分析和EMA交叉技术的综合交易系统。通过在高时间框架确定整体趋势,并在低时间框架寻找精确入场点,该策略旨在提高交易的准确性和盈利能力。虽然存在一些固有的风险,如滞后性和假突破,但通过适当的风险管理和持续优化,该策略有潜力成为一个强大的交易工具。未来的优化方向包括引入额外的技术指标、实现动态参数调整、改进止损策略以及探索机器学习应用等。总的来说,这是一个值得进一步研究和改进的策略框架,特别适合那些希望在趋势跟踪和动量交易之间寻求平衡的交易者。

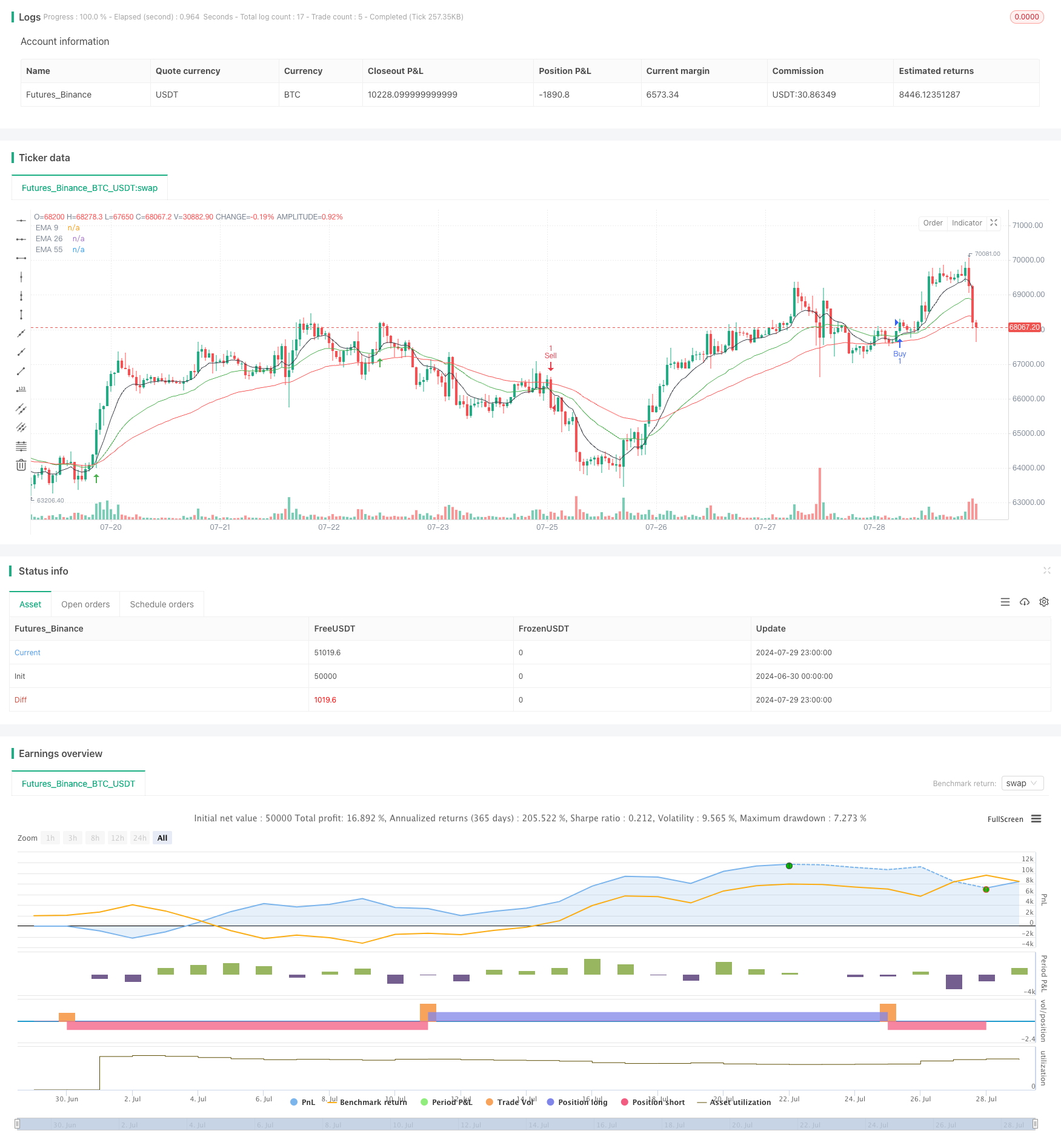

/*backtest

start: 2024-06-30 00:00:00

end: 2024-07-30 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Golden Crossover", overlay=true)

// Define EMA lengths

ema9_length = 9

ema26_length = 26

ema55_length = 55

// Input parameters

timeFrame9 = input.timeframe('', 'Time Frame - EMA 9')

timeFrame26 = input.timeframe('', 'Time Frame - EMA 26')

timeFrame55 = input.timeframe('', 'Time Frame - EMA 55')

// Request data from specified time frames

ema9 = request.security(syminfo.tickerid, timeFrame9, ta.ema(close, ema9_length))

ema26 = request.security(syminfo.tickerid, timeFrame26, ta.ema(close, ema26_length))

ema55 = request.security(syminfo.tickerid, timeFrame55, ta.ema(close, ema55_length))

// Plot EMAs on the chart

plot(ema9, color=color.black, title="EMA 9")

plot(ema26, color=color.green, title="EMA 26")

plot(ema55, color=color.red, title="EMA 55")

// Define buy condition

buy_condition = ta.crossover(ema9, ema26) and ema26 > ema55 //and ema26 > ema55 // (We can activate additional condition to get more accurate signals)

// Define sell condition

sell_condition = ta.crossunder(ema9, ema26) and (ema26 < ema55) //and ema26 < ema55 // (We can activate additional condition to get more accurate signals)

// Execute buy and sell orders

if (buy_condition)

strategy.entry("Buy", strategy.long)

if (sell_condition)

strategy.entry("Sell", strategy.short)

// Optional: Plot buy and sell signals on the chart

plotshape(series=buy_condition, location=location.belowbar, color=color.green, style=shape.arrowup, title="Buy")

plotshape(series=sell_condition, location=location.abovebar, color=color.red, style=shape.arrowdown, title="Sell")

- 多均线趋势跟踪与ATR动态目标策略

- 多重技术指标趋势跟踪与动量RSI过滤交易策略

- 短线做空高流通货币对策略

- 多周期指数移动平均交叉策略与期权交易建议系统

- 双EMA指标智能交叉交易系统与动态止盈止损策略

- 基于EMA均线波动带的多周期趋势跟踪交易系统

- 无上引线看涨K线突破策略

- 多指标动态止损动量趋势交易策略

- 多指标趋势动量交易策略:基于布林带、斐波那契和ATR的优化量化交易系统

- 交易量动态调整DCA策略

- EMA MACD 动量跟踪策略

- 动态仓位管理RSI超买反转策略

- RSI多区间交易策略

- 动态趋势跟踪策略与机器学习增强型风险管理

- 交叉均线与平安蜡烛动量策略

- 双均线交叉日内盈利目标策略

- 移动平均交叉动态止盈止损策略

- MACD-ATR-EMA 多重指标动态趋势跟踪策略

- RSI动量背离突破策略

- 多指标协同长线交易策略

- 三重超级趋势交叉策略

- 基于多维度动态云图的Ichimoku高级多周期交易策略

- 双均线动量交易策略:基于时间优化的趋势跟踪系统

- 增强型EMA/WMA交叉策略与综合退出条件

- Supertrend和EMA交叉量化交易策略

- EMA, SMA, 均线交叉, 动量指标

- SMA, FVG, SMA交叉策略与公平价值缺口回调结合的综合交易系统

- 动态支撑阻力突破均线交叉策略

- 动态趋势追踪与精准止盈止损策略

- 一目均衡图趋势跟踪与支撑阻力策略