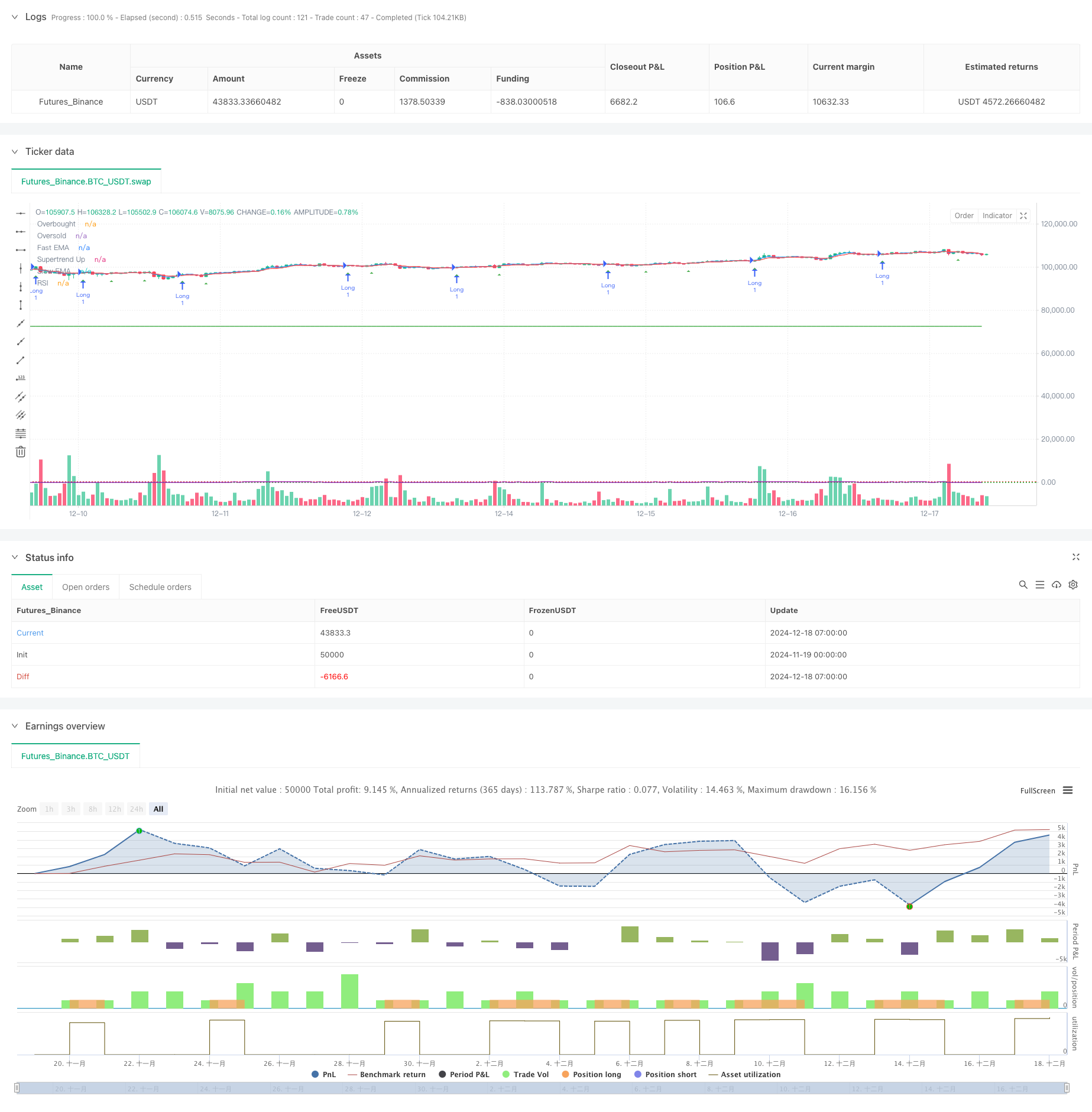

概述

这是一个结合了多个技术指标的趋势跟踪策略,主要使用了快慢指数移动平均线(EMA)交叉、Supertrend趋势指标以及相对强弱指标(RSI)来识别交易机会。该策略通过指标的有机结合,在趋势跟踪的基础上增加了动量过滤,同时利用ATR动态调整止损止盈位置,实现了一个完整的交易系统。

策略原理

策略采用了三重过滤机制来确定交易信号: 1. EMA交叉系统用于捕捉短期趋势变化,当快速EMA上穿慢速EMA时产生做多信号,下穿时产生做空信号。 2. Supertrend指标基于ATR计算动态支撑/阻力线,用于确认整体趋势方向。只有当价格位于Supertrend线上方时才允许做多,位于线下方时才允许做空。 3. RSI指标用于过滤过度买入或卖出的市场状态。在RSI未达到超买区域时才允许做多,未达到超卖区域时才允许做空。

策略还包含了基于ATR的动态止损止盈系统,可以根据市场波动性自动调整风险管理参数。同时通过时间过滤器限制交易时间段,以避免低流动性期间的交易。

策略优势

- 多重技术指标的结合提供了更可靠的交易信号,避免了单一指标可能带来的虚假信号。

- 动态的止损止盈设置能够适应不同的市场波动状况,在波动性较大时给予交易更大的呼吸空间。

- RSI过滤机制有效降低了在市场极端状态下入场的风险。

- 时间过滤功能允许交易者专注于特定的交易时段,避免低效率时段的交易。

策略风险

- 多重过滤条件可能导致错过一些潜在的交易机会。

- 在快速波动的市场中,止损位可能被轻易触及。

- 参数优化过度可能导致过拟合问题。

- 高频交易可能带来较高的交易成本。

策略优化方向

- 可以考虑增加成交量指标作为辅助确认。

- 引入自适应的参数调整机制,使策略能够更好地适应不同市场环境。

- 加入趋势强度过滤器,以避免在弱趋势市场中过度交易。

- 开发更智能的仓位管理系统,根据市场状况动态调整持仓比例。

总结

该策略通过结合多个技术指标和过滤条件,构建了一个相对完整的交易系统。其核心优势在于多重确认机制和动态风险管理,但同时也需要注意参数优化和交易成本等问题。通过持续优化和改进,该策略有望在不同市场环境下保持稳定的表现。

策略源码

/*backtest

start: 2024-11-19 00:00:00

end: 2024-12-18 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title="Supertrend + EMA Crossover with RSI Filter", shorttitle="ST_EMA_RSI", overlay=true)

// Input parameters for EMA

fastEMA = input.int(3, title="Fast EMA Period", minval=1)

slowEMA = input.int(6, title="Slow EMA Period", minval=1)

atrLength = input.int(3, title="ATR Length", minval=1)

// Using a fixed multiplier for Supertrend calculation

stMultiplier = 1

// Stop loss and take profit multipliers

stopLossATR = input.float(2.5, title="Stop Loss ATR Multiplier", minval=0.1, step=0.1)

takeProfitATR = input.float(4, title="Take Profit ATR Multiplier", minval=0.1, step=0.1)

// RSI inputs

rsiLength = input.int(10, title="RSI Length", minval=1)

rsiOverbought = input.float(65, title="RSI Overbought Level", minval=50.0, maxval=100.0)

rsiOversold = input.float(30.0, title="RSI Oversold Level", minval=0.0, maxval=50.0)

// Declare the RSI plot toggle input as a global variable

bool rsiPlotEnabled = input.bool(true, title="Show RSI in separate panel")

// Time filter inputs

i_startTime = input(title="Start Filter", defval=timestamp("01 Jan 2023 13:30 +0000"), group="Time Filter", tooltip="Start date & time to begin searching for setups")

i_endTime = input(title="End Filter", defval=timestamp("28 Apr 2099 19:30 +0000"), group="Time Filter", tooltip="End date & time to stop searching for setups")

// Date/time filtering logic

inDateRange = true

// Calculate EMAs

fastEMALine = ta.ema(close, fastEMA)

slowEMALine = ta.ema(close, slowEMA)

// Calculate ATR

atr = ta.atr(atrLength)

// Calculate Supertrend using fixed multiplier

up = high - (stMultiplier * atr)

dn = low + (stMultiplier * atr)

var float trendUp = na

var float trendDown = na

var int trend = na

trendUp := na(trendUp[1]) ? up : (close[1] > trendUp[1] ? math.min(up, trendUp[1]) : up)

trendDown := na(trendDown[1]) ? dn : (close[1] < trendDown[1] ? math.max(dn, trendDown[1]) : dn)

trend := close > nz(trendUp[1]) ? 1 : close < nz(trendDown[1]) ? -1 : nz(trend[1], 1)

supertrend = trend == 1 ? trendUp : trendDown

// Calculate RSI

myRSI = ta.rsi(close, rsiLength)

// Entry conditions with RSI filter

longEntryCondition = ta.crossover(fastEMALine, slowEMALine) and (trend == 1) and (myRSI < rsiOverbought)

shortEntryCondition = ta.crossunder(fastEMALine, slowEMALine) and (trend == -1) and (myRSI > rsiOversold)

// Strategy entries

if inDateRange and longEntryCondition and strategy.position_size <= 0

strategy.entry("Long", strategy.long)

if inDateRange and shortEntryCondition and strategy.position_size >= 0

strategy.entry("Short", strategy.short)

// Stops and targets

if strategy.position_size > 0

longStopLoss = strategy.position_avg_price - stopLossATR * atr

longTakeProfit = strategy.position_avg_price + takeProfitATR * atr

strategy.exit("Long SL/TP", "Long", stop=longStopLoss, limit=longTakeProfit)

if strategy.position_size < 0

shortStopLoss = strategy.position_avg_price + stopLossATR * atr

shortTakeProfit = strategy.position_avg_price - takeProfitATR * atr

strategy.exit("Short SL/TP", "Short", stop=shortStopLoss, limit=shortTakeProfit)

// Plot EMAs and Supertrend

plot(fastEMALine, title="Fast EMA", color=color.new(color.blue, 0))

plot(slowEMALine, title="Slow EMA", color=color.new(color.red, 0))

plot(trend == 1 ? supertrend : na, title="Supertrend Up", color=color.green, style=plot.style_linebr)

plot(trend == -1 ? supertrend : na, title="Supertrend Down", color=color.red, style=plot.style_linebr)

// Plot RSI and hlines

plot(rsiPlotEnabled ? myRSI : na, title="RSI", color=color.new(color.purple, 0))

hline(rsiOverbought, "Overbought", color=color.red, linestyle=hline.style_dotted)

hline(rsiOversold, "Oversold", color=color.green, linestyle=hline.style_dotted)

// Plot entry signals

plotshape(longEntryCondition, title="Long Entry Signal", style=shape.triangleup, location=location.belowbar, size=size.tiny, color=color.new(color.green, 0))

plotshape(shortEntryCondition, title="Short Entry Signal", style=shape.triangledown, location=location.abovebar, size=size.tiny, color=color.new(color.red, 0))

相关推荐