Fukuiz Octa-EMA + Ichimoku

Autora:ChaoZhang, Data: 2022-05-16 17:43:51Tags:EMA

Esta estratégia baseia-se na EMA de 8 períodos diferentes e na Ichimoku Cloud que funciona melhor em 1 hora 4 horas e no período diário.

Uma breve introdução ao Ichimoku O Ichimoku Cloud é uma coleção de indicadores técnicos que mostram níveis de suporte e resistência, bem como impulso e direção da tendência.

Uma breve introdução à EMA Uma média móvel exponencial (EMA) é um tipo de média móvel (MA) que coloca um maior peso e significância nos pontos de dados mais recentes.

Como usar A estratégia dará pontos de entrada em si, você pode monitorar e tirar lucro manualmente (recomendado), ou você pode usar a configuração de saída.

EMA (Color) = Tendência de alta EMA (Gray) = Tendência de baixa

Condição Comprar = Todas Ema (cor) acima da nuvem. VENDER= Todas as Ema ficam cinzentas.

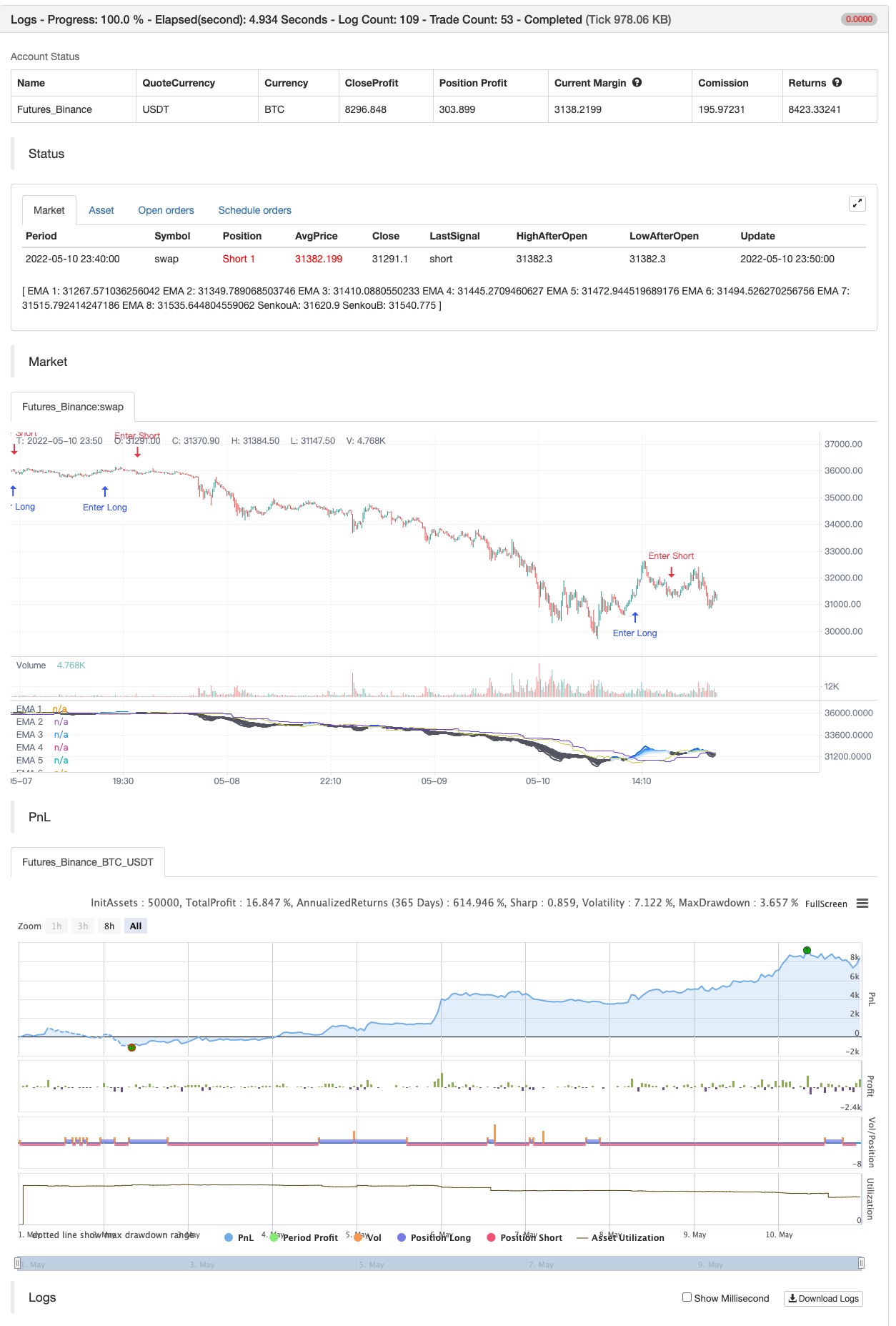

backtest

/*backtest

start: 2022-05-01 00:00:00

end: 2022-05-10 23:59:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//Fukuiz

//strategy(title='Fukuiz Octa-EMA + Ichimoku', shorttitle='Fuku octa strategy', overlay=true, process_orders_on_close=true,

// default_qty_type= strategy.cash , default_qty_value=1000, currency=currency.USD, initial_capital=10000 ,commission_type = strategy.commission.percent,commission_value=0.25)

//OCTA EMA ##################################################

// Functions

f_emaRibbon(_src, _e1, _e2, _e3, _e4, _e5, _e6, _e7, _e8) =>

_ema1 = ta.ema(_src, _e1)

_ema2 = ta.ema(_src, _e2)

_ema3 = ta.ema(_src, _e3)

_ema4 = ta.ema(_src, _e4)

_ema5 = ta.ema(_src, _e5)

_ema6 = ta.ema(_src, _e6)

_ema7 = ta.ema(_src, _e7)

_ema8 = ta.ema(_src, _e8)

[_ema1, _ema2, _ema3, _ema4, _ema5, _ema6, _ema7, _ema8]

showRibbon = input(true, 'Show Ribbon (EMA)')

ema1Len = input(5, title='EMA 1 Length')

ema2Len = input(11, title='EMA 2 Length')

ema3Len = input(15, title='EMA 3 Length')

ema4Len = input(18, title='EMA 4 Length')

ema5Len = input(21, title='EMA 5 Length')

ema6Len = input(24, title='EMA 6 Length')

ema7Len = input(28, title='EMA 7 Length')

ema8Len = input(34, title='EMA 8 Length')

[ema1, ema2, ema3, ema4, ema5, ema6, ema7, ema8] = f_emaRibbon(close, ema1Len, ema2Len, ema3Len, ema4Len, ema5Len, ema6Len, ema7Len, ema8Len)

//Plot

ribbonDir = ema8 < ema2

p1 = plot(ema1, color=showRibbon ? ribbonDir ? #1573d4 : color.new(#5d606b, 15) : na, linewidth=2, title='EMA 1')

p2 = plot(ema2, color=showRibbon ? ribbonDir ? #3096ff : color.new(#5d606b, 15) : na, linewidth=2, title='EMA 2')

plot(ema3, color=showRibbon ? ribbonDir ? #57abff : color.new(#5d606b, 15) : na, linewidth=2, title='EMA 3')

plot(ema4, color=showRibbon ? ribbonDir ? #85c2ff : color.new(#5d606b, 15) : na, linewidth=2, title='EMA 4')

plot(ema5, color=showRibbon ? ribbonDir ? #9bcdff : color.new(#5d606b, 30) : na, linewidth=2, title='EMA 5')

plot(ema6, color=showRibbon ? ribbonDir ? #b3d9ff : color.new(#5d606b, 30) : na, linewidth=2, title='EMA 6')

plot(ema7, color=showRibbon ? ribbonDir ? #c9e5ff : color.new(#5d606b, 30) : na, linewidth=2, title='EMA 7')

p8 = plot(ema8, color=showRibbon ? ribbonDir ? #dfecfb : color.new(#5d606b, 30) : na, linewidth=2, title='EMA 8')

fill(p1, p2, color.new(#1573d4, 85))

fill(p2, p8, color.new(#1573d4, 85))

//ichimoku##################################################

//color

colorblue = #3300CC

colorred = #993300

colorwhite = #FFFFFF

colorgreen = #CCCC33

colorpink = #CC6699

colorpurple = #6633FF

//switch

switch1 = input(false, title='Chikou')

switch2 = input(false, title='Tenkan')

switch3 = input(false, title='Kijun')

middleDonchian(Length) =>

lower = ta.lowest(Length)

upper = ta.highest(Length)

math.avg(upper, lower)

//Functions

conversionPeriods = input.int(9, minval=1)

basePeriods = input.int(26, minval=1)

laggingSpan2Periods = input.int(52, minval=1)

displacement = input.int(26, minval=1)

Tenkan = middleDonchian(conversionPeriods)

Kijun = middleDonchian(basePeriods)

xChikou = close

SenkouA = middleDonchian(laggingSpan2Periods)

SenkouB = (Tenkan[basePeriods] + Kijun[basePeriods]) / 2

//Plot

A = plot(SenkouA[displacement], color=color.new(colorpurple, 0), title='SenkouA')

B = plot(SenkouB, color=color.new(colorgreen, 0), title='SenkouB')

plot(switch1 ? xChikou : na, color=color.new(colorpink, 0), title='Chikou', offset=-displacement)

plot(switch2 ? Tenkan : na, color=color.new(colorred, 0), title='Tenkan')

plot(switch3 ? Kijun : na, color=color.new(colorblue, 0), title='Kijun')

fill(A, B, color=color.new(colorgreen, 90), title='Ichimoku Cloud')

//Buy and Sell signals

fukuiz = math.avg(ema2, ema8)

white = ema2 > ema8

gray = ema2 < ema8

buycond = white and white[1] == 0

sellcond = gray and gray[1] == 0

bullish = ta.barssince(buycond) < ta.barssince(sellcond)

bearish = ta.barssince(sellcond) < ta.barssince(buycond)

buy = bearish[1] and buycond and fukuiz > SenkouA[displacement] and fukuiz > SenkouB

sell = bullish[1] and sellcond and fukuiz > SenkouA[displacement] and fukuiz > SenkouB

sell2=ema2 < ema8

buy2 = white and fukuiz > SenkouA[displacement] and fukuiz > SenkouB

//$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$

//Back test

startYear = input.int(defval=2017, title='Start Year', minval=2000, maxval=3000)

startMonth = input.int(defval=1, title='Start Month', minval=1, maxval=12)

startDay = input.int(defval=1, title='Start Day', minval=1, maxval=31)

endYear = input.int(defval=2023, title='End Year', minval=2000 ,maxval=3000)

endMonth = input.int(defval=12, title='End Month', minval=1, maxval=12)

endDay = input.int(defval=31, title='End Day', minval=1, maxval=31)

start = timestamp(startYear, startMonth, startDay, 00, 00)

end = timestamp(endYear, endMonth, endDay, 23, 59)

period() => time >= start and time <= end ? true : false

if buy2

strategy.entry("Enter Long", strategy.long)

else if sell2

strategy.entry("Enter Short", strategy.short)

- Sistema de reconhecimento de impulso de tendência e de negociação stop-loss multi-EMA

- Estratégia de confirmação da tendência de volume dupla da EMA para negociação quantitativa

- O valor da posição em risco deve ser calculado de acordo com o método de cálculo da posição em risco, de acordo com o método de cálculo da posição em risco.

- Tendência de adaptação dinâmica de vários períodos reforçada na sequência do sistema de negociação

- Estratégia quantitativa de reversão da média de Bollinger reforçada

- Estratégia de negociação quantitativa cruzada da EMA

- Tendência de cruzamento multi-EMA Seguindo estratégia com otimização dinâmica de stop-loss e take-profit

- O risco de risco de risco de risco de risco de risco

- Sistema de negociação de tendência adaptativa de múltiplas estratégias

- Sistema de negociação de média móvel de vários níveis com reconhecimento de padrões de velas

- Estratégia de negociação de tendência de impulso da EMA com vários prazos

- ZigZag baseado em momento

- VuManChu Cipher B + Divergências Estratégia

- Conceito Dual SuperTrend

- Super Scalper

- Testes de regresso - Indicador

- Trendelicious

- O assassino do Sma BTC.

- Modelo de alertas ML

- Progressão de Fibonacci com quebras

- RSI MTF Ob+Os

- Ob+Os do MTF CCI

- MACD mais inteligente

- Estratégia R5.1 do OCC

- Bem-vindo ao mercado de ursos.

- Sidboss

- Pontos pivô altos e baixos Multi Time Frame

- Ghosts Tracking Trends é uma base de dados estratégica

- O Ghosts Trends está seguindo estratégias do banco de dados

- Estratégias de rastreamento de tendências de fantasmas

- Oscilador Arco-íris