多周期均线趋势动量跟踪交易策略

Author: ChaoZhang, Date: 2024-11-12 16:35:41Tags: EMAATRKCSMALR

概述

这是一个结合了多周期均线趋势跟踪和动量分析的量化交易策略。策略主要通过分析20、50、100和200日指数移动平均线(EMA)的排列组合,结合日线和周线的动量指标进行交易。策略采用ATR止损方式,在EMA对齐且动量条件满足时入场,通过设定ATR倍数的止损和获利目标来管理风险。

策略原理

策略的核心逻辑包括以下几个关键部分: 1. EMA对齐系统:要求20日EMA位于50日EMA之上,50日EMA位于100日EMA之上,100日EMA位于200日EMA之上,形成完美的多头排列。 2. 动量确认系统:分别在日线和周线时间周期计算基于线性回归的自定义动量指标。该动量指标通过对价格与Keltner通道中轴的偏离程度进行线性回归来衡量。 3. 回调入场系统:价格需要回调到20日EMA的指定百分比范围内才允许入场,避免追高。 4. 风险管理系统:使用ATR的倍数设置止损和获利目标,默认止损为1.5倍ATR,获利目标为3倍ATR。

策略优势

- 多重确认机制:通过均线排列、多周期动量和价格回调等多重条件确认,降低虚假信号。

- 科学的风险管理:采用ATR动态调整止损和获利目标,适应市场波动性变化。

- 趋势跟踪与动量结合:既可以抓住大趋势,又能在趋势中把握较好的入场时机。

- 可定制性强:策略的各个参数都可以根据不同市场特点进行优化调整。

- 多周期分析:通过日线和周线的配合,提高信号的可靠性。

策略风险

- 均线滞后性:EMA作为滞后指标可能导致入场时机偏晚。建议结合其他领先指标。

- 震荡市不适用:策略在横盘震荡市场可能频繁产生虚假信号。建议加入市场环境过滤器。

- 回撤风险:虽然有ATR止损,但在极端行情下仍可能面临较大回撤。可以考虑设置最大回撤限制。

- 参数敏感性:策略效果对参数设置较为敏感。建议进行充分的参数优化测试。

策略优化方向

- 市场环境识别:加入波动率指标或趋势强度指标,在不同市场环境下使用不同的参数组合。

- 入场优化:可以增加RSI等摆动指标,在回调区域内寻找更精确的入场点。

- 动态参数调整:根据市场波动性自动调整ATR倍数和回调范围。

- 加入成交量分析:通过成交量确认趋势强度,提高信号可靠性。

- 引入机器学习:使用机器学习算法动态优化参数,提高策略适应性。

总结

这是一个设计合理、逻辑严谨的趋势跟踪策略。通过多重技术指标的配合使用,既保证了策略的稳健性,又提供了良好的风险管理机制。策略的可定制性强,可以根据不同市场特点进行优化。虽然存在一些固有的风险,但通过建议的优化方向可以进一步提升策略的表现。总的来说,这是一个值得尝试和深入研究的量化交易策略。

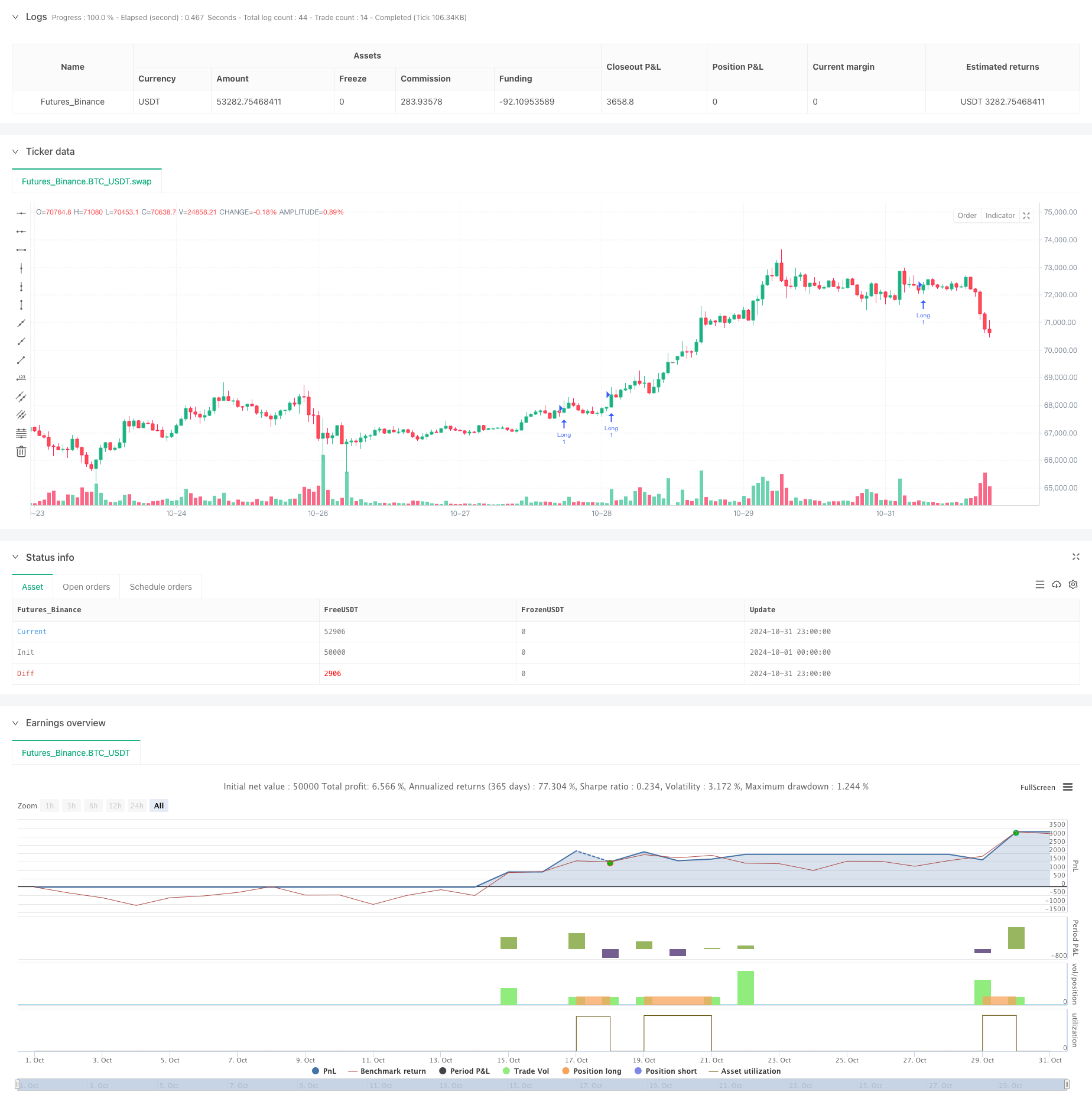

/*backtest

start: 2024-10-01 00:00:00

end: 2024-10-31 23:59:59

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Swing Trading with EMA Alignment and Custom Momentum", overlay=true)

// User inputs for customization

atrLength = input.int(14, title="ATR Length", minval=1)

atrMultiplierSL = input.float(1.5, title="Stop-Loss Multiplier (ATR)", minval=0.1) // Stop-loss at 1.5x ATR

atrMultiplierTP = input.float(3.0, title="Take-Profit Multiplier (ATR)", minval=0.1) // Take-profit at 3x ATR

pullbackRangePercent = input.float(1.0, title="Pullback Range (%)", minval=0.1) // 1% range for pullback around 20 EMA

lengthKC = input.int(20, title="Length for Keltner Channels (Momentum Calculation)", minval=1)

// EMA settings

ema20 = ta.ema(close, 20)

ema50 = ta.ema(close, 50)

ema100 = ta.ema(close, 100)

ema200 = ta.ema(close, 200)

// ATR calculation

atrValue = ta.atr(atrLength)

// Custom Momentum Calculation based on Linear Regression for Daily Timeframe

highestHighKC = ta.highest(high, lengthKC)

lowestLowKC = ta.lowest(low, lengthKC)

smaCloseKC = ta.sma(close, lengthKC)

// Manually calculate the average of highest high and lowest low

averageKC = (highestHighKC + lowestLowKC) / 2

// Calculate daily momentum using linear regression

dailyMomentum = ta.linreg(close - (averageKC + smaCloseKC) / 2, lengthKC, 0) // Custom daily momentum calculation

// Fetch weekly data for momentum calculation using request.security()

[weeklyHigh, weeklyLow, weeklyClose] = request.security(syminfo.tickerid, "W", [high, low, close])

// Calculate weekly momentum using linear regression on weekly timeframe

weeklyHighestHighKC = ta.highest(weeklyHigh, lengthKC)

weeklyLowestLowKC = ta.lowest(weeklyLow, lengthKC)

weeklySmaCloseKC = ta.sma(weeklyClose, lengthKC)

weeklyAverageKC = (weeklyHighestHighKC + weeklyLowestLowKC) / 2

weeklyMomentum = ta.linreg(weeklyClose - (weeklyAverageKC + weeklySmaCloseKC) / 2, lengthKC, 0) // Custom weekly momentum calculation

// EMA alignment condition (20 EMA > 50 EMA > 100 EMA > 200 EMA)

emaAligned = ema20 > ema50 and ema50 > ema100 and ema100 > ema200

// Momentum increasing condition (daily and weekly momentum is positive and increasing)

dailyMomentumIncreasing = dailyMomentum > 0 and dailyMomentum > dailyMomentum[1] //and dailyMomentum[1] > dailyMomentum[2]

weeklyMomentumIncreasing = weeklyMomentum > 0 and weeklyMomentum > weeklyMomentum[1] //and weeklyMomentum[1] > weeklyMomentum[2]

// Redefine Pullback condition: price within 1% range of the 20 EMA

upperPullbackRange = ema20 * (1 + pullbackRangePercent / 100)

lowerPullbackRange = ema20 * (1 - pullbackRangePercent / 100)

pullbackToEma20 = (close <= upperPullbackRange) and (close >= lowerPullbackRange)

// Entry condition: EMA alignment and momentum increasing on both daily and weekly timeframes

longCondition = emaAligned and dailyMomentumIncreasing and weeklyMomentumIncreasing and pullbackToEma20

// Initialize stop loss and take profit levels as float variables

var float longStopLevel = na

var float longTakeProfitLevel = na

// Calculate stop loss and take profit levels based on ATR

if (longCondition)

longStopLevel := close - (atrMultiplierSL * atrValue) // Stop loss at 1.5x ATR below the entry price

longTakeProfitLevel := close + (atrMultiplierTP * atrValue) // Take profit at 3x ATR above the entry price

// Strategy execution

if (longCondition)

strategy.entry("Long", strategy.long)

// Exit conditions: Stop-loss at 1.5x ATR and take-profit at 3x ATR

if (strategy.position_size > 0)

strategy.exit("Take Profit/Stop Loss", "Long", stop=longStopLevel, limit=longTakeProfitLevel)

相关内容

- 多重通道动态支撑阻力肯尼通道策略

- 黑天鹅波动与均线交叉动量跟踪策略

- 基于多维度动态云图的Ichimoku高级多周期交易策略

- ML Alerts Template

- 高级多指标趋势确认交易策略

- 动态Keltner通道动量反转策略

- 三重探底反弹突破动量策略

- 多重指标动态自适应调仓ATR波动率策略

- SSL Hybrid

- EMA, SMA, CCI, ATR, 均线完美排列策略与趋势魔法指标自动交易系统

更多内容

- 强化波林格均值回归量化策略

- 动态达瓦斯箱体突破与均线趋势确认交易系统

- EMA双均线交叉动态止盈止损量化交易策略

- 多重EMA交叉趋势跟踪与动态止盈止损优化策略

- 双均线交叉自适应动态止盈止损策略

- 双平台对冲平衡策略

- 双均线交叉动态止盈止损量化策略

- 多重均线趋势强度捕捉与波动获利策略

- 多策略自适应趋势跟踪与突破交易系统

- 多级均线结合蜡烛图形态识别交易系统

- 智能时间周期多空轮动均衡交易策略

- MACD动态趋势量化交易策略进阶版

- 趋势突破交易系统(移动平均线突破策略)

- 基于ATR的多重趋势跟踪策略与止盈止损优化系统

- 基于 RSI 动量和多层级止盈止损的智能自适应交易系统

- 自适应RSI震荡阈值动态交易策略

- RSI与AO协同趋势追踪型量化交易策略

- 适应性趋势动量RSI策略结合均线过滤系统

- 双均线交叉RSI动量策略与风险收益优化系统

- 多重指标交叉动态策略系统:基于EMA、RVI和交易信号的量化交易模型