Estratégia de rastreamento de fuga

Autora:ChaoZhang, Data: 2023-10-17 16:36:49Tags:

Resumo

Esta estratégia usa principalmente o indicador

Estratégia lógica

-

Parâmetros definidos para o indicador

Canal de Donchian , período padrão é 20; -

Definição da média móvel da EMA, período de imposição é 200;

-

Relação risco/recompensa definida, incumprimento é 1,5;

-

Definição dos parâmetros de retração após a ruptura para longo e curto;

-

Registre se a ruptura anterior foi um ponto alto ou baixo;

-

Signais longos: se a ruptura anterior for baixa, o preço rompe acima da faixa superior de Donchian e acima da linha EMA;

-

Signo curto: se a ruptura anterior foi alta, o preço rompe abaixo da faixa inferior de Donchian e abaixo da linha EMA;

-

Após entrada longa, definir stop loss na faixa inferior de Donchian menos 5 pontos, obter lucro na relação risco/recompensa vezes a distância stop loss;

-

Após a entrada curta, definir stop loss na banda superior de Donchian mais 5 pontos, tirar lucro na relação risco/recompensa vezes a distância stop loss.

Desta forma, a estratégia combina a tendência seguindo e a negociação de ruptura, para negociar junto com a tendência principal.

Análise das vantagens

-

Siga a tendência principal, evite negociar contra a tendência.

-

O canal de Donchian como indicador de longo prazo, combinado com o filtro EMA, pode identificar eficazmente a tendência.

-

Parar perdas e obter lucros controla o risco por negociação, limita perdas potenciais.

-

A otimização do rácio risco/recompensa pode aumentar o fator de lucro, buscando retornos excessivos.

-

Parâmetros de backtest flexíveis, podem otimizar parâmetros para diferentes mercados.

Análise de riscos

-

O canal de Donchian e a EMA podem dar sinais errados às vezes.

-

A negociação de breakout pode ser facilmente presa, precisa identificar claramente o contexto da tendência.

-

O stop loss fixo e o take profit não podem ser ajustados com base na volatilidade do mercado.

-

Espaço de otimização limitado para parâmetros, desempenho ao vivo não garantido.

-

Sistemas de negociação vulneráveis a eventos de cisne negro, podem levar a perdas graves.

Orientações de otimização

-

Considere adicionar mais filtros como osciladores para melhorar a qualidade do sinal.

-

Estabelecer um stop loss adaptativo e obter lucros com base na volatilidade do mercado e no ATR.

-

Usar aprendizado de máquina para testar e otimizar parâmetros para se adequar a mercados reais.

-

Otimizar a lógica de entrada com volume ou volatilidade como condição para evitar armadilhas.

-

Combinar com sistemas de tendência ou aprendizado de máquina para criar modelos híbridos de robustez.

Conclusão

Esta estratégia é uma estratégia de rastreamento de breakout, com a lógica de negociação ao longo da tendência principal identificada, e tomando a breakout como sinal de entrada, enquanto define stop loss e take profit para controlar o risco por negociação. A estratégia tem algumas vantagens, mas também espaço para melhorias.

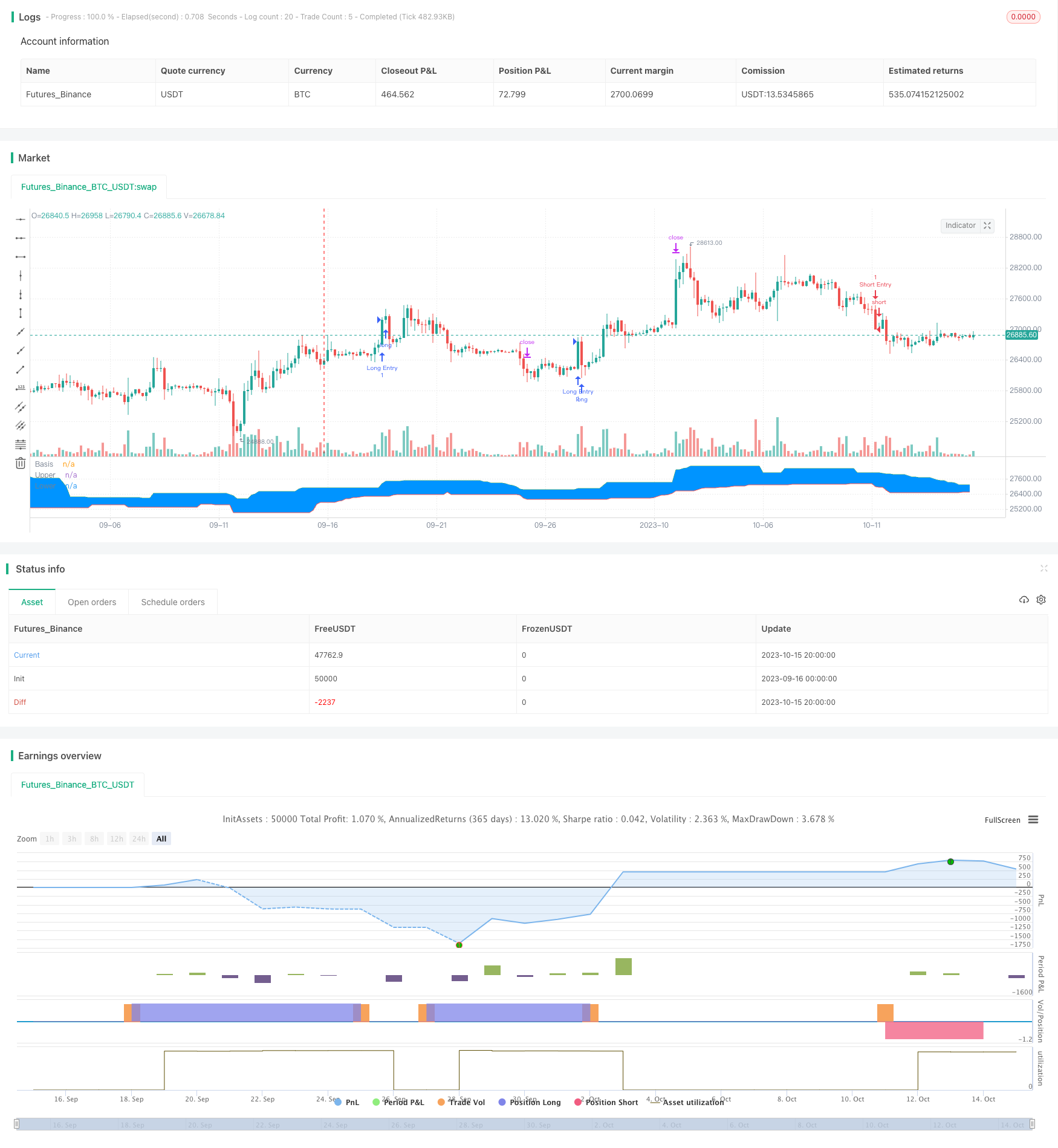

/*backtest

start: 2023-09-16 00:00:00

end: 2023-10-16 00:00:00

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

// Welcome to my second script on Tradingview with Pinescript

// First of, I'm sorry for the amount of comments on this script, this script was a challenge for me, fun one for sure, but I wanted to thoroughly go through every step before making the script public

// Glad I did so because I fixed some weird things and I ended up forgetting to add the EMA into the equation so our entry signals were a mess

// This one was a lot tougher to complete compared to my MACD crossover trend strategy but I learned a ton from it, which is always good and fun

// Also I'll explain the strategy and how I got there through some creative coding(I'm saying creative because I had to figure this stuff out by myself as I couldn't find any reference codes)

// First things first. This is a Donchian Channel Breakout strategy which follows the following rules

// If the price hits the upperband of the Donchian Channel + price is above EMA and the price previously hit the lowerband of the Donchian Channel it's a buy signal

// If the price hits the lowerband of the Donchian Channel + price is below EMA and the price prevbiously hit the upper band of the Donchian Channel it's a sell signal

// Stop losses are set at the lower or upper band with a 0.5% deviation because we are acting as if those two bands are the resistance in this case

// Last but not least(yes, this gave BY FAR the most trouble to code), the profit target is set with a 1.5 risk to reward ratio

// If you have any suggestions to make my code more efficient, I'll be happy to hear so from you

// So without further ado, let's walk through the code

// The first line is basically standard because it makes backtesting so much more easy, commission value is based on Binance futures fees when you're using BNB to pay those fees in the futures market

// strategy(title="Donchian Channels", shorttitle="DC", overlay=true, default_qty_type = strategy.cash, default_qty_value = 150, initial_capital = 1000, currency = currency.USD, commission_type = "percent", commission_value = 0.036)

// The built-in Donchian Channels + an added EMA input which I grouped with the historical bars from the Donchian Channels

length = input(20, minval=1, group = "Indicators")

lower = lowest(length)

upper = highest(length)

basis = avg(upper, lower)

emaInput = input(title = "EMA Input", type = input.integer, defval = 200, minval = 10, maxval = 400, step = 1, group = "Indicators")

// I've made three new inputs, for risk/reward ratio and for the standard pullback deviation. My advise is to not use the pullback inputs as I'm not 100% sure if they work as intended or not

riskreward = input(title = "Risk/Reward Ratio", type = input.float, defval = 1.50, minval = 0.01, maxval = 100, step = 0.01, group = "Risk/Reward")

pullbackLong = input(title = "Distance from Long pullback %", type = input.float, defval = 0.995, minval = 0.001, maxval = 2, step = 0.001, group = "Risk/Reward")

pullbackShort = input(title = "Distance from Short pullback %", type = input.float, defval = 1.005, minval = 0.001, maxval = 2, step = 0.001, group = "Risk/Reward")

// Input backtest range, you can adjust these in the input options, just standard stuff

fromMonth = input(defval = 1, title = "From Month", type = input.integer, minval = 1, maxval = 12, group = "Backtest Date Range")

fromDay = input(defval = 1, title = "From Day", type = input.integer, minval = 1, maxval = 31, group = "Backtest Date Range")

fromYear = input(defval = 2000, title = "From Year", type = input.integer, minval = 1970, group = "Backtest Date Range")

thruMonth = input(defval = 1, title = "Thru Month", type = input.integer, minval = 1, maxval = 12, group = "Backtest Date Range")

thruDay = input(defval = 1, title = "Thru Day", type = input.integer, minval = 1, maxval = 31, group = "Backtest Date Range")

thruYear = input(defval = 2099, title = "Thru Year", type = input.integer, minval = 1970, group = "Backtest Date Range")

// Date variable also standard stuff

inDataRange = (time >= timestamp(syminfo.timezone, fromYear, fromMonth, fromDay, 0, 0)) and (time < timestamp(syminfo.timezone, thruYear, thruMonth, thruDay, 0, 0))

// I had to makes these variables because the system has to remember whether the previous 'breakout' was a high or a low

// Also, because I based my stoploss on the upper/lower band of the indicator I had to find a way to change this value just once without losing the value, that was added, on the next bar

var previousishigh = false

var previousislow = false

var longprofit = 0.0

var shortprofit = 0.0

var stoplossLong = 0.0

var stoplossShort = 0.0

// These are used as our entry variables

emaCheck = ema(close, emaInput)

longcond = high >= upper and close > emaCheck

shortcond = low <= lower and close < emaCheck

// With these two if statements I'm changing the boolean variable above to true, we need this to decide out entry position

if high >= upper

previousishigh := true

if low <= lower

previousislow := true

// Made a last minute change on this part. To clean up our entry signals we don't want our breakouts, while IN a position, to change. This way we do not instantly open a new position, almost always in the opposite direction, upon exiting one

if strategy.position_size > 0 or strategy.position_size < 0

previousishigh := false

previousislow := false

// Strategy inputs

// Long - previous 'breakout' has to be a low, the current price has to be a new high and above the EMA, we're not allowed to be in a position and ofcourse it has to be within our given data for backtesting purposes

if previousislow == true and longcond and strategy.position_size == 0 and inDataRange

strategy.entry("Long Entry", strategy.long, comment = "Entry Long")

stoplossLong := lower * pullbackLong

longprofit := ((((1 - stoplossLong / close) * riskreward) + 1) * close)

strategy.exit("Long Exit", "Long Entry", limit = longprofit, stop = stoplossLong, comment = "Long Exit")

// Short - Previous 'breakout' has to be a high, current price has to be a new low and lowe than the 200EMA, we're not allowed to trade when we're in a position and it has to be within our given data for backtesting purposes

if previousishigh == true and shortcond and strategy.position_size == 0 and inDataRange

strategy.entry("Short Entry", strategy.short, comment = "Entry Short")

stoplossShort := upper * pullbackShort

shortprofit := (close - ((((1 - close / stoplossShort) * riskreward) * close)))

strategy.exit("Short Exit", "Short Entry", limit = shortprofit, stop = stoplossShort, comment = "Short Exit")

// This plots the Donchian Channels on the chart which is just using the built-in Donchian Channels

plot(basis, "Basis", color=color.blue)

u = plot(upper, "Upper", color=color.green)

l = plot(lower, "Lower", color=color.red)

fill(u, l, color=#0094FF, transp=95, title="Background")

// These plots are to show if the variables are working as intended, it's a mess I know but I didn't have any better ideas, they work well enough for me

// plot(previousislow ? close * 0.95 : na, color=color.red, linewidth=2, style=plot.style_linebr)

// plot(previousishigh ? close * 1.05 : na, color=color.green, style=plot.style_linebr)

// plot(longprofit, color=color.purple)

// plot(shortprofit, color=color.silver)

// plot(stoplossLong)

// plot(stoplossShort)

// plot(strategy.position_size)

- Estratégia do sistema de bandas de Bollinger de média móvel dupla

- Estratégia de backtesting de avanço na arquitetura

- Estratégia de fuga baseada no comércio de tartarugas

- A tendência da DEMA a seguir a estratégia

- Algoritmo Estratégia de ruptura do intervalo RSI

- RSI Rising Crypto Trending Estratégia

- EMA Slope Cross Trend Seguindo a Estratégia

- Estratégia de negociação do RSI intradiário TAM

- Estratégia de cruzamento da média móvel exponencial

- Estratégia de cruzamento da média móvel

- Modelo de monitorização de médias móveis duplas

- Estratégia de reversão média baseada no ATR

- Tendência do volume relativo na sequência da estratégia de negociação

- Estratégia de equilíbrio da tendência do MACD

- EMA e estratégia de negociação de Heikin Ashi

- Tendência de seguir uma estratégia de longo prazo

- Estratégia de combinação de padrões de candelabro com vários modelos

- Análise da estratégia de negociação de reversão do canal

- Estratégia de negociação de ligeira reversão de indicador duplo

- Estratégia do surfista