Estratégia de pesca de fundo de regressão linear Vix Fix

Autora:ChaoZhang, Data: 2024-01-30 16:56:39Tags:

Resumo

A ideia central desta estratégia é combinar o indicador Vix Fix e a sua regressão linear para capturar com precisão os fundos do mercado.

Estratégia lógica

- Calcular o indicador Vix Fix, que é bom para avaliar o fundo do mercado

- Aplicar regressão linear em Vix Fix. Quando a cor do histograma de regressão linear fica verde, isso significa que a regressão linear Vix Fix começa a subir, um sinal de compra pode ser desencadeado

- Combinar com as colunas verdes do indicador Vix Fix para confirmar ainda mais o calendário das entradas

- Quando a cor do histograma de regressão linear fica vermelha, significa que a regressão linear Vix Fix começa a diminuir, um sinal de venda é desencadeado

O processo acima utiliza regressão linear para melhorar a precisão e a puntualidade dos sinais Vix Fix, filtrando alguns sinais falsos e, assim, capturando com precisão os fundos.

Análise das vantagens

- A estratégia utiliza regressão linear para filtrar alguns sinais falsos do indicador Vix Fix, tornando os sinais de compra / venda mais precisos e confiáveis

- A regressão linear melhora a sensibilidade e a atualidade dos sinais e pode capturar rapidamente os pontos de virada do mercado

- A lógica da estratégia é simples e clara, fácil de entender e implementar, adequada para negociação quantitativa

- Existem muitos parâmetros configuráveis que podem ser ajustados de forma flexível para se adaptarem às mudanças do mercado

Riscos e soluções

- Esta estratégia é utilizada principalmente para determinar o fundo global do mercado, não sendo adequada para existências individuais

- A regressão linear não pode filtrar completamente os falsos sinais.

- Necessidade de ajustar adequadamente os parâmetros para se adaptar às alterações do mercado e evitar falhas

- Recomenda-se combinar com outros indicadores para confirmar ainda mais os sinais

Orientações de otimização

- Considerar a combinação com indicadores de volatilidade ou indicadores de volume no balanço para filtrar ainda mais os sinais

- Estudar métodos de otimização adaptativa de parâmetros para tornar a estratégia mais inteligente

- Explorar métodos de aprendizagem de máquina para prever tendências de Vix Fix com modelos mais complexos

- Tente aplicar métodos semelhantes a ações individuais para estudar como filtrar falsos sinais

Conclusão

Esta estratégia utiliza o indicador Vix Fix para julgar os fundos, ao mesmo tempo em que introduz a regressão linear para melhorar a qualidade do sinal, capturando efetivamente os fundos do mercado. A estratégia é simples, prática e produz resultados decentes. O principal risco está nos falsos sinais que não conseguem ser completamente filtrados. Ainda precisamos otimizar as configurações de parâmetros e considerar a introdução de outros meios para confirmar ainda mais os sinais para tornar a estratégia mais robusta.

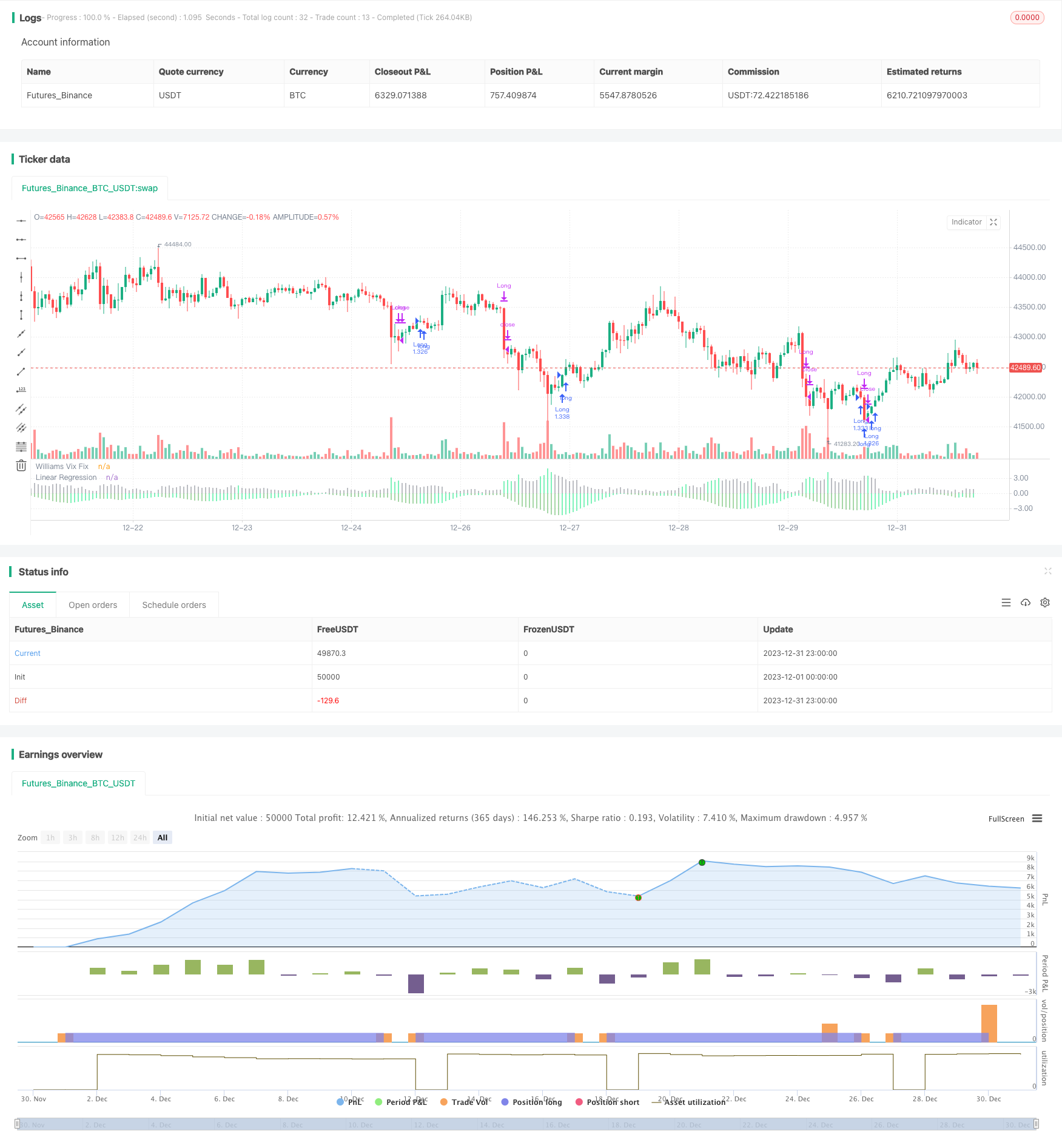

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © HeWhoMustNotBeNamed

//@version=4

strategy("VixFixLinReg-Strategy", shorttitle="VixFixLinReg - Strategy",

overlay=false, initial_capital = 100000,

default_qty_type = strategy.percent_of_equity, default_qty_value = 100, commission_type = strategy.commission.percent, pyramiding = 1,

commission_value = 0.01)

pd = input(22, title="LookBack Period Standard Deviation High")

bbl = input(20, title="Bolinger Band Length")

mult = input(2.0 , minval=1, maxval=5, title="Bollinger Band Standard Devaition Up")

lb = input(50 , title="Look Back Period Percentile High")

ph = input(.85, title="Highest Percentile - 0.90=90%, 0.95=95%, 0.99=99%")

pl = input(1.01, title="Lowest Percentile - 1.10=90%, 1.05=95%, 1.01=99%")

hp = input(false, title="Show High Range - Based on Percentile and LookBack Period?")

sd = input(false, title="Show Standard Deviation Line?")

i_startTime = input(defval = timestamp("01 Jan 2010 00:00 +0000"), title = "Start Time", type = input.time)

i_endTime = input(defval = timestamp("01 Jan 2099 00:00 +0000"), title = "End Time", type = input.time)

inDateRange = true

considerVIXFixClose = input(false)

lengthKC=input(20, title="KC Length")

multKC = input(1.5, title="KC MultFactor")

atrLen = input(22)

atrMult = input(5)

initialStopBar = input(5)

waitForCloseBeforeStop = input(true)

f_getStop(atrLen, atrMult)=>

stop = strategy.position_size > 0 ? close - (atrMult * atr(atrLen)) : lowest(initialStopBar)

stop := strategy.position_size > 0 ? max(stop,nz(stop[1], stop)) : lowest(initialStopBar)

stop

wvf = ((highest(close, pd)-low)/(highest(close, pd)))*100

sDev = mult * stdev(wvf, bbl)

midLine = sma(wvf, bbl)

lowerBand = midLine - sDev

upperBand = midLine + sDev

rangeHigh = (highest(wvf, lb)) * ph

rangeLow = (lowest(wvf, lb)) * pl

col = wvf >= upperBand or wvf >= rangeHigh ? color.lime : color.gray

val = linreg(wvf, pd, 0)

absVal = abs(val)

linRegColor = val>val[1]? (val > 0 ? color.green : color.orange): (val > 0 ? color.lime : color.red)

plot(hp and rangeHigh ? rangeHigh : na, title="Range High Percentile", style=plot.style_line, linewidth=4, color=color.orange)

plot(hp and rangeLow ? rangeLow : na, title="Range High Percentile", style=plot.style_line, linewidth=4, color=color.orange)

plot(wvf, title="Williams Vix Fix", style=plot.style_histogram, linewidth = 4, color=col)

plot(sd and upperBand ? upperBand : na, title="Upper Band", style=plot.style_line, linewidth = 3, color=color.aqua)

plot(-absVal, title="Linear Regression", style=plot.style_histogram, linewidth=4, color=linRegColor)

vixFixState = (col == color.lime) ? 1: 0

vixFixState := strategy.position_size == 0? max(vixFixState, nz(vixFixState[1],0)) : vixFixState

longCondition = (vixFixState == 1 and linRegColor == color.lime) and inDateRange

exitLongCondition = (linRegColor == color.orange or linRegColor == color.red) and considerVIXFixClose

stop = f_getStop(atrLen, atrMult)

label_x = time+(60*60*24*1000*20)

myLabel = label.new(x=label_x, y=0, text="Stop : "+tostring(stop), xloc=xloc.bar_time, style=label.style_none, textcolor=color.black, size=size.normal)

label.delete(myLabel[1])

strategy.entry("Long", strategy.long, when=longCondition, oca_name="oca_buy")

strategy.close("Long", when=exitLongCondition or (close < stop and waitForCloseBeforeStop and linRegColor == color.green))

strategy.exit("ExitLong", "Long", stop = stop, when=not waitForCloseBeforeStop and linRegColor == color.green)

- Estratégia de canal de volatilidade de ruptura dupla

- Estratégia de tendência baseada em múltiplos indicadores

- Estratégia de negociação MACD multiframe

- Estratégia de retorno mensal com referência

- Estratégia de ruptura do momento de compressão

- Estratégia de duplo avanço

- Estratégia de negociação algorítmica do padrão de ruptura e engulfamento de impulso

- Estratégia de confluência de média móvel dupla

- Uma estratégia de negociação de reversão do RSI

- Estratégia de negociação ADX bidirecional

- Três médias móveis exponenciais e estratégia de negociação do índice de força relativa estocástico

- Estratégia dupla de fuga de 7 dias.

- Estratégia de negociação quantitativa MACD dupla

- Estratégia de cruzamento da média móvel da faixa de Bollinger

- Scalping Dips na Estratégia de Bolsa

- Tendência seguindo uma estratégia baseada na média móvel adaptativa

- Estratégia de média móvel de movimento relativo verdadeiro

- Estratégia de negociação de impulso de 5 minutos baseada no MACD e no RSI

- Estratégia de ruptura fractal dupla

- Noro mudou a estratégia de stop loss da média móvel