Estratégia de tendência baseada em múltiplos indicadores

Autora:ChaoZhang, Data: 2024-01-30 17:51:04Tags:

Resumo

Esta estratégia identifica tendências combinando múltiplos indicadores e define o rastreamento de tendências stop loss para bloquear os lucros.

Princípio da estratégia

Os principais indicadores de julgamento da estratégia são Bollinger Bands, RSI e ADX. Quando o preço se aproxima do trilho inferior das Bandas de Bollinger e o RSI está abaixo de 30, ele é julgado como sobrevendido e a posição longa é tomada; quando o preço se aproxima do trilho superior das Bandas de Bollinger e o RSI está acima de 70, ele é julgado como sobrecomprado e a posição curta é tomada. Além disso, se o ADX estiver acima de 25, isso significa que uma tendência se formou, o que torna os sinais longos e curtos mais eficazes.

Após a abertura de posições, a estratégia usa o indicador ATR e os trilhos de Bollinger Bands para definir o stop loss. Especificamente, o ATR define o intervalo máximo de stop loss. Quando o preço atinge o ponto máximo de stop loss, feche a posição; os trilhos de Bollinger Bands definem pontos de stop loss que se atualizam de acordo com o movimento do preço.

Análise das vantagens

A estratégia combina múltiplos indicadores para julgamento e utiliza um mecanismo de stop loss para bloquear os lucros e reduzir o risco.

- Utilização de bandas de Bollinger para julgar situações de sobrecompra e sobrevenda para oportunidades de reversão

- A combinação com o indicador RSI aumenta a precisão do julgamento

- O indicador ADX determina a formação de tendências para garantir a direção correta do comércio

- ATR e Bandas de Bollinger seguindo stop loss podem maximizar o bloqueio de lucro

Análise de riscos

Há também alguns riscos para esta estratégia:

- O julgamento de múltiplos indicadores leva a uma alta probabilidade de otimização excessiva

- Os sinais são menos eficazes quando o intervalo das Bandas de Bollinger é demasiado amplo

- O atraso inadequado do stop loss pode conduzir a perdas aumentadas

Para combater estes riscos, podemos tomar as seguintes medidas:

- Optimização de múltiplos parâmetros para evitar a otimização excessiva

- Ajustar os parâmetros das bandas de Bollinger com base na volatilidade do mercado

- Parâmetros da distância de perda de parada de ensaio para suportar flutuações normais

Orientações de otimização

A estratégia pode também ser otimizada nos seguintes aspectos:

- Adicionar dimensionamento de posição para ajustar a escala de posição com base no multiplicador de stop loss

- Adicionar módulo de gestão de fundos para controlar estritamente o montante da perda de parada única

- Teste outros indicadores de stop loss como DMI, Envelop etc.

- Adicionar modelos de aprendizagem de máquina para determinar a probabilidade de tendência e melhorar o desempenho

Resumo

Em resumo, esta é uma estratégia de tendência relativamente robusta. Determinando a direção da tendência através de múltiplos indicadores e controlando os riscos através de medidas de stop loss, pode alcançar um bom retorno sobre o investimento. Também propusemos vários aspectos que a estratégia pode otimizar. Outras otimizações podem levar a resultados ainda melhores.

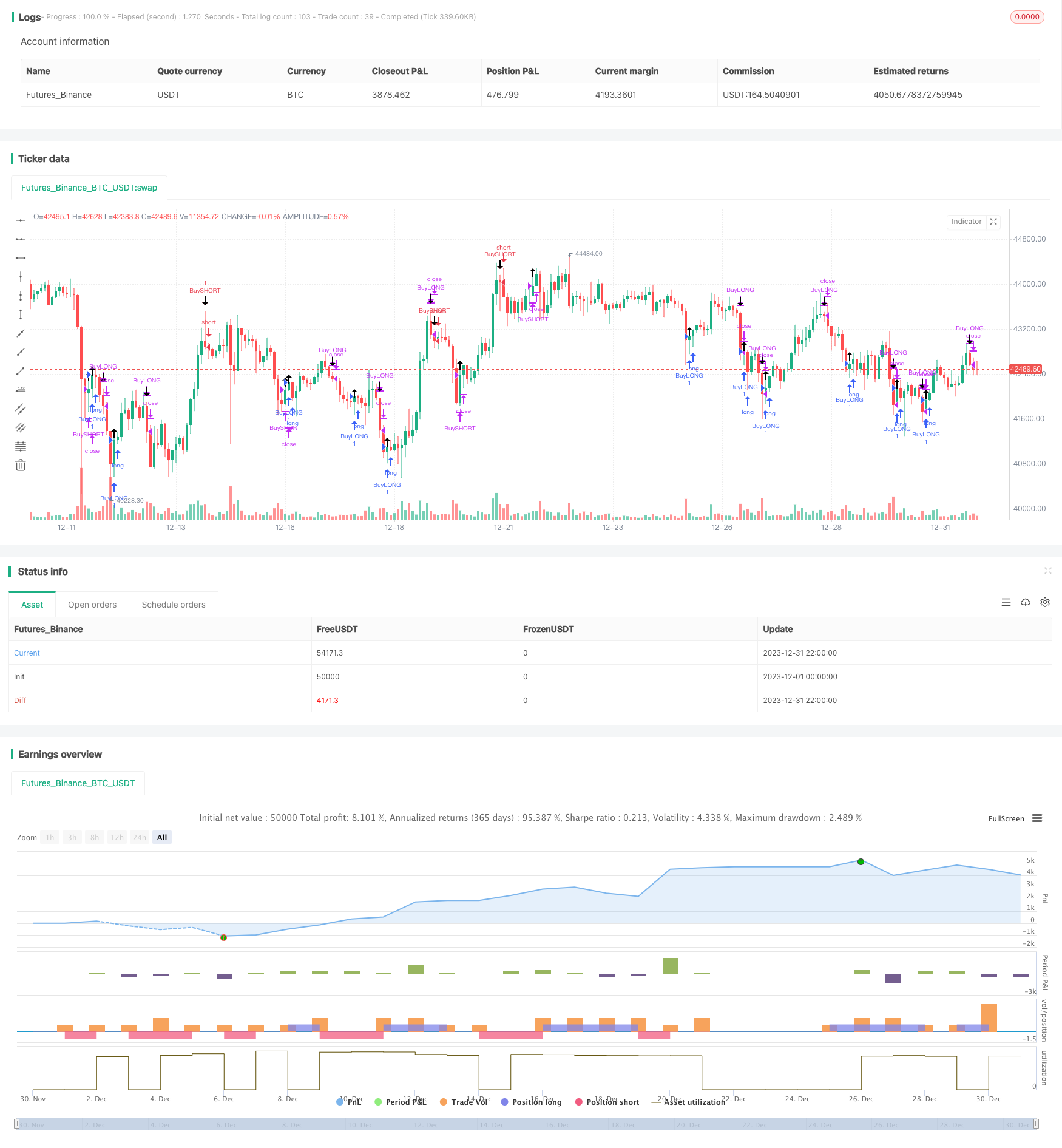

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

// THIS SCRIPT IS MEANT TO ACCOMPANY COMMAND EXECUTION BOTS

// THE INCLUDED STRATEGY IS NOT MEANT FOR LIVE TRADING

// THIS STRATEGY IS PURELY AN EXAMLE TO START EXPERIMENTATING WITH YOUR OWN IDEAS

/////////////////////////////////////////////////////////////////////////////////

// comment out the next line to use this script as an alert script

strategy(title="Dragon Bot - Default Script", overlay=true)

// remove the // in the next line to use this script as an alert script

// study(title="Dragon Bot - Default Script", overlay=true)

// Dragon-Bot default script version 2.0

// This can also be used with bot that reacts to tradingview alerts.

// Use the script as "strategy" for backtesting

// Comment out line 8 and de-comment line 10 to be able to set tradingview alerts.

// You should also comment out (place // before it) the lines 360, 364, 368 and 372 (strategy.entry and strategy.close) to be able to set the alerts.

/////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

// In this first part of the script we setup variables and make sure the script keeps all information it used in the past. //

/////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

longs = 0

longs := nz(longs[1])

shorts = 0

shorts := nz(shorts[1])

buyprice = 0.0

buyprice := buyprice[1]

sellprice = 0.0

sellprice := sellprice[1]

scaler = 0.0

scaler := scaler[1]

sellprofit = input(1.0, minval=0.0, step=0.1, title="main strat profit")

sellproffinal = sellprofit/100

enable_shorts = input(1, minval=0, maxval=1, title="Shorts on/off")

enable_flipping = input(0, minval=0, maxval=1, title="Flipping on/off -> Go directly from long -> short or short -> long without closing ")

enable_stoploss = input(0, minval=0, maxval=1, title="Stoploss on/off")

sellstoploss = input(30.0, minval=0.0, step=1.0, title="Stoploss %")

sellstoplossfinal = sellstoploss/100

enable_trailing = input(1, minval=0, maxval=1, title="Trailing on/off")

enable_trailing_ATR = input(1, minval=0, maxval=1, title="Trailing use ATR on/off")

ATR_Multi = input(1.0, minval=0.0, step=0.1, title="Multiplier for ATR")

selltrailing = input(10.0, minval=0.0, step=1.0, title="Trailing %")

selltrailingfinal = selltrailing/100

Backtestdate = input(0, minval=0, maxval=1, title="backtest date on/off")

// Component Code by pbergden - Start backtest dates

// The following code snippet is taken from an example by pbergen

// All rights to this snippet remain with pbergden

testStartYear = input(2018, "Backtest Start Year")

testStartMonth = input(1, "Backtest Start Month")

testStartDay = input(1, "Backtest Start Day")

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testStopYear = input(2019, "Backtest Stop Year")

testStopMonth = input(1, "Backtest Stop Month")

testStopDay = input(1, "Backtest Stop Day")

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

// A switch to control background coloring of the test period

testPeriodBackground = input(title="Color Background?", type=bool, defval=true)

testPeriodBackgroundColor = testPeriodBackground and (time >= testPeriodStart) and (time <= testPeriodStop) ? #00FF00 : na

bgcolor(testPeriodBackgroundColor, transp=97)

testPeriod() => true

/////////////////////////////////////////////////////////////////////////////////////////////////////

// In this second part of the script we setup indicators that we can use for our actual algorithm. //

/////////////////////////////////////////////////////////////////////////////////////////////////////

//ATR

lengthtr = input(20, minval=1, title="ATR Length")

ATRsell = input(0, minval=0, title="1 for added ATR when selling")

ATR=rma(tr(true), lengthtr)

Trail_ATR=rma(tr(true), 10) * ATR_Multi

atr = 0.0

if ATRsell == 1

atr := ATR

//OC2

lengthoc2 = input(20, minval=1, title="OC2 Length")

OC2sell = input(0, minval=0, title="1 for added OC2 when selling")

OC2mult = input(1, minval=1, title="OC2 multiplayer")

OC= abs(open[1]-close)

OC2=rma(OC, lengthoc2)

oc2 = 0.0

if OC2sell == 1

oc2 := OC2*OC2mult

//ADX

lenadx = input(10, minval=1, title="DI Length")

lensig = input(10, title="ADX Smoothing", minval=1, maxval=50)

up = change(high)

down = -change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

trur = rma(tr, lenadx)

plus = fixnan(100 * rma(plusDM, lenadx) / trur)

minus = fixnan(100 * rma(minusDM, lenadx) / trur)

sum = plus + minus

sigadx = 100 * rma(abs(plus - minus) / (sum == 0 ? 1 : sum), lensig)

//StochRSI

smoothKRSI = input(3, minval=1)

smoothDRSI = input(3, minval=1)

lengthRSI = input(14, minval=1)

lengthStochRSI = input(14, minval=1)

srcRSI = input(close, title="RSI Source")

buyRSI = input(30, minval=1, title="RSI Buy Value")

sellRSI = input(70, minval=1, title="RSI Sell Value")

rsi1 = rsi(srcRSI, lengthRSI)

krsi = sma(stoch(rsi1, rsi1, rsi1, lengthStochRSI), smoothKRSI)

drsi = sma(krsi, smoothDRSI)

// Bollinger bands

lengthbb = input(20, minval=1)

srcbb = input(close, title="Sourcebb")

multbb = input(2.0, minval=0.001, maxval=50)

bb_buy_value = input(0.5, step=0.1, title="BB Buy Value")

bb_sell_value = input(0.5, step=0.1, title="BB Sell Value")

basisbb = sma(srcbb, lengthbb)

devbb = multbb * stdev(srcbb, lengthbb)

upperbb = basisbb + devbb

lowerbb = basisbb - devbb

bbr = (srcbb - lowerbb)/(upperbb - lowerbb)

bbbuy = basisbb - (devbb*bb_buy_value)

bbsell = basisbb + (devbb*bb_sell_value)

//ema very short

shorter = ema(close, 2)

shorterlong = ema(close, 5)

//ema short

short = ema(close, 10)

long = ema(close, 30)

//ema long

shortday = ema(close, 110)

longday = ema(close, 360)

//ema even longer

shortlongerday = ema(close, 240)

longlongerday = ema(close, 720)

//declaring extra timeframe value

profit = request.security(syminfo.tickerid, timeframe.period, close)

////////////////////////////////////////////////////////////////////////

// In the 3rd part of the script we define all the entries and exits //

///////// This third part is basically the acual algorithm ////////////

///////////////////////////////////////////////////////////////////////

//Declaring function with the long entries

OPENLONG_funct() =>

// You can add more buy entries to the script

longentry1 = false

longentry2 = false

longentry3 = false

longentry4 = false

longentry5 = false

makelong_funct = false

if close<bbbuy and krsi<buyRSI // You could for instance add "and shortday > longday"

longentry1 := close>close[1]

// longentry2 := ...

// if another thing we want to buy on happens

// longentry3 := ...

//All the buy entries go above, this last variable is what the function puts out

// if you add more entries, add them in the following list too

makelong_funct := longentry1 or longentry2 or longentry3 or longentry4 or longentry5

//Declaring function wit the short entries

OPENSHORT_funct() =>

// You can add more buy entries to the script

shortentry1 = false

shortentry2 = false

shortentry3 = false

shortentry4 = false

shortentry5 = false

makeshort_funct = false

if close>bbsell and krsi>sellRSI // You could for instance add "and shortday < longday"

shortentry1 := close<close[1]

// shortentry2 := ...

// if another thing we want to buy on happens

// shortentry3 := ...

//All the buy entries go above, this last variable is what the function puts out

// if you add more entries, add them in the following list too

makeshort_funct := shortentry1 or shortentry2 or shortentry3 or shortentry4 or shortentry5

//Declaring function with the long exits

CLOSELONG_funct() =>

// You can add more buy entries to the script

longexit1 = false

longexit2 = false

longexit3 = false

longexit4 = false

longexit5 = false

closelong_funct = false

if close>bbsell and krsi>sellRSI

longexit1 := close<close[1]

// longexit2 := ...

// if another thing we want to close on on happens you can add them here...

// longexit3 := ...

//All the buy entries go above, this last variable is what the function puts out

// if you add more exits, add them in the following list too

closelong_funct := longexit1 or longexit2 or longexit3 or longexit4 or longexit5

//Declaring function wit the short exits

CLOSESHORT_funct() =>

// You can add more buy entries to the script

shortexit1 = false

shortexit2 = false

shortexit3 = false

shortexit4 = false

shortexit5 = false

closeshort_funct = false

if close<bbsell and krsi<sellRSI

shortexit1 := close>close[1]

// shortexit2 := ...

// if another thing we want to close on on happens you can add them here...

// shortexit3 := ...

//All the buy entries go above, this last variable is what the function puts out

// if you add more exits, add them in the following list too

closeshort_funct := shortexit1 or shortexit2 or shortexit3 or shortexit4 or shortexit5

/////////////////////////////////////////////////////////////////////////////////////

////////////// End of "entries" and "exits" definition code /////////////////////////

/////////////////////////////////////////////////////////////////////////////////////

/// In the fourth part we do the actual work, as defined in the part before this ////

////////////////////// This part does not need to be changed ////////////////////////

/////////////////////////////////////////////////////////////////////////////////////

//OPEN LONG LOGIC

makelong = false

//buy with backtesting on specific dates

if Backtestdate > 0 and testPeriod()

if (longs < 1 and shorts < 1) or (short > 0 and enable_flipping > 0 and enable_shorts > 0)

makelong := OPENLONG_funct()

//buy without backtesting on specific dates

if Backtestdate < 1

if (longs < 1 and shorts < 1) or (short > 0 and enable_flipping > 0 and enable_shorts > 0)

makelong := OPENLONG_funct()

if makelong

buyprice := close

scaler := close

longs := 1

shorts := 0

//OPEN SHORT LOGIC

makeshort = false

//buy with backtesting on specific dates

if Backtestdate > 0 and testPeriod()

if (shorts < 1 and longs < 1 and enable_shorts > 0) or (longs > 0 and enable_flipping > 0 and enable_shorts > 0)

makeshort := OPENSHORT_funct()

//buy without backtesting on specific dates

if Backtestdate < 1

if (shorts < 1 and longs < 1 and enable_shorts > 0) or (longs > 0 and enable_flipping > 0 and enable_shorts > 0)

makeshort := OPENSHORT_funct()

if makeshort

buyprice := close

scaler := close

shorts := 1

longs := 0

//Calculating values for traling stop

if longs > 0 and enable_flipping < 1

if close > scaler+Trail_ATR and enable_trailing_ATR > 0

scaler := close

if close > scaler * (1.0 + selltrailingfinal) and enable_trailing_ATR < 1

scaler := close

if shorts > 0 and enable_flipping < 1

if close < scaler-Trail_ATR and enable_trailing_ATR > 0

scaler := close

if close < scaler * (1.0 - selltrailingfinal) and enable_trailing_ATR < 1

scaler := close

long_exit = false

long_security1 = false

long_security2 = false

long_security3 = false

//CLOSE LONG LOGIC

if longs > 0 and enable_flipping < 1

if ( (buyprice + (buyprice*sellproffinal) + atr + oc2) < close) and ( (buyprice + (buyprice*sellproffinal) ) < profit)

long_exit := CLOSELONG_funct()

//security

if enable_stoploss > 0

long_security1 := close < ( buyprice * (1.0 - sellstoplossfinal) )

if enable_trailing > 0 and enable_trailing_ATR < 1

long_security2 := close < ( scaler * (1.0 - selltrailingfinal) )

if enable_trailing > 0 and enable_trailing_ATR > 0

long_security2 := close < ( scaler - Trail_ATR)

//CLOSE LONG LOGIC

if longs > 0 and enable_flipping > 0

//security

if enable_stoploss > 0

long_security1 := close < ( buyprice * (1.0 - sellstoplossfinal) )

if enable_trailing > 0 and enable_trailing_ATR < 1

long_security2 := close < ( scaler * (1.0 - selltrailingfinal) )

if enable_trailing > 0 and enable_trailing_ATR > 0

long_security2 := close < ( scaler - Trail_ATR)

closelong = long_exit or long_security1 or long_security2 or long_security3

short_exit = false

short_security1 = false

short_security2 = false

short_security3 = false

if closelong

longs := 0

//CLOSE SHORT LOGIC

if shorts > 0 and enable_flipping < 1

if ( (buyprice - (buyprice*(sellproffinal) - atr - oc2) > close) and ( (buyprice - (buyprice*sellproffinal) ) > profit) )

short_exit := CLOSESHORT_funct()

//security

if enable_stoploss > 0

short_security1 := close > ( buyprice * (1.0 + sellstoplossfinal) )

if enable_trailing > 0 and enable_trailing_ATR < 1

short_security2 := close > ( scaler * (1.0 + selltrailingfinal) )

if enable_trailing > 0 and enable_trailing_ATR > 0

short_security2 := close > ( scaler + Trail_ATR)

if shorts > 0 and enable_flipping > 0

//security

if enable_stoploss > 0

short_security1 := close > ( buyprice * (1.0 + sellstoplossfinal) )

if enable_trailing > 0 and enable_trailing_ATR < 1

short_security2 := close > ( scaler * (1.0 + selltrailingfinal) )

if enable_trailing > 0 and enable_trailing_ATR > 0

short_security2 := close > ( scaler + Trail_ATR)

closeshort = short_exit or short_security1 or short_security2 or short_security3

if closeshort

shorts := 0

///////////////////////////////////////////////////////////////////////////////////////

///////////// The last section takes care of the alerts //////////////////////////////

//////////////////////////////////////////////////////////////////////////////////////

plotshape(makelong, style=shape.arrowup)

alertcondition(makelong, title="openlong", message="openlong")

strategy.entry("BuyLONG", strategy.long, oca_name="DBCross", when= makelong, comment="Open Long")

plotshape(makeshort, style=shape.arrowdown)

alertcondition(makeshort, title="openshort", message="openshort")

strategy.entry("BuySHORT", strategy.short, oca_name="DBCross", when= makeshort, comment="Open Short")

plotshape(closelong, style=shape.arrowdown)

alertcondition(closelong, title="closelong", message="closelong")

strategy.close("BuyLONG", when=closelong)

plotshape(closeshort, style=shape.arrowup)

alertcondition(closeshort, title="closeshort", message="closeshort")

strategy.close("BuySHORT", when=closeshort)

- Estratégia de negociação quantitativa multifator

- Estratégia de cruzamento de média móvel dupla

- Estratégia dinâmica de acompanhamento de tendências com duplo mecanismo

- Estratégia de negociação de Bitcoin baseada na Nuvem Ichimoku

- Sistema de rastreamento do mercado de touros

- Estratégia de negociação intradiária de ações baseada no retracement do ponto baixo da Renko

- Estratégia de negociação de tendências baseada no canal de preços das médias móveis duplas

- Estratégia de ruptura de impulso de MA duplo

- Estratégia de negociação quantitativa profissional SMART

- Estratégia de canal de volatilidade de ruptura dupla

- Estratégia de negociação MACD multiframe

- Estratégia de retorno mensal com referência

- Estratégia de ruptura do momento de compressão

- Estratégia de duplo avanço

- Estratégia de negociação algorítmica do padrão de ruptura e engulfamento de impulso

- Estratégia de confluência de média móvel dupla

- Uma estratégia de negociação de reversão do RSI

- Estratégia de negociação ADX bidirecional

- Estratégia de pesca de fundo de regressão linear Vix Fix

- Três médias móveis exponenciais e estratégia de negociação do índice de força relativa estocástico