Han Yue - Tendência após estratégia de negociação baseada em múltiplas EMAs, ATR e RSI

Autora:ChaoZhang, Data: 2024-05-14 16:37:52Tags:EMAATRRSI

Resumo

Esta estratégia usa três médias móveis exponenciais (EMA) com períodos diferentes para determinar a tendência do mercado, e combina o índice de força relativa (RSI) e a faixa verdadeira média (ATR) para identificar pontos de entrada, stop-loss e níveis de take-profit. Quando o preço atravessa o canal formado pelas três EMA e o RSI também atravessa sua média móvel, a estratégia desencadeia um sinal de entrada.

Princípios de estratégia

- Calcular três EMA com períodos diferentes (a curto, médio e longo prazo) para determinar a tendência geral do mercado.

- Usar o indicador RSI para confirmar a força e sustentabilidade da tendência.

- Gerar sinais de entrada baseados na relação entre o preço e o canal EMA, bem como sinais RSI: abrir uma posição na direção da tendência quando o preço atravessa o canal EMA e o RSI também atravessa a sua média móvel.

- O ATR é utilizado para determinar o tamanho das posições e os níveis de stop-loss, controlando a exposição ao risco de cada operação.

- Estabelecer níveis de lucro baseados numa relação risco/retorno predefinida (por exemplo, 1,5:1) para garantir a rentabilidade da estratégia.

Análise das vantagens

- Simples e eficazes: a estratégia utiliza apenas alguns indicadores técnicos comuns, com uma lógica clara e fácil de compreender e implementar.

- Seguimento de tendências: Ao combinar o canal EMA e o RSI, a estratégia pode seguir as tendências do mercado e capturar movimentos de preços maiores.

- Controlo de risco: o uso do ATR para definir níveis de stop-loss e controlar o dimensionamento das posições limita efetivamente a exposição ao risco de cada negociação.

- Flexibilidade: Os parâmetros da estratégia (como períodos EMA, períodos RSI, multiplicadores ATR, etc.) podem ser ajustados de acordo com diferentes mercados e estilos de negociação para otimizar o desempenho.

Análise de riscos

- Optimização de parâmetros: o desempenho da estratégia depende em grande parte da escolha de parâmetros, e configurações incorretas de parâmetros podem levar ao fracasso da estratégia ou ao baixo desempenho.

- Risco de mercado: A estratégia pode sofrer perdas significativas em caso de acontecimentos inesperados ou condições extremas de mercado, especialmente durante inversões de tendência ou mercados voláteis.

- Sobreajuste: se a estratégia for sobreajustada a dados históricos durante o processo de otimização de parâmetros, pode levar a um baixo desempenho na negociação real.

Orientações de otimização

- Parâmetros dinâmicos: ajustar dinamicamente os parâmetros da estratégia de acordo com as alterações nas condições do mercado, como por exemplo, utilizar períodos de EMA mais longos quando a tendência é forte e períodos mais curtos em mercados instáveis.

- Combinar outros indicadores: introduzir outros indicadores técnicos (como as bandas de Bollinger, o MACD, etc.) para melhorar a fiabilidade e a precisão dos sinais de entrada.

- Incorporar o sentimento do mercado: combinar indicadores do sentimento do mercado (como o Índice de Medo e Ganância) para ajustar a exposição ao risco e a gestão da posição da estratégia.

- Análise de vários prazos: Analisar as tendências e sinais do mercado em diferentes prazos para obter uma perspectiva de mercado mais abrangente e tomar decisões comerciais mais robustas.

Resumo

Esta estratégia constrói um sistema de negociação de tendência simples e eficaz, combinando vários indicadores técnicos comuns, como EMAs, RSI e ATR. Ele usa o canal EMA para determinar tendências de mercado, RSI para confirmar a força da tendência e ATR para controlar o risco. As vantagens da estratégia estão em sua simplicidade e adaptabilidade, pois pode seguir tendências e negociar sob diferentes condições de mercado. No entanto, o desempenho da estratégia depende em grande parte da escolha de parâmetros, e configurações de parâmetros inadequadas podem levar ao fracasso ou mau desempenho da estratégia. Além disso, a estratégia pode enfrentar riscos significativos durante eventos inesperados ou condições extremas de mercado. Para otimizar ainda mais a estratégia, pode-se considerar a introdução de ajustes de parâmetros dinâmicos, combinando outros indicadores, incorporando análise de sentimento de mercado e conduzindo uma análise multi-tempo.

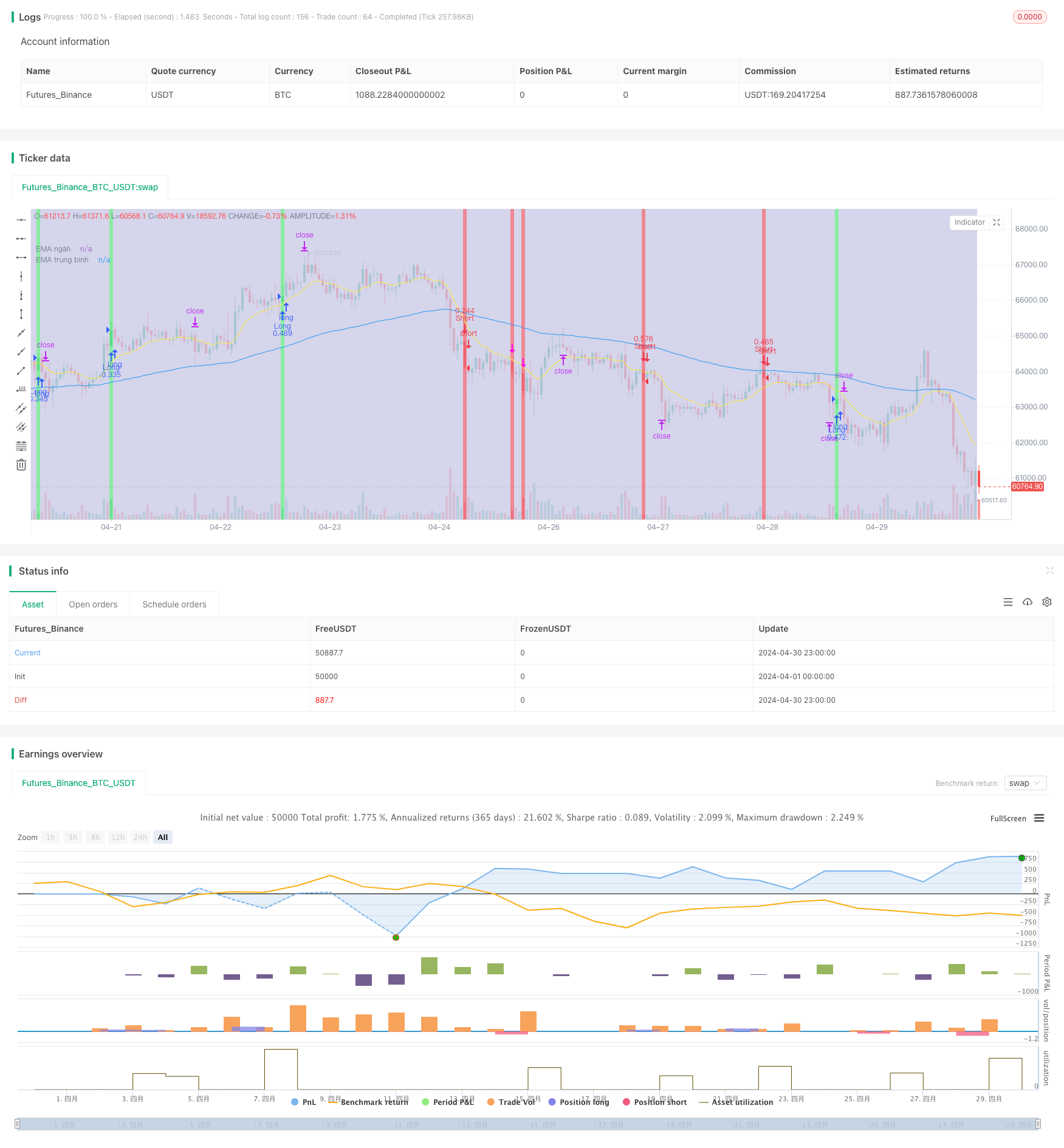

/*backtest

start: 2024-04-01 00:00:00

end: 2024-04-30 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © hatnxkld

//@version=4

strategy("Win ha", overlay=true)

ss2 = input("0300-1700", title = "Khung thời gian")

t2 = time(timeframe.period,ss2)

c2 = #cacae6

bgcolor(t2 ? c2 : na, transp = 70)

//3ema

emangan=input(title="Ema ngắn", defval = 12)

ngan=ema(close, emangan)

a= plot(ngan, title="EMA ngắn", color=color.yellow)

ematb=input(title="Ema trung bình", defval = 100)

tb=ema(close, ematb)

b= plot(tb, title="EMA trung bình", color=color.blue)

//emadai=input(title="Ema dai", defval = 288)

//dai=ema(close,emadai)

//c= plot(dai, title="EMA dai", color=color.red)

// nhập hệ số nhân ATR

i=input(title="Hệ số nhân với ATR", defval=1.25)

// RSI

rsi=rsi(close, emangan)

marsi=sma(rsi, emangan)

// Kênh keltler

//heso=input(defval=1, title="Hệ số Kênh Keltler")

//atr=atr(emangan)

//tren=ngan+atr*heso

//d=plot(tren, title="Kênh trên", color=color.white)

//duoi=ngan-atr*heso

//e=plot(duoi, title="Kênh dưới", color=color.white)

//fill(d,e, color=color.rgb(48, 58, 53))

ban = ( close[1]>open[1] and (high[1]-close[1])>(close[1]-low[1]) and open>close and close<low[1] )

//or ( open[1] > close[1] and (high[1]-open[1])>(open[1]-low[1]) and (open[1]-close[1])>(close[1]-low[1]) and open>close and close <low[1] ) ) //and time(timeframe.period,"2200-1300")

//and (close[1]-open[1])>(open[1]-low[1])

//high > ngan and close < ngan and ngan<tb and

// and time(timeframe.period,"1000-2300")

bgcolor(color = ban ? color.rgb(235, 106, 123) : na)

//bgcolor(color.rgb(82, 255, 154),transp = 100, offset = 1, show_last = 2)

//and time(timeframe.period,"2300-1500") and ((open>ngan and close<ngan) or (open>tren and close<tren))

plotshape(ban , style=shape.arrowdown, location=location.abovebar, color=#ff00ff, size=size.tiny, textcolor=color.rgb(255, 59, 213))

alertcondition(ban, "Ban", "Ban")

mua= ( open[1]>close[1] and (close[1]-low[1])>(high[1]-close[1]) and close > open and close > high[1] ) //and time(timeframe.period,"2200-1300")

//or ( close[1]>open[1] and (open[1]-low[1]) > (high[1]-open[1]) and (close[1]-open[1])>(high[1]-close[1]) and close>open and close>high[1] ) )

//and (open[1]-close[1])>(high[1]-open[1])

//low < ngan and close > ngan and ngan>tb and

//or ( close[1]>open[1] and (open[1]-low[1]) > (high[1]-open[1]) and (close[1]-open[1])>(high[1]-close[1]) and close>open and close>high[1] )

// and time(timeframe.period,"1000-2300")

bgcolor(color= mua? color.rgb(108, 231, 139):na)

//and time(timeframe.period,"2300-1500") and ((open<ngan and close>ngan)or (open<duoi and close>duoi) )

plotshape(mua , style=shape.arrowup, location=location.belowbar, color=#00ff6a, size=size.tiny, textcolor=color.rgb(83, 253, 60))

alertcondition(mua , "Mua", "Mua")

//len1 = ban==true and (high-low)>2*atr

//plotshape(len1 , style=shape.flag, location=location.abovebar, color=#ff00ff, size=size.tiny, title="Sell Signal", text="Xuong 1", textcolor=color.rgb(255, 59, 213))

//bann= ban==true and rsi < marsi and marsi[2]>marsi[1]

//plotshape(bann , style=shape.labeldown, location=location.abovebar, color=#ff00ff, size=size.tiny, title="Sell Signal", text="BAN 2", textcolor=color.rgb(240, 234, 239))

//bannn = mua==true and rsi>marsi and marsi[2]<marsi[1]

//plotshape(bannn , style=shape.labelup, location=location.belowbar, color=#00ff6a, size=size.tiny, title="Buy Signal", text="Mua 2", textcolor=color.rgb(237, 241, 236))

//a1= ban==true and (high - low)<atr

//plotshape(a1 , style=shape.xcross, location=location.bottom, color=#00ff6a, size=size.tiny, title="Sell", text="<atr", textcolor=color.rgb(240, 95, 76))

//a2 = ban ==true and (high - low)>atr and (high - low)<(2*atr)

//plotshape(a2 , style=shape.xcross, location=location.bottom, color=#00ff6a, size=size.tiny, title="Sell", text="<2atr", textcolor=color.rgb(237, 241, 236))

//a3= ban==true and (high - low)>(2*atr)

//plotshape(a3 , style=shape.xcross, location=location.bottom, color=#00ff6a, size=size.tiny, title="Sell", text=">2atr", textcolor=color.rgb(234, 252, 74))

//b1= mua==true and (high - low)<atr

//plotshape(b1 , style=shape.xcross, location=location.bottom, color=#00ff6a, size=size.tiny, title="Buy", text="<atr", textcolor=color.rgb(237, 241, 236))

//b2 = mua ==true and (high - low)>atr and (high - low)<(2*atr)

//plotshape(b2 , style=shape.xcross, location=location.bottom, color=#00ff6a, size=size.tiny, title="Buy", text="<2atr", textcolor=color.rgb(237, 241, 236))

//b3= mua==true and (high - low)>(2*atr)

//plotshape(b3 , style=shape.xcross, location=location.bottom, color=#00ff6a, size=size.tiny, title="Buy", text=">2atr", textcolor=color.rgb(237, 241, 236))

// Đặt SL TP ENTRY

risk= input(title="Rủi ro % per Trade", defval=0.5)

rr= input(title="RR", defval=1.5)

onlylong= input(defval=false)

onlyshort=input(defval=false)

stlong = mua and strategy.position_size<=0 ? low[1]:na

stoplong= fixnan(stlong)

stshort = ban and strategy.position_size>=0 ? high[1]:na

stopshort= fixnan(stshort)

enlong = mua and strategy.position_size<=0 ? close:na

entrylong =fixnan(enlong)

enshort = ban and strategy.position_size>=0 ? close:na

entryshort = fixnan(enshort)

amountL = risk/100* strategy.initial_capital / (entrylong - stoplong)

amountS = risk/100* strategy.initial_capital / (stopshort - entryshort)

TPlong= mua and strategy.position_size<=0? entrylong + (entrylong -stoplong)*rr:na

takeprofitlong =fixnan(TPlong)

TPshort = ban and strategy.position_size>=0? entryshort - (stopshort - entryshort)*rr:na

takeprofitshort = fixnan(TPshort)

strategy.entry("Long", strategy.long , when = enlong and not onlyshort, qty= amountL )

strategy.exit("exitL", "Long", stop = stoplong, limit= takeprofitlong)

strategy.entry("Short", strategy.short , when = enshort and not onlylong, qty= amountS )

strategy.exit("exitS", "Short", stop = stopshort, limit= takeprofitshort)

- A taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação.

- Estratégia de reversão da dinâmica do canal de tendência do ouro

- Estratégia de pirâmide inteligente de múltiplos indicadores

- Estratégia de cruzamento dos índices de risco da EMA

- 4 Horas de Tempo Engulfing Padrão Estratégia de Negociação com Dinâmica Take Profit e Stop Loss Optimização

- RSI50_EMA Estratégia única de longo prazo

- Sistema de negociação ATR-RSI de tendência reforçada

- Estratégia de cruzamento da média móvel exponencial de vários prazos com otimização de risco-recompensa

- Estratégia de negociação do AlphaTradingBot

- Estratégia RSI-EMA-ATR de negociação de volatilidade com vários indicadores

- 8 horas de ema

- RSI Estratégia de negociação quantitativa

- Bollinger Band ATR Tendência Seguindo estratégia

- Estratégia de negociação de volume delta com níveis de Fibonacci

- Estratégia diferencial RSI dupla

- Estratégia de RSI estocástico de Crypto Big Move

- Indice de força relativa tripla Estratégia de negociação quantitativa

- Estratégia de otimização MACD dupla que combina tendência de seguimento e negociação de momento

- Estratégia de negociação baseada em três velas de baixa consecutivas e médias móveis duplas

- Estratégia de ruptura da sessão DZ

- 200 EMA, VWAP, MFI

- Estratégia cruzada da EMA com Divergência do RSI, Identificação de tendência de 30 minutos e Esgotamento de preços

- Não há estratégia de ruptura de vela alta

- Estratégia de reversão do índice de força relativa

- BMSB Bollinger SuperTrend Estratégia de negociação

- O valor da posição em risco deve ser calculado em função da posição em risco da instituição.

- Estratégia de negociação de média móvel dupla da SMA

- Estratégia de negociação a curto prazo baseada em bandas de Bollinger, média móvel e RSI

- Estratégia de cruzamento de média móvel dupla

- EMA, MACD e RSI Triple Indicator Momentum