概述

AlphaTradingBot是一款基于Zigzag指标和fibonacci数列的日内交易策略。该策略通过识别市场的高点(HH)和低点(LL)来判断趋势,并结合fibonacci回撤和扩张来设置入场点位、止盈和止损。该策略只在设定的日期区间内运行,可以分别做多和做空,具有一定的趋势把握能力和盈亏比把控。

策略原理

- 通过Zigzag指标识别市场的高点(HH)、低点(LL)、较高低点(HL)和较低高点(LH)。

- 当出现HH时,视为上升趋势开始,开始寻找做多机会;当出现LL时,视为下降趋势开始,开始寻找做空机会。

- 在上升趋势中,如果出现HL,则以HL和之前的LL形成的区间作为多头的fibonacci回撤区间。若价格突破前高,则在回撤23.6%-38.2% (可设置)之间的区域开多单,止损设在回撤61.8%处,止盈以RR值(可设置)计算。

- 在下降趋势中,如果出现LH,则以LH和之前的HH形成的区间作为空头的fibonacci回撤区间。若价格突破前低,则在回撤61.8%-76.4% (可设置)之间的区域开空单,止损设在回撤38.2%处,止盈以RR值(可设置)计算。

- 订单管理:每次信号只开一单,直到该单平仓。如果单笔亏损达到账户总额的X%(可设置),则策略停止运行。

优势分析

- 趋势跟踪能力强。通过Zigzag有效识别趋势,可以在趋势初期介入。

- 回撤逻辑清晰。利用fibonacci回撤设置进场区间,在趋势回撤时介入,胜率相对较高。

- 风险可控。通过设置单笔最大亏损比例来控制每笔交易风险,同时严格的止损制度也保证了总风险可控。

- 盈亏比可优化。可根据市场特点和个人偏好,调整RR值来优化策略的盈亏比。

风险分析

- 频繁交易。由于Zigzag灵敏度较高,可能会频繁产生信号,导致过度交易。

- 趋势把握不精准。Zigzag判断的趋势仍可能出现偏差,导致入场时机不够理想。

- 震荡行情表现欠佳。在震荡市中,该策略可能产生较多的亏损交易。

- 运行周期有限。策略只在指定日期区间内运行,可能错失部分行情。

优化方向

- 引入更多技术指标,如MA、MACD等,提高趋势判断的精确度。

- 优化仓位管理,如根据ATR等指标动态调整头寸。

- 优化止盈止损逻辑,如根据市场波动率动态调整止损位。

- 引入市场情绪指标,在极度乐观或悲观时避免入场。

- 放宽日期限制,增加策略的普适性。

总结

AlphaTradingBot是一款基于zigzag指标和fibonacci回撤的趋势跟踪日内策略。它通过高低点判断趋势,并在趋势回撤时入场,以追求更高的胜率和盈亏比。该策略的优势在于趋势把握能力强,回撤逻辑清晰,风险可测,但同时也存在过度交易、趋势判断偏差、震荡行情表现欠佳等风险。未来可从技术指标、仓位管理、止盈止损、市场情绪等方面对该策略进行优化,以提升策略的稳健性和盈利性。

策略源码

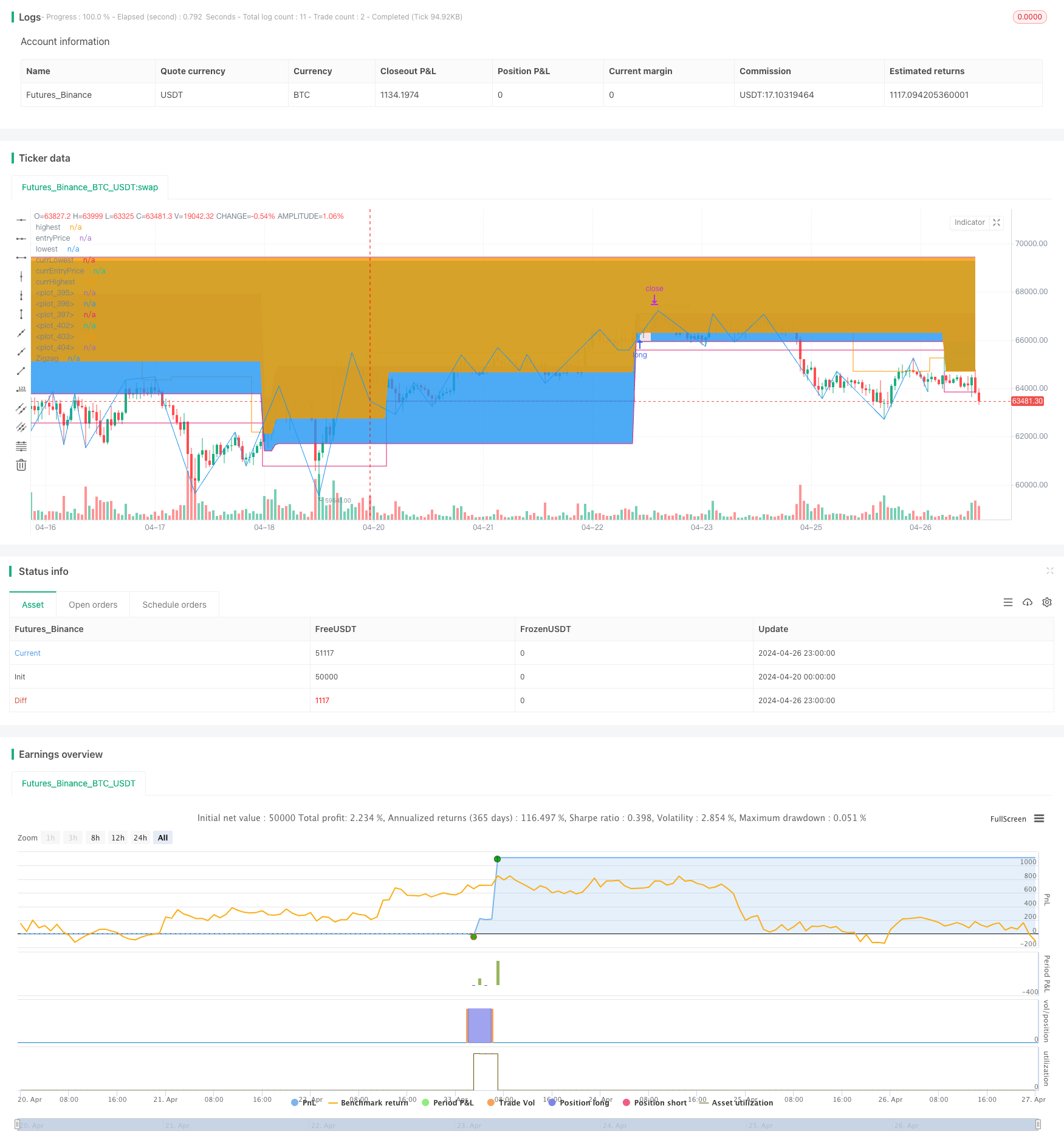

/*backtest

start: 2024-04-20 00:00:00

end: 2024-04-27 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © javierfish

//@version=5

strategy(title = 'Augusto Bot v1.2', shorttitle='🤑 🤖 v1.2', overlay = true, pyramiding=0, initial_capital=100000, default_qty_value=1)

lb = input.int(5, title='Pivot Bars Count', minval=1)

rb = lb

var color supcol = color.lime

var color rescol = color.red

// srlinestyle = line.style_dotted

srlinewidth = 1

changebarcol = true

bcolup = color.blue

bcoldn = color.black

intDesde = input(timestamp('2023-01-01T00:00:00'), 'Desde', group='Rango de fechas')

intHasta = input(timestamp('2023-12-31T23:59:59'), 'Hasta', group='Rango de fechas')

blnFechas = true

blnShorts = input.bool(false, " Shorts", group="Trading", tooltip = 'Checked = Shorts. No Checked = Longs')

blnLongs = not blnShorts

pctRisk = input.float(1, 'Riesgo %', 0.1, 100,step = .1, group='Trading', tooltip = 'Porcentaje del total de su cuenta que está dispuesto a arriesgar en cada trade')

RR = input.float(2, 'Ratio de Ganancia X', 1, 10, .5, tooltip = 'Proporción de Take Profit contra Stop Loss', group='Trading')

retro = input.float(40, 'Retroceso %', 1, 100, 10, tooltip = 'Porcentaje de Fibonacci que debe alcanzar el precio para considerar un retroceso', group='Fibonacci')

fibSL = input.float(72, 'Stop Loss %', 1, 100, 5, tooltip = 'Porcentaje de Fibonacci que debe alcanzar el precio para considerar perdido un trade', group='Fibonacci')

blnDebug = input.bool(false, 'Debug', tooltip = 'Mostrar información de depuración como estatus y línea de tendencia')

showsupres = blnDebug

blnEnLong = strategy.position_size > 0

blnEnShort = strategy.position_size < 0

blnEnTrade = blnEnLong or blnEnShort

ph = ta.pivothigh(lb, rb)

pl = ta.pivotlow(lb, rb)

iff_1 = pl ? -1 : na // Trend direction

hl = ph ? 1 : iff_1

iff_2 = pl ? pl : na // similar to zigzag but may have multiple highs/lows

zz = ph ? ph : iff_2

valuewhen_1 = ta.valuewhen(hl, hl, 1)

valuewhen_2 = ta.valuewhen(zz, zz, 1)

zz := pl and hl == -1 and valuewhen_1 == -1 and pl > valuewhen_2 ? na : zz

valuewhen_3 = ta.valuewhen(hl, hl, 1)

valuewhen_4 = ta.valuewhen(zz, zz, 1)

zz := ph and hl == 1 and valuewhen_3 == 1 and ph < valuewhen_4 ? na : zz

valuewhen_5 = ta.valuewhen(hl, hl, 1)

valuewhen_6 = ta.valuewhen(zz, zz, 1)

hl := hl == -1 and valuewhen_5 == 1 and zz > valuewhen_6 ? na : hl

valuewhen_7 = ta.valuewhen(hl, hl, 1)

valuewhen_8 = ta.valuewhen(zz, zz, 1)

hl := hl == 1 and valuewhen_7 == -1 and zz < valuewhen_8 ? na : hl

zz := na(hl) ? na : zz

findprevious() => // finds previous three points (b, c, d, e)

float loc1 = na

float loc2 = na

float loc3 = na

float loc4 = na

if not na(hl)

ehl = hl == 1 ? -1 : 1

loc1 := 0.0

loc2 := 0.0

loc3 := 0.0

loc4 := 0.0

xx = 0

for x = 1 to 1000 by 1

if hl[x] == ehl and not na(zz[x])

loc1 := zz[x]

xx := x + 1

break

ehl := hl

for x = xx to 1000 by 1

if hl[x] == ehl and not na(zz[x])

loc2 := zz[x]

xx := x + 1

break

ehl := hl == 1 ? -1 : 1

for x = xx to 1000 by 1

if hl[x] == ehl and not na(zz[x])

loc3 := zz[x]

xx := x + 1

break

ehl := hl

for x = xx to 1000 by 1

if hl[x] == ehl and not na(zz[x])

loc4 := zz[x]

break

[loc1, loc2, loc3, loc4]

[loc1, loc2, loc3, loc4] = findprevious()

a = fixnan(zz)

b = loc1

c = loc2

d = loc3

e = loc4

_hh = zz and a > b and a > c and c > b and c > d

_ll = zz and a < b and a < c and c < b and c < d

_hl = zz and (a >= c and b > c and b > d and d > c and d > e or a < b and a > c and b < d)

_lh = zz and (a <= c and b < c and b < d and d < c and d < e or a > b and a < c and b > d)

plotshape(blnDebug and _hl, text='HL', title='Higher Low', style=shape.labelup, color=color.lime, textcolor=color.new(color.black, 0), location=location.belowbar, offset=-rb)

plotshape(blnDebug and _hh, text='HH', title='Higher High', style=shape.labeldown, color=color.lime, textcolor=color.new(color.black, 0), location=location.abovebar, offset=-rb)

plotshape(blnDebug and _ll, text='LL', title='Lower Low', style=shape.labelup, color=color.red, textcolor=color.new(color.white, 0), location=location.belowbar, offset=-rb)

plotshape(blnDebug and _lh, text='LH', title='Lower High', style=shape.labeldown, color=color.red, textcolor=color.new(color.white, 0), location=location.abovebar, offset=-rb)

float res = na

float sup = na

res := _lh ? zz : res[1]

sup := _hl ? zz : sup[1]

int trend = na

iff_3 = close < sup ? -1 : nz(trend[1])

trend := close > res ? 1 : iff_3

res := trend == 1 and _hh or trend == -1 and _lh ? zz : res

sup := trend == 1 and _hl or trend == -1 and _ll ? zz : sup

rechange = res != res[1]

suchange = sup != sup[1]

var line resline = na

var line supline = na

if showsupres

if rechange

line.set_x2(resline, bar_index)

line.set_extend(resline, extend=extend.none)

resline := line.new(x1=bar_index - rb, y1=res, x2=bar_index, y2=res, color=rescol, extend=extend.right, width=srlinewidth)

resline

if suchange

line.set_x2(supline, bar_index)

line.set_extend(supline, extend=extend.none)

supline := line.new(x1=bar_index - rb, y1=sup, x2=bar_index, y2=sup, color=supcol, extend=extend.right, width=srlinewidth)

supline

iff_4 = trend == 1 ? bcolup : bcoldn

barcolor(color=changebarcol and blnDebug ? iff_4 : na)

usdCalcRisk = strategy.equity * pctRisk / 100

usdRisk = usdCalcRisk > 0 ? usdCalcRisk : 0

blnOrder = strategy.opentrades > 0

var entryPrice = close

var hhVal = high

var lhVal = high

var hlVal = low

var llVal = low

var longTP = high

var longSL = low

var shortTP = low

var shortSL = high

var lowest = low

var highest = high

var status = 0

var closedTrades = strategy.closedtrades

var currSignal = ''

var prevSignal = currSignal

if _hh

hhVal := a

prevSignal := currSignal

currSignal := 'HH'

else if _lh

lhVal := a

prevSignal := currSignal

currSignal := 'LH'

else if _hl

hlVal := a

prevSignal := currSignal

currSignal := 'HL'

else if _ll

llVal := a

prevSignal := currSignal

currSignal := 'LL'

fibo(fibTop, fibLow) =>

diff = fibTop - fibLow

fib50 = 0.0

if status % 2 == 1 // Estatus pares son longs

fib50 := fibLow + (diff * (1 - (retro / 100))) // Longs

else

fib50 := fibLow + (diff * (retro / 100))

fib70UP = fibLow + (diff * (1 - (fibSL / 100))) // Fibo 61.8% up

fib70DW = fibLow + (diff * (fibSL / 100)) // Fibo 61.8% down

[fib50, fib70UP, fib70DW]

currLowest = ta.lowest(low, lb + 1) // El menor low de las últimas n barras

currHighest = ta.highest(high, lb + 1) // El mayor high de las últimas n barras

// status 0. En espera de un LL para longs o un HH para shorts

if status == 0 and blnFechas

closedTrades := strategy.closedtrades

if _ll and blnLongs

status := 1

else if _hh and blnShorts

status := 2

// -------- LONGS --------

// status 1. Longs. En espera de un nuevo nivel superior (HH o LH)

else if status == 1

closedTrades := strategy.closedtrades

if _hh or _lh

highest := currHighest

else if _hl

lowest := currLowest

if high > highest

status := 5

highest := high

[fib50, fibUP, fibDW] = fibo(highest, lowest)

entryPrice := fib50

if low <= entryPrice and close <= open // Si la vela roja que rebasó el reciente nivel superior también cruzó el precio de entrada se ingresa a un trade inmediatamente

entryPrice := close

longSL := fibUP // Reajuste de SL para long

diff = entryPrice - longSL

longTP := entryPrice + diff * RR // Reajuste de TP para long

lotSize = usdRisk / diff

if entryPrice > longSL

strategy.entry('🚀 1', strategy.long, limit = entryPrice, qty = lotSize, alert_message = 'long ' + ' ' + syminfo.ticker + ' p=' + str.tostring(entryPrice) + ' tp=' + str.tostring(longTP) + ' sl=' + str.tostring(longSL) + ' q=' + str.tostring(pctRisk) + '%')

strategy.exit('lx', '🚀 1', limit = longTP, stop = longSL, comment_loss = '💥', comment_profit = '✅', alert_message = 'bal')

else

status := 3

[fib50, fibUP, fibDW] = fibo(highest, lowest)

entryPrice := fib50

else if low < llVal

status := 0

// status 3. Longs. En espera de que aparezca un HL

else if status == 3

if _hl

lowest := currLowest

if _lh or _ll or low < hlVal

strategy.cancel_all()

status := _ll ? 1 : 0 // Si fue un nuevo LL comienza a formarse un nuevo setup alcista

else if high > highest

status := 5

highest := high

[fib50, fibUP, fibDW] = fibo(highest, lowest)

entryPrice := fib50

if low <= entryPrice

entryPrice := close

longSL := fibUP // Reajuste de SL para long

diff = entryPrice - longSL

longTP := entryPrice + diff * RR // Reajuste de TP para long

lotSize = usdRisk / diff

if not blnEnLong and entryPrice > longSL

strategy.cancel_all()

strategy.entry('🚀 3', strategy.long, limit = entryPrice, qty = lotSize, alert_message = 'long ' + ' ' + syminfo.ticker + ' p=' + str.tostring(entryPrice) + ' tp=' + str.tostring(longTP) + ' sl=' + str.tostring(longSL) + ' q=' + str.tostring(pctRisk) + '%')

strategy.exit('lx', '🚀 3', limit = longTP, stop = longSL, comment_loss = '💥', comment_profit = '✅', alert_message = 'bal')

// status 5. Longs. Crecimiento del fibo en espera de que se rebase el nivel superior y se toque el entry price para entrar a un trade

else if status == 5

if strategy.closedtrades > closedTrades // Caso trade abre y cierra en una misma vela

status := 0

else if blnEnLong

status := 7

else if _lh or _ll or low < llVal // Caso invalidación por nuevo bajo nivel

strategy.cancel_all()

status := _ll ? 1 : 0 // Si fue un nuevo LL comienza a formarse un nuevo setup alcista

else if high > highest // Caso de rebase de niveles superiores

highest := high

[fib50, fibUP, fibDW] = fibo(highest, lowest)

entryPrice := fib50

longSL := fibUP // Reajuste de SL para long

diff = entryPrice - longSL

longTP := entryPrice + diff * RR // Reajuste de TP para long

lotSize = usdRisk / diff

if not blnEnLong and entryPrice > longSL // Orden limit de long con su TP y SL

strategy.cancel_all()

strategy.entry('🚀 5', strategy.long, limit = entryPrice, qty = lotSize, alert_message = 'long ' + ' ' + syminfo.ticker + ' p=' + str.tostring(entryPrice) + ' tp=' + str.tostring(longTP) + ' sl=' + str.tostring(longSL) + ' q=' + str.tostring(pctRisk) + '%')

strategy.exit('lx', '🚀 5', limit = longTP, stop = longSL, comment_loss = '💥', comment_profit = '✅', alert_message = 'bal')

// status 7. Longs. En espera que finalice el trade

else if status == 7

blnOrder := false

if not blnEnLong

strategy.cancel_all()

if currSignal == 'HH' and blnShorts // Si se finaliza un trade e inmediatamente se presenta un HH debe comenzarse la formación de un setup bajista

status := 2

else

status := 0

// -------- SHORTS --------

// status 2. Shorts. En espera de un nuevo nivel inferior (LL o HL)

else if status == 2

closedTrades := strategy.closedtrades

if _ll or _hl

lowest := currLowest

else if _lh

highest := currHighest

if low < lowest

status := 6

lowest := low

[fib50, fibUP, fibDW] = fibo(highest, lowest)

entryPrice := fib50

if high >= entryPrice and close > open // Si la vela verde que rebasó el reciente nivel inferior tambien cruzó el precio de entrada se ingresa a un trade inmediatamente

entryPrice := close

shortSL := fibDW

diff = shortSL - entryPrice

shortTP := entryPrice - diff * RR

lotSize = usdRisk / diff

if entryPrice < shortSL

strategy.entry('🐻 2', strategy.short, limit = entryPrice, qty = lotSize, alert_message = 'short ' + ' ' + syminfo.ticker + ' p=' + str.tostring(entryPrice) + ' tp=' + str.tostring(shortTP) + ' sl=' + str.tostring(shortSL) + ' q=' + str.tostring(pctRisk) + '%')

strategy.exit('sx', '🐻 2', limit = shortTP, stop = shortSL, comment_loss = '☠️', comment_profit = '❎', alert_message = 'bal')

else

status := 4

[fib50, fibUP, fibDW] = fibo(highest, lowest)

entryPrice := fib50

else if high > hhVal

status := 0

// status 4. Shorts. En espera de que aparezca un LH

else if status == 4

if _lh

highest := currHighest

if _hl or _hh or high > lhVal

strategy.cancel_all()

status := _hh ? 2 : 0 // Si fue un nuevo HH comienza a formarse un nuevo setup bajista

else if low < lowest

status := 6

lowest := low

[fib50, fibUP, fibDW] = fibo(highest, lowest)

entryPrice := fib50

if high >= entryPrice

entryPrice := close

shortSL := fibDW

diff = shortSL - entryPrice

shortTP := entryPrice - diff * RR

lotSize = usdRisk / diff

if not blnEnShort and entryPrice < shortSL

strategy.cancel_all()

strategy.entry('🐻 4', strategy.short, limit = entryPrice, qty = lotSize, alert_message = 'short ' + ' ' + syminfo.ticker + ' p=' + str.tostring(entryPrice) + ' tp=' + str.tostring(shortTP) + ' sl=' + str.tostring(shortSL) + ' q=' + str.tostring(pctRisk) + '%')

strategy.exit('sx', '🐻 4', limit = shortTP, stop = shortSL, comment_loss = '☠️', comment_profit = '❎', alert_message = 'bal')

// status 6. Shorts. Crecimiento del fibo en espera de que se rebase el nivel inferior y se toque el entry price para entrar a un trade

else if status == 6

if strategy.closedtrades > closedTrades // Caso trade abre y cierra en una misma vela

status := 0

else if blnEnShort

status := 8

else if _hl or _hh or high > hhVal

strategy.cancel_all()

status := _hh ? 2 : 0 // Si fue un nuevo HH comienza a formarse un nuevo setup bajista

else if low < lowest // Caso de rebase de niveles inferiores

lowest := low

[fib50, fibUP, fibDW] = fibo(highest, lowest)

entryPrice := fib50

shortSL := fibDW

diff = shortSL - entryPrice

shortTP := entryPrice - diff * RR

lotSize = usdRisk / diff

if entryPrice < shortSL

strategy.cancel_all()

strategy.entry('🐻 6', strategy.short, limit = entryPrice, qty = lotSize, alert_message = 'short ' + ' ' + syminfo.ticker + ' p=' + str.tostring(entryPrice) + ' tp=' + str.tostring(shortTP) + ' sl=' + str.tostring(shortSL) + ' q=' + str.tostring(pctRisk) + '%')

strategy.exit('sx', '🐻 6', limit = shortTP, stop = shortSL, comment_loss = '☠️', comment_profit = '❎', alert_message = 'bal')

// status 8. Shorts. En espera que finalice el trade

else if status == 8

blnOrder := false

if not blnEnShort

strategy.cancel_all()

if currSignal == 'LL' and blnLongs // Si inmediatamente después de finalizar un trade existe un LL debe comenzarse un setup alcista

status := 1

else

status := 0

plotchar(blnDebug and status == 0 and blnFechas, '0', '0', location.abovebar, color.yellow, size = size.tiny)

plotchar(blnDebug and status == 1 and blnFechas, '1', '1', location.abovebar, color.yellow, size = size.tiny)

plotchar(blnDebug and status == 2 and blnFechas, '2', '2', location.abovebar, color.yellow, size = size.tiny)

plotchar(blnDebug and status == 3 and blnFechas, '3', '3', location.abovebar, color.yellow, size = size.tiny)

plotchar(blnDebug and status == 4 and blnFechas, '4', '4', location.abovebar, color.yellow, size = size.tiny)

plotchar(blnDebug and status == 5 and blnFechas, '5', '5', location.abovebar, color.yellow, size = size.tiny)

plotchar(blnDebug and status == 6 and blnFechas, '6', '6', location.abovebar, color.yellow, size = size.tiny)

plotchar(blnDebug and status == 7 and blnFechas, '7', '7', location.abovebar, color.yellow, size = size.tiny)

plotchar(blnDebug and status == 8 and blnFechas, '8', '8', location.abovebar, color.yellow, size = size.tiny)

plot(highest, 'highest', (status == 5 or status[1] == 5) and blnLongs ? color.new(color.orange, 50) : na, 1, plot.style_stepline)

plot(entryPrice, 'entryPrice', (status == 5 or status[1] == 5) and blnLongs ?color.new(color.white, 50) : na, 1, plot.style_stepline)

plot(lowest, 'lowest', (status == 3 or status == 5 or status[1] == 5) and blnLongs ? color.new(color.yellow, 50) : na, 1, plot.style_stepline)

plot(lowest, 'currLowest', (status == 6 or status[1] == 6) and blnShorts ? color.new(color.orange, 50) : na, 1, plot.style_stepline)

plot(entryPrice, 'currEntryPrice', (status == 6 or status[1] == 6) and blnShorts ?color.new(color.white, 50) : na, 1, plot.style_stepline)

plot(highest, 'currHighest', (status == 4 or status == 6 or status[1] == 6) and blnShorts ?color.new(color.yellow, 50) : na, 1, plot.style_stepline)

exitLong = barstate.isconfirmed and blnEnLong and time >= intHasta

exitShort = barstate.isconfirmed and blnEnShort and time >= intHasta

if exitLong

strategy.cancel_all()

strategy.close_all(comment = close > strategy.position_avg_price ? '✅' : '💥')

status := 0

if exitShort

strategy.cancel_all()

strategy.close_all(comment = close < strategy.position_avg_price ? '❎' : '☠️')

status := 0

plot(zz, 'Zigzag', blnDebug ? color.white : na, offset = lb * -1)

rayaTradeLong = strategy.position_size == strategy.position_size[1] and (strategy.position_size > 0) and blnLongs

tpPlLong = plot(longTP, color = rayaTradeLong ? color.teal : na)

epPlLong = plot(entryPrice, color= rayaTradeLong ? color.white : na)

slPlLong = plot(longSL, color = rayaTradeLong ? color.maroon : na)

fill(tpPlLong, epPlLong, color= rayaTradeLong ? color.new(color.teal, 85) : na)

fill(epPlLong, slPlLong, color= rayaTradeLong ? color.new(color.maroon, 85) : na)

rayaTradeShort = strategy.position_size == strategy.position_size[1] and strategy.position_size < 0 and blnShorts

tpPlShort = plot(shortTP, color = rayaTradeShort ? color.teal : na)

epPlShort = plot(entryPrice, color=rayaTradeShort ? color.white : na)

slPlShort = plot(shortSL, color=rayaTradeShort ? color.maroon : na)

fill(tpPlShort, epPlShort, color=rayaTradeShort ? color.new(color.teal, 85) : na)

fill(epPlShort, slPlShort, color=rayaTradeShort ? color.new(color.maroon, 85) : na)

相关推荐