Média móvel de tendência dupla, seguindo uma estratégia com sistema de gestão de riscos baseado no ATR

Autora:ChaoZhang, Data: 2024-11-29 14:56:43Tags:SMAATRTPSLHTF

Resumo

Esta estratégia combina o clássico seguimento de tendência de média móvel dupla com gerenciamento de risco dinâmico baseado em ATR. Ele oferece dois modos de negociação: um modo básico usando cruzamento de média móvel simples para seguir a tendência e um modo avançado incorporando filtragem de tendência de prazo mais alto e mecanismos dinâmicos de stop-loss baseados em ATR. Os comerciantes podem alternar entre os modos através de um menu suspenso simples, atendendo às necessidades de gerenciamento de risco de iniciantes e experientes.

Princípios de estratégia

A estratégia 1 (Modo Básico) emprega um sistema de média móvel dupla de 21 e 49 dias, gerando sinais longos quando o MA rápido cruza acima do MA lento. As metas de lucro podem ser definidas em porcentagem ou pontos, com uma parada de trailering opcional para bloquear os lucros. A estratégia 2 (Modo Avançado) adiciona filtragem de tendência diária, permitindo entradas apenas quando o preço está acima da média móvel de prazo mais alto. Incorpora um stop-loss dinâmico baseado em ATR de 14 períodos que se ajusta à volatilidade do mercado e inclui uma funcionalidade de captação de lucro parcial para proteger ganhos.

Vantagens da estratégia

- Estratégia altamente adaptável que pode adaptar-se à experiência do comerciante e às condições do mercado

- Análise de quadros de tempo em modo avançado melhora a qualidade do sinal

- As paradas dinâmicas baseadas no ATR adaptam-se à variação da volatilidade do mercado

- Saldos de lucro parcial proteção dos lucros com continuação da tendência

- Configuração flexível dos parâmetros para diferentes características do mercado

Riscos estratégicos

- O sistema de MA dupla pode gerar sinais falsos frequentes em mercados variados

- A filtragem da tendência pode causar atraso no sinal, perdendo algumas oportunidades de negociação

- As paradas do ATR podem não se ajustar suficientemente rapidamente aos picos de volatilidade

- A obtenção parcial de lucros pode reduzir o tamanho das posições demasiado cedo em caso de tendências fortes

Orientações para a otimização da estratégia

- Adicionar indicadores de volume e volatilidade para filtrar sinais falsos

- Considerar a aplicação de uma adaptação dinâmica dos parâmetros com base nas condições de mercado

- Otimizar o período de cálculo do ATR para equilibrar sensibilidade e estabilidade

- Adicionar módulo de reconhecimento do estado do mercado para seleção automática do modo de estratégia

- Introduzir mais opções de stop-loss como trailing stops e saídas baseadas em tempo

Resumo

Este é um sistema de negociação bem concebido e abrangente. A combinação de duplo seguimento de tendência média móvel e gerenciamento de risco baseado em ATR garante fiabilidade e controle de risco eficaz. O design de modo duplo atende às necessidades de diferentes níveis de comerciantes, enquanto configurações de parâmetros ricas fornecem amplas oportunidades de otimização. Os comerciantes são aconselhados a começar com parâmetros conservadores na negociação ao vivo e otimizar gradualmente para melhores resultados.

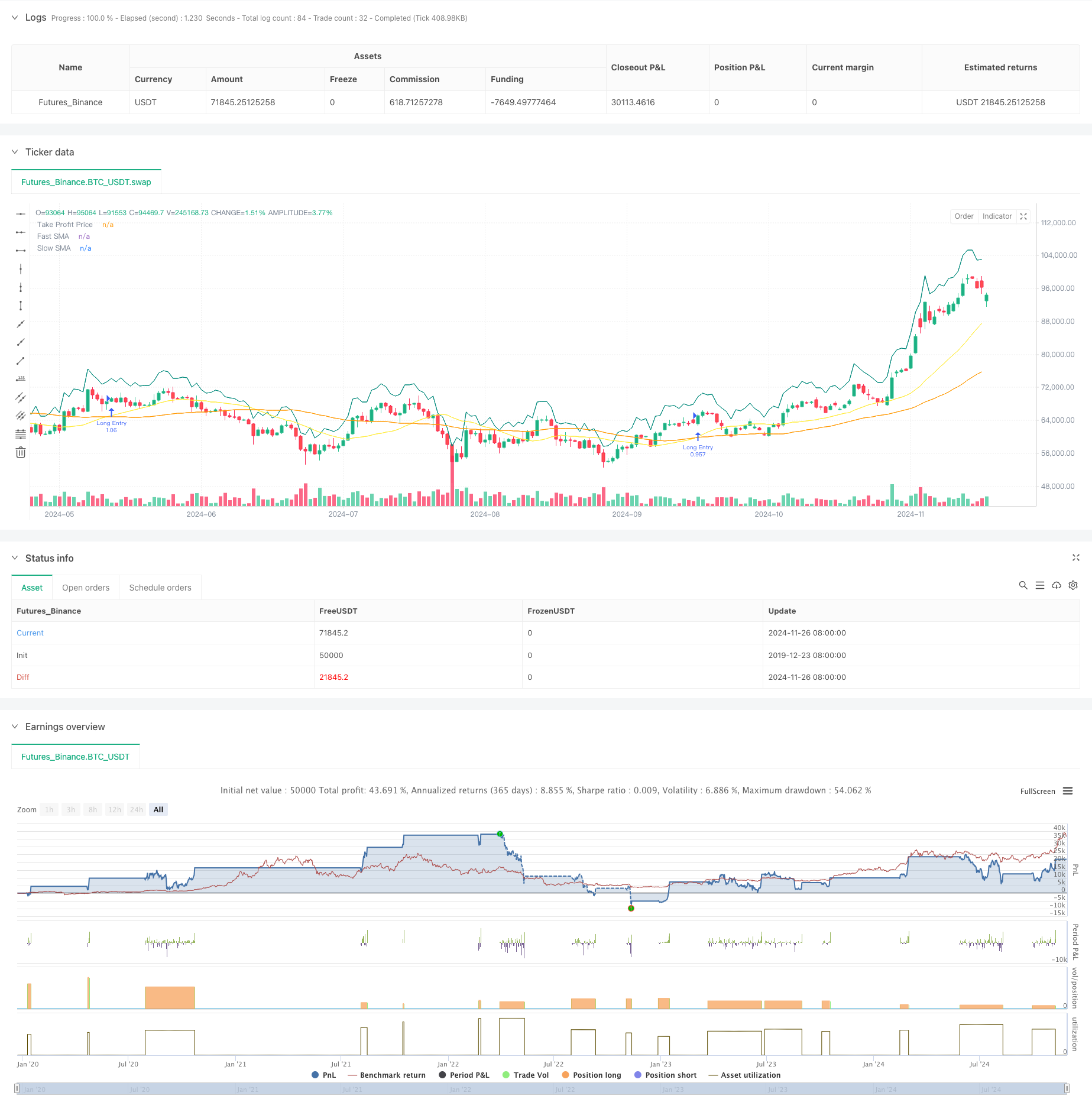

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-27 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © shaashish1

//@version=5

strategy("Dual Strategy Selector V2 - Cryptogyani", overlay=true, pyramiding=0,

default_qty_type=strategy.percent_of_equity, default_qty_value=100, initial_capital=100000)

//#region STRATEGY SELECTION

strategyOptions = input.string(title="Select Strategy", defval="Strategy 1", options=["Strategy 1", "Strategy 2"], group="Strategy Selection")

//#endregion STRATEGY SELECTION

// ####################### STRATEGY 1: Original Logic ########################

//#region STRATEGY 1 INPUTS

s1_fastMALen = input.int(defval=21, title="Fast SMA Length (S1)", minval=1, group="Strategy 1 Settings", inline="S1 MA")

s1_slowMALen = input.int(defval=49, title="Slow SMA Length (S1)", minval=1, group="Strategy 1 Settings", inline="S1 MA")

s1_takeProfitMode = input.string(defval="Percentage", title="Take Profit Mode (S1)", options=["Percentage", "Pips"], group="Strategy 1 Settings")

s1_takeProfitPerc = input.float(defval=7.0, title="Take Profit % (S1)", minval=0.05, step=0.05, group="Strategy 1 Settings") / 100

s1_takeProfitPips = input.float(defval=50, title="Take Profit Pips (S1)", minval=1, step=1, group="Strategy 1 Settings")

s1_trailingTakeProfitEnabled = input.bool(defval=false, title="Enable Trailing (S1)", group="Strategy 1 Settings")

//#endregion STRATEGY 1 INPUTS

// ####################### STRATEGY 2: Enhanced with Recommendations ########################

//#region STRATEGY 2 INPUTS

s2_fastMALen = input.int(defval=20, title="Fast SMA Length (S2)", minval=1, group="Strategy 2 Settings", inline="S2 MA")

s2_slowMALen = input.int(defval=50, title="Slow SMA Length (S2)", minval=1, group="Strategy 2 Settings", inline="S2 MA")

s2_atrLength = input.int(defval=14, title="ATR Length (S2)", group="Strategy 2 Settings", inline="ATR")

s2_atrMultiplier = input.float(defval=1.5, title="ATR Multiplier for Stop-Loss (S2)", group="Strategy 2 Settings", inline="ATR")

s2_partialTakeProfitPerc = input.float(defval=50.0, title="Partial Take Profit % (S2)", minval=10, maxval=100, step=10, group="Strategy 2 Settings")

s2_timeframeTrend = input.timeframe(defval="1D", title="Higher Timeframe for Trend Filter (S2)", group="Strategy 2 Settings")

//#endregion STRATEGY 2 INPUTS

// ####################### GLOBAL VARIABLES ########################

var float takeProfitPrice = na

var float stopLossPrice = na

var float trailingStopPrice = na

var float fastMA = na

var float slowMA = na

var float higherTimeframeTrendMA = na

var bool validOpenLongPosition = false

// Precalculate higher timeframe values (global scope for Strategy 2)

higherTimeframeTrendMA := request.security(syminfo.tickerid, s2_timeframeTrend, ta.sma(close, s2_slowMALen))

// ####################### LOGIC ########################

if (strategyOptions == "Strategy 1")

// Strategy 1 Logic (Original Logic Preserved)

fastMA := ta.sma(close, s1_fastMALen)

slowMA := ta.sma(close, s1_slowMALen)

openLongPosition = ta.crossover(fastMA, slowMA)

validOpenLongPosition := openLongPosition and strategy.opentrades.size(strategy.opentrades - 1) == 0

// Take Profit Price

takeProfitPrice := if (s1_takeProfitMode == "Percentage")

close * (1 + s1_takeProfitPerc)

else

close + (s1_takeProfitPips * syminfo.mintick)

// Trailing Stop Price (if enabled)

if (strategy.position_size > 0 and s1_trailingTakeProfitEnabled)

trailingStopPrice := high - (s1_takeProfitPips * syminfo.mintick)

else

trailingStopPrice := na

else if (strategyOptions == "Strategy 2")

// Strategy 2 Logic with Recommendations

fastMA := ta.sma(close, s2_fastMALen)

slowMA := ta.sma(close, s2_slowMALen)

openLongPosition = ta.crossover(fastMA, slowMA) and close > higherTimeframeTrendMA

validOpenLongPosition := openLongPosition and strategy.opentrades.size(strategy.opentrades - 1) == 0

// ATR-Based Stop-Loss

atr = ta.atr(s2_atrLength)

stopLossPrice := close - (atr * s2_atrMultiplier)

// Partial Take Profit Logic

takeProfitPrice := close * (1 + (s2_partialTakeProfitPerc / 100))

//#endregion STRATEGY LOGIC

// ####################### PLOTTING ########################

plot(series=fastMA, title="Fast SMA", color=color.yellow, linewidth=1)

plot(series=slowMA, title="Slow SMA", color=color.orange, linewidth=1)

plot(series=takeProfitPrice, title="Take Profit Price", color=color.teal, linewidth=1, style=plot.style_linebr)

// Trailing Stop and ATR Stop-Loss Plots (Global Scope)

plot(series=(strategyOptions == "Strategy 1" and s1_trailingTakeProfitEnabled) ? trailingStopPrice : na, title="Trailing Stop", color=color.red, linewidth=1, style=plot.style_linebr)

plot(series=(strategyOptions == "Strategy 2") ? stopLossPrice : na, title="ATR Stop-Loss", color=color.red, linewidth=1, style=plot.style_linebr)

//#endregion PLOTTING

// ####################### POSITION ORDERS ########################

//#region POSITION ORDERS

if (validOpenLongPosition)

strategy.entry(id="Long Entry", direction=strategy.long)

if (strategyOptions == "Strategy 1")

if (strategy.position_size > 0)

if (s1_trailingTakeProfitEnabled)

strategy.exit(id="Trailing Take Profit", from_entry="Long Entry", stop=trailingStopPrice)

else

strategy.exit(id="Take Profit", from_entry="Long Entry", limit=takeProfitPrice)

else if (strategyOptions == "Strategy 2")

if (strategy.position_size > 0)

strategy.exit(id="Partial Take Profit", from_entry="Long Entry", qty_percent=s2_partialTakeProfitPerc, limit=takeProfitPrice)

strategy.exit(id="Stop Loss", from_entry="Long Entry", stop=stopLossPrice)

//#endregion POSITION ORDERS

- Estratégia dupla de cruzamento de médias móveis com gestão dinâmica do risco

- A taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação.

- Tendência dinâmica de dupla ESMA seguindo uma estratégia com gestão inteligente do risco

- Estratégia avançada de ruptura da linha de tendência dinâmica de longo prazo

- Rompimento da estrutura com confirmação de volume Estratégia de negociação inteligente multicondicional

- Sistema de negociação quantitativo de volatilidade adaptativa e de impulso (AVMQTS)

- Modelo de estratégia de otimização da tendência de fusão ATR

- Estratégia de negociação de intensidade de tendência multi-MA - Sistema de negociação inteligente flexível baseado no desvio de MA

- Estratégia de cruzamento de média móvel dinâmica e bandas de Bollinger com modelo fixo de otimização de stop-loss

- A taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação.

- Estratégia de ruptura de seguimento e estrutura de tendências múltiplas

- TRAMA Dual Moving Average Crossover Inteligente Estratégia de Negociação Quantitativa

- Estratégia de negociação RSI-EMA de momento multi-tempo com dimensionamento de posição

- Tendência multi-MA seguindo a estratégia de impulso do RSI

- Método de EMA de Fibonacci de vários níveis

- Sistema de negociação de breakout de diferença de tendência com filtro SMA

- Tendência de cruzamento da EMA dupla Seguindo uma estratégia com gestão de risco e sistema de filtragem do tempo

- Tendência de média móvel duplamente suavizada seguindo a estratégia - baseada no Heikin-Ashi modificado

- Sistema de negociação MACD Multi-Interval Dynamic Stop-Loss e Take-Profit

- Sistema de negociação dinâmico com RSI estocástico e confirmação de candlestick

- O valor da posição em risco deve ser calculado de acordo com o método de cálculo da posição em risco, de acordo com o método de cálculo da posição em risco.

- A estratégia de negociação de tendência de MA com resistência dinâmica

- Sistema de Estratégia Quantitativa de Reversão de Momento de Multifrequência

- Sistema automatizado de negociação quantitativa com duplo crossover EMA e gestão de riscos

- Tendência dinâmica de dupla ESMA seguindo uma estratégia com gestão inteligente do risco

- Tendência paramétrica adaptativa baseada no KNN na sequência da estratégia

- Tendência multiperíodo após sistema de negociação baseado em faixas de volatilidade da EMA

- Gerador de transações aleatórias do sistema de detecção

- Tendência de alta taxa de ganho da EMA de vários prazos (Advanced)

- Tendência da volatilidade do intervalo adaptativo na sequência da estratégia de negociação