Стратегия торговли Nifty на основе индикатора RSI

Автор:Чао ЧжанТэги:

Обзор

Принцип стратегии

Анализ преимуществ

- Немногие параметры показателей, легко оптимизировать и регулировать

- Преследование краткосрочной избыточной доходности, соответствует философии скальпинга

- Настраиваемый период времени торговли, адаптируется к различным ожиданиям

Анализ рисков

К основным рискам этой стратегии относятся:

- Не в состоянии улавливать долгосрочные тенденции, вероятно, пропустит большие движения

- Чрезмерная зависимость от оптимизации параметров, риск перенастройки

- Нет механизма остановки потерь для эффективного контроля потерь

- Частая торговля влияет на период хранения, что приводит к увеличению затрат на транзакции

Чтобы контролировать вышеупомянутые риски, можно оптимизировать следующие аспекты:

- Включить индикаторы тенденций для выявления долгосрочных движений

- Используйте анализ ходьбы вперед для предотвращения перенастройки

- Установка точек остановки для своевременной остановки

Руководство по оптимизации

Основные аспекты оптимизации стратегии:

- Оптимизировать параметры RSI для поиска оптимальных комбинаций параметров

- Включить скользящие средние и т.д. для оценки долгосрочной тенденции

- Добавить модуль размещения позиций для оптимизации распределения позиций

- Добавление количественных авторских прав для автоматической корректировки параметров

Заключение

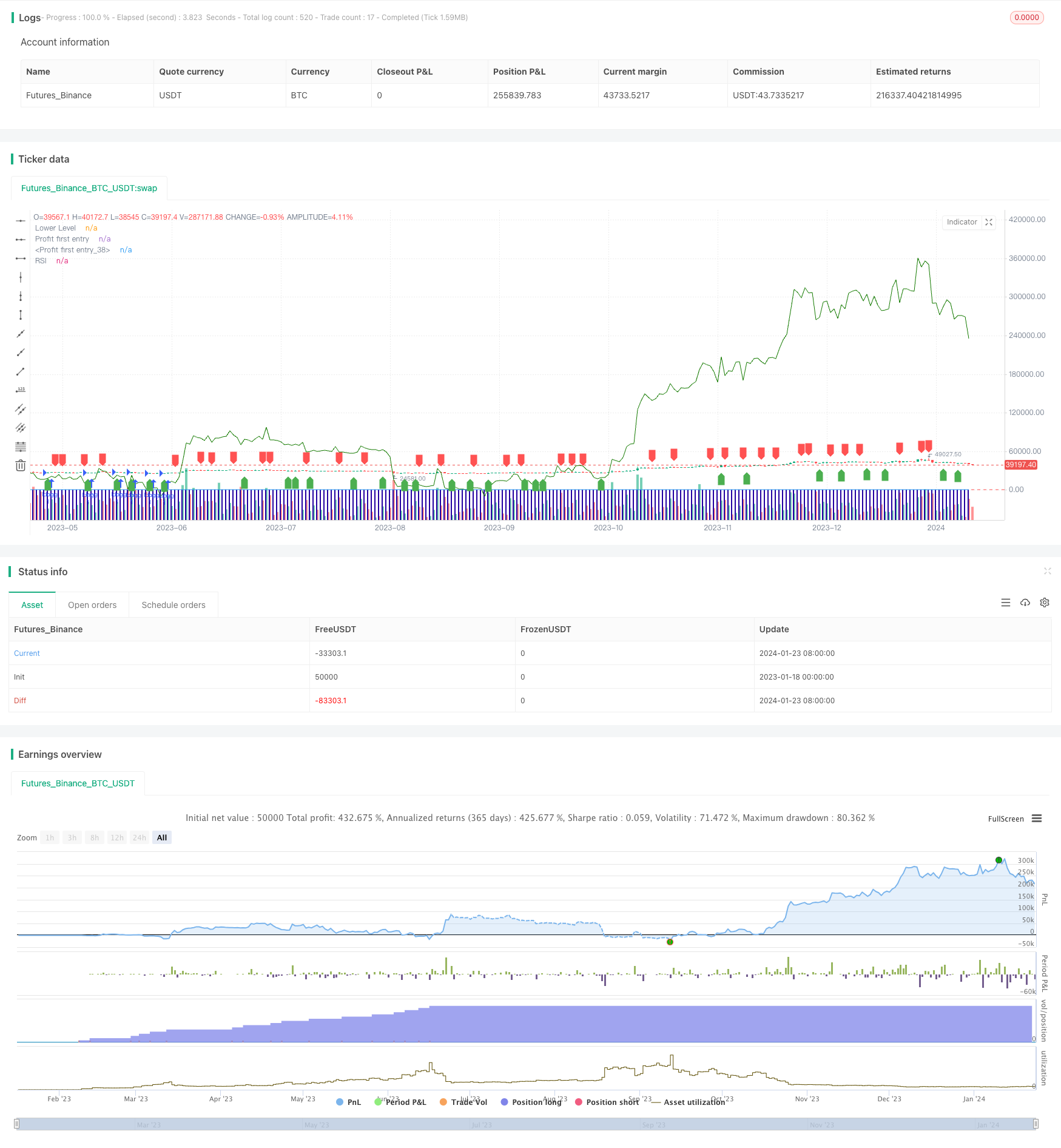

/*backtest

start: 2023-01-18 00:00:00

end: 2024-01-24 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("RSI Strategy", overlay=true,pyramiding = 1000)

rsi_period = 2

rsi_lower = 20

rsi_upper = 70

rsi_value = rsi(close, rsi_period)

buy_signal = crossover(rsi_value, rsi_lower)

sell_signal = crossunder(rsi_value, rsi_upper)

current_date1 = input(defval=timestamp("01 Nov 2009 00:00 +0000"), title="stary Time", group="Time Settings")

current_date = input(defval=timestamp("01 Nov 2023 00:00 +0000"), title="End Time", group="Time Settings")

investment_amount = 100000.0

start_time = input(defval=timestamp("01 Dec 2018 00:00 +0000"), title="Start Time", group="Time Settings")

end_time = input(defval=timestamp("30 Nov 2023 00:00 +0000"), title="End Time", group="Time Settings")

in_time = time >= start_time and time <= end_time

// Variable to track accumulation.

var accumulation = 0.0

out_time = time >= end_time

if (buy_signal )

strategy.entry("long",strategy.long,qty= 1)

accumulation += 1

if (out_time)

strategy.close(id="long")

plotshape(series=buy_signal, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup)

plotshape(series=sell_signal, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown)

plot(rsi_value, title="RSI", color=color.blue)

hline(rsi_lower, title="Lower Level", color=color.red)

plot(strategy.opentrades, style=plot.style_columns,

color=#2300a1, title="Profit first entry")

plot(strategy.openprofit, style=plot.style_line,

color=#147a00, title="Profit first entry")

// plot(strategy.position_avg_price, style=plot.style_columns,

// color=#ca0303, title="Profit first entry")

// log.info(strategy.position_size * strategy.position_avg_price)

Больше

- Стратегия отслеживания трендов на основе фильтра Калмана

- Сезоновая обратная стратегия межвременной торговли

- Двойная экспоненциальная скользящая средняя кроссоверная алгоритмическая стратегия торговли

- Количественная стратегия торговли с несколькими факторами

- Стратегия отслеживания торговых операций с отставанием на 2 линии

- Стратегия торговли BTC на основе EMA и MACD

- Интеллектуальная стратегия остановки потерь

- Прорыв адаптивной волатильности

- Стратегия поиска импульса

- Стратегия переворота штифта пирсинга

- Стратегия, основанная на тренде RSI и EMA

- Стратегия отслеживания подтверждения тренда

- Стратегия показателей дивергенции РСИ

- Стратегия консолидации движущейся средней

- Быстрая стратегия перекрестной торговли QQE, основанная на фильтре трендов

- Стратегия отслеживания адаптивной скользящей средней

- Стратегия скальпинга на рынке перемены тренда

- Двунаправленная стратегия трансковантальной торговли EMA

- Стратегия внутридневного скальпинга EMA

- Составная стоп-лосс и стратегия получения прибыли на основе случайного входа