概述

该策略基于Ichimoku云指标的叫Lagging Span 2的线,根据该线的移动判断趋势方向,进行仓位建立。当价格突破Lagging Span 2线时,判断为趋势转折点,此时可以建立新的头寸。

策略原理

该策略主要判断指标Ichimoku云中Lagging Span 2线的移动情况。Lagging Span 2线是基于价格的一个平滑移动均线,通过平滑参数可以调整其灵敏度。当价格从上向下突破Lagging Span 2线时,做空;当价格从下向上突破Lagging Span 2线时,做多。

具体来说,策略通过Donchian函数计算出Lagging Span 2线。然后给该线做一个位移偏移,得到最终的交易信号线。当价格突破该信号线时,判断为价格趋势转折点,此时做多做空。

在入场时,策略同时设置了止盈止损点。做多时设置多单止盈和止损;做空时设置空单止盈和止损。

优势分析

该策略主要优势有:

使用Ichimoku云指标中的Lagging Span 2线判断趋势,该线平滑性好,避免假突破。

做多做空信号比较清晰,容易判断。

同时设置止盈止损,可以很好控制风险。

风险分析

该策略主要风险有:

Lagging Span 2线本身也会有滞后,可能错过趋势较好的入场点。可以适当调整平滑参数优化。

止盈止损设置不当可能造成亏损扩大。可以根据不同品种特点优化设置。

突破交易本身就有被套利盘套住的风险。可以设置趋势过滤条件或者确认突破来避免。

优化方向

该策略可以从以下几个方面进行优化:

调整Lagging Span 2线的平滑参数,优化其灵敏度,在发现趋势转折点和防止假突破之间找到平衡。

为做多做空单分别设置止盈止损,同时优化止盈止损的设置,防止过大亏损。

增加趋势判断条件,避免逆势交易。例如结合其他指标判断整体趋势方向。

增加确认机制。在首次突破时不直接入场,而是等待再次回调突破的确认信号。

总结

该策略整体较为简单实用。以Ichimoku云指标的Lagging Span 2线为基础,判断价格趋势转折点。同时设置止盈止损来控制风险。该策略优化空间较大,可从多个方面进行调整,既可获得更优入场时机,也可进一步控制风险,从而获得较好的策略效果。

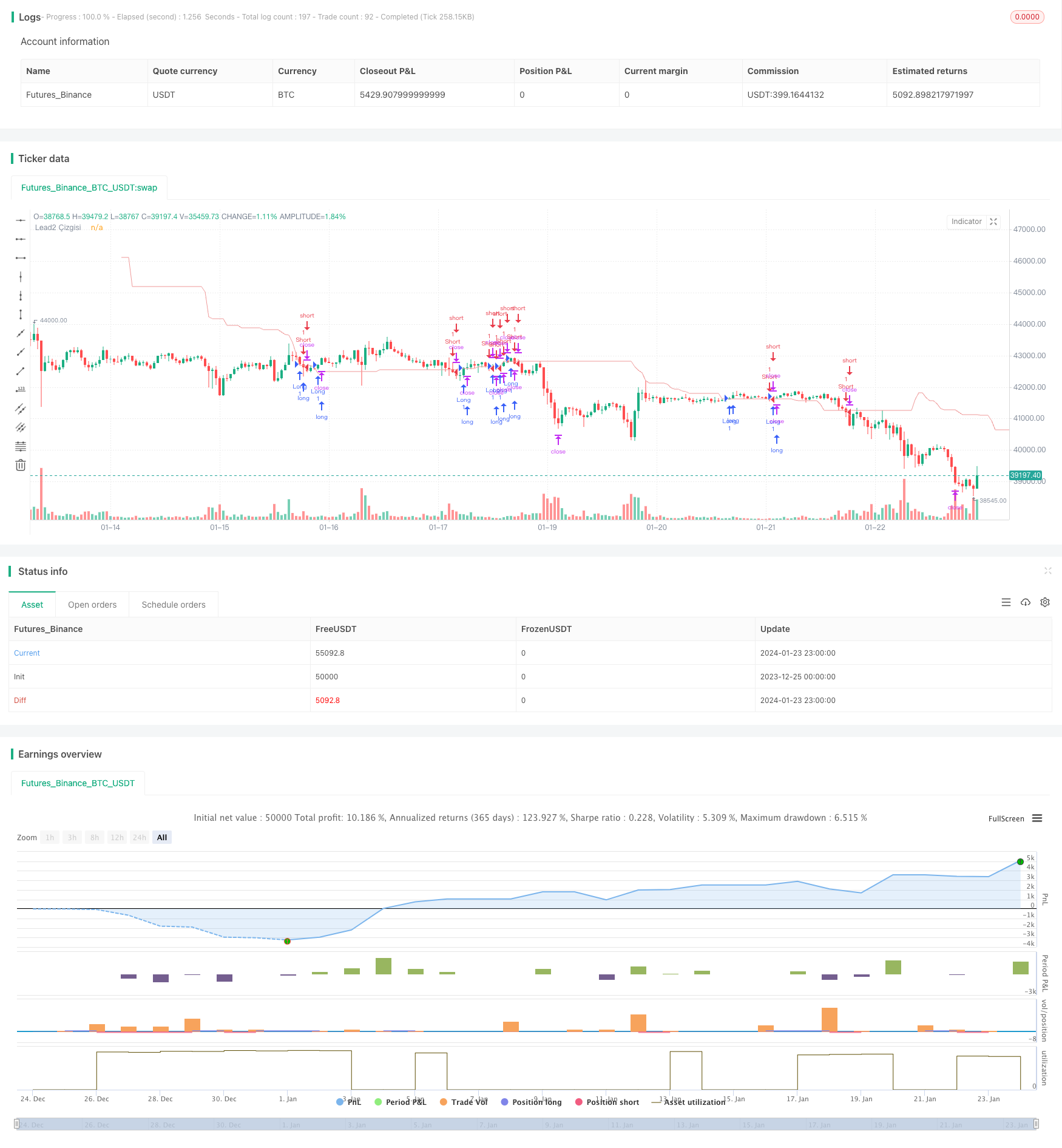

/*backtest

start: 2023-12-25 00:00:00

end: 2024-01-24 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © MGULHANN

//@version=5

strategy("TPS - FX Trade", overlay=true)

laggingSpan2Periods = input.int(52, minval=1, title="Lead Look Back")

displacement = input.int(26, minval=1, title="Displacement")

pozyonu = input.bool(false,title="Sadece Long Yönlü Poz Aç")

// Stop Loss ve Kar Al Seviye Girişleri

TPLong = input.int(10000, minval = 30, title ="Long Kar Al Puanı", step=10)

SLLong = input.int(7500, minval = 30, title ="Long Zarar Durdur Puanı", step=10)

TPShort = input.int(20000, minval = 30, title ="Short Kar Al Puanı", step=10)

SLShort = input.int(7500, minval = 30, title ="Short Zarar Durdur Puanı", step=10)

donchian(len) => math.avg(ta.lowest(len), ta.highest(len))

leadLine = donchian(laggingSpan2Periods)

plot(leadLine, offset = displacement - 1, color=#EF9A9A,title="Lead2 Çizgisi")

buycross = ta.crossover(close,leadLine[displacement-1])

sellcross = ta.crossover(leadLine[displacement-1],close)

if (buycross) and (pozyonu == true) or buycross

strategy.entry("Long", strategy.long)

strategy.exit("Exit Long", "Long", profit=TPLong, loss=SLLong)

if (sellcross) and pozyonu == false

strategy.entry("Short", strategy.short)

strategy.exit("Exit Short", "Short", profit=TPShort, loss=SLShort)