Синергетическая торговая система с многотехническими показателями

Автор:Чао Чжан, Дата: 2024-12-27 16:00:07Тэги:М.А.РСИMACDББSMAЕМА

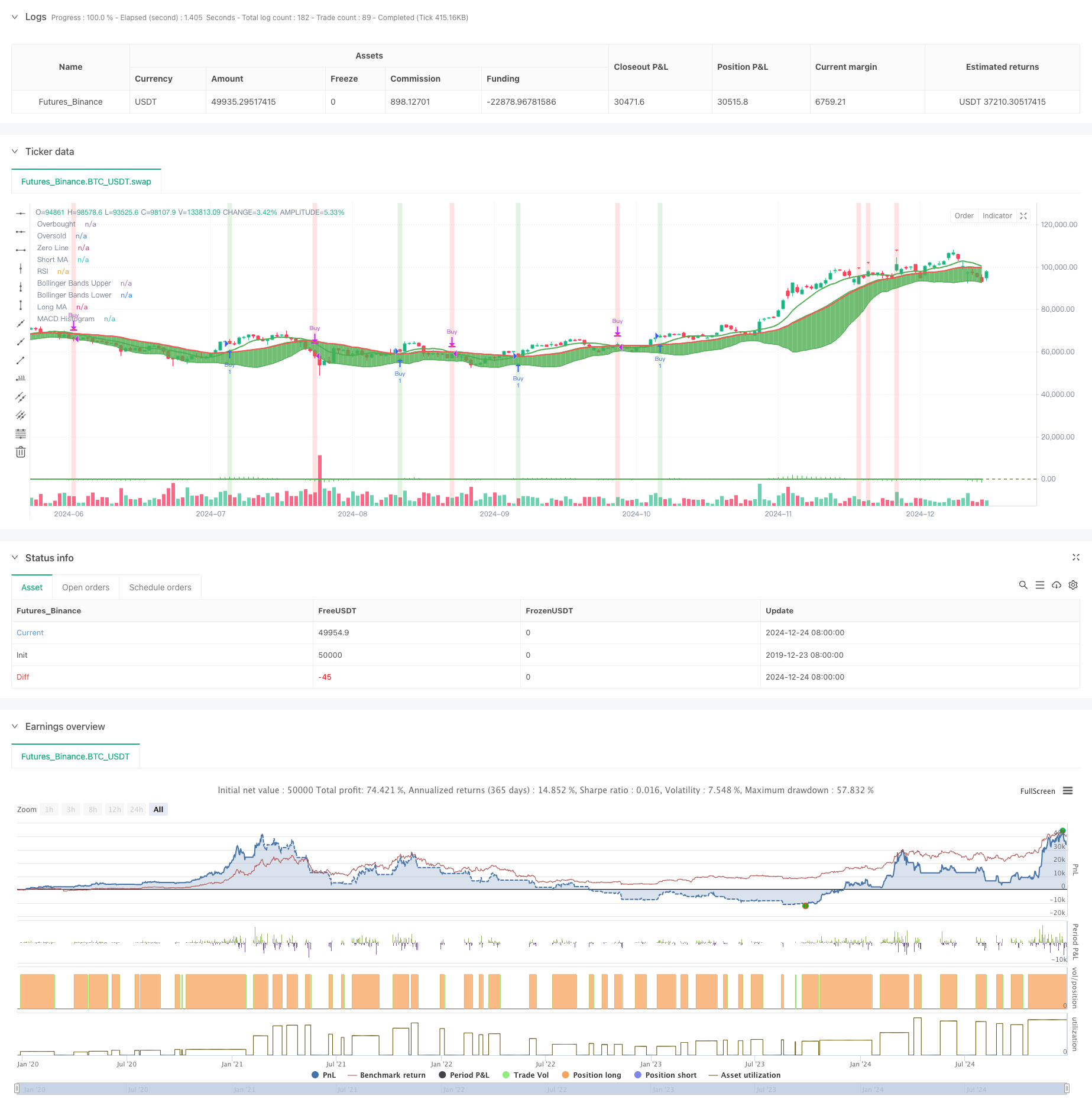

Обзор

Эта стратегия представляет собой комплексную торговую систему, которая сочетает в себе несколько классических технических индикаторов, включая скользящую среднюю (MA), индекс относительной силы (RSI), скользящую среднюю конвергенцию дивергенции (MACD) и полосы Боллинджера (BB).

Принципы стратегии

Стратегия использует многоуровневый механизм проверки сигналов, включающий:

- Использование кроссоверов краткосрочных (9-дневных) и долгосрочных (21-дневных) скользящих средних для определения основного направления тренда

- Использование РСИ (14 дней) для выявления перекупленных и перепроданных зон с ключевыми уровнями 70 и 30

- Использование MACD (12,26,9) для подтверждения силы тренда и потенциальных поворотных точек

- Использование диапазонов Боллинджера (20-дневные, 2 стандартных отклонения) для оценки диапазона волатильности цен и потенциальных точек переворота

Система генерирует торговые сигналы при следующих условиях:

- Первичный сигнал покупки: краткосрочный MA пересекает длительный MA

- Первичный сигнал продажи: кратковременный MA пересекает длительный MA

- Вторичный сигнал покупки: RSI ниже 30, MACD-гистограмма положительная, и цена достигает нижней полосы Боллинджера.

- Вторичный сигнал продажи: RSI выше 70, гистограмма MACD отрицательная, и цена достигает верхней полосы Боллинджера.

Преимущества стратегии

- Многомерный анализ: обеспечивает более полную перспективу анализа рынка путем интеграции нескольких технических показателей

- Механизм подтверждения сигнала: уменьшает количество ложных сигналов путем сочетания первичных и вторичных сигналов.

- Устойчивый контроль рисков: контролирует риск входных точек с использованием комбинации полос Боллинджера и RSI.

- Способность отслеживать тенденции: отслеживает основные тенденции и определяет точки обратного движения тенденции с помощью комбинации MA и MACD

- Сильная визуализация: обеспечивает четкий графический интерфейс, включая запросы на цвет фона и маркеры формы

Стратегические риски

- Отставание сигнала: скользящие средние имеют врожденное отставание, потенциально ведущее к неоптимальным точкам входа

- Боковой рыночный риск: может порождать частые ложные сигналы на различных рынках

- Конфликты индикаторов: несколько индикаторов иногда могут генерировать противоречивые сигналы

- Чувствительность параметров: эффективность стратегии чувствительна к параметрам, требуя тщательной оптимизации

Направления оптимизации стратегии

- Динамическая корректировка параметров: автоматическая корректировка параметров показателей на основе волатильности рынка

- Классификация рыночной среды: Добавление механизмов идентификации рыночной среды для использования различных комбинаций сигналов в различных рыночных условиях

- Улучшение стоп-лосса: включить более гибкие стратегии стоп-лосса, такие как стоп-стопы с отставанием или стоп-стопы на основе ATR.

- Оптимизация управления позициями: динамическое регулирование размеров позиций на основе силы сигнала и волатильности рынка

- Синхронизация временных рамок: рассмотреть вопрос о добавлении многократного анализа временных рамок для улучшения надежности сигнала

Резюме

Это хорошо разработанная многомерная система торговой стратегии, которая обеспечивает торговые сигналы посредством синергии нескольких технических индикаторов. Основные преимущества стратегии заключаются в ее всеобъемлющей аналитической структуре и строгом механизме подтверждения сигналов, при этом необходимо уделять внимание оптимизации параметров и адаптивности к рыночной среде.

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-25 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Ultimate Buy/Sell Indicator", overlay=true)

// Inputs for Moving Averages

shortMaLength = input.int(9, title="Short MA Length", minval=1)

longMaLength = input.int(21, title="Long MA Length", minval=1)

// Inputs for RSI

rsiLength = input.int(14, title="RSI Length", minval=1)

rsiOverbought = input.int(70, title="RSI Overbought Level", minval=1, maxval=100)

rsiOversold = input.int(30, title="RSI Oversold Level", minval=1, maxval=100)

// Inputs for MACD

macdShortLength = input.int(12, title="MACD Short EMA Length", minval=1)

macdLongLength = input.int(26, title="MACD Long EMA Length", minval=1)

macdSignalSmoothing = input.int(9, title="MACD Signal Smoothing", minval=1)

// Inputs for Bollinger Bands

bbLength = input.int(20, title="Bollinger Bands Length", minval=1)

bbMultiplier = input.float(2.0, title="Bollinger Bands Multiplier", minval=0.1)

// Calculate Moving Averages

shortMa = ta.sma(close, shortMaLength)

longMa = ta.sma(close, longMaLength)

// Calculate RSI

rsi = ta.rsi(close, rsiLength)

// Calculate MACD

[macdLine, signalLine, _] = ta.macd(close, macdShortLength, macdLongLength, macdSignalSmoothing)

macdHist = macdLine - signalLine

// Calculate Bollinger Bands

[bbUpper, bbBasis, bbLower] = ta.bb(close, bbLength, bbMultiplier)

// Define colors

colorPrimary = color.new(color.green, 0)

colorSecondary = color.new(color.red, 0)

colorBackgroundBuy = color.new(color.green, 80)

colorBackgroundSell = color.new(color.red, 80)

colorTextBuy = color.new(color.green, 0)

colorTextSell = color.new(color.red, 0)

// Plot Moving Averages

plot(shortMa, color=colorPrimary, linewidth=2, title="Short MA")

plot(longMa, color=colorSecondary, linewidth=2, title="Long MA")

// Plot Bollinger Bands

bbUpperLine = plot(bbUpper, color=colorPrimary, linewidth=1, title="Bollinger Bands Upper")

bbLowerLine = plot(bbLower, color=colorPrimary, linewidth=1, title="Bollinger Bands Lower")

fill(bbUpperLine, bbLowerLine, color=color.new(colorPrimary, 90))

// Buy/Sell Conditions based on MA cross

buySignal = ta.crossover(shortMa, longMa)

sellSignal = ta.crossunder(shortMa, longMa)

// Execute Buy/Sell Orders

if buySignal

strategy.entry("Buy", strategy.long, 1)

strategy.close("Sell", qty_percent=1) // Close all positions when selling

if sellSignal

strategy.close("Sell", qty_percent=1) // Close all positions when selling

strategy.close("Buy") // Close any remaining buy positions

// Plot Buy/Sell Signals for MA crossovers

plotshape(series=buySignal, location=location.belowbar, color=colorTextBuy, style=shape.triangleup, size=size.small, title="Buy Signal")

plotshape(series=sellSignal, location=location.abovebar, color=colorTextSell, style=shape.triangledown, size=size.small, title="Sell Signal")

// Background Color based on Buy/Sell Signal for MA crossovers

bgcolor(buySignal ? colorBackgroundBuy : na, title="Buy Signal Background")

bgcolor(sellSignal ? colorBackgroundSell : na, title="Sell Signal Background")

// Plot RSI with Overbought/Oversold Levels

hline(rsiOverbought, "Overbought", color=colorSecondary, linestyle=hline.style_dashed, linewidth=1)

hline(rsiOversold, "Oversold", color=colorPrimary, linestyle=hline.style_dashed, linewidth=1)

plot(rsi, color=colorPrimary, linewidth=2, title="RSI")

// Plot MACD Histogram

plot(macdHist, color=colorPrimary, style=plot.style_histogram, title="MACD Histogram", linewidth=2)

hline(0, "Zero Line", color=color.new(color.gray, 80))

// Additional Buy/Sell Conditions based on RSI, MACD, and Bollinger Bands

additionalBuySignal = rsi < rsiOversold and macdHist > 0 and close < bbLower

additionalSellSignal = rsi > rsiOverbought and macdHist < 0 and close > bbUpper

// Plot Additional Buy/Sell Signals

plotshape(series=additionalBuySignal and not buySignal, location=location.belowbar, color=colorTextBuy, style=shape.triangleup, size=size.small, title="Additional Buy Signal")

plotshape(series=additionalSellSignal and not sellSignal, location=location.abovebar, color=colorTextSell, style=shape.triangledown, size=size.small, title="Additional Sell Signal")

// Background Color based on Additional Buy/Sell Signal

bgcolor(additionalBuySignal and not buySignal ? colorBackgroundBuy : na, title="Additional Buy Signal Background")

bgcolor(additionalSellSignal and not sellSignal ? colorBackgroundSell : na, title="Additional Sell Signal Background")

- Нет стратегии взрыва верхней ветви.

- Болинджерские полосы + РСИ + Стратегия тренда Multi-MA

- Многоуровневый динамический тренд MACD после стратегии с 52-недельной системой анализа высокого/низкого расширения

- Тенденция высокой ставки прибыли в рамках EMA в течение нескольких периодов времени в соответствии со стратегией (продвинутая)

- Количественная долгосрочная стратегия переключения, основанная на G-канале и EMA

- Многостратегическая система торговли техническим анализом

- Многопоказательная комплексная стратегия торговли: идеальное сочетание импульса, перекупленности/перепродажи и волатильности

- Количественная стратегия торговли для сбора динамических тенденций с использованием множественной EMA

- Динамическая двойная скользящая средняя кроссоверная количественная стратегия торговли

- Многоиндикаторная динамическая стратегия торгового тренда стоп-лосс

- Стратегия высокочастотного динамического оптимизации на основе мультитехнических показателей

- Тройной супертенд и экспоненциальный скользящий средний тренд после количественной стратегии торговли

- Стратегия количественного тренда двойной скользящей средней с использованием облачных полос Боллингера

- Многоуровневая количественная стратегия торговли, основанная на дивергенции тренда полос Боллинджера

- Количественная стратегия торговли, основанная на Fibonacci 0.7 Level Trend Breakthrough

- Многопериодный фрактальный блок ордера на прорыв адаптивная стратегия торговли

- Оптимизированная стратегия соотношения риск-вознаграждение, основанная на перекрестном перемещении скользящих средних

- Стратегия торговли адаптивной тенденции после динамической тенденции признания

- Трансграничная динамическая диапазона количественной стратегии торговли на основе полос Боллинджера

- Стратегия адаптивного прогнозирования перекрестного сигнала SMI на основе импульса