本文将介绍一个结合了多个技术指标的交易策略系统。该系统通过整合MACD、EMA、简单移动平均线和MA100等多个技术分析方法,配合风险管理和时间过滤器,旨在为交易者提供一个全面的交易解决方案。

策略概述

该策略是一个多策略组合型技术分析系统,包含四个独立的子策略:MACD策略、EMA8策略、简单MA策略和MA100策略。系统允许交易者根据市场情况灵活选择不同的策略类型,每个子策略都有其独特的进场和出场逻辑,并配备了相应的风险管理机制。

策略原理

MACD策略:通过识别MACD直方图的连续上升和下降模式来捕捉市场趋势。当出现三根连续上升的直方图柱时触发买入信号,两根连续下降的直方图柱触发卖出信号。

EMA8策略:结合周线EMA8均线、前期高点和K线形态分析。当价格突破周线EMA8且收盘价高于前期高点,同时出现强势K线时,系统进行买入。该策略配备了2%的止损设置。

简单MA策略:使用多重指数移动平均线(10,15,25,35,40周期)构建趋势跟踪系统。当较短周期均线位于较长周期均线之上且价格突破最短周期均线时,触发买入信号。同样设置了2%的止损。

MA100策略:结合100日均线、8日均线和25日均线,并引入随机指标进行超卖判断。当短期均线位于长期均线之上,且价格在MA100附近波动时,系统在超卖区域寻找买入机会。此策略采用3%的止损设置。

策略优势

- 多策略融合:通过组合不同的技术分析方法,提高了系统的适应性和稳定性。

- 风险控制完善:每个子策略都配备了止损机制,有效控制单笔交易风险。

- 灵活性强:交易者可以根据市场环境选择最适合的策略类型。

- 多维度分析:结合了趋势、动量和波动性等多个维度的市场分析。

- 可视化支持:系统提供了完整的图表可视化功能,便于交易者理解市场状况。

策略风险

- 参数优化风险:多个技术指标的参数需要定期优化,过度优化可能导致过拟合。

- 市场环境依赖:不同的子策略在不同市场环境下表现各异,需要正确选择。

- 信号滞后:技术指标本质上具有滞后性,可能导致入场或出场时机不够理想。

- 假突破风险:在横盘市场中可能产生较多假信号。

优化方向

- 增加市场环境识别模块:建议添加市场环境判断功能,自动选择最适合的子策略。

- 完善止盈机制:可以根据不同市场环境动态调整止盈水平。

- 加入波动率过滤:建议引入ATR指标进行波动率分析,过滤低波动率环境下的交易信号。

- 优化参数自适应:可以开发参数动态调整机制,提高系统适应性。

- 增加交易量分析:建议加入交易量确认机制,提高信号可靠性。

总结

该多策略组合型技术分析交易系统通过整合多个成熟的技术分析方法,为交易者提供了一个全面的交易决策框架。系统的主要优势在于其灵活性和风险控制能力,但同时也需要交易者对市场有较深的理解才能正确使用。通过持续优化和改进,该系统有望成为一个更加完善的交易工具。

策略源码

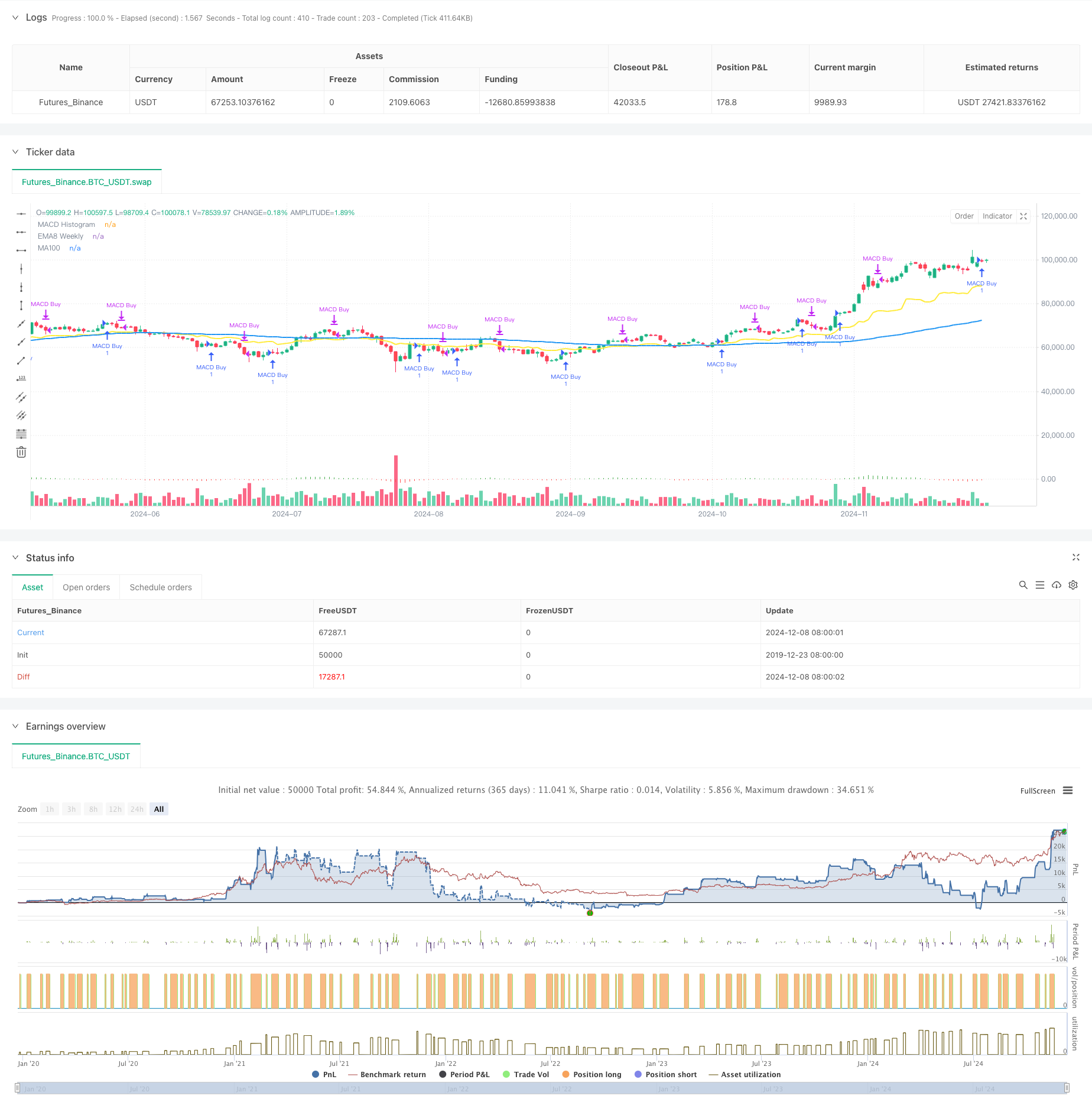

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-09 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ v5 code implements multiple trading strategies

//@version=5

strategy("Multi-Strategy Trading System", overlay=true)

// Input parameters for customization

strategy_type = input.string("MACD", "Strategy Type", options=["MACD", "EMA8", "SimpleMA", "MA100"])

show_macd = input.bool(true, "Show MACD Signals")

show_ema = input.bool(true, "Show EMA Signals")

show_ma = input.bool(true, "Show MA Signals")

// MACD Strategy Components

[macdLine, signalLine, histLine] = ta.macd(close, 12, 26, 9)

// Function to detect three consecutive ascending histogram bars

isThreeAscendingBars(hist) =>

not na(hist[3]) and hist[3] < hist[2] and hist[2] < hist[1] and hist[1] < hist[0]

// Function to detect two consecutive descending histogram bars

isTwoDescendingBars(hist) =>

not na(hist[2]) and hist[2] > hist[1] and hist[1] > hist[0]

// EMA Strategy Components

ema8_weekly = request.security(syminfo.tickerid, "W", ta.ema(close, 8))

weeklyHigh = request.security(syminfo.tickerid, "W", high)

previousWeekHigh = weeklyHigh[1]

isStrongCandleWeekly = request.security(syminfo.tickerid, "W", close > open and (close - open) > (high - low) * 0.6)

// Simple MA Strategy Components

ema10 = ta.ema(close, 10)

ema15 = ta.ema(close, 15)

ema25 = ta.ema(close, 25)

ema35 = ta.ema(close, 35)

ema40 = ta.ema(close, 40)

// MA100 Strategy Components

ma100 = ta.sma(close, 100)

ma8 = ta.sma(close, 8)

ma25 = ta.sma(close, 25)

// Corrected Stochastic Oscillator Calculation

stochK = ta.stoch(high, low, close, 14)

stochD = ta.sma(stochK, 3)

isOversold = stochK < 20 and stochD < 20

// MACD Strategy Logic

if strategy_type == "MACD"

// Buy condition: Three ascending histogram bars after lowest

if isThreeAscendingBars(histLine)

strategy.entry("MACD Buy", strategy.long)

// Sell condition: Two descending histogram bars after highest

if isTwoDescendingBars(histLine)

strategy.close("MACD Buy")

// EMA8 Strategy Logic

if strategy_type == "EMA8"

if close > ema8_weekly and close > previousWeekHigh and isStrongCandleWeekly

strategy.entry("EMA8 Buy", strategy.long)

strategy.exit("EMA8 Exit", "EMA8 Buy", stop=low - (low * 0.02))

// Simple MA Strategy Logic

if strategy_type == "SimpleMA"

isUptrend = ema10 > ema15 and ema15 > ema25 and ema25 > ema35 and ema35 > ema40

if isUptrend and close > ema10 and close[1] <= ema10[1]

strategy.entry("MA Buy", strategy.long)

strategy.exit("MA Exit", "MA Buy", stop=low - (low * 0.02))

// MA100 Strategy Logic

if strategy_type == "MA100"

isUptrend = ma8 > ma100 and ma25 > ma100

isPriceNearMA100 = math.abs(close - ma100) / ma100 * 100 < 1

if isUptrend and isPriceNearMA100 and isOversold

strategy.entry("MA100 Buy", strategy.long)

strategy.exit("MA100 Exit", "MA100 Buy", stop=low - (low * 0.03))

// Plotting components for visualization

plot(ma100, "MA100", color=color.blue, linewidth=2)

plot(ema8_weekly, "EMA8 Weekly", color=color.yellow, linewidth=2)

plot(series=histLine, title="MACD Histogram", style=plot.style_histogram, color=histLine > 0 ? color.green : color.red)

相关推荐