دوہری الٹ آسنٹلنگ بینڈ ٹرینڈ اسٹریٹجی کے بعد

مصنف:چاؤ ژانگ، تاریخ: 2024-01-25 16:01:04ٹیگز:

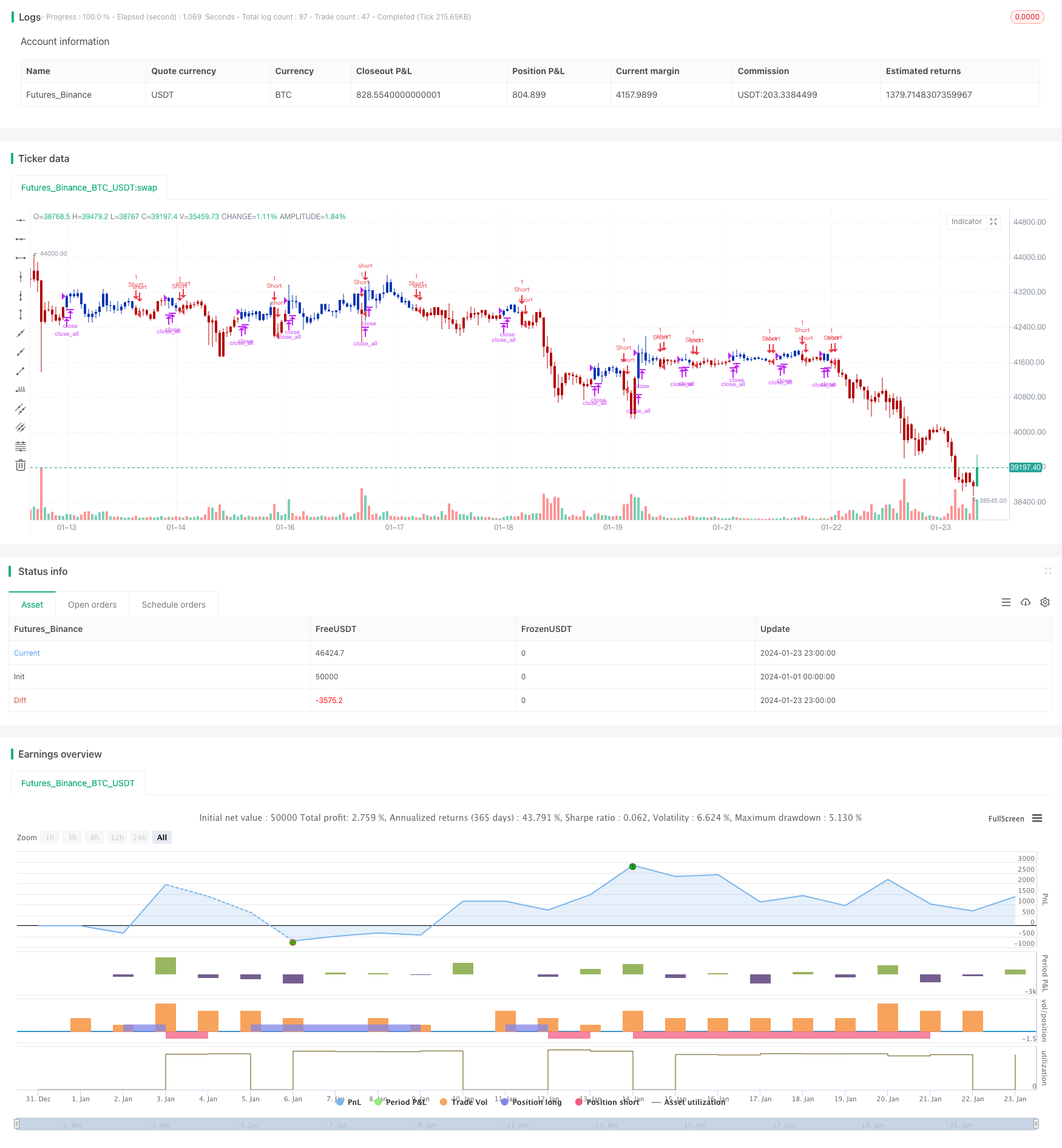

جائزہ

حکمت عملی کا اصول

123 ریورس سسٹم

فریکٹل افراتفری بینڈ اشارے

فریکٹل افراتفری بینڈ اشارے قیمتوں کی اونچائیوں اور نچلی سطحوں کو اوپر اور نیچے کی ریلیں بنانے کے لئے پلاٹ کرکے مارکیٹ کے رجحانات کا تعین کرتا ہے۔ مخصوص قواعد یہ ہیں:

خریدیں جب قیمت اوپر کی ریل کو توڑتی ہے۔ فروخت کریں جب قیمت نیچے کی ریل کو توڑتی ہے۔

یہ سیکشن بنیادی طور پر رجحان فلٹر کے طور پر کام کرتا ہے ، جس میں 123 الٹ سگنل کے ساتھ مل کر کام کیا جاتا ہے۔ صرف اس وقت جب دونوں سگنل مستقل ہوں گے تو پوزیشن کھولی جائے گی۔

حکمت عملی کے فوائد

- مواقع کو جامع طور پر حاصل کرنے کے لئے الٹ اور رجحان کا امتزاج

ایک ہی اشارے کے مقابلے میں، یہ حکمت عملی جھوٹے سگنل کو بہت کم کر سکتی ہے اور دوہری اشارے کے مجموعوں کو فلٹر کرنے کے ذریعے اصل ٹریڈنگ جیت کی شرح اور منافع کی شرح کو بہتر بنا سکتی ہے۔

- لچکدار پیرامیٹر ایڈجسٹمنٹ اور مضبوط موافقت

خطرات اور اصلاح

- اہم رجحانات کے تحت اپنانے کے قابل نہیں

- مارجن کیپٹل سپورٹ کی ضرورت ہے

- فلٹرنگ کے لئے زیادہ اشارے کو یکجا کر سکتے ہیں

نتیجہ

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-24 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 21/09/2020

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// Stock market moves in a highly chaotic way, but at a larger scale, the movements

// follow a certain pattern that can be applied to shorter or longer periods of time

// and we can use Fractal Chaos Bands Indicator to identify those patterns. Basically,

// the Fractal Chaos Bands Indicator helps us to identify whether the stock market is

// trending or not. When a market is trending, the bands will have a slope and if market

// is not trending the bands will flatten out. As the slope of the bands decreases, it

// signifies that the market is choppy, insecure and variable. As the graph becomes more

// and more abrupt, be it going up or down, the significance is that the market becomes

// trendy, or stable. Fractal Chaos Bands Indicator is used similarly to other bands-indicator

// (Bollinger bands for instance), offering trading opportunities when price moves above or

// under the fractal lines.

//

// The FCB indicator looks back in time depending on the number of time periods trader selected

// to plot the indicator. The upper fractal line is made by plotting stock price highs and the

// lower fractal line is made by plotting stock price lows. Essentially, the Fractal Chaos Bands

// show an overall panorama of the price movement, as they filter out the insignificant fluctuations

// of the stock price.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

fractalUp(pattern) =>

p = high[pattern+1]

okl = 1

okr = 1

res = 0.0

for i = pattern to 1

okl := iff(high[i] < high[i+1] and okl == 1 , 1, 0)

for i = pattern+2 to pattern*2+1

okr := iff(high[i] < high[i-1] and okr == 1, 1, 0)

res := iff(okl == 1 and okr == 1, p, res[1])

res

fractalDn(pattern) =>

p = low[pattern+1]

okl = 1

okr = 1

res =0.0

for i = pattern to 1

okl := iff(low[i] > low[i+1] and okl == 1 , 1, 0)

for i = pattern+2 to pattern*2+1

okr := iff(low[i] > low[i-1] and okr == 1, 1, 0)

res := iff(okl == 1 and okr == 1, p, res[1])

res

FCB(Pattern) =>

pos = 0.0

xUpper = fractalUp(Pattern)

xLower = fractalDn(Pattern)

pos := iff(close > xUpper, 1,

iff(close < xLower, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Fractal Chaos Bands", shorttitle="Combo", overlay = true)

Length = input(15, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

Pattern = input(1, minval=1)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posFCB = FCB(Pattern)

pos = iff(posReversal123 == 1 and posFCB == 1 , 1,

iff(posReversal123 == -1 and posFCB == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )

مزید

- لکیری رجسٹریشن اور دوہری چلتی اوسط مختصر مدت کی حکمت عملی

- ٹرپل اوورلیپنگ اسٹوکاسٹک مومنٹم حکمت عملی

- رفتار رجحان کی حکمت عملی

- رفتار منتقل اوسط کراس اوور مقدار کی حکمت عملی

- دوہری حرکت پذیر اوسط الٹ اور اے ٹی آر ٹریلنگ اسٹاپ کی مجموعی حکمت عملی

- لیورجڈ مارٹنگل فیوچر ٹریڈنگ کی حکمت عملی

- رفتار واپس لینے کی حکمت عملی

- ڈبل موم بتی کی پیشن گوئی قریبی حکمت عملی

- اسٹوکاسٹک سپر ٹرینڈ ٹریکنگ سٹاپ نقصان ٹریڈنگ کی حکمت عملی

- ڈی ایم آئی اور آر ایس آئی پر مبنی حکمت عملی کے بعد رجحان

- معاونت اور مزاحمت کی مقدار میں اتار چڑھاؤ کی حکمت عملی

- 3 ای ایم اے، ڈی ایم آئی اور ایم اے سی ڈی کے ساتھ رجحان کی پیروی کرنے والی حکمت عملی

- دوہری اشارے کی اہم حکمت عملی

- پیٹ ویو ٹریڈنگ سسٹم کی حکمت عملی

- ایکسپونینشل حرکت پذیر اوسط اور حجم وزن پر مبنی مقداری حکمت عملی

- ہموار چلتی اوسط پر مبنی Origix Ashi حکمت عملی

- بلیک بٹ ٹریڈر XO میکرو ٹرینڈ سکینر حکمت عملی

- خام تیل ADX رجحان حکمت عملی کے بعد

- MT-تعاون تجارتی حکمت عملی