基于双均线和RSI的短线可扩展趋势追踪策略

Author: ChaoZhang, Date: 2024-04-01 10:58:30Tags:

概述

该策略使用两条移动平均线(快速移动平均线和慢速移动平均线)以及相对强弱指数(RSI)来识别市场的短期趋势和超买超卖状态。当快速移动平均线从下向上穿过慢速移动平均线,且RSI低于超卖水平时,策略开多头仓位;当快速移动平均线从上向下穿过慢速移动平均线,且RSI高于超买水平时,策略开空头仓位。策略通过移动平均线的交叉和RSI水平来确定进场和出场点,以捕捉短期价格趋势。

策略原理

- 计算快速移动平均线(默认周期为5)和慢速移动平均线(默认周期为10)。

- 计算相对强弱指数RSI(默认周期为7),并设定超买和超卖水平(默认分别为80和20)。

- 当快速移动平均线从下向上穿过慢速移动平均线,且RSI低于超卖水平时,开多头仓位。

- 当快速移动平均线从上向下穿过慢速移动平均线,且RSI高于超买水平时,开空头仓位。

- 当快速移动平均线与慢速移动平均线再次交叉,或RSI超过相反的超买/超卖水平时,平仓。

策略优势

- 结合移动平均线和RSI两个指标,提高信号的可靠性和准确性。

- 通过捕捉短期趋势,适合在波动市场中进行短线交易。

- 参数可调,灵活性高,易于适应不同的市场环境和交易风格。

- 逻辑清晰,易于理解和实现。

策略风险

- 在震荡市场中,频繁的交叉信号可能导致过多的交易次数和手续费损失。

- 短期趋势的持续时间可能较短,盈利空间有限。

- 对于长期趋势的把握能力较弱,可能错过大趋势带来的利润。

- 参数设置不当可能导致信号失效或虚假信号增多。

策略优化方向

- 引入其他技术指标或价格行为模式,如MACD、布林带等,以提高信号的可靠性和过滤效果。

- 优化参数选择,如根据不同市场特点和交易品种,调整移动平均线的周期和RSI的超买超卖水平。

- 加入止损和止盈机制,控制单笔交易的风险敞口和收益预期。

- 结合多时间框架分析,如在日线级别确定大趋势,在小时或分钟级别进行实际交易,提高趋势把握的准确性。

- 考虑加入仓位管理和资金管理策略,如根据市场波动性和个人风险偏好,动态调整每笔交易的仓位大小。

总结

该策略通过结合双移动平均线和RSI指标,在短期内捕捉价格趋势,适合在波动市场中进行短线交易。策略逻辑清晰,参数灵活,易于实现和优化。但在震荡市场中可能产生过多的交易信号,且对长期趋势的把握能力较弱。因此,在实际应用中,可以考虑引入其他指标、优化参数选择、加入风险管理措施等方式,以提高策略的稳健性和盈利能力。

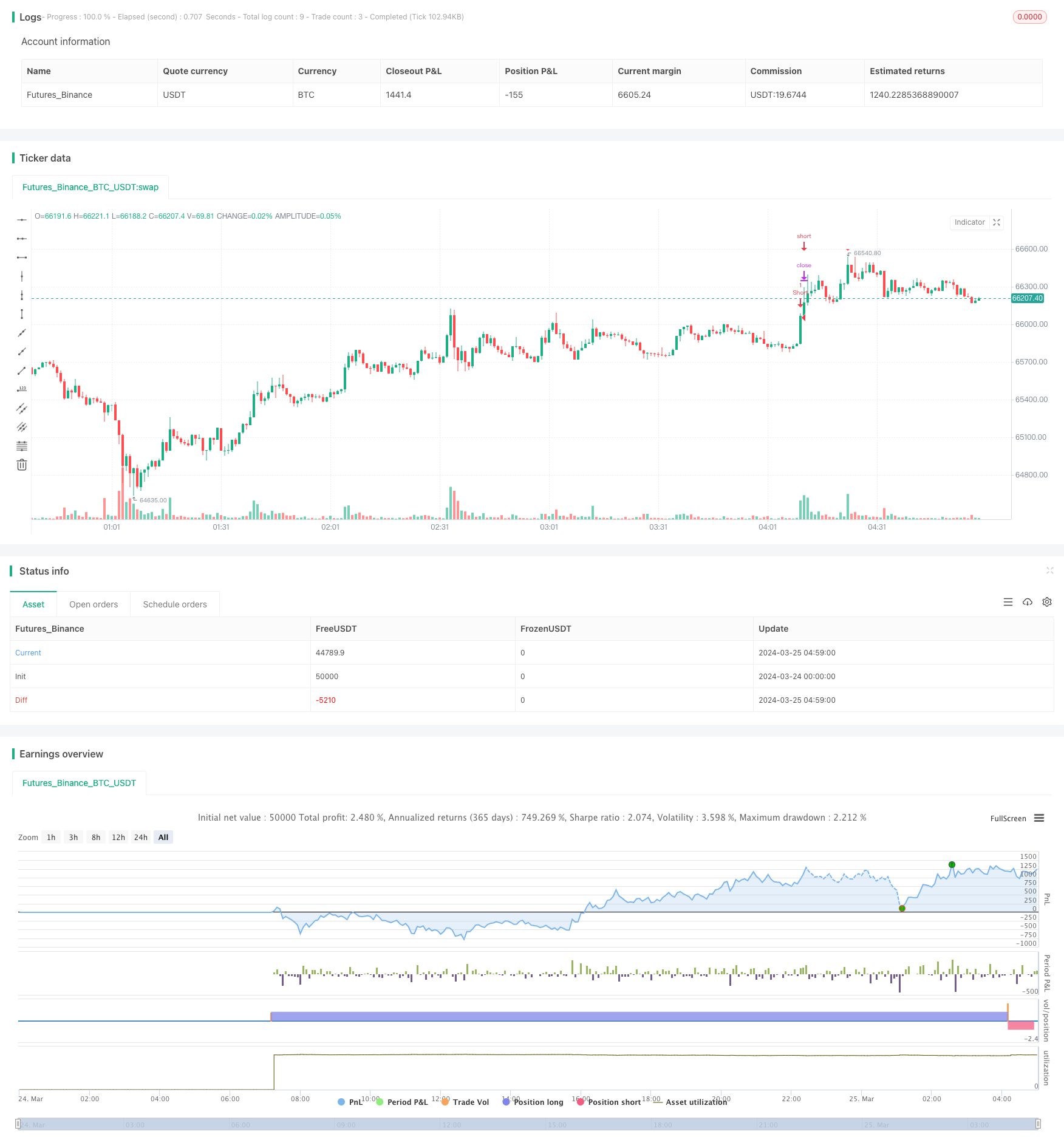

/*backtest

start: 2024-03-24 00:00:00

end: 2024-03-25 05:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Short-Term Scalp Trading Strategy", overlay=true)

// Define strategy parameters

fastMA_length = input(5, title="Fast MA Length")

slowMA_length = input(10, title="Slow MA Length")

rsi_length = input(7, title="RSI Length")

rsi_oversold = input(20, title="RSI Oversold Level")

rsi_overbought = input(80, title="RSI Overbought Level")

// Calculate Moving Averages

fastMA = ta.sma(close, fastMA_length)

slowMA = ta.sma(close, slowMA_length)

// Calculate RSI

rsi = ta.rsi(close, rsi_length)

// Define entry conditions

longCondition = ta.crossunder(fastMA, slowMA) and rsi < rsi_oversold

shortCondition = ta.crossover(fastMA, slowMA) and rsi > rsi_overbought

// Enter long position

strategy.entry("Long", strategy.long, when=longCondition)

// Enter short position

strategy.entry("Short", strategy.short, when=shortCondition)

// Define exit conditions

longExitCondition = ta.crossunder(fastMA, slowMA) or ta.crossover(rsi, rsi_overbought)

shortExitCondition = ta.crossover(fastMA, slowMA) or ta.crossunder(rsi, rsi_oversold)

// Exit long position

if (longExitCondition)

strategy.close("Exit Long", "Long")

// Exit short position

if (shortExitCondition)

strategy.close("Exit Short", "Short")

// Plot buy and sell signals

plotshape(series=longCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

plotshape(series=shortCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small)

更多内容