动态MACD和一目均衡图交易策略

Author: ChaoZhang, Date: 2024-05-17 10:45:23Tags: MACDICHIMOKU

概述

该交易策略结合了MACD和一目均衡图两个技术指标,旨在捕捉中期趋势和动量变化。MACD指标由快速、慢速和信号线组成,分别使用12、26和9的参数设置,用于识别动量转变和趋势反转。一目均衡图包含转折线、基准线、先行上限和先行下限,提供关于趋势强度、方向以及支撑/阻力位的洞察。该策略为积极的交易者提供基于明确定义标准的进场和出场信号,同时考虑风险管理,以保护每笔交易免受过度风险,同时争取可观的利润。

策略原理

该策略利用MACD指标和一目均衡图云来生成买入和卖出信号。当价格超过一目均衡图云且MACD线上穿信号线时,触发买入信号,表明看涨趋势。当价格跌破一目均衡图云且MACD线下穿信号线时,触发卖出信号,表明看跌趋势。止损和止盈水平可根据波动性和历史价格走势进行配置,但初始设置以风险管理为重点,以保护资金并锁定利润。

策略优势

- 结合MACD和一目均衡图两个强大的技术指标,提供更全面和可靠的交易信号。

- 适用于中期交易,捕捉趋势和动量变化。

- 明确定义的买入和卖出标准,易于理解和执行。

- 包含风险管理指南,通过止损和止盈设置保护资金。

- 鼓励根据个人交易风格和股票特点进行优化和定制。

策略风险

- MACD和一目均衡图参数可能不适用于所有市场条件和股票。

- 在波动市场中,频繁的交易信号可能导致过度交易和手续费损失。

- 止损位置如果设置不当,可能导致过早止损或承担过多风险。

- 该策略依赖历史数据,可能无法准确预测未来价格走势。

策略优化方向

- 根据不同股票和市场条件,调整MACD和一目均衡图参数。

- 引入其他技术指标,如相对强弱指数(RSI)或平均真实范围(ATR),以改进信号质量。

- 优化止损和止盈水平,以更好地管理风险和最大化利润。

- 考虑市场情绪和基本面因素,以补充技术分析。

总结

动态MACD和一目均衡图交易策略提供了一种强大的方法,结合两个广受欢迎的技术指标来识别中期趋势和动量变化。通过明确定义的买入和卖出标准,以及风险管理指南,该策略旨在帮助交易者做出明智的决策,控制风险并最大化利润。然而,交易者应根据自己的交易风格和市场特点对策略进行优化和定制,并持续监控其性能。通过适当的调整和风险管理,该策略可成为交易者工具箱中的宝贵补充。

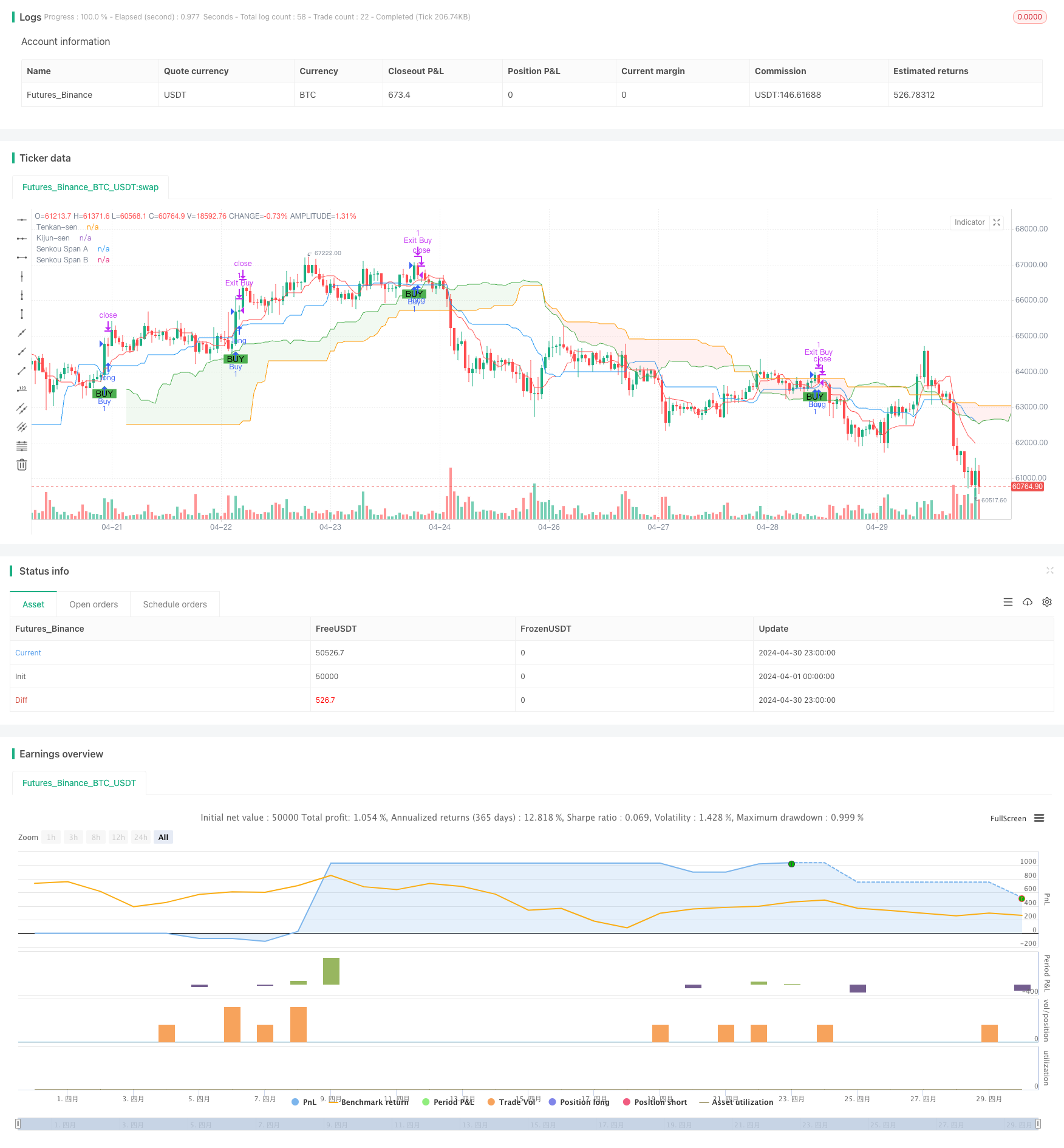

/*backtest

start: 2024-04-01 00:00:00

end: 2024-04-30 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("MACD and Ichimoku Cloud Strategy", overlay=true)

// MACD Components

fastLength = 12

slowLength = 26

signalLength = 9

[macdLine, signalLine, _] = ta.macd(close, fastLength, slowLength, signalLength)

// Ichimoku Cloud Components

tenkanLength = 9

kijunLength = 26

senkouLength = 52

displacement = 26

tenkanSen = (ta.highest(high, tenkanLength) + ta.lowest(low, tenkanLength)) / 2

kijunSen = (ta.highest(high, kijunLength) + ta.lowest(low, kijunLength)) / 2

senkouSpanA = (tenkanSen + kijunSen) / 2

senkouSpanB = (ta.highest(high, senkouLength) + ta.lowest(low, senkouLength)) / 2

chikouSpan = close[displacement]

// Plot Ichimoku Cloud

plot(tenkanSen, color=color.red, title="Tenkan-sen")

plot(kijunSen, color=color.blue, title="Kijun-sen")

p1 = plot(senkouSpanA, color=color.green, title="Senkou Span A", offset=displacement)

p2 = plot(senkouSpanB, color=color.orange, title="Senkou Span B", offset=displacement)

fill(p1, p2, color=senkouSpanA > senkouSpanB ? color.new(color.green, 90) : color.new(color.red, 90))

// Define Buy and Sell Conditions

macdBuy = ta.crossover(macdLine, signalLine)

ichimokuBuy = (close > senkouSpanA) and (close > senkouSpanB) and (tenkanSen > kijunSen)

buySignal = macdBuy and ichimokuBuy

macdSell = ta.crossunder(macdLine, signalLine)

ichimokuSell = (close < senkouSpanA) and (close < senkouSpanB) and (tenkanSen < kijunSen) and (tenkanSen[displacement] < math.min(senkouSpanA, senkouSpanB))

sellSignal = macdSell and ichimokuSell

// Execute Buy or Sell orders

if (buySignal)

strategy.entry("Buy", strategy.long)

if (sellSignal)

strategy.entry("Sell", strategy.short)

// Setting up the stop loss and take profit

stopLossPerc = 5.0

takeProfitPerc = 10.0

strategy.exit("Exit Buy", "Buy", loss=stopLossPerc, profit=takeProfitPerc)

strategy.exit("Exit Sell", "Sell", loss=stopLossPerc, profit=takeProfitPerc)

// Plot Buy and Sell Signals

plotshape(series=buySignal, location=location.belowbar, color=color.green, style=shape.labelup, title="Buy Signal", text="BUY")

plotshape(series=sellSignal, location=location.abovebar, color=color.red, style=shape.labeldown, title="Sell Signal", text="SELL")

相关内容

- MACD RSI 一目均衡Ichimoku动量趋势多头策略

- MACD与Supertrend组合策略

- MACD + SMA 200 Strategy

- MAGIC MACD

- MACD与R:R比率日内限制收敛策略

- [blackcat] L2 Reversal Labels Strategy

- MACD Pine简单策略

- MacD Custom Indicator-Multiple Time Frame+All Available Options!

- MACD Willy Strategy

- Swing High/Low Indicator w/ MACD and EMA Confirmations

更多内容

- 布林带动态止损止盈策略

- 改进型多空转换K线形态突破策略

- Laguerre RSI与ADX滤波交易信号策略

- 价量突破买入策略

- K线连续数目牛熊判断策略

- 超级均线与Upperband交叉策略

- 基于RSI、ADX和一目均衡图的多因子趋势跟踪量化交易策略

- RSI与MACD结合的多空策略

- 一云多均线交易策略

- 威廉鳄鱼均线趋势捕捉策略

- 基于平均方向指数过滤器的均线拒绝策略

- Bollinger Bands 布林带策略:精准交易,实现最大收益

- ATR均线突破策略

- KNN 机器学习策略:基于 K 近邻算法的趋势预测交易系统

- CCI+RSI+KC趋势滤波多空双向交易策略

- BMSB 突破策略

- SR 突破策略

- 动态布林带突破策略

- 8小时 ema

- RSI量化交易策略