布林带动态止损止盈策略

Author: ChaoZhang, Date: 2024-05-17 15:11:50Tags: SMA

概述

该策略是一个基于布林带的交易策略。它使用布林带来生成买卖信号,并动态设置止损和止盈水平。当价格穿越下轨时产生买入信号,穿越上轨时产生卖出信号。止损位置设置在过去一段时间内的最低价或最高价,止盈位置则根据新的信号动态调整。

策略原理

- 计算布林带上轨、中轨和下轨。

- 当价格穿越下轨时,产生买入信号;当价格穿越上轨时,产生卖出信号。

- 买入时,止损位置设置为过去一段时间内的最低价,止盈位置暂不设置。

- 卖出时,止损位置设置为过去一段时间内的最高价,止盈位置暂不设置。

- 当出现新的买入或卖出信号时,止盈位置重置为空。

策略优势

- 布林带是一个成熟且广泛使用的技术指标,能够有效捕捉市场波动。

- 动态止损和止盈设置能够适应不同的市场条件,提高策略的适应性。

- 止损位置的设置能够有效控制风险,防止单笔交易损失过大。

- 策略逻辑清晰,易于理解和实现。

策略风险

- 在震荡市场中,频繁的买卖信号可能导致过多的交易,增加交易成本。

- 止损位置的设置基于历史数据,可能无法适应未来的市场变化。

- 策略缺乏对趋势方向的判断,可能在强趋势市场中错失机会。

策略优化方向

- 引入趋势判断指标,如移动平均线,在趋势方向上进行交易,提高策略的趋势适应性。

- 优化止损和止盈位置的设置方法,如使用ATR等波动率指标,使其更加动态和适应市场变化。

- 在买卖信号中加入额外的过滤条件,如交易量、波动率等,提高信号的可靠性。

- 对参数进行优化,如布林带的长度和标准差倍数,找到最佳的参数组合。

总结

该策略是一个基于布林带的交易策略,通过布林带的穿越来产生买卖信号,并动态设置止损和止盈水平。策略逻辑清晰,易于实现,能够适应不同的市场条件。但在震荡市场中可能产生过多的交易,并且缺乏对趋势方向的判断。未来可以通过引入趋势判断指标、优化止损止盈设置方法、添加过滤条件和参数优化等方式来提高策略的表现。

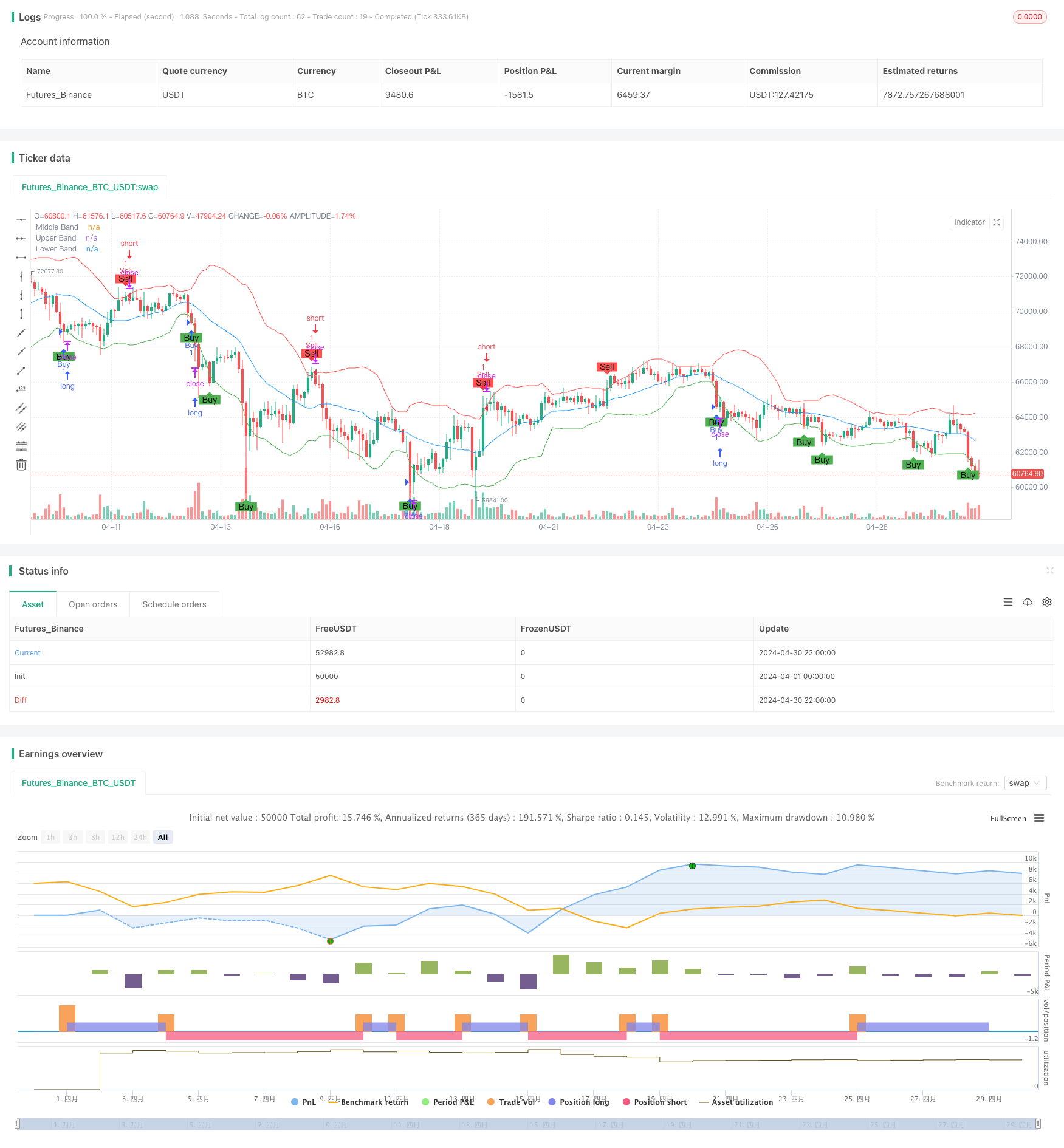

/*backtest

start: 2024-04-01 00:00:00

end: 2024-04-30 23:59:59

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Bollinger Bands Strategy", overlay=true)

// Bollinger Bands settings

length = 20

src = close

mult = 2.0

// Calculate Bollinger Bands

basis = ta.sma(src, length)

dev = mult * ta.stdev(src, length)

upper = basis + dev

lower = basis - dev

// Plot Bollinger Bands

plot(basis, color=color.blue, title="Middle Band")

plot(upper, color=color.red, title="Upper Band")

plot(lower, color=color.green, title="Lower Band")

// Trade logic

// Buy when the price crosses below the lower Bollinger Band

buySignal = ta.crossover(lower, src)

// Sell when the price crosses above the upper Bollinger Band

sellSignal = ta.crossover(src, upper)

// Define stop loss and take profit levels

var float stopLoss = na

var float takeProfit = na

// Calculate stop loss and take profit levels

if (buySignal)

stopLoss := ta.lowest(low, length)

takeProfit := na

if (sellSignal)

stopLoss := ta.highest(high, length)

takeProfit := na

// Update take profit on new signals

if (buySignal)

takeProfit := na

if (sellSignal)

takeProfit := na

// Execute trades

if (buySignal)

strategy.entry("Buy", strategy.long, stop=stopLoss, limit=takeProfit)

if (sellSignal)

strategy.entry("Sell", strategy.short, stop=stopLoss, limit=takeProfit)

// Plot signals on chart

plotshape(series=buySignal, location=location.belowbar, color=color.green, style=shape.labelup, text="Buy", title="Buy Signal")

plotshape(series=sellSignal, location=location.abovebar, color=color.red, style=shape.labeldown, text="Sell", title="Sell Signal")

// Alert conditions

alertcondition(buySignal, title="Buy Alert", message="Buy Signal detected")

alertcondition(sellSignal, title="Sell Alert", message="Sell Signal detected")

相关内容

- 多维度趋势判断与ATR动态止盈止损策略

- 自适应布林带趋势反转量化交易策略

- 高级多指标趋势确认交易策略

- 双均线-RSI多重信号趋势交易策略

- 自适应趋势跟踪与多重确认交易策略

- 动态调整止损的大象柱形态趋势跟踪策略

- 多均线交叉辅助RSI动态参数量化交易策略

- 多维度K近邻算法与烛台形态的量价分析交易策略

- 基于移动平均线和日内模式的智能追踪止损策略

- 自适应多策略动态切换系统:融合趋势跟踪与区间震荡的量化交易策略

- 多指标多维度趋势交叉高级量化策略

更多内容

- 一目云和ATR策略

- BONK多因子交易策略

- 双均线交叉策略

- HalfTrend多空趋势追踪止损限价买入策略

- Alligator 长期趋势跟踪交易策略

- 基于脉冲MACD和双均线交叉的多时间尺度趋势追踪策略

- EMA5与EMA13交叉策略

- EMA SAR 中长期趋势跟踪策略

- 逆向波动率突破策略

- Nifty50三分钟开盘价突破策略

- 改进型多空转换K线形态突破策略

- Laguerre RSI与ADX滤波交易信号策略

- 价量突破买入策略

- K线连续数目牛熊判断策略

- 超级均线与Upperband交叉策略

- 基于RSI、ADX和一目均衡图的多因子趋势跟踪量化交易策略

- RSI与MACD结合的多空策略

- 一云多均线交易策略

- 威廉鳄鱼均线趋势捕捉策略

- 动态MACD和一目均衡图交易策略