Laguerre RSI与ADX滤波交易信号策略

Author: ChaoZhang, Date: 2024-05-17 15:01:17Tags: RSIADX

概述

该策略使用Laguerre RSI指标生成买卖信号,并结合ADX指标对信号进行过滤。当Laguerre RSI越过预设的买卖级别,且ADX高于设定的阈值时,策略会产生买卖信号。这种结合快速和慢速指标的方法,可以在趋势强度足够时及时捕捉交易机会,同时避免在趋势不明朗的情况下交易。

策略原理

Laguerre RSI是一种动量指标,用于衡量价格变化的速度和强度。它基于Laguerre滤波器,相比传统RSI对价格变化的反应更加灵敏。策略通过比较Laguerre RSI与预设的买卖级别,产生对应的信号。

ADX指标衡量价格趋势的强度,数值越大表明趋势越强。策略通过设定ADX阈值,在趋势强度达标时开仓,而在趋势不明显时保持观望。这有助于提高信号的可靠性,避免频繁交易。

策略使用Laguerre RSI的交叉来触发买卖信号,当指标上穿买入水平时开多仓,下穿卖出水平时开空仓。同时,ADX需高于预设的阈值,以确认趋势强度。这种双重条件的设计,旨在捕捉强势趋势中的交易机会。

策略优势

- Laguerre RSI灵敏捕捉价格变化,能够及时产生交易信号。

- ADX过滤器确保在趋势明确时交易,提高了信号的可靠性。

- 参数可调,用户能够根据自己的偏好设置买卖级别和ADX阈值。

- 代码简洁高效,易于理解和实现。

- 适用于多种市场和时间框架,具有较好的通用性。

策略风险

- Laguerre RSI在震荡市会产生较多虚假信号,导致频繁交易。

- ADX滤波可能延迟信号产生,错失部分交易机会。

- 固定的买卖级别无法适应市场的动态变化。

- 策略未设置止损,面临单次交易风险无法控制的问题。

- 缺乏仓位管理和资金管理,难以控制整体风险。

策略优化方向

- 引入自适应买卖级别,根据价格波动幅度动态调整。这有助于适应不同市场状态,减少虚假信号。

- 优化ADX过滤器,设置更加动态的阈值,在趋势初期就开始交易。这可以提早捕捉趋势,增加收益。

- 加入止损和止盈机制,控制单次交易风险。避免持仓亏损过大,同时及时锁定利润。

- 结合其他辅助指标,如交易量、波动率等,提高信号的可靠性。

- 引入仓位管理和资金管理,控制总体风险敞口。根据市场趋势强度和账户净值,动态调整每次交易的资金比例。

总结

Laguerre RSI结合ADX过滤的交易策略,是一种趋势跟踪方法。它利用快速指标捕捉价格变化,同时通过慢速指标确认趋势强度。这种组合可以在趋势明确时及时交易,又能在趋势不明朗时保持观望。策略优势在于逻辑简单,适用范围广,但也存在频繁交易和风险控制不足的问题。未来可以从信号优化、风控完善、仓位管理等方面对策略进行提升,以期获得更加稳健的收益。

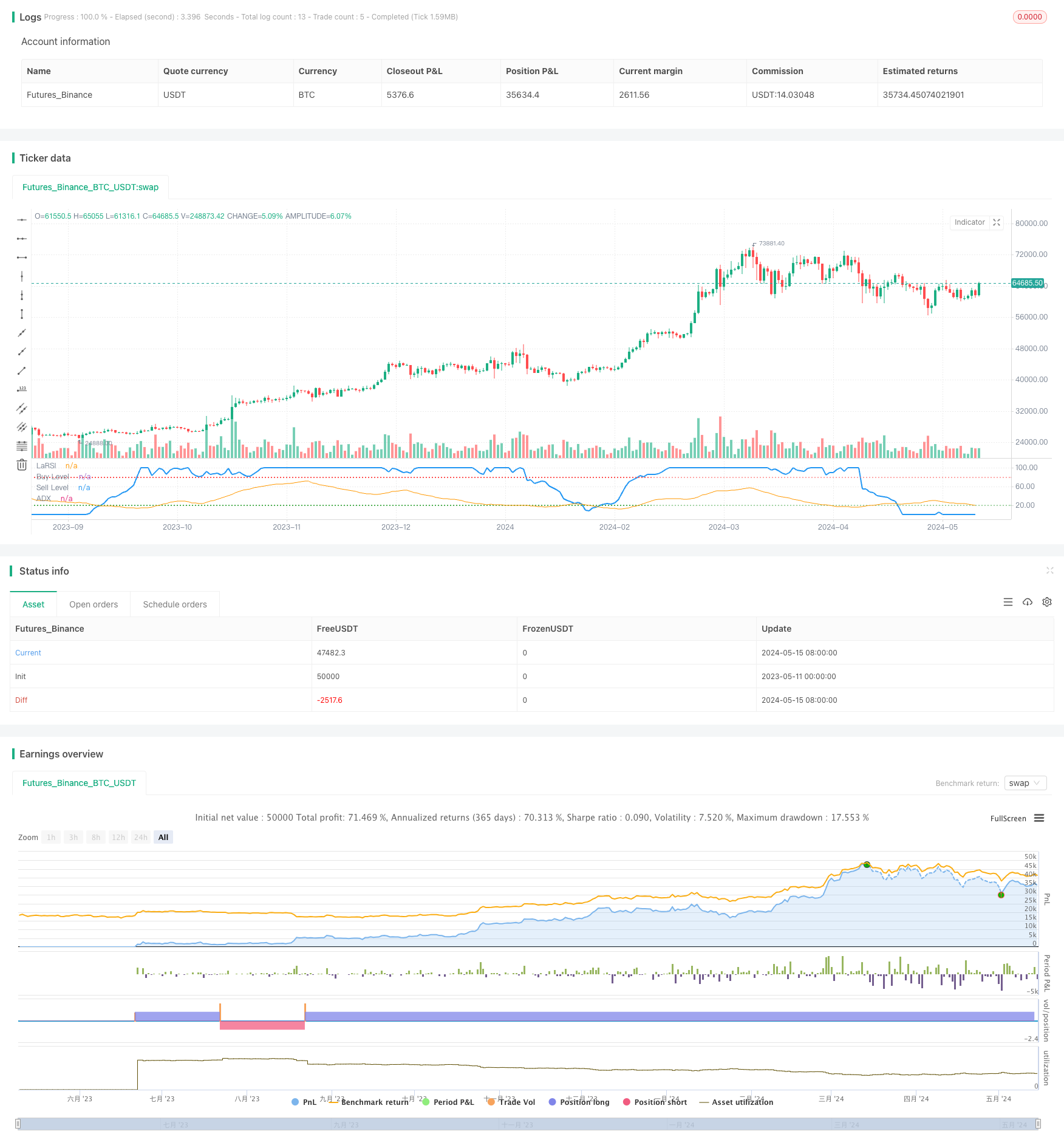

/*backtest

start: 2023-05-11 00:00:00

end: 2024-05-16 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy('Laguerre RSI with Buy/Sell Signals and ADX Filter', shorttitle='LaRSI_ADX Signals', overlay=false)

// Kullanıcı girdileri

src = input(title='Source', defval=close)

alpha = input.float(title='Alpha', minval=0, maxval=1, step=0.1, defval=0.2)

buyLevel = input(20, title='Buy Level')

sellLevel = input(80, title='Sell Level')

adxLength = input(14, title='ADX Length')

adxSmoothing = input(14, title='ADX Smoothing')

adxLevel = input(20, title='ADX Level') // adxLevel tanımlamasını ekledik

// ADX hesaplaması

[diPlus, diMinus, adx] = ta.dmi(adxLength, adxSmoothing)

// Laguerre RSI hesaplamaları

gamma = 1 - alpha

L0 = 0.0

L0 := (1 - gamma) * src + gamma * nz(L0[1])

L1 = 0.0

L1 := -gamma * L0 + nz(L0[1]) + gamma * nz(L1[1])

L2 = 0.0

L2 := -gamma * L1 + nz(L1[1]) + gamma * nz(L2[1])

L3 = 0.0

L3 := -gamma * L2 + nz(L2[1]) + gamma * nz(L3[1])

cu = (L0 > L1 ? L0 - L1 : 0) + (L1 > L2 ? L1 - L2 : 0) + (L2 > L3 ? L2 - L3 : 0)

cd = (L0 < L1 ? L1 - L0 : 0) + (L1 < L2 ? L2 - L1 : 0) + (L2 < L3 ? L3 - L2 : 0)

temp = cu + cd == 0 ? -1 : cu + cd

LaRSI = temp == -1 ? 0 : cu / temp

// Alım ve satım sinyalleri

longCondition = ta.crossover(100 * LaRSI, buyLevel) and adx > adxLevel

shortCondition = ta.crossunder(100 * LaRSI, sellLevel) and adx > adxLevel

// Strateji giriş ve çıkışları

strategy.entry('Long', strategy.long, when=longCondition)

strategy.entry('Short', strategy.short, when=shortCondition)

// Göstergeleri çizme

plot(100 * LaRSI, title='LaRSI', linewidth=2, color=color.new(color.blue, 0))

hline(buyLevel, title='Buy Level', color=color.new(color.green, 0), linestyle=hline.style_dotted)

hline(sellLevel, title='Sell Level', color=color.new(color.red, 0), linestyle=hline.style_dotted)

plot(adx, title='ADX', color=color.new(color.orange, 0))

相关内容

- 多重指标智能金字塔策略

- Johny's BOT

- 纳达拉亚-沃森带状图多重确认动态止损策略

- VuManChu Cipher B + Divergences Strategy

- 多重均线超级趋势结合布林带突破交易策略

- 基于RSI动量和ADX趋势强度的资金管理系统

- 多重技术指标交叉动量量化交易策略-基于EMA、RSI和ADX的整合分析

- 基于ATR动态管理的开市突破交易策略

- 基于RSI、ADX和一目均衡图的多因子趋势跟踪量化交易策略

- 多指标趋势跟踪与波动突破策略

更多内容

- 双均线交叉策略

- HalfTrend多空趋势追踪止损限价买入策略

- Alligator 长期趋势跟踪交易策略

- 基于脉冲MACD和双均线交叉的多时间尺度趋势追踪策略

- EMA5与EMA13交叉策略

- EMA SAR 中长期趋势跟踪策略

- 逆向波动率突破策略

- Nifty50三分钟开盘价突破策略

- 布林带动态止损止盈策略

- 改进型多空转换K线形态突破策略

- 价量突破买入策略

- K线连续数目牛熊判断策略

- 超级均线与Upperband交叉策略

- 基于RSI、ADX和一目均衡图的多因子趋势跟踪量化交易策略

- RSI与MACD结合的多空策略

- 一云多均线交易策略

- 威廉鳄鱼均线趋势捕捉策略

- 动态MACD和一目均衡图交易策略

- 基于平均方向指数过滤器的均线拒绝策略

- Bollinger Bands 布林带策略:精准交易,实现最大收益