概述

该策略是一种改进型的多空转换突破策略,旨在利用看涨和看跌吞没形态K线组合来捕捉潜在的趋势反转信号。策略通过识别swing高点和低点,并在价格突破这些关键水平时产生交易信号。同时,该策略采用了预定义的风险回报比来设置止盈和止损水平,以更好地管理交易风险。

策略原理

- 计算swing高点和低点:通过比较当前高点和低点与前两个周期的高低点,判断是否形成了新的swing高点或低点。

- 识别看涨和看跌吞没形态:当收盘价高于前一周期的开盘价,且当前K线为阳线,前一周期为阴线时,判断为看涨吞没形态;反之,当收盘价低于前一周期的开盘价,且当前K线为阴线,前一周期为阳线时,判断为看跌吞没形态。

- 生成交易信号:当看涨吞没形态出现,并且价格突破swing高点时,产生做多信号;当看跌吞没形态出现,并且价格突破swing低点时,产生做空信号。

- 设置止盈止损:根据预定义的风险回报比计算止盈和止损水平,并在交易执行时设置相应的止盈止损单。

优势分析

- 结合价格行为和K线形态:该策略不仅考虑了价格突破关键水平,还结合了看涨和看跌吞没形态,提高了交易信号的可靠性。

- 风险管理:通过预定义风险回报比设置止盈止损,有助于控制单次交易的风险敞口,提高整体风险管理效果。

- 适应不同市场状况:策略同时考虑多空方向,可以在不同的市场趋势中寻找交易机会。

风险分析

- 假信号风险:在某些情况下,价格突破和K线形态可能产生假信号,导致交易进入错误方向。可以通过添加其他确认指标或过滤条件来减少假信号。

- 市场波动风险:在剧烈波动的市场中,价格可能快速突破关键水平并触发止损,导致连续亏损。可以通过调整止损水平或采用动态止损策略来应对。

- 交易频率和成本:频繁的交易可能增加手续费成本,影响策略的整体表现。可以通过优化入场条件或适当调整参数来控制交易频率。

优化方向

- 引入趋势确认指标:结合移动平均线或其他趋势指标,以验证价格突破的有效性,提高交易信号质量。

- 动态调整止损:根据市场波动性或价格变化动态调整止损水平,以更好地应对不同市场状况。

- 优化参数:通过对不同参数组合进行回测和优化,找出最佳的参数设置,提高策略的稳定性和盈利能力。

总结

改进型多空转换K线形态突破策略通过结合价格突破和K线形态,在捕捉趋势反转机会的同时,注重风险管理。策略的优势在于综合考虑了价格行为和市场情绪,适应不同的市场环境。然而,策略也面临假信号、市场波动和交易成本等风险,需要通过引入趋势确认指标、动态调整止损和优化参数等方法来进一步改进。总的来说,该策略为捕捉潜在的趋势反转机会提供了一种思路,但在实际应用中需要根据具体市场特点和交易需求进行适当调整和优化。

策略源码

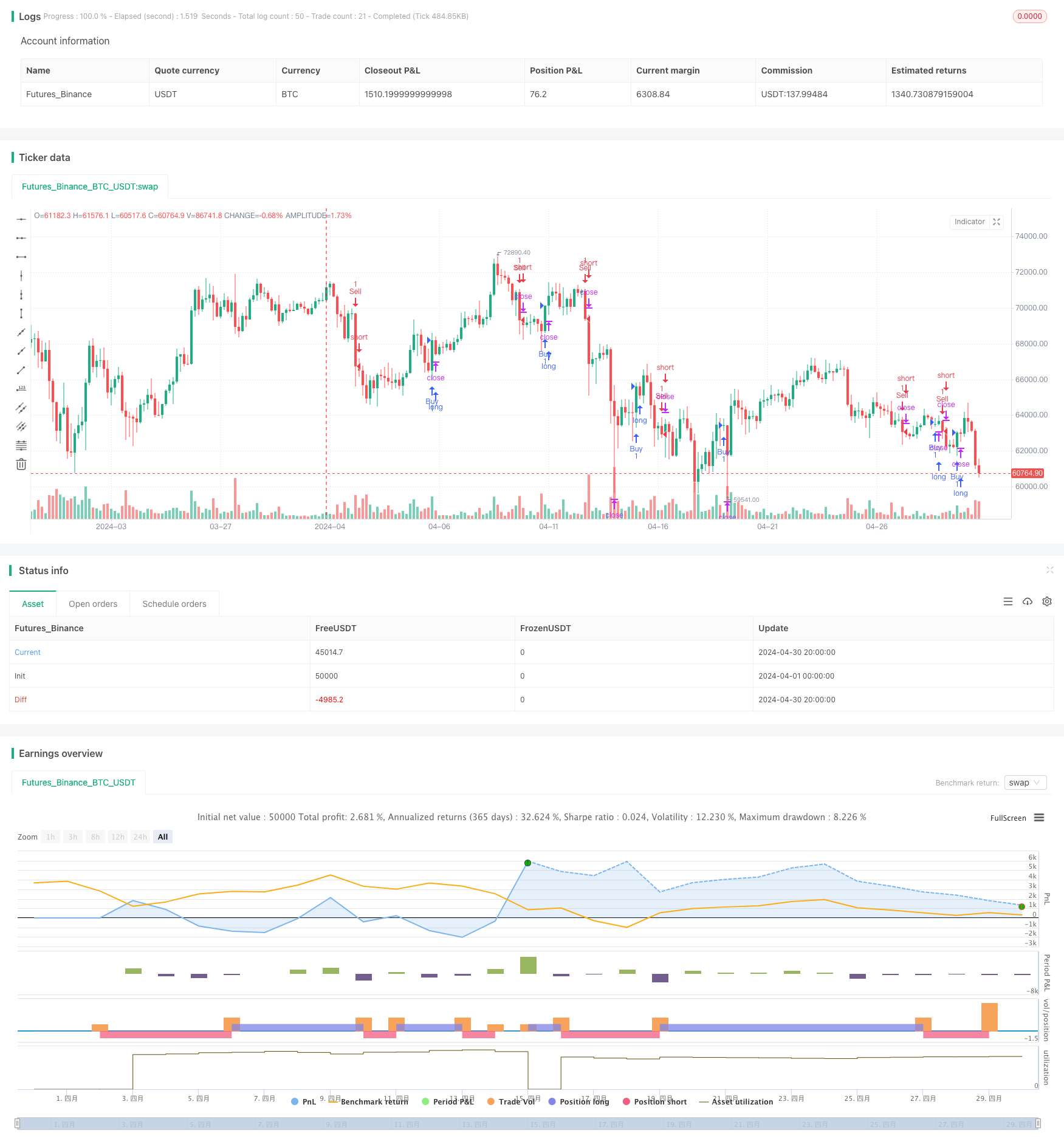

/*backtest

start: 2024-04-01 00:00:00

end: 2024-04-30 23:59:59

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Markoline007

//@version=5

strategy("Improved Swing High/Low Breakout Strategy", overlay=true)

// Define input variables

length = input(14, title="Swing Length")

multiplier = input(3, title="Multiplier")

risk_reward_ratio = input(1.6, title="Risk-Reward Ratio")

target_multiplier = input(2, title="Target Multiplier")

// Calculate swing highs and swing lows

var float lastHigh = na

var float lastLow = na

var bool isHigh = na

var bool isLow = na

if high[1] < high and high[2] < high[1]

lastHigh := high[1]

isHigh := true

isLow := false

else if low[1] > low and low[2] > low[1]

lastLow := low[1]

isLow := true

isHigh := false

else

isHigh := false

isLow := false

// Define buy and sell conditions

buySignal = close > lastHigh and close > open and close[1] < open[1] // Bullish engulfing

sellSignal = close < lastLow and close < open and close[1] > open[1] // Bearish engulfing

// Calculate stop and target levels

stopLevel = close

targetLevel = close + (close - stopLevel) * risk_reward_ratio

// Execute buy and sell trades

if buySignal

strategy.entry("Buy", strategy.long)

strategy.exit("TP/SL", "Buy", profit=targetLevel, loss=stopLevel)

if sellSignal

strategy.entry("Sell", strategy.short)

strategy.exit("TP/SL", "Sell", profit=targetLevel, loss=stopLevel)

相关推荐

- 5EMA趋势跟踪动态止盈止损策略

- 移动平均交叉动态止盈止损策略

- 多时间框架融合型指数均线交叉策略

- 动态风险管理的指数均线交叉策略

- 双均线交叉风险收益智能调控策略

- 布林带趋势突破增强型量化策略结合指标动量过滤系统

- 多指标交叉动量交易策略结合止盈止损优化系统

- 高级MACD均线交叉交易策略结合自适应风险管理

- 双均线随机震荡策略系统:趋势跟踪与动量结合的量化交易模型

- 双重交叉趋势追踪策略:指数均线与MACD协同交易系统

更多内容

- BONK多因子交易策略

- 双均线交叉策略

- HalfTrend多空趋势追踪止损限价买入策略

- Alligator 长期趋势跟踪交易策略

- 基于脉冲MACD和双均线交叉的多时间尺度趋势追踪策略

- EMA5与EMA13交叉策略

- EMA SAR 中长期趋势跟踪策略

- 逆向波动率突破策略

- Nifty50三分钟开盘价突破策略

- 布林带动态止损止盈策略

- Laguerre RSI与ADX滤波交易信号策略

- 价量突破买入策略

- K线连续数目牛熊判断策略

- 超级均线与Upperband交叉策略

- 基于RSI、ADX和一目均衡图的多因子趋势跟踪量化交易策略

- RSI与MACD结合的多空策略

- 一云多均线交易策略

- 威廉鳄鱼均线趋势捕捉策略

- 动态MACD和一目均衡图交易策略

- 基于平均方向指数过滤器的均线拒绝策略