概述

该策略是一个基于多重技术指标的量化交易系统,结合了指数移动平均线(EMA)、相对波动指数(RVI)和自定义交易信号进行交易决策。系统采用动态止损和获利目标,通过ATR指标进行风险管理,实现了一个全面的交易策略框架。

策略原理

策略主要依靠三个核心组件做出交易决策: 1. 双均线系统:使用20周期和200周期的EMA,通过均线交叉判断市场趋势 2. RVI指标:用于确认市场波动方向,提供额外的交易确认信号 3. 自定义信号:整合外部交易信号,为交易决策提供第三重确认 系统在以下条件同时满足时进入多头: - EMA20上穿EMA200 - RVI为正值 - 收到做多信号 空头条件相反。同时,系统使用基于ATR的动态止损和获利目标来管理风险。

策略优势

- 多重确认机制:通过多个独立指标的综合分析降低虚假信号

- 动态风险管理:基于ATR的止损设置能够适应市场波动

- 灵活的资金管理:采用基于现金的头寸规模计算

- 可视化支持:完整的图形界面支持,便于分析和优化

- 模块化设计:各组件独立,便于维护和优化

策略风险

- 均线滞后性:EMA指标本质上是滞后指标,可能导致入场延迟

- 信号依赖:过度依赖多重信号可能导致错过部分交易机会

- 市场适应性:在震荡市场中可能产生频繁的虚假信号

- 参数敏感性:多个指标参数需要精确调优,增加了优化难度 建议通过回测不同市场环境来优化参数,并考虑添加市场环境过滤器。

策略优化方向

- 市场环境识别:添加市场状态判断模块,在不同市场环境使用不同参数

- 动态参数调整:根据市场波动率自动调整EMA和RVI的周期

- 信号权重系统:为不同指标设置动态权重,提高系统适应性

- 止损优化:考虑添加移动止损,更好地保护利润

- 头寸管理:实现更复杂的头寸管理策略,如金字塔加仓

总结

该策略通过综合运用多个技术指标和风险管理工具,构建了一个相对完整的交易系统。虽然存在一些固有的局限性,但通过建议的优化方向,系统有望获得更好的表现。关键是要在实盘中持续监控和调整,确保策略在不同市场环境中都能保持稳定性。

策略源码

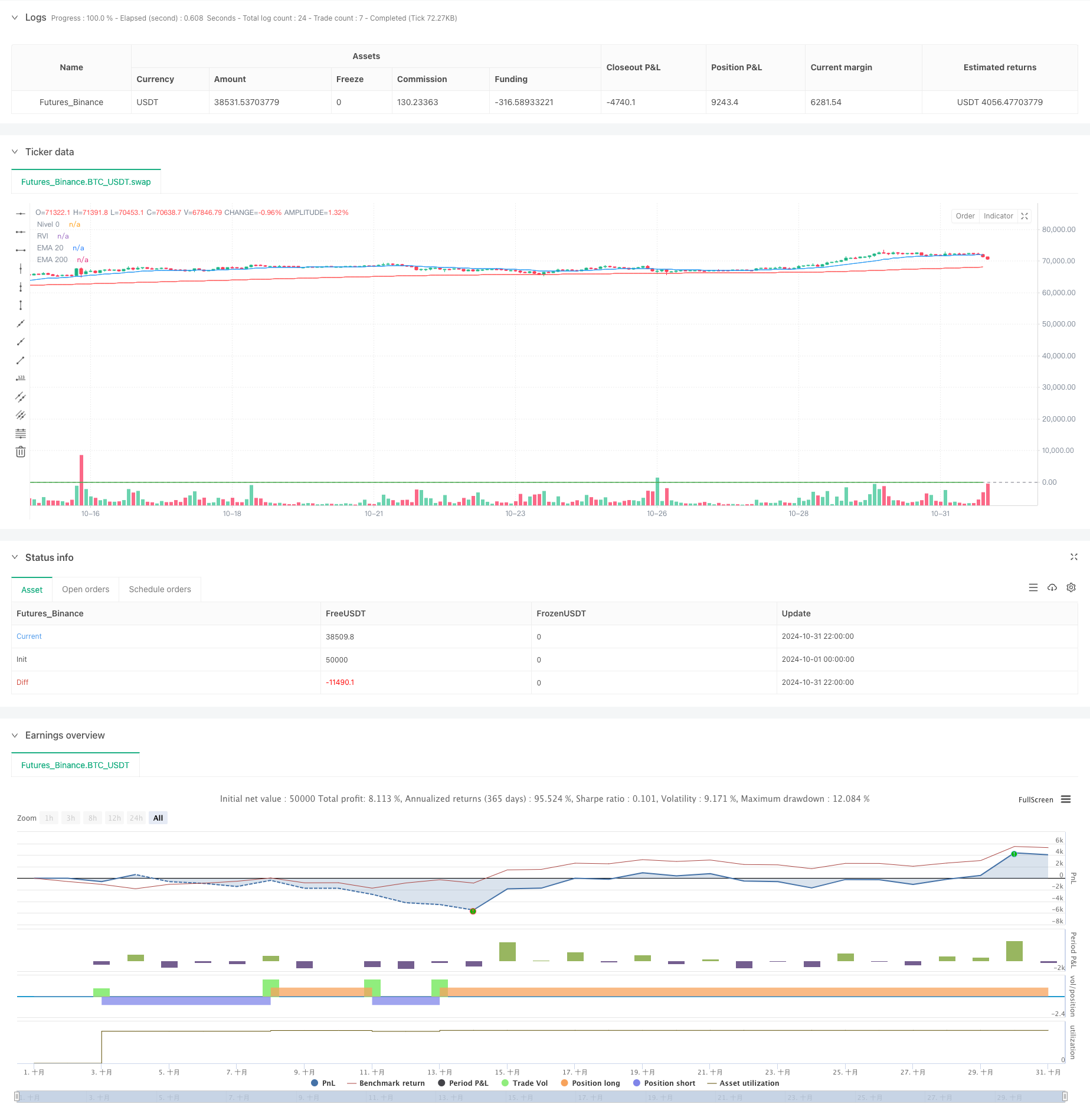

/*backtest

start: 2024-10-01 00:00:00

end: 2024-10-31 23:59:59

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Gold Bot with Viamanchu, EMA20/200, and RVI - 3min", overlay=true)

// Parámetros de las EMAs

ema20 = ta.ema(close, 20)

ema200 = ta.ema(close, 200)

// Relative Volatility Index (RVI)

rvi_length = input(14, title="RVI Length")

rvi = ta.rma(close - close[1], rvi_length) / ta.rma(math.abs(close - close[1]), rvi_length)

// Simulación de Viamanchu (aleatoria para demo, se debe reemplazar por señal de Viamanchu real)

var int seed = time

simulated_vi_manchu_signal = math.random() > 0.5 ? 1 : -1 // 1 para compra, -1 para venta (puedes sustituir por la lógica de Viamanchu)

// Gestión de riesgos: Stop Loss y Take Profit usando ATR

atr_length = input(14, title="ATR Length")

atr = ta.atr(atr_length)

atr_multiplier = input.float(1.5, title="ATR Multiplier for Stop Loss/Take Profit")

stop_loss_level = strategy.position_avg_price - (atr * atr_multiplier)

take_profit_level = strategy.position_avg_price + (atr * atr_multiplier)

// Condiciones de entrada

longCondition = ta.crossover(ema20, ema200) and rvi > 0 and simulated_vi_manchu_signal == 1

shortCondition = ta.crossunder(ema20, ema200) and rvi < 0 and simulated_vi_manchu_signal == -1

// Ejecutar compra (long)

if (longCondition)

strategy.entry("Compra", strategy.long, stop=stop_loss_level, limit=take_profit_level)

// Ejecutar venta (short)

if (shortCondition)

strategy.entry("Venta", strategy.short, stop=stop_loss_level, limit=take_profit_level)

// Visualización de las condiciones de entrada en el gráfico

plotshape(series=longCondition, title="Compra señal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=shortCondition, title="Venta señal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Visualización de las EMAs en el gráfico

plot(ema20, color=color.blue, title="EMA 20")

plot(ema200, color=color.red, title="EMA 200")

// Visualización del RVI en el gráfico

plot(rvi, color=color.green, title="RVI")

hline(0, "Nivel 0", color=color.gray)

相关推荐