ট্রেলিং স্টপ লস সঙ্গে SUPERTREND ATR

লেখক:চাওঝাং, তারিখ: ২০২২-০৫-২৩ 14:54:31ট্যাগঃএটিআর

সুপারট্রেন্ড হ'ল অস্থিরতার (এটিআর) উপর ভিত্তি করে একটি চলমান স্টপ এবং বিপরীত লাইন।

এই কৌশলটি আপনার স্টপ লস বাড়িয়ে দেবে যখন দামের গতি ১% হবে।

যখন বাজার মূল্য স্টপ লস অতিক্রম করবে তখন কৌশলটি আপনার অপারেশন বন্ধ করবে।

যখন অস্থিরতার উপর ভিত্তি করে লাইনটি অতিক্রম করা হবে তখন কৌশলটি অপারেশন বন্ধ করবে

কৌশলটির নিম্নলিখিত পরামিতি রয়েছেঃ

- এটিআর পিরিয়ড- ফিরে বার সংখ্যা নির্বাচন করুন গণনা চালানোর জন্য

- এটিআর মাল্টিপ্লেয়ার- ভোল্টেবিলিটি উপর একটি মাল্টিপ্লিয়ার ফ্যাক্টর যোগ করার জন্য

- প্রাথমিক স্টপ লস- যেখানে প্রথম স্টপ মান isert করতে পারেন.

- পজিশন টাইপ- কোথায় ট্রেড পজিশন নির্বাচন করতে পারেন.

- পিছিয়ে পড়া সময়কাল- পরিসীমা নির্বাচন করতে.

ডিসক্লেইমার

- আমি লাইসেন্সপ্রাপ্ত আর্থিক উপদেষ্টা বা ব্রোকার ডিলার নই। আমি আপনাকে কখন বা কী কিনতে বা বিক্রি করতে হবে তা বলি না। আমি এই সফ্টওয়্যারটি তৈরি করেছি যা আপনাকে ট্রেডিং ভিউ ব্যবহার করে ম্যানুয়াল বা স্বয়ংক্রিয় ট্রেডগুলি একাধিক ট্রেড সম্পাদন করতে সক্ষম করে। সফ্টওয়্যারটি আপনাকে ট্রেডগুলিতে প্রবেশ এবং প্রস্থান করার জন্য আপনার পছন্দসই মানদণ্ড সেট করতে দেয়।

- আপনি যে টাকা হারাতে পারবেন না তার সাথে ব্যবসা করবেন না।

- আমি সুসংগত মুনাফা গ্যারান্টি দিচ্ছি না অথবা যে কেউ কোন প্রচেষ্টা ছাড়াই অর্থ উপার্জন করতে পারে।

- প্রতিটি সিস্টেমে জয় ও পরাজয়ের ধারা থাকতে পারে।

- আপনার ট্রেডিংয়ের ফলাফলগুলিতে অর্থ পরিচালনা একটি বড় ভূমিকা পালন করে। উদাহরণস্বরূপঃ লটের আকার, অ্যাকাউন্টের আকার, ব্রোকার লিভারেজ এবং ব্রোকার মার্জিন কল নিয়মগুলি ফলাফলের উপর প্রভাব ফেলে। এছাড়াও, পৃথক জোড়া ব্যবসায়ের জন্য আপনার লাভ এবং স্টপ লস সেটিংস এবং সামগ্রিক অ্যাকাউন্ট ইক্যুইটি ফলাফলের উপর বড় প্রভাব ফেলে। আপনি যদি ট্রেডিংয়ে নতুন হন এবং এই আইটেমগুলি বুঝতে না পারেন তবে আমি আপনাকে আপনার জ্ঞান বাড়ানোর জন্য শিক্ষামূলক উপকরণগুলি সন্ধান করার পরামর্শ দিই।

আপনাকে ট্রেডিং সিস্টেমটি খুঁজে বের করতে হবে এবং ব্যবহার করতে হবে যা আপনার এবং আপনার ট্রেডিং সহনশীলতার জন্য সবচেয়ে ভাল কাজ করে।

আমি আপনাকে ট্রেডিংভিউতে এই প্রোগ্রামের সাথে ট্রেড করার জন্য বিকল্পগুলির সাথে একটি সরঞ্জাম ছাড়া আর কিছুই সরবরাহ করি নি।

নোট

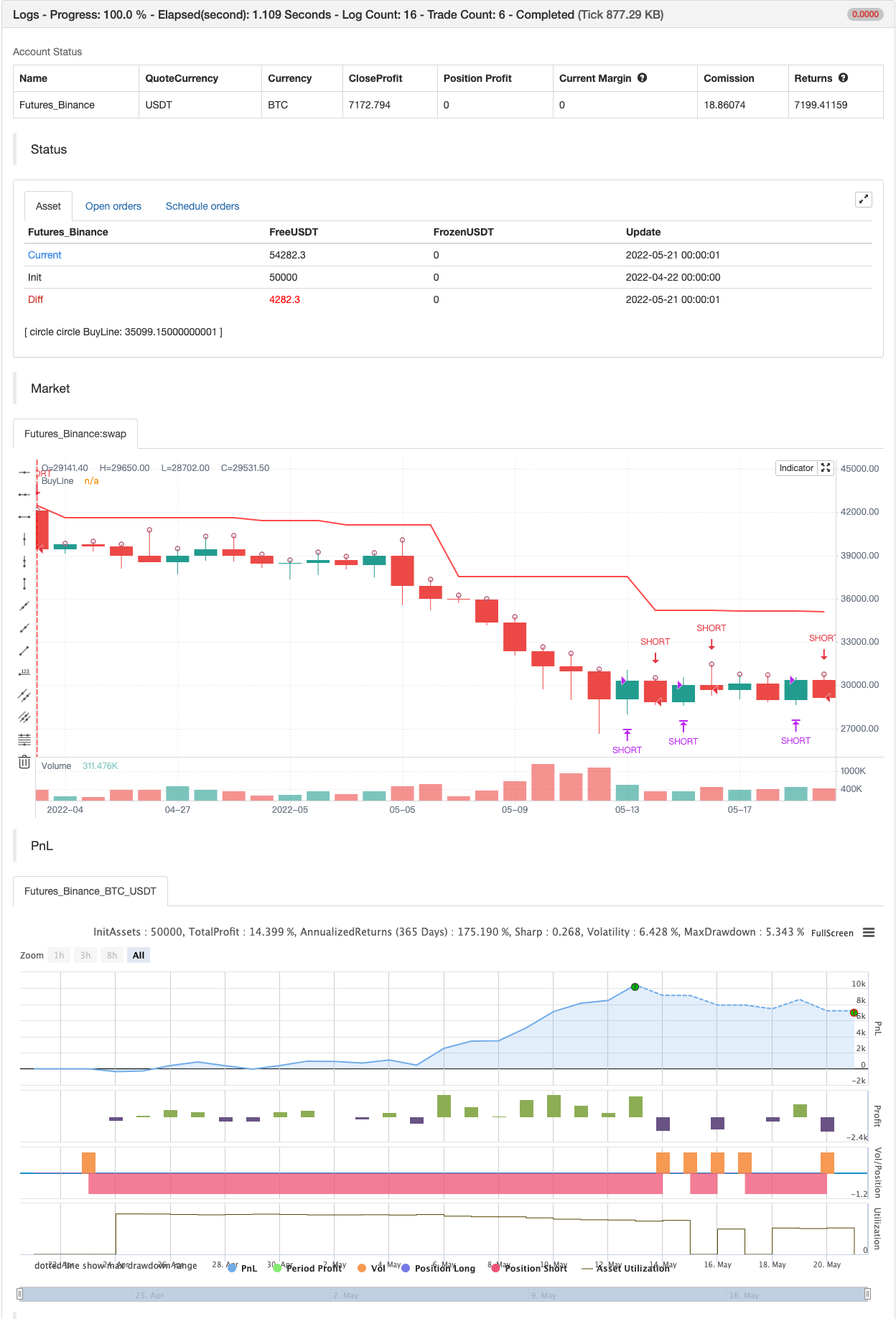

ব্যাকটেস্ট

/*backtest

start: 2022-02-22 00:00:00

end: 2022-05-22 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// -----------------------------------------------------------------------------

// Copyright 2019 Mauricio Pimenta | exit490

// SuperTrend with Trailing Stop Loss script may be freely distributed under the MIT license.

//

// Permission is hereby granted, free of charge,

// to any person obtaining a copy of this software and associated documentation files (the "Software"),

// to deal in the Software without restriction, including without limitation the rights to use, copy, modify, merge,

// publish, distribute, sublicense, and/or sell copies of the Software, and to permit persons to whom the Software is furnished to do so,

// subject to the following conditions:

//

// The above copyright notice and this permission notice shall be included in all copies or substantial portions of the Software.

//

// THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND,

// EXPRESS OR IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF MERCHANTABILITY,

// FITNESS FOR A PARTICULAR PURPOSE AND NONINFRINGEMENT. IN NO EVENT SHALL THE AUTHORS OR COPYRIGHT HOLDERS BE LIABLE FOR ANY CLAIM,

// DAMAGES OR OTHER LIABILITY, WHETHER IN AN ACTION OF CONTRACT, TORT OR OTHERWISE, ARISING FROM,

// OUT OF OR IN CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER DEALINGS IN THE SOFTWARE.

//

// -----------------------------------------------------------------------------

//

// Authors: @exit490

// Revision: v1.0.0

// Date: 5-Aug-2019

//

// Description

// ===========

// SuperTrend is a moving stop and reversal line based on the volatility (ATR).

// The strategy will ride up your stop loss when price moviment 1%.

// The strategy will close your operation when the market price crossed the stop loss.

// The strategy will close operation when the line based on the volatility will crossed

//

// The strategy has the following parameters:

//

// INITIAL STOP LOSS - Where can isert the value to first stop.

// POSITION TYPE - Where can to select trade position.

// ATR PERIOD - To select number of bars back to execute calculation

// ATR MULTPLIER - To add a multplier factor on volatility

// BACKTEST PERIOD - To select range.

//

// -----------------------------------------------------------------------------

// Disclaimer:

// 1. I am not licensed financial advisors or broker dealers. I do not tell you

// when or what to buy or sell. I developed this software which enables you

// execute manual or automated trades multplierFactoriplierFactoriple trades using TradingView. The

// software allows you to set the criteria you want for entering and exiting

// trades.

// 2. Do not trade with money you cannot afford to lose.

// 3. I do not guarantee consistent profits or that anyone can make money with no

// effort. And I am not selling the holy grail.

// 4. Every system can have winning and losing streaks.

// 5. Money management plays a large role in the results of your trading. For

// example: lot size, account size, broker leverage, and broker margin call

// rules all have an effect on results. Also, your Take Profit and Stop Loss

// settings for individual pair trades and for overall account equity have a

// major impact on results. If you are new to trading and do not understand

// these items, then I recommend you seek education materials to further your

// knowledge.

//

// YOU NEED TO FIND AND USE THE TRADING SYSTEM THAT WORKS BEST FOR YOU AND YOUR

// TRADING TOLERANCE.

//

// I HAVE PROVIDED NOTHING MORE THAN A TOOL WITH OPTIONS FOR YOU TO TRADE WITH THIS PROGRAM ON TRADINGVIEW.

//

// I accept suggestions to improve the script.

// If you encounter any problems I will be happy to share with me.

// -----------------------------------------------------------------------------

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

strategy(title = "SUPERTREND ATR WITH TRAILING STOP LOSS",

shorttitle = "SUPERTREND ATR WITH TSL",

overlay = true,

precision = 8,

calc_on_order_fills = true,

calc_on_every_tick = true,

backtest_fill_limits_assumption = 0,

default_qty_type = strategy.percent_of_equity,

default_qty_value = 100,

initial_capital = 1000,

currency = currency.USD,

linktoseries = true)

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

// === BACKTEST RANGE ===

backTestSectionFrom = input(title = "═══════════════ FROM ═══════════════", defval = true, type = input.bool)

FromMonth = input(defval = 1, title = "Month", minval = 1)

FromDay = input(defval = 1, title = "Day", minval = 1)

FromYear = input(defval = 2019, title = "Year", minval = 2014)

backTestSectionTo = input(title = "════════════════ TO ════════════════", defval = true, type = input.bool)

ToMonth = input(defval = 31, title = "Month", minval = 1)

ToDay = input(defval = 12, title = "Day", minval = 1)

ToYear = input(defval = 9999, title = "Year", minval = 2014)

backTestPeriod() => (time > timestamp(FromYear, FromMonth, FromDay, 00, 00)) and (time < timestamp(ToYear, ToMonth, ToDay, 23, 59))

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

parameterSection = input(title = "═════════════ STRATEGY ═════════════", defval = true, type = input.bool)

// === INPUT TO SELECT POSITION ===

positionType = input(defval="SHORT", title="Position Type", options=["LONG", "SHORT"])

// === INPUT TO SELECT INITIAL STOP LOSS

initialStopLossPercent = input(defval = 3.0, minval = 0.0, title="Initial Stop Loss")

// === INPUT TO SELECT BARS BACK

barsBack = input(title="ATR Period", defval=1)

// === INPUT TO SELECT MULTPLIER FACTOR

multplierFactor = input(title="ATR multplierFactoriplier", step=0.1, defval=3.0)

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

// LOGIC TO FIND DIRECTION WHEN THERE IS TREND CHANGE ACCORDING VOLATILITY

atr = multplierFactor * atr(barsBack)

longStop = hl2 - atr

longStopPrev = nz(longStop[1], longStop)

longStop := close[1] > longStopPrev ? max(longStop, longStopPrev) : longStop

shortStop = hl2 + atr

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := close[1] < shortStopPrev ? min(shortStop, shortStopPrev) : shortStop

direction = 1

direction := nz(direction[1], direction)

direction := direction == -1 and close > shortStopPrev ? 1 : direction == 1 and close < longStopPrev ? -1 : direction

longColor = color.blue

shortColor = color.blue

var valueToPlot = 0.0

var colorToPlot = color.white

if (direction == 1)

valueToPlot := longStop

colorToPlot := color.green

else

valueToPlot := shortStop

colorToPlot := color.red

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

//

// === GLOBAL VARIABLES AND FUNCTIONS TO STORE IMPORTANT CONDITIONALS TO TRAILING STOP

hasEntryLongConditional() => direction == 1

hasCloseLongConditional() => direction == -1

hasEntryShortConditional() => direction == -1

hasCloseShortConditional() => direction == 1

stopLossPercent = positionType == "LONG" ? initialStopLossPercent * -1 : initialStopLossPercent

var entryPrice = 0.0

var updatedEntryPrice = 0.0

var stopLossPrice = 0.0

hasOpenTrade() => strategy.opentrades != 0

notHasOpenTrade() => strategy.opentrades == 0

strategyClose() =>

if positionType == "LONG"

strategy.close("LONG", when=true)

else

strategy.close("SHORT", when=true)

strategyOpen() =>

if positionType == "LONG"

strategy.entry("LONG", strategy.long, when=true)

else

strategy.entry("SHORT", strategy.short, when=true)

isLong() => positionType == "LONG" ? true : false

isShort() => positionType == "SHORT" ? true : false

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

//

// === LOGIC TO TRAILING STOP IN LONG POSITION

if (isLong())

crossedStopLoss = close <= stopLossPrice

terminateOperation = hasOpenTrade() and (crossedStopLoss or hasCloseLongConditional())

if (terminateOperation)

entryPrice := 0.0

updatedEntryPrice := entryPrice

stopLossPrice := 0.0

strategyClose()

startOperation = notHasOpenTrade() and hasEntryLongConditional()

if(startOperation)

entryPrice := close

updatedEntryPrice := entryPrice

stopLossPrice := entryPrice + (entryPrice * stopLossPercent) / 100

strategyOpen()

strategyPercentege = (close - updatedEntryPrice) / updatedEntryPrice * 100.00

rideUpStopLoss = hasOpenTrade() and strategyPercentege > 1

if (isLong() and rideUpStopLoss)

stopLossPercent := stopLossPercent + strategyPercentege - 1.0

newStopLossPrice = updatedEntryPrice + (updatedEntryPrice * stopLossPercent) / 100

stopLossPrice := max(stopLossPrice, newStopLossPrice)

updatedEntryPrice := stopLossPrice

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

//

// === LOGIC TO TRAILING STOP IN SHORT POSITION

if (isShort())

crossedStopLoss = close >= stopLossPrice

terminateOperation = hasOpenTrade() and (crossedStopLoss or hasCloseShortConditional())

if (terminateOperation)

entryPrice := 0.0

updatedEntryPrice := entryPrice

stopLossPrice := 0.0

strategyClose()

startOperation = notHasOpenTrade() and hasEntryShortConditional()

if(startOperation)

entryPrice := close

updatedEntryPrice := entryPrice

stopLossPrice := entryPrice + (entryPrice * stopLossPercent) / 100

strategyOpen()

strategyPercentege = (close - updatedEntryPrice) / updatedEntryPrice * 100.00

rideDownStopLoss = hasOpenTrade() and strategyPercentege < -1

if (rideDownStopLoss)

stopLossPercent := stopLossPercent + strategyPercentege + 1.0

newStopLossPrice = updatedEntryPrice + (updatedEntryPrice * stopLossPercent) / 100

stopLossPrice := min(stopLossPrice, newStopLossPrice)

updatedEntryPrice := stopLossPrice

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

//

// === DRAWING SHAPES

entryPricePlotConditinal = entryPrice == 0.0 ? na : entryPrice

trailingStopLossPlotConditional = stopLossPrice == 0.0 ? na : stopLossPrice

plotshape(entryPricePlotConditinal, title= "Entry Price", color=color.blue, style=shape.circle, location=location.absolute, size=size.tiny)

plotshape(trailingStopLossPlotConditional, title= "Stop Loss", color=color.red, style=shape.circle, location=location.absolute, size=size.tiny)

plot(valueToPlot == 0.0 ? na : valueToPlot, title="BuyLine", linewidth=2, color=colorToPlot)

plotshape(direction == 1 and direction[1] == -1 ? longStop : na, title="Buy", style=shape.labelup, location=location.absolute, size=size.normal, text="Buy", transp=0, textcolor = color.white, color=color.green, transp=0)

plotshape(direction == -1 and direction[1] == 1 ? shortStop : na, title="Sell", style=shape.labeldown, location=location.absolute, size=size.normal, text="Sell", transp=0, textcolor = color.white, color=color.red, transp=0)

alertcondition(direction == 1 and direction[1] == -1 ? longStop : na, title="Buy", message="Buy!")

alertcondition(direction == -1 and direction[1] == 1 ? shortStop : na, title="Sell", message="Sell!")

সম্পর্কিত

- বড় অস্থিরতা ব্রেকআউট দ্বি-দিকের ট্রেডিং কৌশলঃ পয়েন্ট ভিত্তিক থ্রেশহোল্ড এন্ট্রি সিস্টেম

- বর্ধিত বোলিংজার মিড ইনভার্সন কোয়ান্টামেটিভ স্ট্র্যাটেজি

- ডায়নামিক রিস্ক ম্যানেজমেন্ট সহ ডাবল মুভিং মিডিয়ার ক্রসওভার কৌশল

- মাল্টি-স্ট্র্যাটেজি অ্যাডাপ্টিভ ট্রেন্ড অনুসরণ এবং ব্রেকআউট ট্রেডিং সিস্টেম

- মাল্টি-টাইমফ্রেম ইএমএ ট্রেন্ড ইম্পটাম ট্রেডিং কৌশল

- স্মার্ট টাইম-ভিত্তিক লং-কোর্ট রোটেশন ব্যালেন্সড ট্রেডিং স্ট্র্যাটেজি

- এটিআর-ভিত্তিক মাল্টি-ট্রেন্ড অনুসরণকারী কৌশল লাভ এবং স্টপ-লস অপ্টিমাইজেশন সিস্টেমের সাথে

- থ্রেশহোল্ড অপ্টিমাইজেশান সহ অ্যাডাপ্টিভ আরএসআই ওসিলেটর ডায়নামিক ট্রেডিং কৌশল

- ঝুঁকি-প্রতিদান অপ্টিমাইজেশান সিস্টেমের সাথে দ্বৈত চলমান গড় ক্রস আরএসআই গতিশীল কৌশল

- মাল্টি-ইন্ডিকেটর ক্রসওভার ডায়নামিক স্ট্র্যাটেজি সিস্টেমঃ একটি পরিমাণগত ট্রেডিং মডেল EMA, RVI এবং ট্রেডিং সিগন্যালের উপর ভিত্তি করে

- উচ্চ জয় হার প্রবণতা অর্থ বিপরীত ট্রেডিং কৌশল

আরো

- লিনিয়ার রিগ্রেশন ++

- এনার্জি বার সহ রেড কে ডুয়াল ভেডার

- একত্রীকরণ অঞ্চল - লাইভ

- পরিমাণগত গুণগত অনুমান

- চলমান গড় ক্রস সতর্কতা, মাল্টি-টাইমফ্রেম (এমটিএফ)

- এমএসিডি পুনরায় লোড করা কৌশল

- সুপারট্রেন্ডড মুভিং মিডিয়ার

- ট্রেডিং এবিসি

- 15MIN BTCUSDTPERP BOT

- শ্যানন এন্ট্রপি ভি২

- ভলিউম ফ্লো v3

- ক্রিপ্টো ফিউচার মা & আরসি - ওগচেকার্সের সাথে ঘণ্টায় স্কালপিং

- এটিআর সমতল

- অর্ডার ব্লক ফাইন্ডার

- TrendScalp-FractalBox-3EMA

- QQE সংকেত

- U বিট গ্রিডের মাত্রা ফিল্টার

- সিএম এমএসিডি কাস্টম ইন্ডিকেটর - মাল্টিপল টাইম ফ্রেম - ভি২

- হডল লাইন

- 2 চলমান গড় রঙের দিক সনাক্তকরণ